American Bitcoin Corp has reached a new milestone, holding 4,004 Bitcoin as part of its aggressive accumulation strategy combining mining and strategic purchases.

Key Takeaways

- American Bitcoin Corp has grown its Bitcoin reserve to 4,004 BTC as of November 5, 2025, a notable increase of 139 BTC since October 24.

- The company’s Satoshis Per Share (SPS) metric rose 3.35 percent, now standing at 432, providing greater transparency for investors.

- Co-founder Eric Trump credited the dual strategy of scaled mining and market purchases for the rapid growth in holdings.

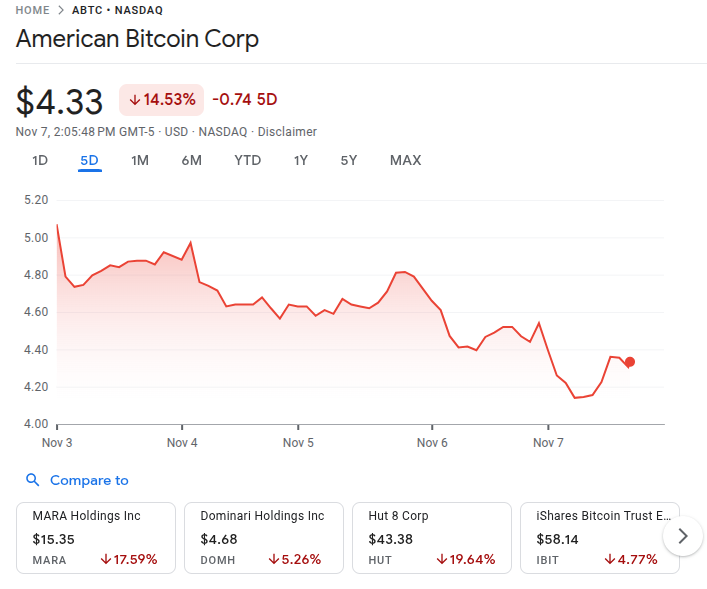

- Despite the milestone, ABTC’s stock fell 5.22 percent on November 5, reflecting market volatility.

What Happened?

American Bitcoin Corp announced it now holds approximately 4,004 Bitcoin, up from 3,865 BTC just 12 days prior. This increase is the result of both ongoing mining operations and disciplined market purchases. The company’s SPS metric also climbed by 3.35 percent during this period, signaling stronger investor exposure to Bitcoin per share.

American Bitcoin has acquired ~₿139 since the October 24, 2025 announcement, bringing total holdings to ~₿4,004 and Satoshis per Share (SPS) to ~432. Let’s keep stacking 🇺🇸 pic.twitter.com/1T1t4tTyAR

— American Bitcoin (@ABTC) November 6, 2025

ABTC’s Dual Strategy: Mining and Market Buys

American Bitcoin’s rise to 4,004 BTC is the outcome of a two-part strategy:

- Scaled Bitcoin mining operations continue to generate a steady stream of BTC.

- Disciplined at-market purchases supplement mined Bitcoin to boost reserves more aggressively.

Co-founder and Chief Strategy Officer Eric Trump stated:

He emphasized that momentum is building as the company strengthens its reserves and SPS.

Investor Transparency Through SPS

A central pillar of American Bitcoin’s strategy is transparency. The company regularly updates its Satoshis Per Share (SPS) metric, which allows investors to calculate how much Bitcoin they indirectly own per share. As of November 5, 2025, that figure is 432 SPS, up from previous levels and representing a 3.35 percent increase in less than two weeks.

SPS is particularly important in the post-merger landscape following American Bitcoin’s union with Gryphon Digital Mining on September 3, 2025. The calculation reflects the adjusted number of outstanding shares and includes both unencumbered Bitcoin and holdings pledged as collateral for hardware purchases with BITMAIN.

A Growing Corporate Trend in Bitcoin

American Bitcoin is not alone in its strategic accumulation. Data from CoinGecko shows that 124 institutions now hold a combined 1.66 million BTC, accounting for nearly 8 percent of total Bitcoin supply, worth around $169 billion. This signals a strong institutional interest in Bitcoin as a long-term treasury asset, despite short-term price volatility.

However, ABTC stock dropped 5.22 percent on November 5, showing that broader market movements can still weigh on investor sentiment even when a company reports internal progress.

CoinLaw’s Takeaway

I think what we’re seeing here is a textbook example of how corporate conviction in Bitcoin is growing, and American Bitcoin Corp is walking the talk. From my perspective, having a transparent metric like SPS is incredibly valuable for retail and institutional investors alike. It makes the link between company equity and Bitcoin ownership crystal clear. In my experience covering the crypto sector, companies that lead with transparency and a clear long-term vision tend to earn stronger investor trust. While the short-term drop in stock price might worry some, I believe ABTC’s consistent accumulation and strategic clarity show they’re in it for the long haul.