Imagine a world where your financial transactions, investments, and savings are handled autonomously, freeing you from tedious decisions while maximizing efficiency. Autonomous finance, driven by cutting-edge AI and machine learning, is rapidly transforming the financial landscape. This innovation continues to gain momentum, offering seamless financial operations and smarter money management. As this field evolves, it not only reshapes individual finances but also has significant implications for businesses and institutions worldwide.

Editor’s Choice

- Over 83% of US financial institutions adopted autonomous finance solutions for operational efficiency in 2025.

- In 2025, over 67% of banking customer interactions were managed by AI-driven platforms.

- Robo-advisors in wealth management grew by 21% in 2025, managing assets worth $2.4 trillion worldwide.

- In 2025, 56% of Gen Z and Millennials preferred autonomous finance tools for budgeting/investment because of convenience.

- Top firms like JPMorgan Chase, Wells Fargo, and PayPal increased investments in autonomous finance technologies in 2025, with spending up 27% year-on-year.

Understanding Autonomous Finance

- AI-powered platforms enabled 64% of finance firms to make autonomous decisions in 2025, driving higher accuracy and efficiency.

- In 2025, automation handles up to 80% of repetitive financial tasks, saving teams 30-40% of time and vastly reducing errors.

- AI-driven systems delivered 52% more personalized financial insights to users in 2025, boosting engagement on platforms like Mint and YNAB.

- By 2025, robo-advisors managed $2.0 trillion in global assets, with the US market reaching $550 billion

- Self-optimizing platforms improved financial outcomes by 35% in 2025 by continuously refining investment and budgeting strategies.

- Accessibility surged in 2025, with 72% of finance teams and millions of everyday users relying on autonomous tools for daily money management.

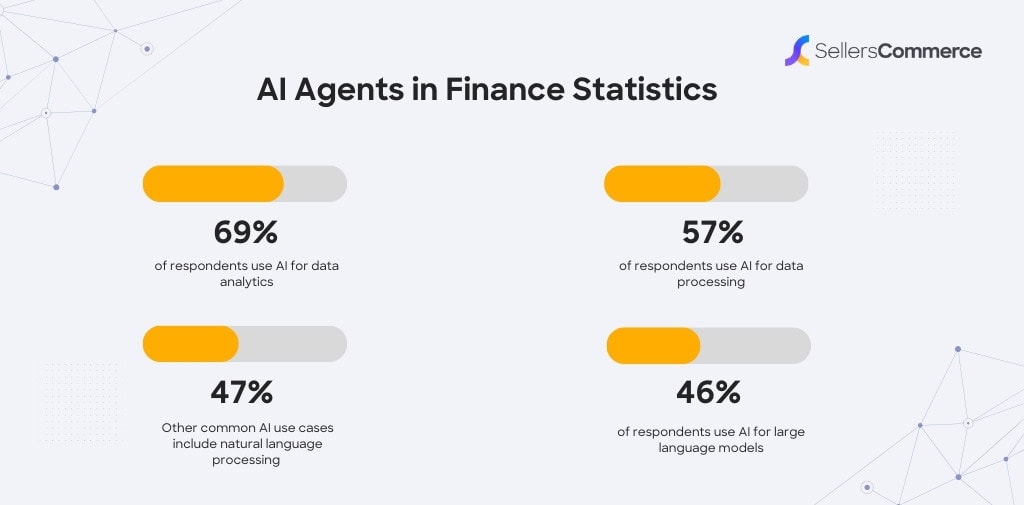

AI Agents in Finance

- 69% of finance professionals use AI for data analytics, making it the top use case.

- 57% of respondents apply AI to data processing tasks for efficiency.

- 47% report using AI for natural language processing (NLP) and related functions.

- 46% use AI-powered large language models (LLMs) for complex financial tasks

Benefits of Autonomous Finance

- In 2025, autonomous finance cut operational costs by up to 50% for businesses adopting AI and automation.

- Over 67% of users rely on autonomous finance tools for 24/7 management, handling tasks like payments and fraud detection in real time.

- AI-driven systems reduced transactional errors by 48% in 2025, ensuring greater accuracy across financial reporting.

- Personalized AI in autonomous platforms improved customer satisfaction scores by 44% with tailored insights and automated services in 2025.

- Automated bill payment and budget tools saved users 6+ hours per month on average in 2025.

- Real-time fraud algorithms decreased losses by up to 60% for banks and fintech firms in 2025.

- Financial inclusion rose by 20% in 2025, as digital autonomous finance platforms expanded access for underserved populations.

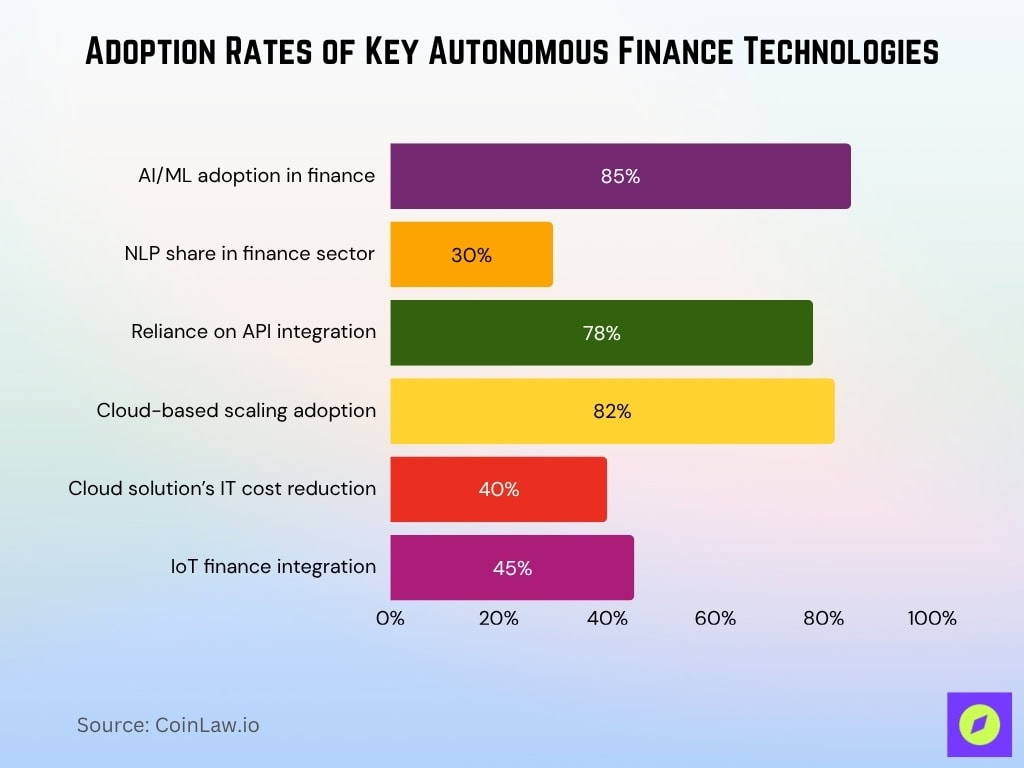

Components of Autonomous Finance

- AI and machine learning adoption in finance reached 85% by 2025, driving predictive analytics and autonomous strategies.

- NLP applications in banking and financial services will account for nearly 30% of all NLP use cases in 2025, powering smarter client interactions.

- Blockchain transactions secured over $2.2 trillion in DeFi assets, providing transparent and tamper-proof solutions in 2025.

- In 2025, 78% of financial companies will rely on API integration for unified digital financial ecosystems.

- Cloud-based finance platforms supported data scaling for 82% of institutions while reducing IT costs by 40% in 2025.

- IoT finance integration enabled real-time monitoring for 45% of enterprises by 2025, fueling automated transactions and reporting.

Adoption Rates Across Financial Institutions

- As of 2025, over 88% of US banks invest in AI-driven financial tools, marking a 19% spending increase year-over-year.

- Global robo-advisor adoption soared to 26% in 2025, reflecting rising consumer trust in autonomous financial solutions.

- 74% of insurance providers now deploy AI-powered platforms for claims processing and underwriting in 2025.

- In 2025, 62% of US credit unions and regional banks have integrated autonomous finance, narrowing the gap with national banks.

- Asia-Pacific leads with 89% of top banks using autonomous finance in 2025, accelerated by digital mandates and innovation grants.

- In 2025, autonomous systems achieved a 41% faster turnaround for customer queries and loan approvals.

- The mortgage industry saw a 38% increase in digital applications in 2025, driven by automation and rapid document verification.

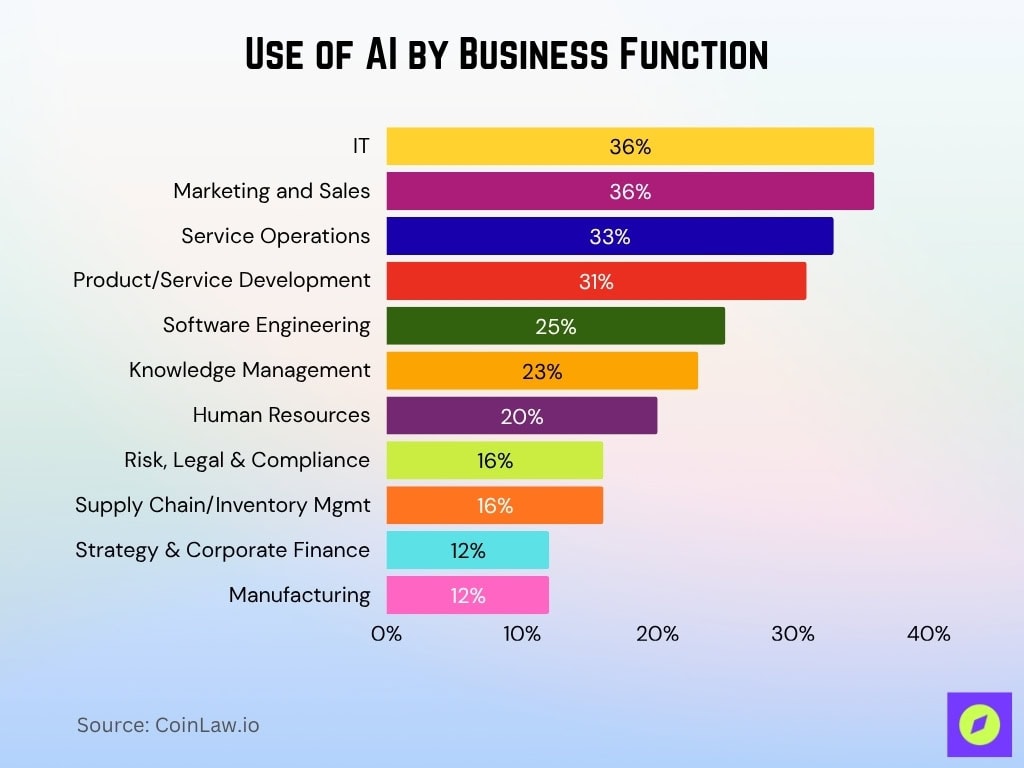

Use of AI by Business Function

- 36% of organizations use AI in IT, the top-ranked functional area.

- 36% also apply AI in marketing and sales to optimize customer engagement.

- 33% leverage AI in service operations for automation and efficiency.

- 31% use AI in product or service development, driving faster innovation.

- 25% of respondents apply AI in software engineering workflows.

- 23% integrate AI into knowledge management systems.

- 20% use AI for human resources, including hiring and employee insights.

- 16% deploy AI in risk, legal, and compliance functions.

- 16% adopt AI in supply chain and inventory management processes.

- 12% utilize AI in strategy and corporate finance decisions.

- 12% apply AI within manufacturing, often for quality control or automation.

Trends in Financial Services

- In 2025, 56% of non-financial businesses offer embedded financial services, expanding digital finance adoption worldwide.

- The global DeFi market grew 20% year-over-year, reaching a cap of $135 billion and TVL of $122 billion in Q2 2025.

- 42% of banking users in 2025 prefer voice-activated financial interactions, driving new digital banking engagement.

- Advanced analytics enabled 87% of financial institutions to deliver hyper-personalized customer experiences in 2025.

- Green finance assets totaled $7.9 trillion in Q1 2025, with $2.9 trillion in outstanding green bonds supporting sustainable investment.

- Gamified savings apps attracted 19% more Millennials and Gen Z users in 2025, boosting digital savings engagement.

- Biometric security secured 85% of autonomous finance transactions by 2025, advancing protection for digital payments.

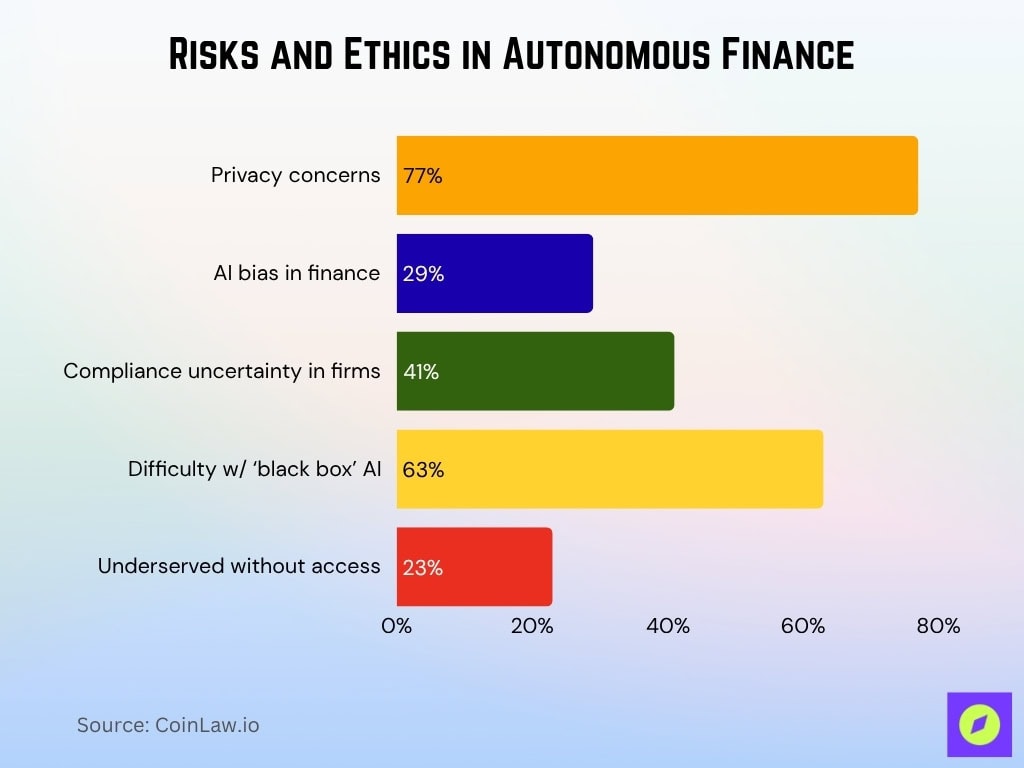

Challenges and Ethical Considerations of Autonomous Finance

- In 2025, 77% of users worry about financial data privacy and misuse by AI-driven platforms.

- Studies found 29% of AI algorithms in finance showed bias, impacting loan approvals and credit scoring in 2025.

- Global automation could displace 4.5 million finance jobs by 2025, driving urgent demand for workforce reskilling.

- Autonomous finance outpaced regulatory frameworks, causing 41% of firms to face compliance uncertainty in 2025.

- Cyberattacks resulted in $12.5 billion in financial sector losses in 2025, with increasing vulnerability from automated systems.

- In 2025, 63% of users reported difficulty understanding “black box” AI decisions in lending and fund management.

- The digital divide persisted, with 23% of underserved populations still lacking access to autonomous financial tools in 2025.

Regional Trends and Variations

- North America leads in 2025 with 75% of financial institutions integrating AI and machine learning across core operations.

- Europe’s regulatory focus sees 54% of new rules targeting transparency and fairness in AI-driven finance by 2025.

- Asia-Pacific is the fastest-growing region, with 80% of top fintechs leveraging autonomous finance and AI innovation in 2025.

- Middle East and Africa see fintech investments rising 22% annually in 2025, but autonomous platform adoption remains below 30%.

- Latin America accelerated adoption with 53% of digital banking transactions handled by AI-powered tools in 2025.

- China’s AI-driven financial ecosystem is valued at over $3.4 trillion in 2025, supported by extensive government investment.

- India attracted over 42 million new robo-advisory users in 2025, reflecting rapid growth in digital wealth management.

Recent Developments

- Hybrid advisory robo-advisors captured 45% of market share in 2025, combining human expertise with automation for personalized financial planning.

- AI-driven ESG investments grew by 23% annually in 2025, reaching $39 trillion in global assets.

- DAOs gained popularity with a 400% year-on-year rise in DeFi protocol assets and $1.2 billion in on-chain loans processed by Q2 2025.

- Wearable integrations powered secure financial tracking and transaction approvals for 28% of digital banking users in 2025.

- AI-powered currency exchange platforms enabled instant conversions for 71% of global travelers in 2025.

- Blockchain-based credit scoring improved loan approval rates by 30% and processed over $176.5 billion in on-chain loans in 2025.

- Big Tech collaborations drove innovation as 85% of major financial institutions partnered with Google, Apple, and Microsoft in 2025.

Frequently Asked Questions (FAQs)

In 2025, industry-wide AI-related budgets are rising by 25%, accounting for 16% of total tech spending.

Over 83% of financial firms are actively applying AI across areas like fraud detection, IT, and risk modeling in 2025.

The Asia Pacific region is growing at a 17.9% CAGR between 2026 and 2035, the fastest globally.

The expected compound annual growth rate (CAGR) is 17.2% during 2025–2035.

Conclusion

Autonomous finance is not just a trend; it’s a paradigm shift redefining the financial landscape. By leveraging AI, machine learning, and automation, this technology empowers users and businesses alike. However, as its adoption accelerates, stakeholders must address challenges like ethical considerations and data security to ensure it benefits everyone equitably. With continued advancements and global collaboration, this year promises to be a pivotal year for autonomous finance, paving the way for a smarter, more efficient financial future.