Bitmain stands as a dominant force in cryptocurrency mining hardware, known globally for its Antminer series and major mining pools like Antpool and BTC.com. Since its founding in 2013, Bitmain has shaped the Bitcoin mining ecosystem by supplying a large share of global ASIC machines and influencing efficiencies that drive network security and revenues.

Its technology now crosses into adjacent high‑performance computing applications and reflects broader shifts in crypto economics and energy use trends. Today, Bitmain’s reach touches mining farms, institutional players, and retail operators, and this article explores the latest verified statistics shaping its business today. Dive into the data to understand how Bitmain’s performance and market dynamics are evolving.

Editor’s Choice

- Bitcoin network hashrate exceeded 1 ZH/s in 2025, a record high.

- More than 95% of Bitcoin blocks will be mined by mining pools by 2026.

- Bitmain’s Antminer S21 XP delivers 270 TH/s with strong efficiency in 2026.

- Mining economics squeezed in 2025 despite Bitcoin’s newfound all‑time pricing, challenging profitability.

- Bitmain has expanded projects into AI server computing alongside ASIC hardware launches.

Recent Developments

- In early 2026, Bitmain launched the Antminer X9, targeting Monero mining with the RandomX algorithm.

- Throughout 2025, Bitmain’s Antminer S20 series achieved efficiency ratios near 15 J/TH, marking great operational improvements.

- Bitmain implemented price cuts on mining rigs in late 2025 as mining revenue per TH declined.

- Network difficulty eased early in 2026, briefly improving miner margins.

- Bitmain’s products continue evolving with multiple Antminer variants tailored for different power and cooling designs.

- Institutional purchases continued, e.g., agreements involving ~30,000 Antminer S21+ units were executed in late 2024 into 2025.

- Competitor hardware tests in late 2025 highlighted the importance of operational hosting and setup logistics.

- Broader industry shifts saw ASIC makers establishing localized manufacturing to address tariffs and supply chain resilience.

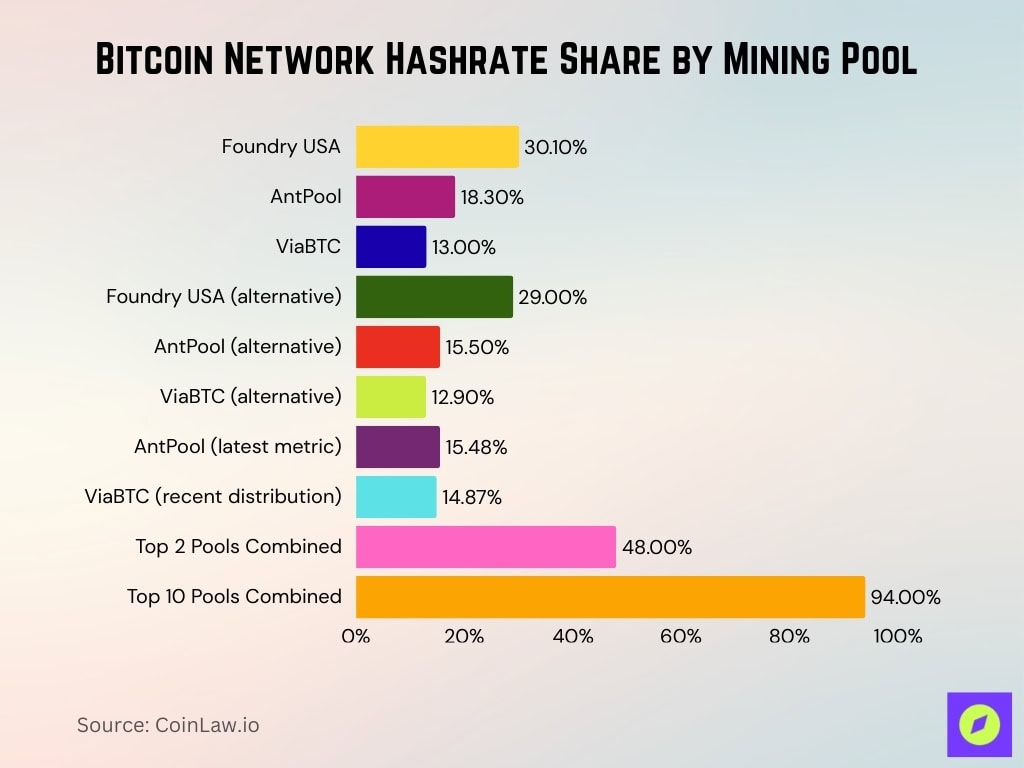

Share of Bitcoin Network Hashrate

- Foundry USA leads with 30.1% hashrate share at 299 EH/s.

- AntPool secures 18.3% of the network hashrate with 211 EH/s.

- ViaBTC contributes 13.0% hashrate at 145 EH/s.

- The top two pools, Foundry USA and AntPool, control over 48% combined.

- Alternative data shows AntPool at 15.5% and ViaBTC 12.9%.

- Foundry USA reported at 29% with AntPool 15.5% recently.

- The top 10 pools dominate 94% of the total Bitcoin network hashrate.

- AntPool holds 15.48% with 17.13 EH/s in the latest metrics.

- ViaBTC accounts for 14.87% hashrate share per recent distribution.

Bitmain Revenue and Profitability Statistics

- Bitmain’s Antminer S23 Hyd achieves 9.5 J/TH efficiency with 580 TH/s hashrate and 5510W power draw.

- S23 Hyd generates $15.02 daily profit at $0.07/kWh electricity, yielding $450.71 monthly.

- Model projects $5,484 yearly net profit under current BTC prices and network conditions.

- Antminer S21 XP Hydro offers 473 TH/s at 12 J/TH, trailing S23 Hyd efficiency.

- ASIC miners like S23 Hyd enable ROI in 813–10438 days, depending on electricity rates.

- Hydro-cooled Bitmain units support industrial farms with $17,000–$18,000 unit pricing.

- Efficiency drives $24.28 daily revenue before $9.26 electricity costs for S23 Hyd.

Valuation and Funding Statistics

- Global ASIC Bitcoin mining hardware market valued at $11.41 billion in 2025, projected to reach $12.42 billion.

- Market expected to grow at CAGR 8.9% from 2025 to 2035, hitting $27.85 billion by 2035.

- Bitcoin mining hardware is set to hit $84.63 billion by 2035 at 22.46% CAGR from 2025.

- Asia-Pacific commands 61% share of the ASIC mining hardware market due to low-cost power.

- The leading five manufacturers control 68% of the ASIC Bitcoin mining hardware market.

- BTC mining segment dominates with 79% of ASIC hardware applications.

- Bitmain holds the top position among producers like Canaan and MicroBT, with the top three holding over 95% share.

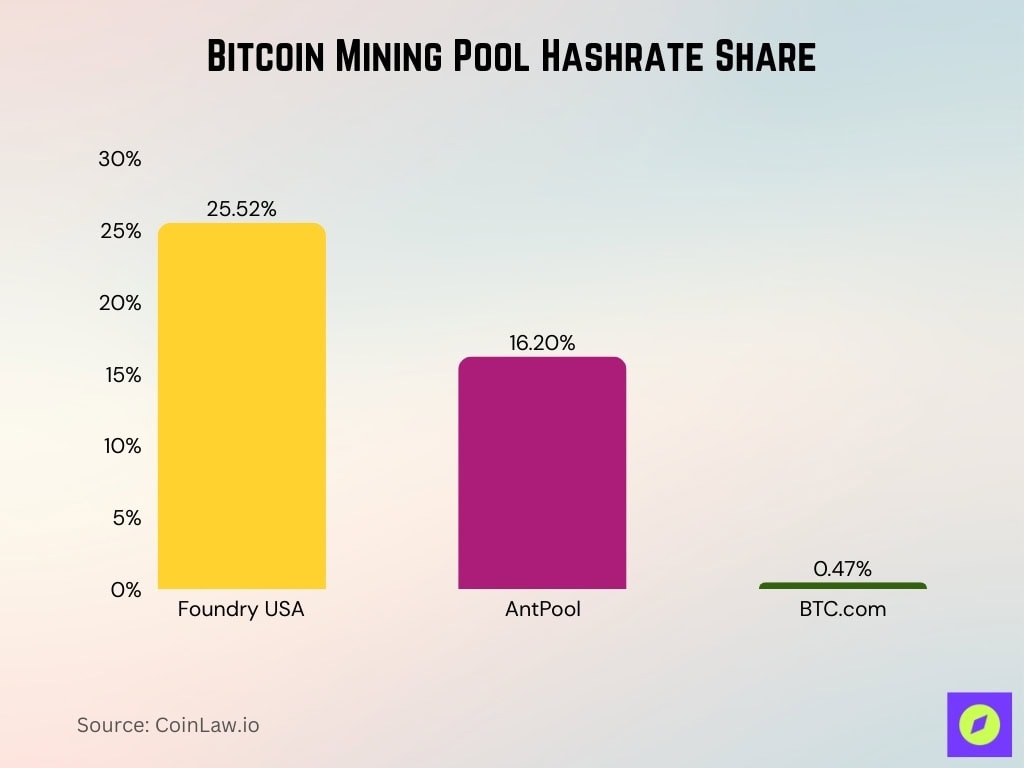

Mining Pool Market Share, Antpool and BTC.com

- AntPool commands 16.2% network hashrate share with 128.6 EH/s.

- BTC.com holds 0.47% hashrate at 3.7 EH/s, ranking 15th.

- Foundry USA leads ahead of AntPool with 25.52% at 202.7 EH/s.

- AntPool mined 139 blocks in the last 100, averaging 0.65% tx fees per block.

- BTC.com secured 4 blocks in the last 100 with 0.31% tx fees per block.

- AntPool uses the FPPS payout method supporting Bitmain rig deployments.

Hardware Pricing and Sales Volume

- Antminer S23 Hyd (580 TH/s) priced at $17,400, or $30/TH.

- Bitcoin Miner U3S23H (1160 TH/s) lists at $34,800, $30/TH.

- S23 Hyd 3U (1.16 PH/s) sells for $18,490, projecting $81.30/day profit.

- S21 XP+ Hyd (500 TH/s) available from $12,700.

- ASIC pricing averages $3–$30 per TH across S-series models amid competition.

- S21 XP (270 TH/s) yields $19.97/day profitability at current rates.

Global Market Share in Mining Hardware

- Bitmain controls over 80% of the global Bitcoin ASIC hardware supply amid Chinese firms’ 97% dominance.

- The leading five manufacturers, including Bitmain, command 68% of the ASIC Bitcoin mining hardware market.

- The top three producers, Bitmain, Canaan, and MicroBT, hold over 95% share in ASIC mining hardware.

- Bitmain supplied over 1.5 million ASIC miners globally in 2024 for large-scale farms.

- Chinese ASIC makers Bitmain, Canaan, and MicroBT are responsible for over 90% mining rig production.

- Asia-Pacific region captures 61% share, driven by mining farms and low electricity costs.

- BTC segment dominates ASIC hardware applications with 79% market share.

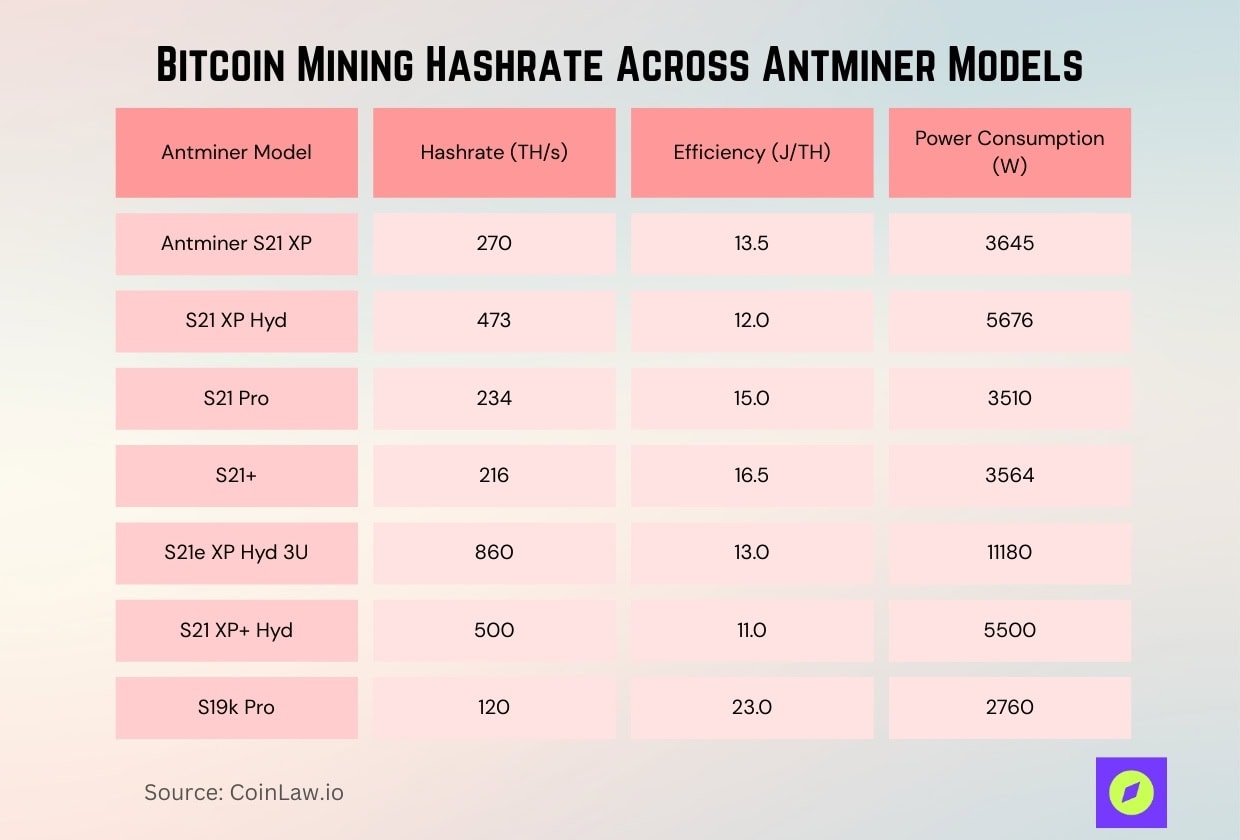

Product Portfolio and Antminer Model

- Antminer S21 XP delivers 270 TH/s at 13.5 J/TH efficiency with 3645W power.

- S21 XP Hyd achieves 473 TH/s using 5676W for 12 J/TH hydro-cooled performance.

- S21 Pro provides 234 TH/s hashrate at 15 J/TH with 3510W consumption.

- S21+ generates 216 TH/s using 3564W for 16.5 J/TH.

- S21e XP Hyd 3U reaches 860 TH/s with 13 J/TH at 11,180W.

- S21 XP+ Hyd targets 500 TH/s at 11 J/TH using 5500W.

- S19k Pro sustains 120 TH/s with 23 J/TH efficiency at 2760W.

Research and Development Statistics

- Global ASIC Bitcoin mining market grows at 8.9% CAGR from $11.41 billion in 2025 to $27.85 billion by 2035.

- Alternative projections show 12.6% CAGR reaching $27.86 billion by 2032 from a $10.78 billion base.

- Bitmain advances to sub-30 J/TH with 5nm and 3nm ASIC chips.

- 47% of manufacturers released next-gen ASICs in 2024 with enhanced hash rates.

- 72% of miners prefer ASICs for superior hash rates and energy efficiency.

- SHA-256 ASICs researched for thermodynamic reservoir computing using BM1366 chips.

- Bitmain plans a US factory with initial output early 2026, full ramp later.

- Leading firms control 68% market, driving R&D for efficiency gaps.

Regulatory and Compliance Statistics

- U.S. DHS launched Operation Red Sunset probe into Bitmain ASICs for espionage risks.

- Chinese firms, including Bitmain, control 97% global Bitcoin ASIC market share.

- Bitmain faces CBP holds on thousands of Antminer shipments at U.S. ports.

- 60% EU mining hashrate runs on renewables to meet MiCA compliance.

- MiCA non-compliance risks €500,000 fines for energy reporting failures.

- China enforces near-total ban on crypto mining since 2021.

- DOE mandates energy reporting for U.S. miners, facing legal challenges.

- 55% hedge funds hold digital assets post U.S./EU regulatory clarity.

- Bitmain plans a U.S. manufacturing hub to mitigate tariffs and reviews.

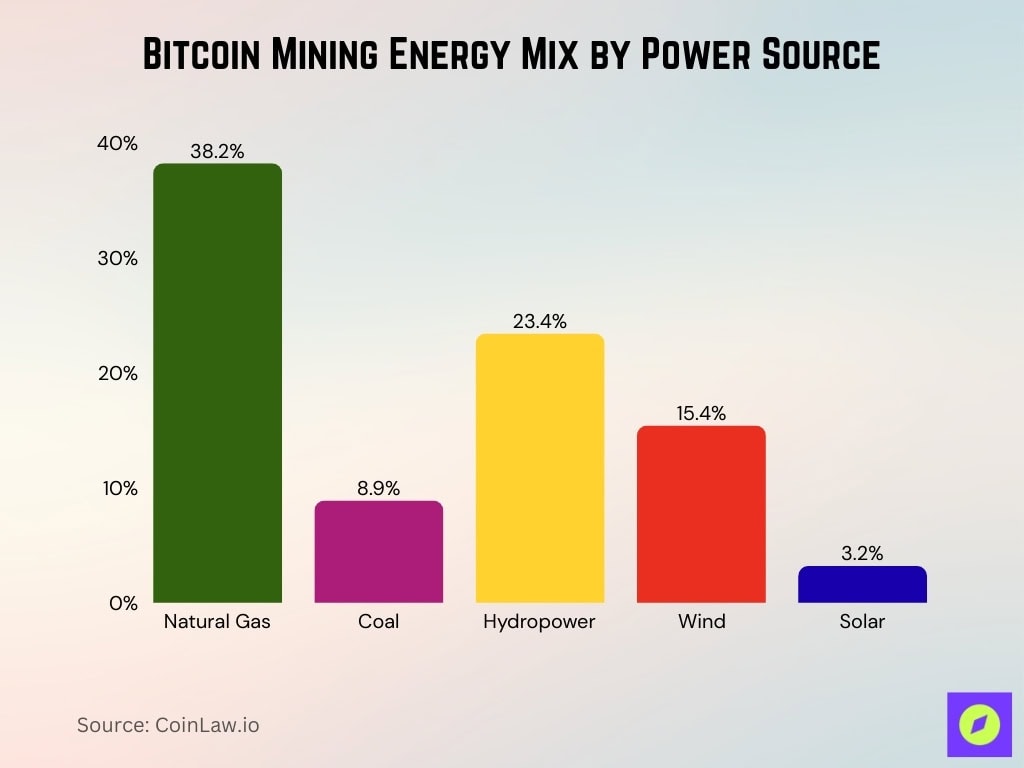

Environmental Impact and Energy Consumption

- Natural gas supplies 38.2%, and coal 8.9% of the mining energy mix.

- Hydropower provides 23.4%, wind 15.4%, and solar 3.2% of power.

- Bitcoin mining emits 139 million tonnes of CO₂ equivalent annually from global operations.

- Network consumes 173 TWh of electricity yearly, 0.5% of the global total.

- 56.7% of Bitcoin mining is powered by sustainable energy sources.

- 52.4% renewable share, including wind, hydro, and nuclear.

- Annual carbon footprint totals 39 million metric tons CO₂.

- Mining uses less than one-third average U.S. household water.

Sustainability and Renewable Energy Adoption

- 56.7% of Bitcoin mining uses sustainable energy, including renewables.

- 52.4% renewable share from hydro, wind, and solar in the network.

- Hydropower supplies 23.4%, wind 15.4%, and solar 3.2% of power.

- 39% nuclear energy supports low-carbon mining operations.

- Natural gas provides 38.2%, and coal 8.9% in the energy mix.

- 60% EU mining hashrate runs on renewables for MiCA compliance.

- Sustainable share rose from 39% in 2021 to 56.7% currently.

- Geothermal contributes <1% but is growing in U.S. operations.

AI and High‐Performance Computing Expansion

- 8 public Bitcoin miners announced AI/HPC pivots by early 2026.

- Cipher Mining forecasts $127 million HPC revenue in 2026, $739 million by 2027.

- AI/HPC is projected to surpass Bitcoin mining revenue for Cipher at $190 million, mining vs HPC growth.

- 20% miner power capacity is expected to pivot to AI by the end of 2027.

- Mining revenue share drops from 85% to under 20% total by late 2026.

- HPC contracts with Google, signed by 3 top miners, Terawulf, IREN, Cipher.

- Applied Digital stock up 30% YTD on 400 MW AI campus progress.

- Hut 8 seeks $5 billion data center zoning for AI expansion.

Competitive Position vs Other ASIC Manufacturers

- Bitmain dominates with 80%+ global Bitcoin ASIC hardware share.

- Chinese firms Bitmain, MicroBT, and Canaan hold 97% market control.

- The top three producers command over 95% ASIC mining hardware share.

- The leading five manufacturers control 68% of the Bitcoin-specific ASIC market.

- MicroBT serves the minority with its hashrate vs Bitmain’s efficiency lead.

- U.S. production plans mitigate 25% tariffs on Chinese imports.

Frequently Asked Questions (FAQs)

Bitcoin mining difficulty rose to about 148.2 trillion at the end of 2025, heading into 2026.

F2Pool reported about 110–115 EH/s hash rate in 2026, representing roughly 10–11% of the network’s hash rate.

The Antminer S21 XP achieved about 270 TH/s hash rate with a 3645W power draw.

Bitmain implemented mining rig price cuts at the end of 2025 after revenue per hashrate declined.

Conclusion

Bitmain remains central to the global Bitcoin mining ecosystem through its ASIC dominance, research progress, and expanding compute interests beyond mining alone. The company’s deep involvement in renewable energy adoption, regulatory compliance trends, and strategic positioning against competitors highlights a maturing industry balancing technological innovation with sustainability and geopolitical realities.

As miners adopt renewable sources and diversify into AI and HPC workloads, the sector’s resilience will hinge on efficiency, regulatory agility, and energy strategy. These trends will shape Bitmain’s trajectory and the broader mining landscape well into the late 2020s.