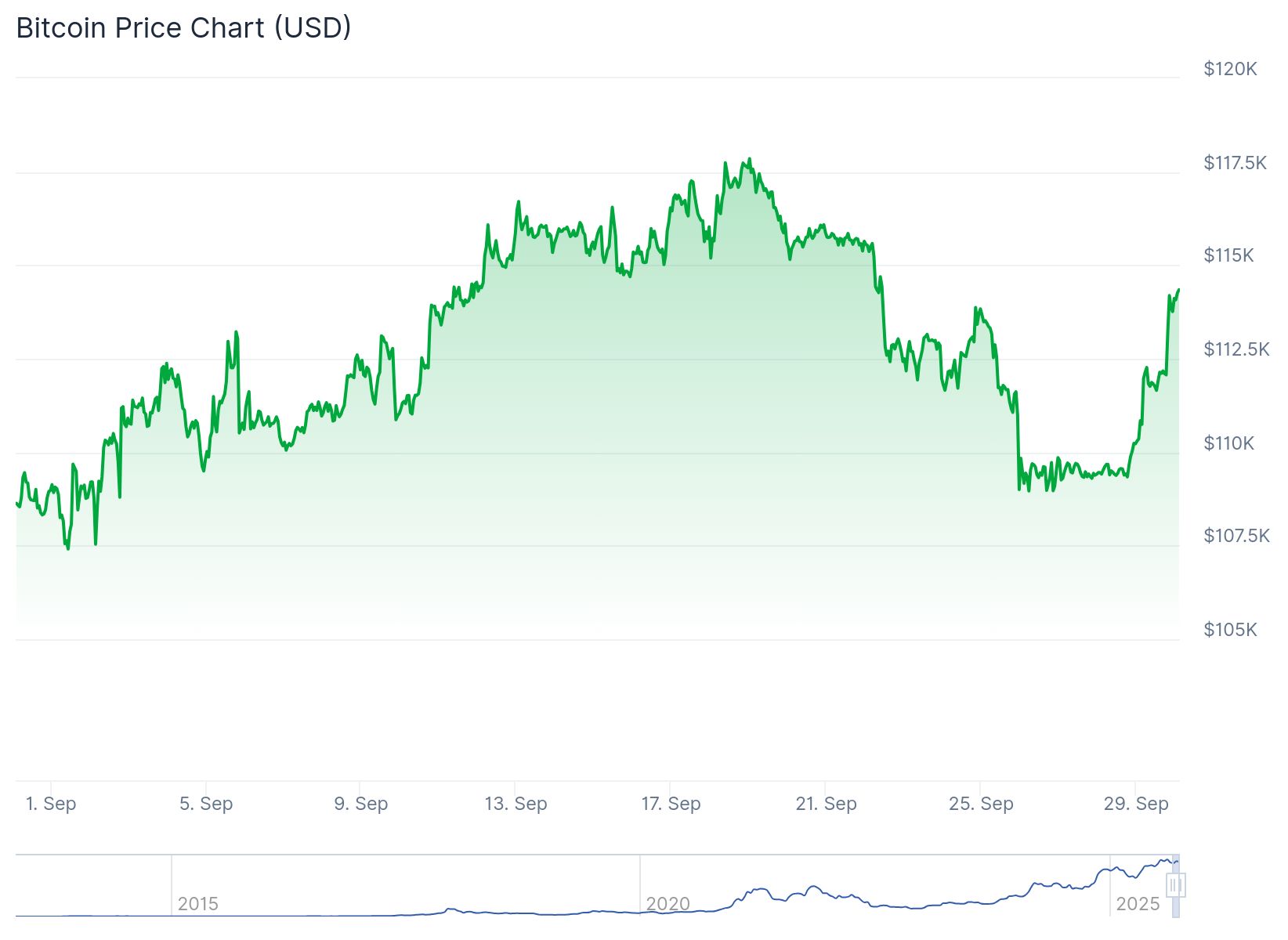

Bitcoin soared past $114,000 at the start of the week, boosted by seasonal optimism and a high-profile endorsement from Eric Trump, who encouraged investors to buy and hold despite recent market volatility.

Key Takeaways

- Bitcoin hit over $114,000, marking its strongest September rally since 2012

- Eric Trump urged investors to “buy the dips” and predicted an “unbelievable” fourth quarter

- Seasonality and macroeconomic factors like lower interest rates are fueling crypto momentum

- Trump family’s crypto investments and public comments are drawing increased attention

What Happened?

Bitcoin surged above the $114,000 mark after a brief dip below $109,000 last week. The rebound, continuing into Monday’s trading hours, marked an 8% monthly gain and defied September’s usual bearish trend. The rally was further energized by Eric Trump, who doubled down on his bullish stance with calls to “buy now” and hold long-term.

Buy the dips!

— Eric Trump (@EricTrump) September 26, 2025

Bitcoin Defies September Slump With Major Comeback

September has historically been a weak month for Bitcoin, but this year was different. The cryptocurrency posted its strongest September gains in over a decade, climbing approximately 8%. Technical analysts attributed the move to a breakout from a descending wedge pattern, often seen as a bullish signal.

- BTC is now up 7% for Q3 2025.

- Ethereum has outperformed BTC with a 68% rally in the same quarter.

- Gold and tech stocks also surged, indicating broader risk-on sentiment.

Market watchers credit the rally in part to declining interest rates in Western economies, which have simultaneously driven gold prices to new highs and lifted stock indexes.

Eric Trump: “Buy Now and Hold for Five Years”

Eric Trump, executive VP of the Trump Organization, has continued his vocal support for Bitcoin, taking to social media and interviews to encourage investment during volatility.

“Volatility is your friend. Buy right now. Shut your eyes. Hold it for the next five years,” Trump advised in a recent interview.

He cited several factors behind his bullish stance:

- Anticipated global monetary easing.

- Historical Q4 gains, averaging 85% in past cycles.

- A growing money supply boosting asset prices.

This isn’t his first time promoting Bitcoin. In February, he shared a similar message during a downturn, which preceded a sharp Ethereum recovery. He also made headlines at an August Bitcoin conference in Hong Kong, stating, “We haven’t even scratched the surface.”

Trump Family’s Crypto Influence Grows

The Trump family’s involvement in crypto goes beyond social media. Eric and Donald Trump Jr. are co-founders of American Bitcoin, a mining and accumulation firm partnered with Hut 8. The company recently secured $220 million in funding and is preparing for a Nasdaq listing through its merger with Gryphon.

- The Trump brothers own roughly 20% of the company.

- The firm’s launch earlier this year saw a strong market debut.

Such high-profile backing has led analysts to caution that public endorsements could influence short-term market behavior, even if long-term fundamentals remain unchanged.

October Could Signal More Gains Ahead

With the start of October often nicknamed “Uptober” in crypto circles, analysts believe Bitcoin could be entering its strongest seasonal window. Since 2013, Bitcoin has averaged 22% returns in October and 46% in November.

Joel Kruger of LMAX Group explained, “Seasonality is about to turn sharply in Bitcoin’s favor,” especially amid major advancements in crypto adoption and regulation this year.

Traders are also watching Friday’s U.S. jobs report and a potential government shutdown, which could impact future Fed decisions. If data is delayed, analysts believe the Fed may be forced to act without key economic indicators, which could further support crypto prices.

CoinLaw’s Takeaway

In my experience, when Bitcoin bucks its usual seasonal trend like it just did this September, it’s often the start of something bigger. The fact that Eric Trump is publicly doubling down with such confidence adds a layer of mainstream attention that crypto doesn’t always get.

I found his timing especially interesting. Big players often buy during fear, and his “buy now, shut your eyes” approach may resonate with both new and seasoned investors. Combined with macro tailwinds and seasonal strength, I wouldn’t be surprised if we see Bitcoin make a serious push toward $120,000 and beyond before year-end.