Imagine logging into your bank account, sending money, or applying for a loan without leaving your favorite financial app. Behind this seamless experience lies a powerful technology: APIs (Application Programming Interfaces). APIs are the invisible engines driving innovation in financial services, enabling smooth integration of applications, data sharing, and personalized customer experiences. With the financial sector undergoing rapid digital transformation, understanding the role and impact of APIs has never been more crucial.

This article delves into the key statistics of APIs in financial services, shedding light on growth, security, regulatory compliance, and more. Whether you’re a fintech enthusiast or a banking professional, these insights will guide you through the evolving API landscape.

Editor’s Choice

- Over 80% of financial institutions are investing in API-driven strategies to enhance customer experiences.

- API-related investments in financial services are projected to exceed $25 billion by 2025, with sustained double-digit annual growth.

- 81% of banks have adopted open banking APIs for secure third-party access in 2025.

- 137 billion open banking API calls were made globally in 2025, rising 427% from last year.

- APIs contribute 42% of revenue growth in leading financial institutions in 2025 by enabling cross-platform integrations and personalization.

- 77% of new fintech apps in 2025 are built using API-first strategies.

- A significant majority of Regtech solutions now utilize APIs for compliance automation, with adoption expected to reach 85–90% by 2025.

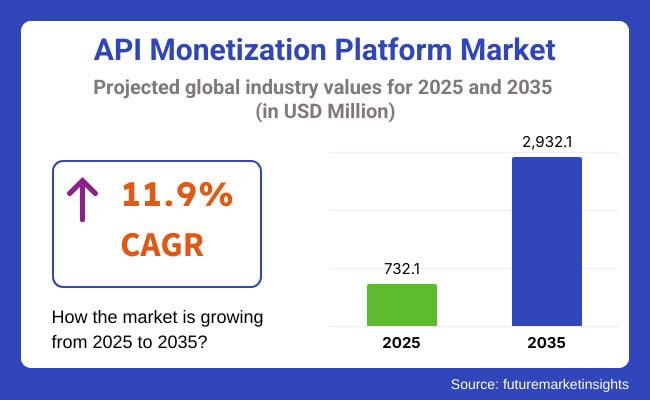

API Monetization Platform Market Growth

- The API Monetization Platform Market is projected to grow from $732.1 million in 2025 to $2,932.1 million in 2035.

- This reflects a strong compound annual growth rate (CAGR) of 11.9% over the 10-year period.

- The market is expected to quadruple in value, showing increased demand for API-driven revenue models.

- API monetization is becoming a core part of digital transformation strategies in industries such as banking, telecom, healthcare, and SaaS.

- The 2035 market size suggests significant long-term investment opportunities for API gateway vendors, fintech platforms, and integration providers.

Recognizing API Security as a Business Priority

- 79% of financial institutions ranked API security as their top technology concern in 2025.

- 99% of organizations reported at least one API security incident in the past 12 months in 2025.

- Spending on API security solutions surpassed $6.2 billion in 2025, with annual growth at 27%.

- Zero Trust API architecture adoption reached 35% in financial institutions in 2025, with banks leading the implementation.

- 95% of organizations identified API gateways as essential for secure traffic management and policy enforcement in 2025.

- 74% of financial service providers use advanced API monitoring tools for real-time threat detection in 2025.

- The average response time to an API-related security breach improved by 51% in 2025, thanks to automated monitoring technologies.

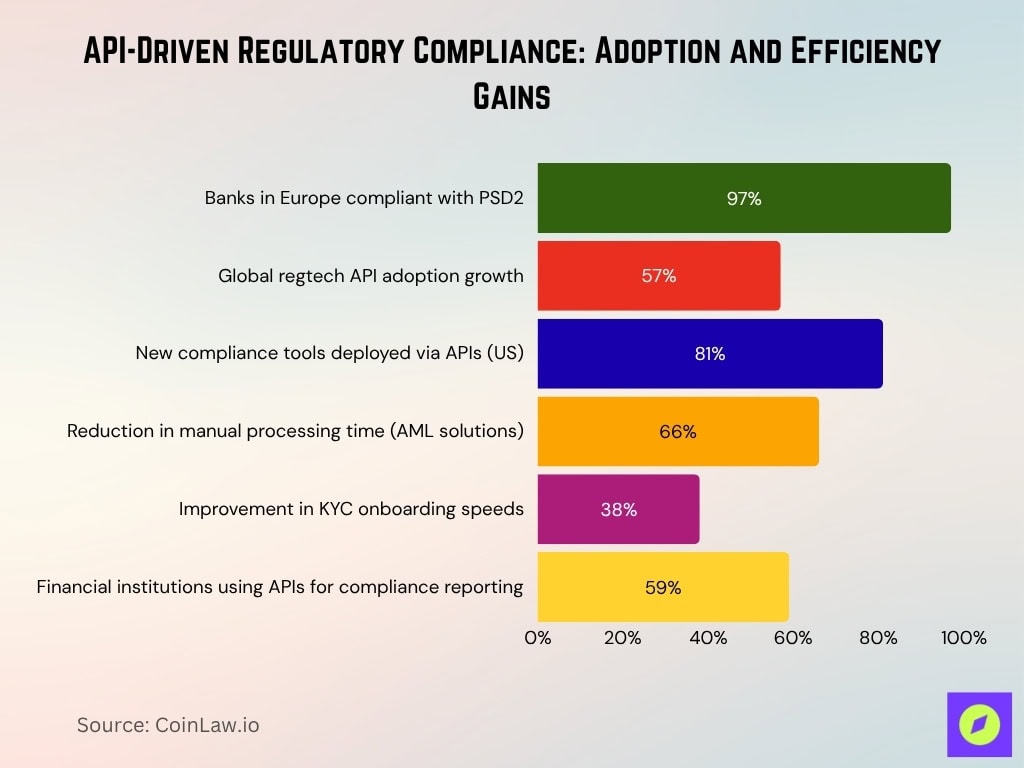

Regulatory Compliance and APIs

- 97% of banks in Europe are compliant with PSD2 in 2025, leveraging APIs to fulfill regulatory mandates.

- Global regtech API adoption soared by 57% in 2025 as firms accelerated tech-driven compliance strategies.

- APIs accounted for 81% of new compliance tools deployed by US financial institutions in 2025.

- API-driven AML solutions cut manual processing time by 66% for major banks in 2025.

- API-based KYC platforms improved onboarding speeds by an average of 38% in 2025.

- 59% of financial institutions used APIs for more efficient compliance reporting, raising accuracy and reducing costs in 2025.

Open Banking and API Landscape

- 90% of countries with advanced financial markets have adopted open banking API regulations in 2025.

- 51% of global consumers use at least one open banking-enabled service in 2025, up from 40% last year.

- Open banking transactions hit $676 billion globally in 2025, marking a 36% year-over-year increase.

- Europe leads with 98% of financial institutions implementing open APIs to comply with PSD2 in 2025.

- 47,000+ open APIs are available globally in 2025, fueling deeper bank-fintech partnerships.

- 68% of consumers voiced concerns about data security in open banking in 2025, underlining API protection needs.

- 61% of small banks in North America participate in open banking initiatives in 2025, a significant rise from previous years.

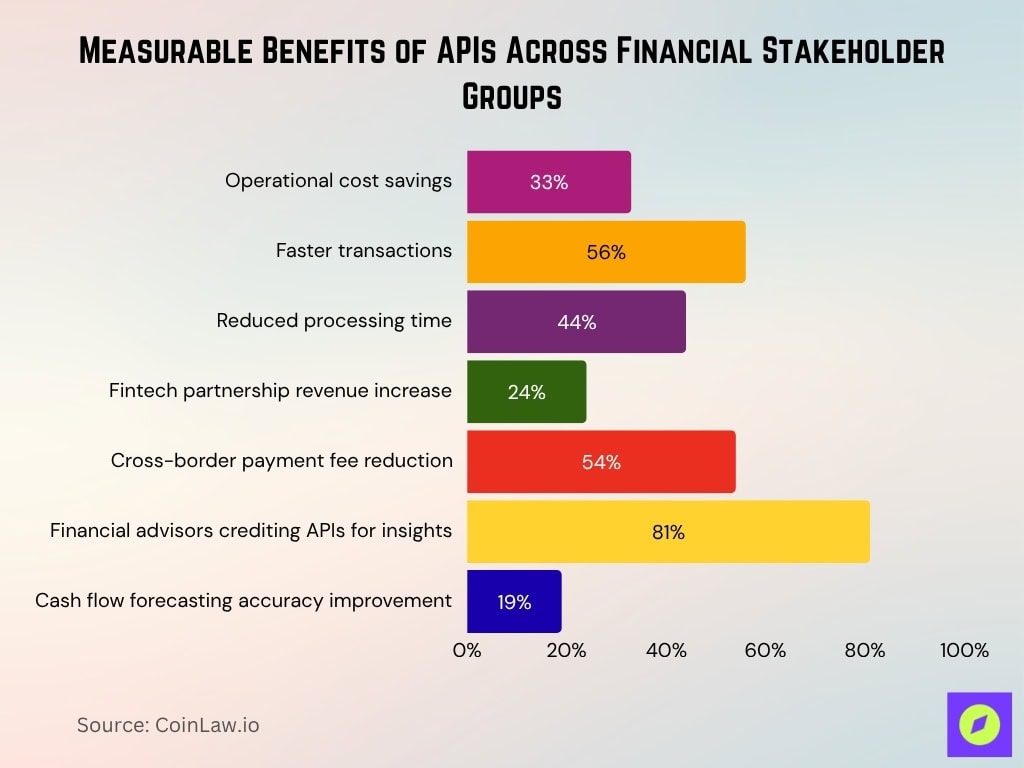

Key Benefits for Stakeholders

- APIs cut operational costs by an average of 33% for financial institutions in 2025 through process automation.

- Customers on API-driven platforms experienced 56% faster transactions in 2025, boosting satisfaction.

- APIs enabled banks to deliver real-time loan approvals, reducing processing time by 44% in 2025.

- Fintech partnership stakeholders saw a 24% revenue increase in 2025 from API-powered integrations.

- APIs enabled cross-border payments with 54% lower fees than legacy methods in 2025.

- 81% of financial advisors credited APIs for richer customer insights and better personalized planning in 2025.

- Corporate clients using API treasury solutions improved cash flow forecasting accuracy by 19% in 2025.

Strategic API Models in Banking Services

- Global Banking-as-a-Service (BaaS) platforms are projected to generate over $30 billion in API-based revenue by 2025, growing at a CAGR of 15–18%.

- API-first banking models cut time-to-market for new products by 39% in 2025, boosting competitiveness.

- 82% of neobanks in 2025 rely on API ecosystems for seamless digital experiences.

- Embedded finance APIs expanded by 47% in 2025, powering direct financial services on third-party platforms.

- APIs for digital wallets processed over $970 billion in global transactions in 2025.

- Customizable API packages are offered by 68% of banks in 2025, supporting business-specific solutions.

- 58% of traditional banks in 2025 have adopted hybrid API strategies, integrating legacy and modern systems.

- APIs form the core foundation of innovation and competitive strategy in banking in 2025.

Country-Specific Statistics and Information

- The US leads in API adoption with 97% of financial institutions actively deploying APIs in 2025.

- Europe’s open banking compliance rate reached 98% in 2025, sustained by PSD2 mandates.

- China’s fintech firms increased API investments by 32% annually in 2025, driven by digital payment innovation.

- In India, API-powered UPI systems processed over $4.2 trillion in transactions in 2025.

- Australia’s Consumer Data Rights (CDR) initiative enabled 94% of banks to adopt APIs for data sharing in 2025.

- Canada’s open banking market is growing at 22% annually in 2025, with a broad API rollout.

- Brazil’s open banking initiative reached a 68% participation rate among banks in 2025, furthering the transformation.

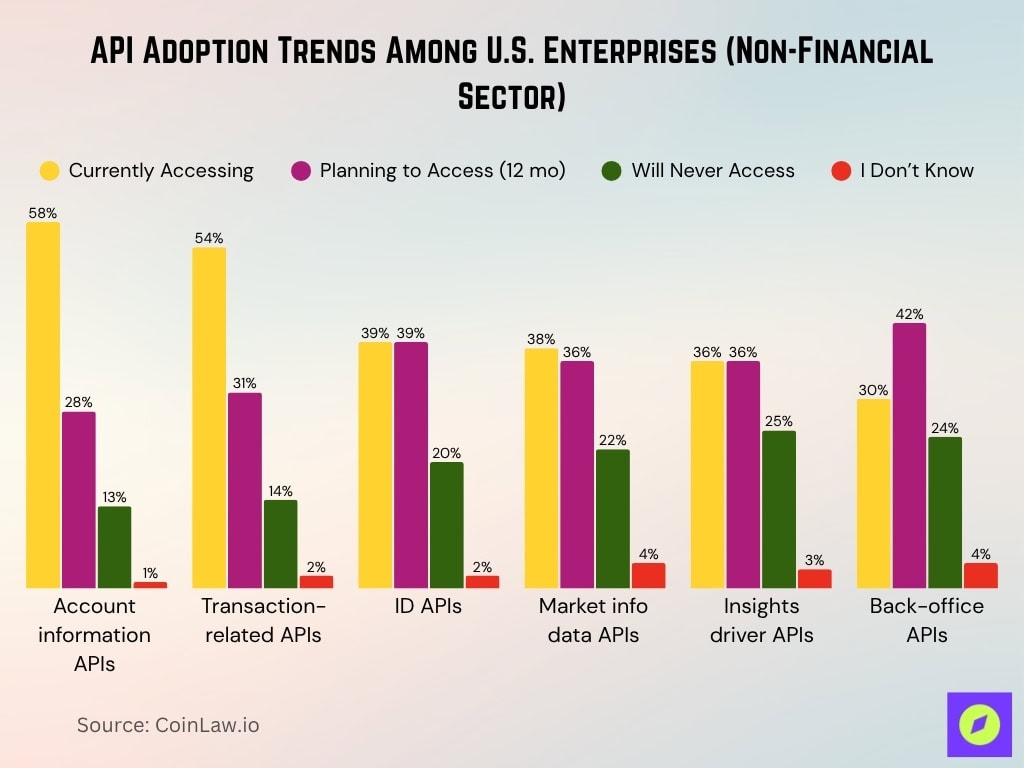

API Adoption Trends Among U.S. Enterprises (Non-Financial Sector)

- 58% of respondents are currently accessing Account Information APIs, making it the most widely adopted API category.

- 54% are using Transaction-related APIs, with 31% planning to adopt them in the next 12 months.

- 39% currently access ID APIs, while another 39% plan to adopt them, the only category with equal current and planned adoption.

- Market Info Data APIs show 38% current usage and 36% planning to adopt, while 22% say they’ll never access them.

- Insights Driver APIs have 36% current adoption and 36% planned, but also a relatively high 25% rejection rate.

- Back-office APIs have the lowest current usage at 30%, but the highest planned adoption at 42%, indicating strong future growth potential.

Recent Developments

- API integrations in financial services surged by 54% in 2025, underscoring accelerated technology adoption.

- AI-powered APIs improved fraud detection accuracy by 42% in 2025, enhancing risk controls.

- Blockchain-based APIs processed over $335 billion in secure transactions in 2025, merging DeFi and TradFi.

- API marketplaces expanded by 29% in 2025, giving developers access to turn-key financial APIs.

- Environmental finance APIs helped institutions meet ESG goals with 37% faster sustainability reporting in 2025.

- Voice-enabled API adoption reached 47% in 2025, boosting accessibility for banking customers.

- Digital identity APIs reduced identity fraud cases by 27% in 2025, promoting safer financial ecosystems.

Frequently Asked Questions (FAQs)

Over 2 billion.

33%.

$676 billion.

81%.

Conclusion

APIs are the lifeblood of innovation in financial services, bridging gaps between traditional institutions and modern fintech solutions. From boosting operational efficiency to ensuring regulatory compliance, APIs are paving the way for a customer-centric, agile financial ecosystem. As investments in API technology continue to soar, stakeholders must focus on security, collaboration, and innovation to stay competitive in the evolving digital landscape.