Barclays stands among the world’s most recognized financial institutions, with a history stretching back to 1690. It operates across retail, corporate, investment banking, wealth management, and payments, serving millions of customers globally. Barclays continues to adapt to changing market dynamics, including interest rate shifts and digital transformation, while generating substantial revenue and profit growth.

Its influence extends from consumer mortgages in the UK to investment banking deals across the Americas and Asia, demonstrating its relevance in both everyday banking and major corporate finance. Below, explore detailed, current statistics that illuminate Barclays’ performance and position in the global banking landscape.

Editor’s Choice

- Barclays reported £26.788 billion in revenue for 2024, up year‑over‑year.

- Total assets reached approximately £1.518 trillion in 2024.

- Barclays posted £6.356 billion net income in 2024.

- Revenue for the trailing twelve months ending Sept 2025 reached ~$37.91 billion, up ~17% YoY.

- Total assets for Q3 2025 were ~$2.196 trillion, growing ~10% YoY.

- Q3 2025 saw an 11% increase in income vs the prior year.

- Barclays’ share buyback program reached £500 million in 2025.

Recent Developments

- Barclays invested in Ubyx, a stablecoin settlement platform, marking its first move into digital asset settlement technologies in 2026.

- Its Q3 2025 results showed income growth of 11% year‑over‑year.

- The bank announced a £500 million share buyback as part of capital return plans.

- Barclays upgraded its Return on Tangible Equity (RoTE) targets for 2025 and 2026.

- Mortgage net lending reached its highest level since 2021 in Q3 2025.

- Barclays reported improved cost efficiency savings ahead of schedule.

- Market volatility in 2025 contributed to strong trading revenues.

- The bank maintained a robust Common Equity Tier 1 (CET1) capital ratio in recent earnings.

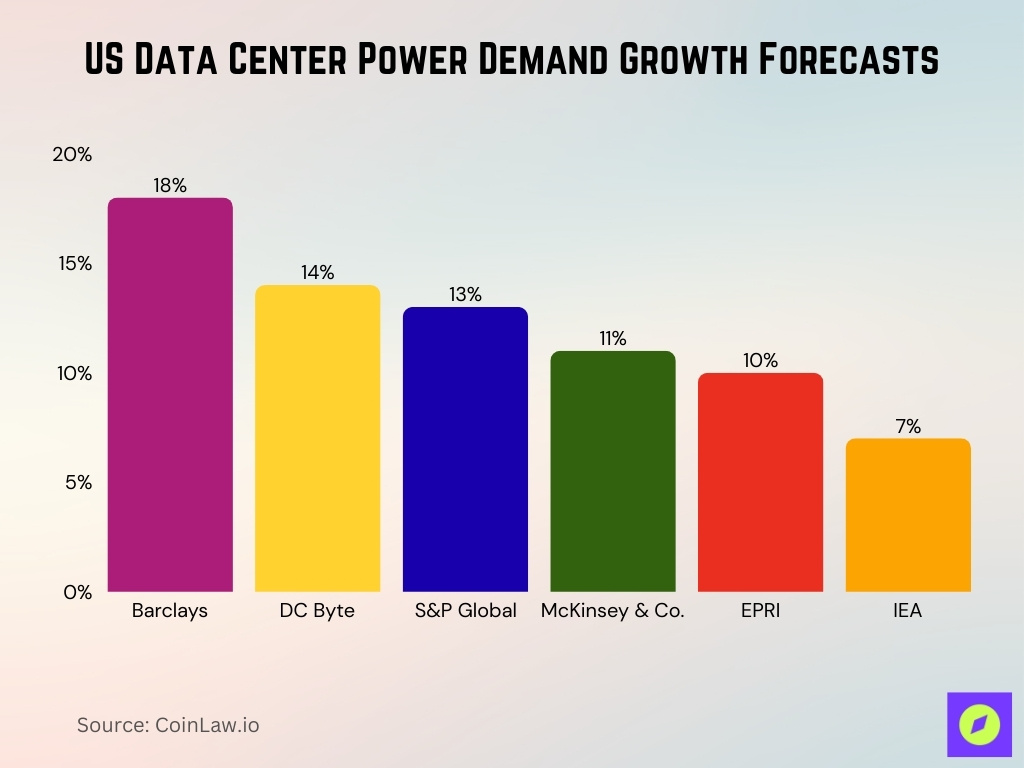

US Data Center Power Demand Growth Forecasts

- Barclays projects the fastest expansion, with US data center power demand growing 18% annually through 2030, highlighting the scale of AI and cloud infrastructure build-out.

- DC Byte estimates a robust 14% annual growth rate, reflecting sustained hyperscale and colocation data center investment.

- S&P Global forecasts 13% yearly growth, signaling strong but slightly more conservative expectations compared to infrastructure-focused analysts.

- McKinsey & Co. projects 11% annual growth, emphasizing efficiency improvements alongside rising compute demand.

- EPRI (high scenario) expects 10% yearly growth, accounting for grid constraints and power availability risks.

- IEA presents the most cautious outlook, forecasting 7% annual growth, reflecting global energy efficiency and policy considerations.

Barclays Key Facts and Figures

- Founded in 1690, Barclays is one of the oldest banks in continuous operation.

- Headquarters: London, United Kingdom.

- Operates in Europe, the Americas, Africa, and Asia.

- Offers retail and commercial banking, investment banking, wealth management, and credit services.

- Number of employees: ~100,000 (2025).

- Key executives include Group CEO C. S. Venkatakrishnan and Group Chairman Nigel Higgins.

- Listed on the London Stock Exchange (LSE) and traded as BARC.L.

- Barclays ranks among the top 10 largest European banks by assets.

Global Presence and Markets Statistics

- Barclays serves clients in over 40 countries worldwide.

- Total consolidated assets reached £1.593 trillion in Q1 2025.

- UK remains Barclays’ largest market with £301.4 billion total assets in Q1 2025.

- Americas operations generated $2.0 billion in investment banking fees YTD 2025 (3.2% market share).

- Plans full Riyadh office opening by 2026, expanding Middle East footprint.

- Asia operations restructured with new APAC investment banking leadership in 2025.

- Participates in global capital markets, targeting £30 billion group income by 2026.

- Investment banking fees ranked sixth globally with a 3.2% market share YTD 2025.

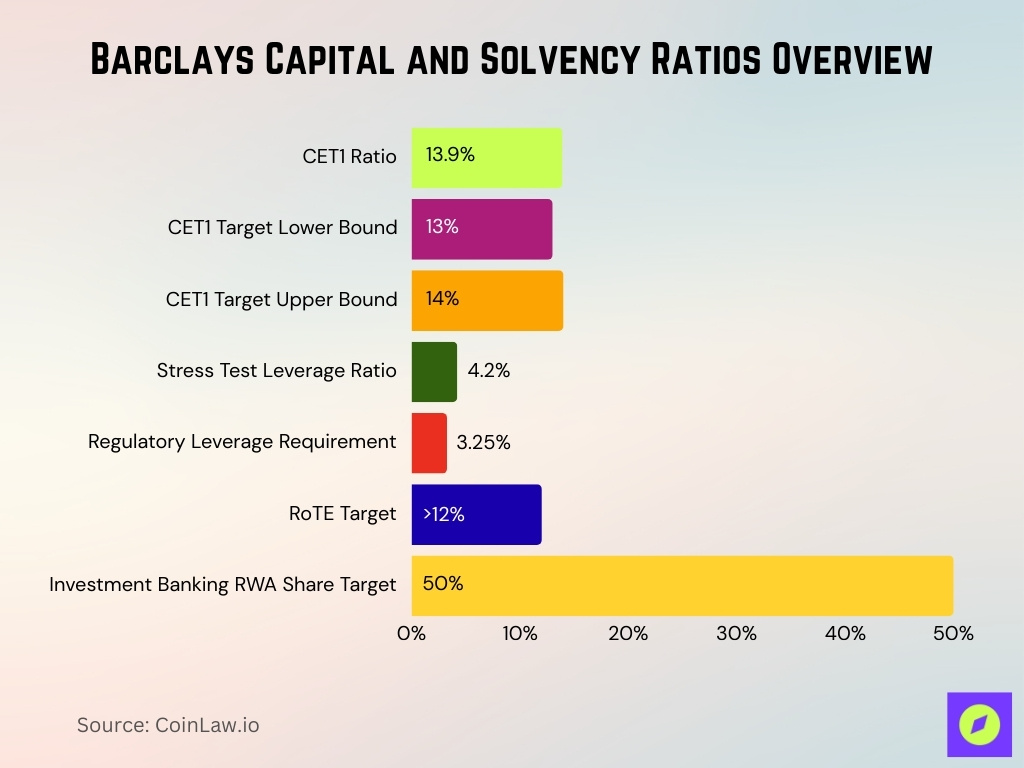

Capital, Liquidity, and Solvency Statistics

- Common Equity Tier 1 (CET1) ratio stands at 13.9% in Q1 2025, within the 13-14% target range.

- Bank of England 2025 stress test passed with a leverage ratio minimum 4.2% above the 3.25% requirement.

- Targets >12% RoTE and £30 billion total income in 2026.

- Investment banking RWAs targeted at ~50% of Group RWAs by 2026.

- Group Risk-Weighted Assets (RWAs) at £351.3 billion in Q1 2025.

- Loan loss rate (LLR) stable at 46 bps through the cycle guidance of 50-60 bps.

- CET1 buffers support £10 billion capital returns planned through 2026.

- Credit impairment charges at £632 million in Q3 2025.

Revenue and Income Statistics

- Barclays’ annual revenue for 2024 was £26.788 billion.

- Trailing twelve‑month revenue ending Sept 2025 was ~$37.91 billion, up ~17% YoY.

- Q3 2025 income grew 11% year‑over‑year.

- Net Interest Income in Q3 2025 was £3.3 billion, up 16% YoY.

- Barclays reported revenue of £7.2 billion for Q3 2025.

- Barclays’ 2024 total income rose by ~6% versus the prior year.

- The commercial and retail division showed consistent revenue growth in 2025.

- Revenue growth in investment banking was supported by market trading activity.

Profit and Earnings Statistics

- Barclays reported £6.356 billion net income in 2024.

- Net income increased to ~£6.64 billion in 2025, a ~25% rise.

- Projected net income for 2026 is ~£8.17 billion, up ~23% from 2025.

- Q3 2025 net income per quarter was £1.964 billion, but showed a slight YoY decline in that quarter.

- Profit before tax in early 2025 rose 28% to £2.5 billion in Q2.

- Barclays improved return on tangible equity (RoTE) in 2025 vs the prior year.

- Earnings per share surged 41% YoY in Q2 2025.

- Barclays raised performance targets after strong pre‑tax profit growth in 2024.

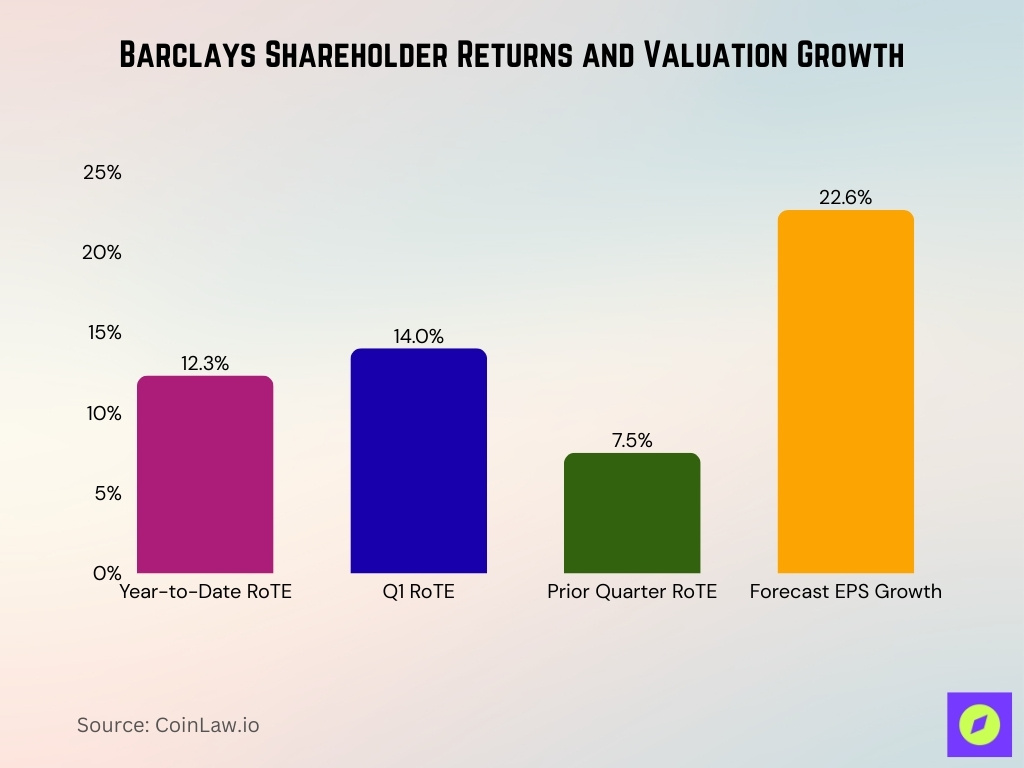

Shareholders and Market Valuation Statistics

- Share price traded at 471.35p on the London Stock Exchange in early January.

- £500 million share buyback program is active until April 2026.

- Plans to return at least £10 billion to shareholders through 2026.

- Year-to-date RoTE reached 12.3% outperforming guidance.

- Q1 RoTE hit 14%, up from 7.5% prior quarter.

- Price-to-book ratio at 0.83, lowest among FTSE 100 peers.

- Major FTSE 100 component with 22.6% forecast EPS growth.

Assets and Balance Sheet Statistics

- Barclays’ total consolidated assets reached approximately $2.19 trillion in Q3 2025, marking about a 10% year‑over‑year increase.

- In annual terms, Barclays’ total assets for 2024 stood around $1.94 trillion.

- Total assets measured in GBP terms were about £1.63 trillion as of late 2025.

- Net assets on the balance sheet were approximately $103.3 billion as of September 2025.

- Equity on the balance sheet was around £72.5 billion for 2024.

- Barclays’ balance sheet reflected resilience through continued lending diversification and liquidity buffers during 2025.

- Retail and corporate loan balances continued to expand, with lending exposures diversified across geographies.

- The bank sustained stable funding and liquidity profiles, with high‑quality liquid assets exceeding regulatory minima historically.

Lending and Credit Portfolio Statistics

- Total gross loans at £368 billion, with a Stage 3 ratio of 2.1% in Q1 2025.

- Stage 3 loans totaled £7.4 billion, Stage 2 at £36.8 billion Q1 2025.

- Credit impairment charges £632 million in Q3 2025, up 69% YoY.

- Loan loss rate 61 bps in Q1 2025, above 50-60 bps guidance.

- Credit card and personal loans Stage 3 ratio stable at 4.8% Q1 2025.

- U.S. consumer Bank credit quality sustained amid fluctuations.

- Customer net loan-to-deposit ratio 61% end of Q1 2025.

- Mortgage lending growth offsets IB book decrease by £2.3 billion in Q1 2025.

- US card portfolio is targeted $40 billion by 2026 from $32 billion.

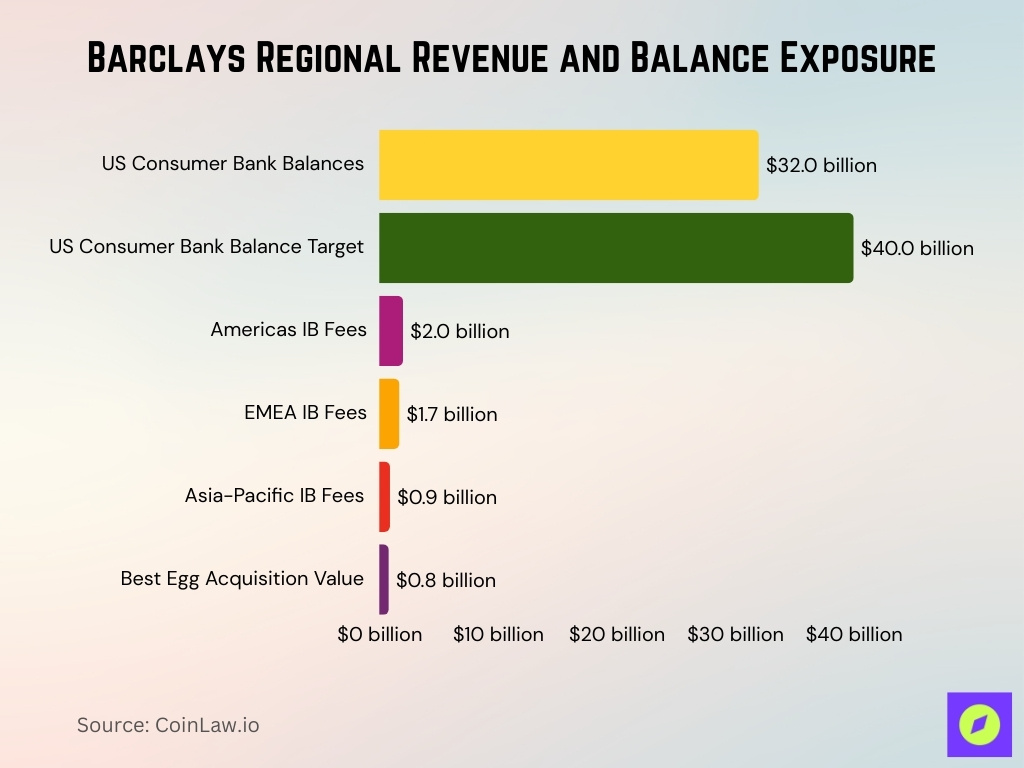

Regional Performance Statistics

- US Consumer Bank balances $32 billion, targeting $40 billion.

- Americas IB fees $2.0 billion YTD 2025 3.2% share.

- EMEA IB fees $1.7 billion YTD 2025.

- Asia-Pacific IB fees $0.9 billion YTD 2025.

- Acquiring $800 million Best Egg, expanding the US consumer base.

- UK retail banking revenue £3.7 billion Q1 2025 up 3%.

- Corporate and Investment Bank income £3.4 billion Q1 2025 up 25%.

- Riyadh office is planned for 2026, boosting the Middle East.

- Wealth and Private Bank income £0.6 billion Q1 2025.

Deposits and Funding Base Statistics

- Total customer deposits at £460 billion in Q1 2025.

- Retail deposits comprise 68% of the total funding base.

- Customer net loan-to-deposit ratio 61% end of Q1 2025.

- Liquidity coverage ratio (LCR) is 175% well above the minimum.

- Average LCR 142% in Q1 2025.

- Retail savings grew, supporting a stable funding profile.

- Wholesale funding reliance reduced with a diversified base.

- Liquidity pool £254 billion in Q1 2025.

Investment Banking and Markets Statistics

- Global investment banking fees rose 11% to $137.6 billion in 2025.

- Barclays’ investment banking fees market share ~3.2% YTD 202,5 sixth globally.

- Americas IB fees $2.0 billion YTD 2025.

- EMEA IB fees $1.7 billion YTD 2025.

- Asia-Pacific IB fees $0.9 billion YTD 2025.

- Investment banking revenue up 25% YoY in Q1 2025.

- Global markets revenue was £2.9 billion in Q1 2025.

- Equities revenue £0.8 billion, FICC £2.1 billion Q1 2025.

Cards and Payments Statistics

- US Consumer Bank serves ~20 million customers tied to cards and finance.

- Processed $786.3 billion transaction value in Europe in 2022.

- November card spending dropped -1.1% YoY despite Black Friday +62.5% volumes.

- December consumer card spending fell -1.7% largest decline since 2021.

- Acquiring $800 million Best Egg for unsecured lending, closing in Q2 2026.

- Cards business Stage 3 ratio stable at 4.8% Q1 2025.

- UK debit/credit card spend up 11% June vs 2019 levels.

- Issue cards under 28 IINs across the UK, US, France, and Ghana.

- 275 BIN/IIN series for UK cards.

Digital and Mobile Banking Statistics

- 33% of digital customers use a mobile app exclusively.

- Barclays US app has 1 million+ downloads, 4.7 stars from 38.6K reviews.

- Nearly 50% of mobile bankers use the app daily, logging in twice as often as desktop.

- £15 billion payments made via UK app past two years.

- 9.5 million digitally active customers globally.

- Average 595 pounds transferred weekly via app.

- 35% of business clients downloaded the mobile app.

- 2 million app downloads historically, with 200% registration growth in 2013.

- UK app enables 4,000 payment transfers daily.

Customer Base and Demographics Statistics

- Total customers 48 million in the UK, 20 million in the US Consumer Bank.

- Employs over 83,500 people worldwide.

- UK retail targets ages 25-55 with a minimum £30,000 annual income.

- The mass affluent segment (£100,000-£500,000 assets) drives 40% wealth profits.

- The digital native cohort (18-35 years) shows 22% app user growth.

- 54% mobile bankers are men.

- 78% daily transactions are now digital across customers.

- 10% UK retail banking market share.

- UK branches ~450 in affluent areas.

Risk Management and Asset Quality Statistics

- Impairment charges £632 million Q3 2025, up 69% YoY.

- Stage 3 loans £7.4 billion, 2.1% of gross loans Q1 2025.

- Loan loss rate 61 bps Q1 2025 above 50-60 bps guidance.

- CET1 ratio 13.9% Q1 2025 above regulatory minimums.

- Leverage ratio is 4.2% above the 3.25% stress test requirement.

Sustainability and Green Finance Statistics

- Sustainable finance revenues were £500 million ($666 million) in 2024.

- Targets $1 trillion sustainable financing by 2030.

- $58 billion in sustainable financing in H1 2025.

- Cumulative sustainable volumes $220.2 billion since 2023.

- 50% sustainable volumes, social financing.

- Environmental green financing $74.5 billion.

- Scope 1 and 2 emissions have been reduced 95% since 2018.

- £65 million climate tech investment.

- 120,867 tCO2e avoided GHG emissions annually from green bonds.

Frequently Asked Questions (FAQs)

Barclays is targeting a sustainable RoTE (return on tangible equity) above 12 % by 2026.

Barclays’ market capitalization was approximately £93.48 billion in January 2026.

Barclays’ U.S. credit card business accounts for about 11 % of the group’s overall profits.

Barclays UK targets adults aged 25–55 with a minimum £30,000 annual income as its core demographic.

Conclusion

Barclays’ statistical profile shows a bank transforming across technology, sustainability, and global markets. From sustainable finance revenue to digital banking engagement shifting to mobile channels, the bank’s performance reflects strategic priorities in growth and risk management. Its customers and far broader international base underscore both scale and complexity, while sustainability targets and risk frameworks point to long‑term resilience. As Barclays navigates competitive pressures and regulatory shifts, understanding these metrics helps stakeholders gauge performance and outlook.