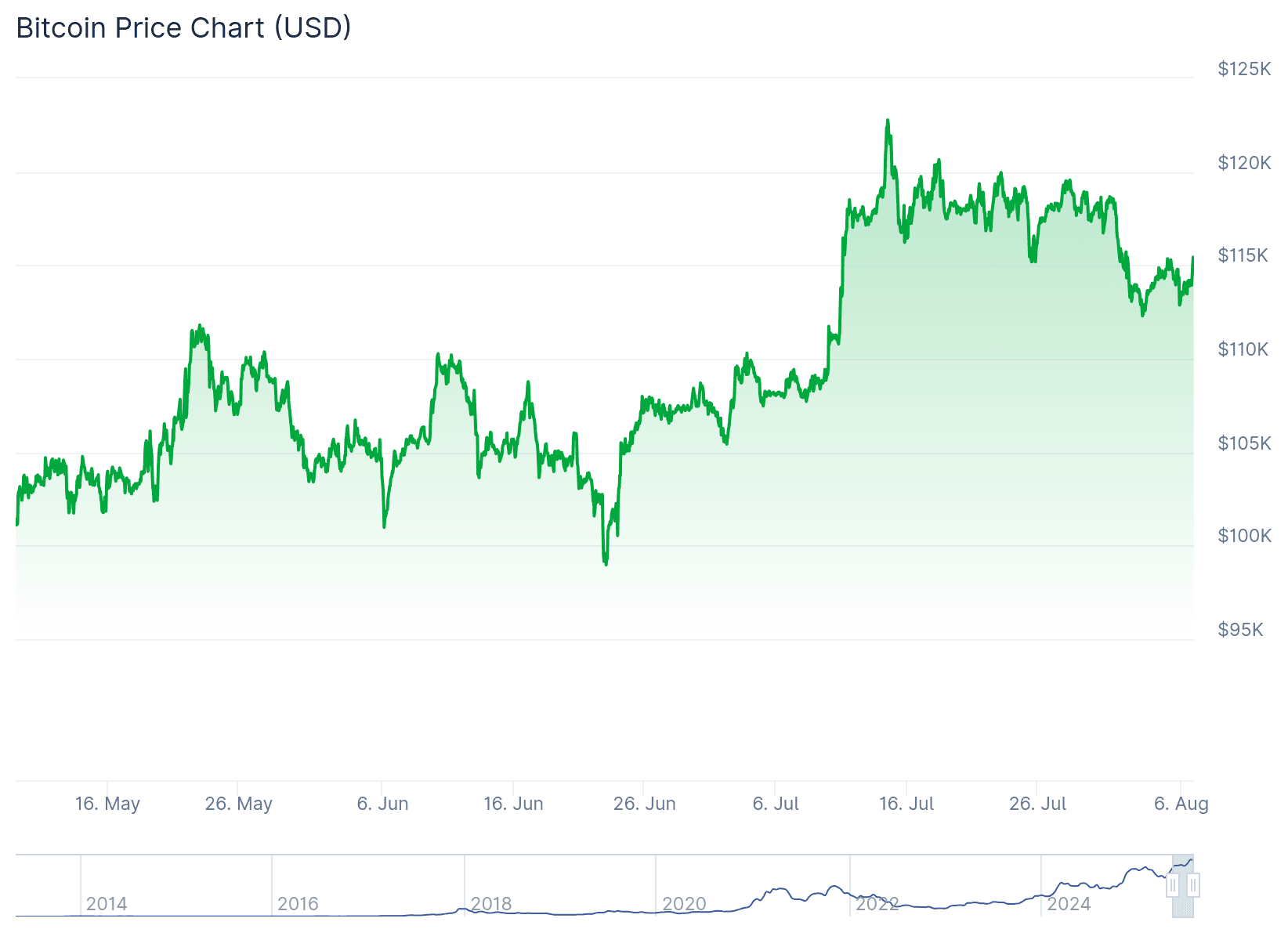

Analysts warn that Bitcoin’s $105,000 level could act as a high-risk trap for leveraged traders, even as prices hover near $115,000.

Key Takeaways

- 1Bitcoin is trading at $115,138, up 1.7% in the last 24 hours, but a key level at $105,000 is drawing attention.

- 2Onchain data highlights converging realized price metrics around $105K, signaling a short-term risk zone.

- 3Experts say elevated open interest and past accumulation around this level may lead to volatility and liquidations.

- 4Despite short-term risks, medium-to-long-term sentiment remains bullish, with a possible upside to $145,000.

What Happened?

Bitcoin’s price is inching higher, currently trading above $115,000. But crypto analysts and onchain data platforms are pointing to $105,000 as a critical zone that could spark sudden volatility. This level is emerging as a major convergence point for short-term holders and leveraged market participants, raising fears of potential bull traps and liquidations if prices drop back down.

$105K Identified as Bitcoin’s Short-Term “Danger Zone”

Multiple data sets now align around the $105,000 mark, suggesting it’s not just another round number but a serious technical battleground:

- UTXO Cost Basis Histogram from CryptoQuant shows a large cluster of realized transactions around $105,644, indicating significant market activity.

- Realized Price of BTC held between 1-3 months averages near $106,000, while short-term holders (less than 155 days) show an average cost of $105,350.

- These clusters hint at a large number of buyers who could panic sell or trigger cascading liquidations if Bitcoin drops to this level again.

Open Interest and Market Fragility Add to the Risk

Bitcoin’s open interest (OI) remains elevated at $79 billion, according to Hyblock Capital, keeping the derivatives market highly sensitive to price swings. This heightened OI, combined with the Fear & Greed Index recently peaking at “Extreme Greed,” has historically led to local tops and pullbacks.

Surprise Surprise. We all know how this played out. The frothy levels were followed by a sharp decline in btc price.

,Hyblock (@hyblockcapital) August 6, 2025

Greed has reduced and we are now in the Neutral territory, marking the 2nd day in a row where the index has decreased. Open Interest still remains high. https://t.co/numUsy3O2n pic.twitter.com/56NkuIclQY

- The recent collapse from $120,000 to $112,000 followed a similar pattern in July.

- Glassnode data shows significant resistance near $117,000, while a large price gap below suggests weak support until $108,000.

📊 Today’s #Matrixport Daily Chart – August 6, 2025⬇️

,Matrixport Official (@Matrixport_EN) August 6, 2025

Why $105,696 Still Matters For Bitcoin, and Why We’re Staying Cautious#Matrixport #Bitcoin #BTC #CryptoMarket #TechnicalAnalysis #BTCPrice #RiskManagement #Altcoins #CryptoOutlook #CryptoResearch pic.twitter.com/s4bjTSWu7K

- Analyst Axel Adler Jr. also noted that bearish pressure in the futures market, although easing, remains a structural risk.

After reaching a new ATH, bearish pressure in the futures market intensified peaking on July 29th –7.5%. It has now weakened to –5.2%, however the market structure remains fragile.

,Axel 💎🙌 Adler Jr (@AxelAdlerJr) August 6, 2025

Any negative news could trigger a cascade of long liquidations, which would instantly amplify… pic.twitter.com/Nbz14zVKEe

Technical Patterns Could Support a Bounce

The $105K zone also aligns with the neckline of a large inverse head-and-shoulders pattern, a bullish formation that Bitcoin recently broke out of. The neckline lies near $109,000, with the 20-week EMA close to $105,844.

- A retest of this neckline could serve as a confirmation of the breakout, potentially propelling Bitcoin toward $145,000, the target from the pattern.

- However, analysts caution that if the price falls into the $105K range without enough buying support, it may act as a bull trap, especially for over-leveraged positions.

Analyst Advice: De-risk and Prepare for Volatility

Crypto analyst CryptoMe emphasized caution for short-term traders. While remaining bullish for the longer term, he urged investors to lower risk exposure if Bitcoin nears the $105K area.

“Because of that, it would be a smart choice for investors to be careful if the price moves down toward this level in the short term. They should try to lower the risk level of their positions and smoothen the volatility exposure of their portfolio,” the analyst advised.

CoinLaw’s Takeaway

I see $105K as a serious short-term tripwire. Even though Bitcoin is looking strong near $115K, the way onchain metrics stack up around $105K makes it a prime shakeout zone. Leverage-heavy traders, in particular, are at risk if volatility flares. I’d say keep your eyes open. This could just be a pit stop before bigger gains, or it might sting if you’re overexposed. Either way, it’s a level to watch closely, not ignore.