Black Friday: a day synonymous with retail frenzy, unbeatable deals, and the thrill of snagging the best bargain. What began as a post-Thanksgiving shopping tradition has now evolved into a global phenomenon, captivating shoppers across the world. The buzz around Black Friday is building, and if the trends from previous years are any indicator, we are set for another record-breaking event. This year, retailers are leveraging technology and consumer data like never before, ensuring that shoppers have access to deals both online and in-store, creating an intense buying experience.

Editor’s Choice

- About 58% of American adults took part in Black Friday 2025 sales, representing roughly 152 million shoppers.

- E-commerce led the day, with U.S. online Black Friday sales reaching a record $11.8 billion, up 9.1% year over year and outpacing in‑store growth.

- Average projected spend per U.S. Black Friday shopper in 2025 reached about $674, helping push total U.S. Black Friday deal spending to roughly $102.4 billion.

- Electronics remained a core driver of demand, contributing to a 4.1% year-over-year increase in total U.S. Black Friday retail sales and ranking among the top-selling online categories.

- Mobile commerce dominated digital behavior, generating about 55–59% of U.S. Black Friday online sales, or roughly $6.5 billion of the $11.8 billion spent online.

- Shoppers using buy now, pay later (BNPL) solutions drove approximately $748–762 million in U.S. Black Friday ecommerce spend, accounting for about 6–7% of digital sales.

- Over the broader Black Friday period, global online sales reached about $79 billion, while Salesforce estimates U.S. Black Friday online revenue at around $18 billion, both growing roughly 3–6% year over year.

The Evolution of Black Friday

- 1950s: “Black Friday” emerged in Philadelphia, with post-Thanksgiving traffic and shopper volumes spiking by 20–30% versus a normal weekend.

- 1990s: National chains’ Black Friday promotions drove Thanksgiving-weekend retail sales growth of roughly 4–5% per year, making it the year’s biggest shopping event.

- Early 2000s: U.S. Black Friday ecommerce revenue surpassed $1 billion in 2005, with annual online sales growing more than 20% through the decade.

- 2010–2020: Over 70% of U.S. holiday shoppers bought during extended Black Friday promotions, lifting November online sales by 15%+ year over year.

- 2021–2025: Smartphones drove about 55–59% of Black Friday 2025 online sales, while social and influencer channels contributed roughly 20–22% of ecommerce revenue.

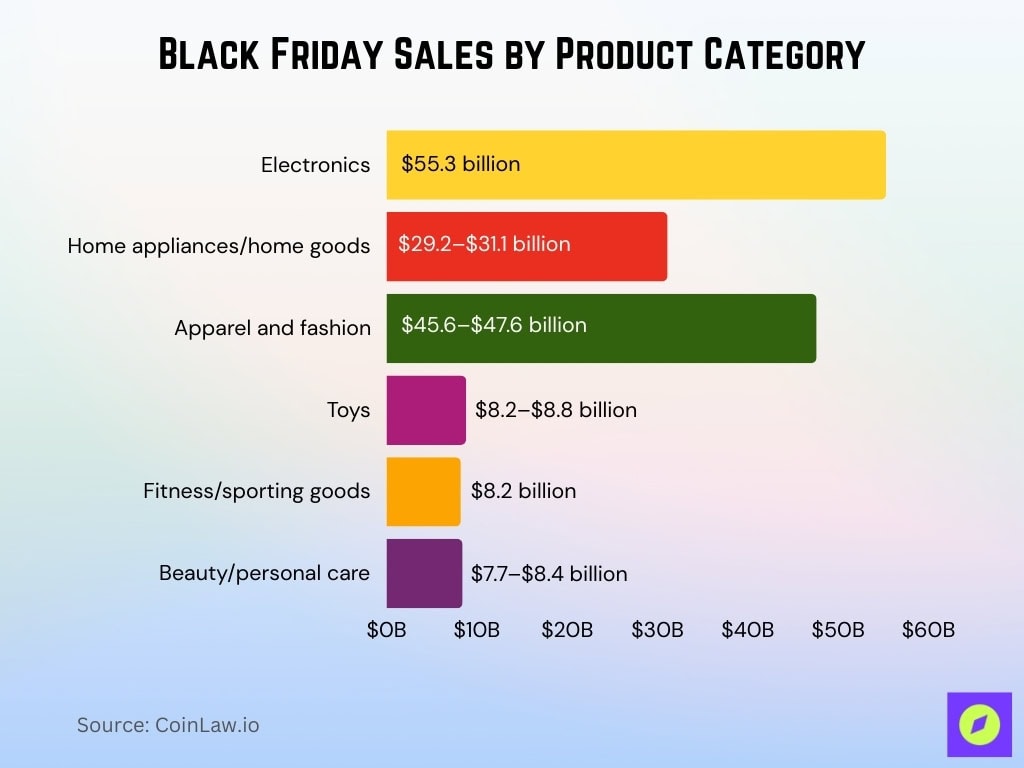

Top Selling Products and Categories

- Electronics remain the top Black Friday category in 2025 with $55.3 billion in sales, representing 28–30% of global spend.

- Home appliances and home goods generate $29.2–31.1 billion in revenue, accounting for 15–18% of Black Friday sales.

- Apparel and fashion produce $45.6–47.6 billion in sales, contributing 20–25% of total spending.

- Toys capture 8–10% of sales with revenue of $8.2–8.8 billion and average discounts of 27–30%.

- Fitness and sporting goods reach about $8.2 billion in sales, growing 5–6% year over year.

- Beauty and personal care generate $7.7–8.4 billion in sales with annual growth of 9–12%.

- Smart home and home tech devices see 15–18% year-over-year sales growth supported by 20–30% discounts.

Online vs. In-Store Sales Trends Over Time

- In 2025, online channels generate 60–62% of U.S. Black Friday sales with ecommerce revenue of $11.8 billion, outpacing in-store growth.

- Physical stores capture 38–40% of Black Friday spending, with U.S. store visits rising 1–2% year over year.

- Click-and-collect and store-based fulfillment account for 20–25% of U.S. Black Friday store orders in 2025 during the $79 billion global online sales weekend.

- Retailers offering fast-shipping perks see online conversion lifts exceeding 20%, helping drive the 9.1% year-over-year ecommerce increase to $11.8 billion.

- Smartphones drive 55–59% of U.S. online Black Friday sales, totaling about $6.5 billion and growing 11–12% year over year.

- Tablets and other mobile devices add 3–5% more, bringing the total mobile share to 58–63% of ecommerce revenue in 2025.

- Desktop’s share slides to 37–42% of Black Friday online purchases, though conversion rates stay around 6–7% with basket sizes 47% larger than mobile.

Consumer Spending Habits and Preferences

- The average U.S. shopper expects to spend $620–$650 over Black Friday–Cyber Monday 2025, contributing to record online Black Friday sales of $11.8 billion.

- Nearly 90% of consumers compare prices and reviews online before buying, and about 94% of Cyber Week shoppers plan to use Amazon at least once.

- Around 71% of Black Friday 2025 shoppers plan to shop online, and about 24% expect to spend $1,000+ on holiday purchases.

- About 75% of Gen Z participates in Black Friday/Cyber Monday events, with many favoring fashion and sustainable brands.

- Roughly 71% of shoppers prioritize discounts and savings, while up to 49% value exclusive or limited-time offers.

- About 25%+ of holiday shoppers plan to use BNPL in 2025, with some global BNPL markets growing over 14% annually.

- Around 62–65% of consumers are willing to choose or pay more for sustainable products, with many Gen Z buyers preferring refurbished or eco-friendly options.

- Customer reviews and social proof influence about 64% of Black Friday shoppers when deciding what to buy.

- Despite inflation, U.S. online Black Friday spending grew 9.1% year over year to $11.8 billion, while total retail sales increased about 4.1%.

Demographics of Black Friday Shoppers

- In 2025, Millennials and Gen Z drive over 75% of Black Friday interest, with Millennials at about 50% and Gen Z at 27%.

- Around 75% of Gen Z consumers plan to shop during Black Friday/Cyber Monday, prioritizing fashion and sustainable brands.

- Deloitte reports that 72% of Gen Z plan to shop in-store on Black Friday compared with 49% of all shoppers.

- Intent to participate is highest among younger adults, with about 79% of Gen Z and Millennials planning to shop versus 68% of the overall population.

- Women make up roughly 60%+ of Black Friday shoppers, with 62% saying they are likely to shop compared with about 50% of men.

- Men expect to spend more, averaging about $724, versus women’s $611, a gap of over $100.

- Up to 90% of Gen Z’s online Black Friday traffic comes from smartphones, far higher than older groups.

- DHL reports that around 45% of Gen Z expect to spend more during Black Friday, versus 34% of Millennials.

- Higher-income groups are over 30% more likely to increase their spending year over year, even as middle-income households make up the bulk of participants.

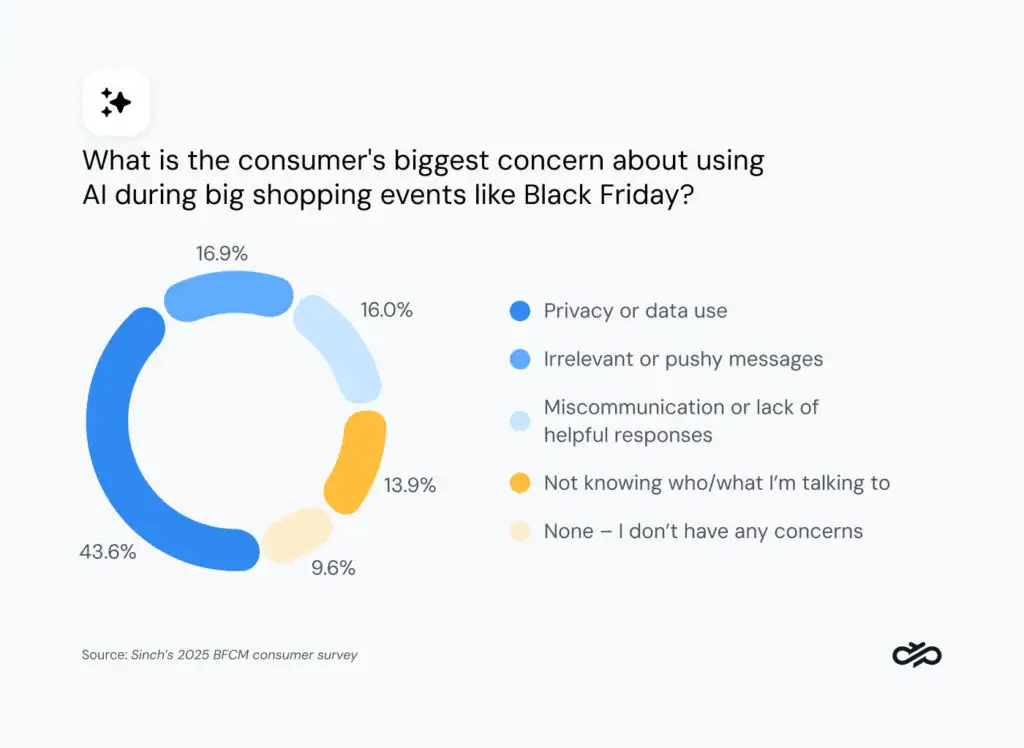

Top Consumer Concerns About AI Use During Black Friday

- 43.6% of shoppers are most concerned about privacy or data use when interacting with AI during big shopping events.

- 16.9% worry about receiving irrelevant or pushy messages from AI-powered platforms.

- 16.0% report frustration due to miscommunication or a lack of helpful responses from AI tools.

- 13.9% feel uncomfortable not knowing who or what they’re talking to, highlighting trust issues in AI interfaces.

- Only 9.6% of respondents say they have no concerns about AI during shopping, indicating widespread caution despite adoption.

Black Friday in Different Regions

- United States: Black Friday 2025 retail sales are estimated at $100–105 billion, including about $18 billion online and $11.8 billion on Black Friday online alone.

- United Kingdom: Consumers are expected to spend around £6.4 billion, up 1.5% from 2024, with over 80% transacting online.

- Canada: Shopify merchants generated $6.2 billion in global Black Friday sales, with Canadian online sales rising 6–8% year over year.

- Germany: Black Friday and Cyber Week contributed to €289 billion in European-linked global online sales, supporting a 6% worldwide year-over-year increase.

- Brazil: Black Friday 2025 online sales are projected in the multi-billion BRL range, driven by Latin America’s ecommerce growth often above 15% CAGR through 2030.

- Australia: About 73% of shoppers plan to buy during Black Friday/Cyber Monday, making it one of the most engaged APAC markets.

- Asia-Pacific: Around 85% of ecommerce businesses plan to participate in Black Friday/Cyber Monday 2025, and 69% reported higher sales in 2024 versus 2023, led by Thailand and Australia.

- Global: Salesforce estimates Black Friday 2025 online sales at $79 billion, while overall Cyber Week reached about $314.9 billion (€289 billion) in worldwide revenue.

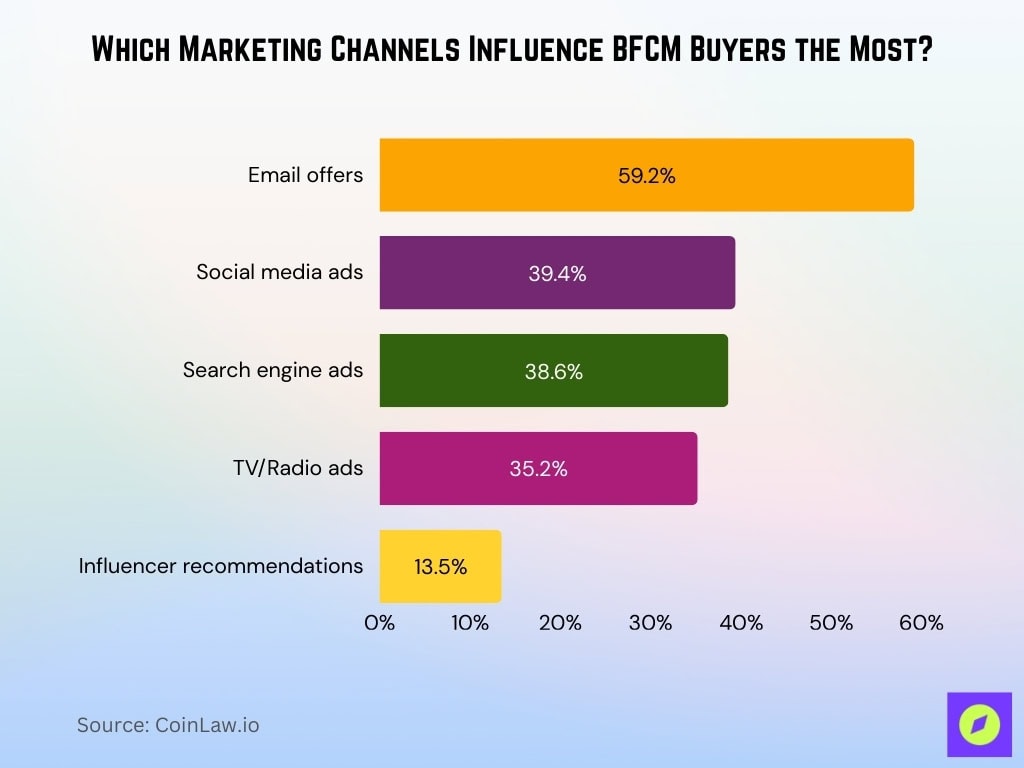

Which Marketing Channels Influence BFCM Buyers the Most?

- 59.2% of shoppers say email offers are the most influential in driving their Black Friday and Cyber Monday purchases.

- 39.4% are influenced by social media ads, making it the second-most impactful channel.

- 38.6% of respondents cite search engine ads as a key driver for purchase decisions.

- 35.2% still respond to TV and radio ads, showing traditional media retains some relevance.

- Only 13.5% consider influencer recommendations as their main purchase influence, highlighting limited impact during BFCM.

E-commerce Dominance During Black Friday

- In 2025, online channels are expected to capture 60–62% of total U.S. Black Friday sales, with ecommerce revenue rising 9–10.4% year over year to $11.8 billion.

- Amazon generated around $2 billion in Black Friday 2025 online sales and captured well over 20% of U.S. ecommerce traffic.

- Social media drove about 3.4% of all Black Friday online sales in 2025, marking a 54.5% year-over-year increase in share.

- Affiliate and partner channels now account for 21.9% of Black Friday online revenue, up from 19.6% the previous year.

- AI-referred traffic converted 38% better than other sources and helped influence the $11.8 billion U.S. online spend.

- Email volumes rose 8–14% year over year, with average click-through rates near 3% compared with SMS at around 19%.

- Global cart abandonment remains near 70%, with mobile abandonment over 85%, costing retailers an estimated $18 billion annually.

- Cross-border ecommerce accounts for 15–20% of global Black Friday online orders, heavily benefiting U.S. retailers.

Mobile vs. Desktop Shopping Statistics

- In 2025, mobile devices generated 55.2–56% of Black Friday online sales, or roughly $6.5 billion of the $11.8 billion spent online in the U.S.

- Desktop’s share fell to around 44–45% of Black Friday ecommerce revenue, even though desktop conversion rates near 6.5% remain about double mobile’s.

- Tablets and other non-phone devices contributed 3–5% of online Black Friday sales, pushing mobile’s overall share above 55% of revenue.

- Mobile commerce worldwide drove about 70% of online Cyber Week sales, with mobile responsible for more than 80% of e-commerce traffic over Black Friday weekend.

- U.S. mobile spending on Black Friday grew 10–12% year over year, surpassing the overall online growth of 9.1%.

- Desktop orders still have higher value, with average desktop baskets 47% larger and containing 3.6 items versus 2.9 items per smartphone order.

- For the full 2025 holiday season, mobile is forecast to drive 56.1% of U.S. online spend, equal to about $142.7 billion.

Recent Developments

- AI is embedded across major retailers, with 30%+ using AI-powered tools and AI-referred traffic converting about 38% better while helping drive $11.8 billion in U.S. Black Friday online sales.

- Social and live shopping drive around 19% of sales from platforms like TikTok and Instagram, with social media overall contributing 3.4% of Black Friday online revenue in 2025.

- “Conscious Black Friday” and ESG-linked products are growing faster than non-ESG goods, with eco-oriented delivery projected to reduce 3.6 million tonnes of CO₂ linked to holiday ecommerce.

- Cyber risk is rising, with fraud and account-takeover threats climbing by double-digit percentages year over year around Black Friday.

- Buy Now, Pay Later usage jumped 8.9% year over year, fueling about $747.5 million in U.S. ecommerce spend and roughly 6.3% of all digital sales that day.

- BNPL is expected to drive around $20 billion in U.S. online holiday spend in 2025, up roughly 11% from 2024.

- Global Black Friday 2025 sales are projected to rise about 11% year over year, while late deliveries can spike 70% versus normal weeks, with average delivery times stretching to 6 days.

Frequently Asked Questions (FAQs)

In 2025, about 88% of consumers plan to shop during Cyber Week, with 71% saying they will shop online for Black Friday and 29% planning to shop in-store.

Deloitte reports that U.S. consumers expect to spend an average of about $622 during the Black Friday–Cyber Monday period in 2025.

More than half of Black Friday 2025 online sales in the U.S. came from mobile, with mobile devices accounting for about 55.2% of the $11.8 billion in ecommerce revenue (roughly $6.5 billion).

Around 39% of shoppers say they do most of their gift and holiday shopping during major sales days such as Black Friday.

Conclusion

Black Friday today is set to break new records, fueled by a combination of consumer demand, technological innovation, and global participation. As more shoppers turn to mobile devices and e-commerce platforms, retailers are responding with personalized, seamless experiences that cater to the modern consumer. From top-selling products to emerging trends like live shopping and AI-powered recommendations, Black Friday continues to evolve, offering consumers endless opportunities to find the best deals. With the holiday season around the corner, shoppers are gearing up for what promises to be the biggest Black Friday yet.