In the early days of blockchain, compliance was something of a gray area. Regulators scrambled to keep pace with emerging technologies, and businesses navigated a maze of requirements. Artificial Intelligence (AI) and Machine Learning (ML) have emerged as powerful tools, reshaping blockchain compliance into something far more agile, accurate, and scalable.

Imagine an AI-driven system that detects suspicious transactions in seconds or automates Know Your Customer (KYC) verifications across jurisdictions without breaking a sweat. These are no longer futuristic concepts; they’re happening now. In this article, we’ll explore the current statistics that highlight the role of AI and ML in blockchain compliance, focusing on adoption rates, benefits, and real-world applications.

Editor’s Choice

- 72% of blockchain compliance leaders report using AI and Machine Learning tools to streamline regulatory processes.

- Companies that have integrated AI-driven Know Your Customer (KYC) verification processes saw a 30% reduction in customer onboarding times.

- AI-powered Anti-Money Laundering (AML) systems identified 51% more suspicious transactions compared to traditional rule-based methods.

- The global RegTech market leveraging AI for blockchain compliance is projected to reach $28.3 billion by the end of the year.

- AI-driven compliance and automation typically reduce operational costs by around 20–30%, with financial institutions and RegTech adopters often reporting savings near 25% in practice.

- Organizations implementing AI-driven blockchain compliance tools report an average efficiency increase of 38%.

Benefits of AI and Machine Learning in Enhancing Blockchain Compliance

- Organizations implementing AI-driven blockchain compliance tools report an average efficiency increase of 38%.

- AI-powered smart contracts have automated regulatory compliance clauses, reducing manual oversight by 45%.

- 90% of blockchain compliance officers believe AI systems will minimize human error in auditing and reporting tasks.

- Companies using AI in compliance processes have reduced compliance-related fines by an average of 31%.

- Real-time risk monitoring, powered by Machine Learning, has helped 58% of businesses prevent potential regulatory breaches.

- AI-driven transaction monitoring has improved anomaly detection rates by 42% compared to traditional methods.

- Automated AI systems have decreased compliance report preparation time by 35%, allowing teams to focus on higher-value tasks.

- 52% of blockchain firms have used AI to achieve real-time regulatory reporting, aligning with stricter regulatory frameworks.

- AI-enhanced KYC and AML procedures have helped 70% of firms improve customer trust by increasing transparency and reducing verification times.

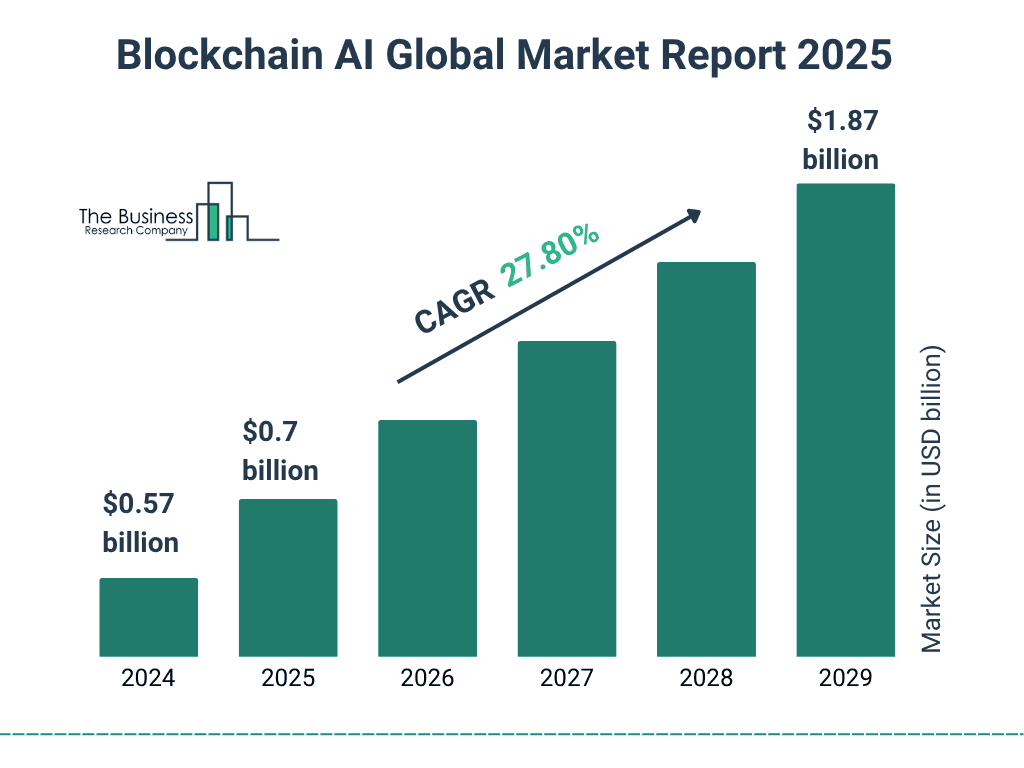

Blockchain AI Global Market Growth Insights

- The global blockchain AI market size increased to $0.70 billion in 2025, driven by rising demand for AI-powered blockchain analytics and compliance tools.

- Continued expansion is projected in 2026, with the market reaching $0.95 billion, fueled by growth in fraud detection and smart contract monitoring.

- By 2027, the blockchain AI market is expected to hit $1.15 billion, supported by increased institutional and regulatory use cases.

- Strong momentum continues into 2028, with market value climbing to $1.45 billion as AI integration becomes more mainstream across blockchain platforms.

- By 2029, the market is forecast to reach $1.87 billion, nearly tripling its 2024 size.

- Overall growth is underpinned by a robust 27.80% CAGR, highlighting the rapid long-term expansion of AI-driven blockchain solutions.

AI-Powered Anti-Money Laundering (AML) and Know Your Customer (KYC)

- 69% of global blockchain companies are leveraging AI-driven AML systems, an increase from 52% in 2024.

- AI-based KYC verification tools have reduced identity verification time by 42%, significantly improving customer onboarding experiences.

- 60% of AI-powered AML solutions now incorporate deep learning algorithms to identify suspicious activities, improving detection accuracy by 37%.

- AI-driven KYC processes have decreased compliance-related operational costs by an average of 29% across the blockchain industry.

- 56% of surveyed cryptocurrency exchanges report that AI-enhanced AML software has led to a 45% improvement in detecting complex money-laundering schemes.

- AI-based biometric verification has resulted in a 35% increase in KYC pass rates, particularly in regions with high documentation irregularities.

- 78% of blockchain-based financial institutions have adopted AI-based transaction monitoring systems to ensure regulatory compliance.

Accuracy and Efficiency Improvements in Blockchain Compliance Through AI

- AI technologies have improved compliance reporting accuracy by 39% for blockchain firms compared to 27% in 2024.

- 75% of organizations using AI and ML for blockchain compliance report real-time data validation, reducing discrepancies and reporting delays.

- AI-powered compliance platforms have reduced audit preparation times by 33%, allowing businesses to focus on strategic tasks.

- Machine Learning algorithms are delivering predictive analytics for risk assessment, increasing decision-making speed by 41%.

- 82% of compliance managers say AI solutions have significantly reduced error rates in regulatory reporting processes by 36%.

- Real-time automated monitoring through AI tools increased the efficiency of transaction surveillance by 44%.

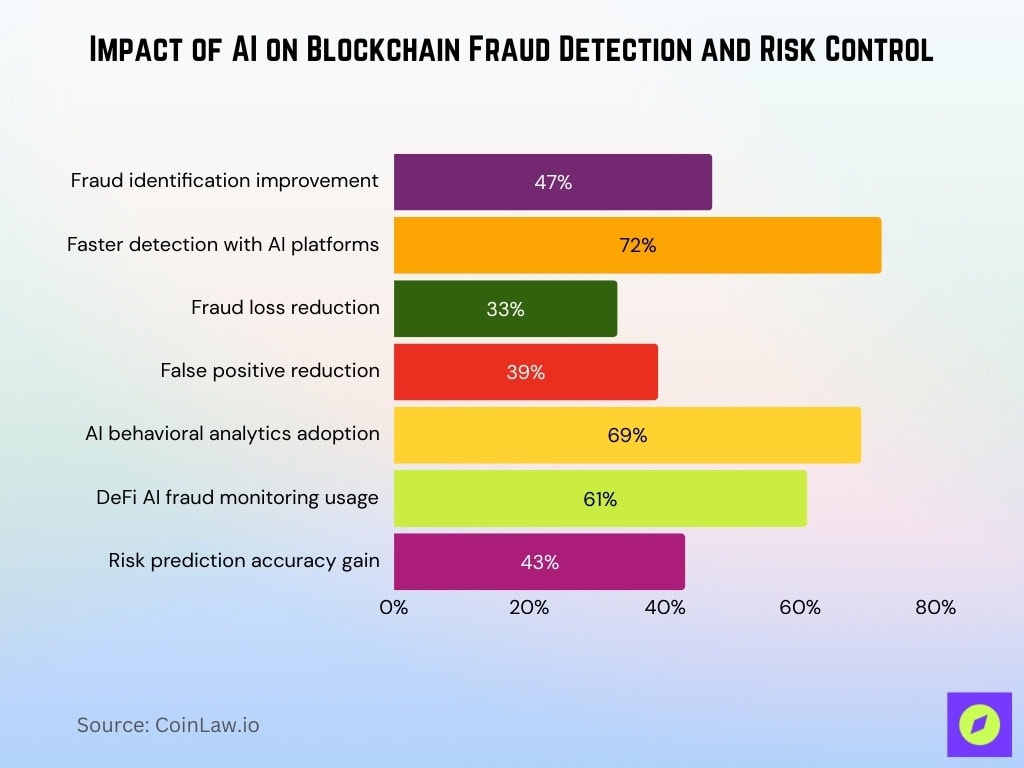

Fraud Detection and Risk Management Using AI in Blockchain

- AI-based fraud detection systems have increased fraud identification rates by 47% across blockchain networks.

- 72% of blockchain payment platforms using AI have detected fraudulent activities 40% faster than with legacy systems.

- AI-powered fraud prevention tools have helped crypto exchanges reduce fraud losses by 33%.

- Deep learning models in AI-driven risk management systems have reduced false positives by 39%, improving the accuracy of fraud detection alerts.

- 69% of blockchain platforms use AI-powered behavioral analytics to detect anomalies in user behavior and potential fraud.

- 61% of decentralized finance (DeFi) platforms deploy AI to monitor smart contract vulnerabilities and prevent fraud-related exploits.

- AI-driven risk-scoring models have increased the predictive accuracy of potential fraud cases by 43%.

Cost Reduction Metrics Attributed to AI and Machine Learning in Compliance Processes

- Blockchain firms using AI in compliance have reported an average operational cost reduction of 26%.

- Automated AI compliance tools have cut down manual labor costs by 32%, freeing up compliance teams for strategic activities.

- Companies implementing AI for regulatory reporting have reduced consultancy and auditing expenses by 24%.

- AI-based KYC verification has saved blockchain businesses up to $0.40 per verification on average, which scales to millions in annual savings.

- 48% of enterprises reported that AI has helped them avoid regulatory fines, saving up to $2.1 million collectively.

- AI-driven compliance processes have reduced data management and storage costs by 29% through optimized data handling.

- 60% of blockchain organizations using AI compliance solutions have reported a 20% reduction in technology maintenance costs.

Regulatory Technology (RegTech) Trends Leveraging AI in Blockchain Compliance

- The AI-powered RegTech market in blockchain compliance is forecasted to grow at a compound annual growth rate (CAGR) of 23.4% from this year to 2030.

- 67% of RegTech solutions adopted this year feature AI capabilities focused on blockchain compliance and real-time monitoring.

- AI-driven RegTech tools have enabled real-time data sharing with regulators for 54% of blockchain firms, improving transparency.

- 45% of blockchain organizations are investing in AI RegTech solutions to automate licensing and reporting obligations.

- AI-integrated RegTech platforms have improved compliance workflow efficiency by 36% across industries, leveraging blockchain.

- 58% of RegTech vendors report that demand for AI-powered compliance solutions has surged, particularly among crypto exchanges.

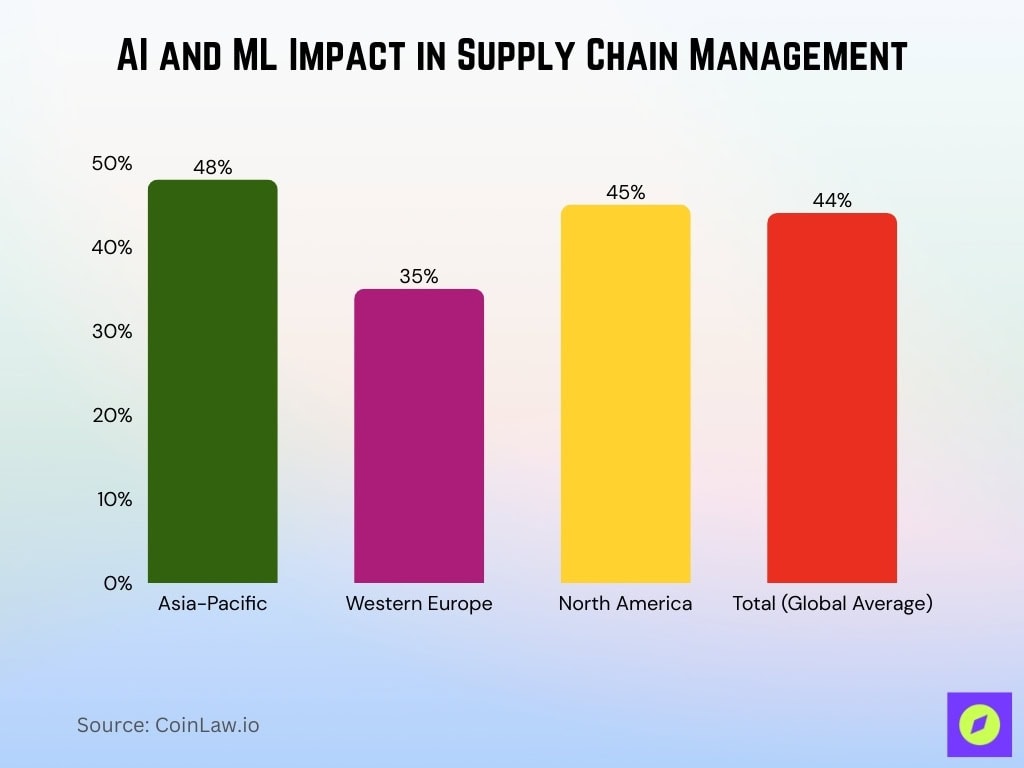

AI and ML Impact in Supply Chain Management

- Asia-Pacific leads adoption, with 48% of supply chain operations reporting measurable impact from AI and ML technologies.

- North America follows closely, as 45% of organizations report efficiency and performance gains from AI-driven supply chain solutions.

- Western Europe trails other regions, with 35% adoption impact, indicating slower integration of AI and ML in supply chain workflows.

- Globally, AI and ML influence 44% of supply chain management activities, highlighting strong worldwide momentum.

- Overall results suggest AI and ML are becoming core enablers of supply chain optimization, forecasting broader adoption beyond 2025.

Industry-Wise Implementation of AI in Blockchain Compliance

- 78% of financial services firms have adopted AI-powered compliance solutions for blockchain operations.

- In the healthcare industry, 54% of blockchain applications now incorporate AI-driven regulatory compliance systems, ensuring data privacy and HIPAA alignment.

- 67% of insurance providers using blockchain technology have implemented AI-enhanced fraud detection and AML compliance tools.

- The energy sector has seen a 43% rise in AI-based blockchain compliance systems, focusing on regulatory reporting for carbon credits and energy trading.

- 62% of blockchain-based supply chain management firms have adopted AI-driven compliance monitoring, particularly for ethical sourcing and sustainability certifications.

- 80% of cryptocurrency exchanges will deploy AI-enabled KYC and AML solutions to meet evolving regulatory requirements.

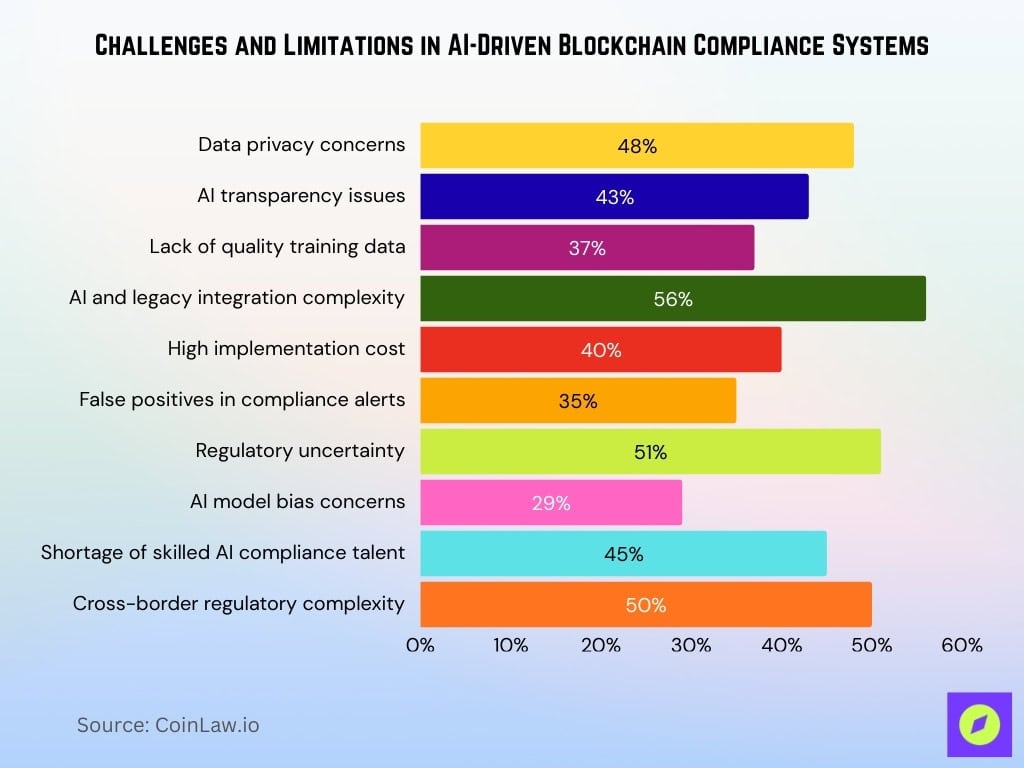

Challenges and Limitations in AI-Driven Blockchain Compliance Systems

- 48% of compliance professionals cite data privacy concerns as the top challenge when implementing AI in blockchain compliance.

- 43% of blockchain enterprises struggle with AI algorithm transparency, making it difficult to meet regulatory audit requirements.

- 37% of organizations report challenges in training AI models due to limited access to high-quality, labeled compliance data.

- 56% of blockchain firms indicate that integration complexity between AI systems and legacy blockchain infrastructures slows adoption.

- 40% of companies deploying AI in blockchain compliance highlight the high cost of implementation as a significant barrier.

- 35% of surveyed firms report false positives in AI-driven compliance alerts, leading to resource-intensive manual reviews.

- 51% of blockchain platforms cite regulatory uncertainty surrounding AI technologies as a key obstacle to full-scale adoption.

- 29% of compliance teams express concerns over AI model bias, potentially resulting in unfair risk scoring or customer profiling.

- 45% of respondents identify a shortage of skilled AI talent with compliance expertise as a limiting factor.

- 50% of enterprises using AI-driven compliance tools struggle with cross-border regulatory harmonization, complicating international operations.

Future Projections for AI and Machine Learning in Blockchain Compliance

- By 2027, 90% of blockchain compliance functions are expected to be automated using AI and Machine Learning.

- The global AI-driven blockchain compliance market is projected to reach $43.5 billion by 2030, growing at a CAGR of 25% from this year.

- 65% of blockchain platforms plan to adopt AI-based predictive analytics for real-time risk management by 2026.

- 78% of blockchain-focused financial institutions expect to integrate AI-powered continuous auditing systems by 2027.

- 60% of DeFi projects are predicted to utilize AI-driven compliance automation tools to meet international regulatory standards by 2028.

- Experts forecast a 38% increase in AI-based RegTech investments within the blockchain sector by 2026, driven by demand for faster compliance.

- 72% of surveyed executives believe AI and ML technologies will become mandatory components of blockchain compliance programs by 2030.

- By 2029, AI-enhanced smart contracts are projected to self-execute compliance checks in 92% of blockchain transactions.

Recent Developments

- In January, Chainalysis launched an AI-powered blockchain compliance platform that integrates real-time transaction monitoring with predictive analytics, identifying over 107,000 unique entities behind blockchain addresses.

- Elliptic introduced AI-enhanced risk management tools, with 60% of institutional investors integrating such AI-powered platforms like Elliptic in 2025.

- Solidus Labs expanded its AI-driven AML surveillance suite for DeFi platforms, enhancing detection of complex fraud patterns through machine learning.

- ComplyAdvantage announced its AI-powered transaction screening system, providing blockchain firms with real-time sanction screening, and 94% of firms use AI for transaction data analysis.

- TRM Labs unveiled an AI-based compliance analytics dashboard, focusing on NFT fraud detection with a 34% increase in institutional adoption for AML risk management.

Frequently Asked Questions (FAQs)

About 72% of blockchain compliance leaders report using AI and ML tools.

AI implementation in blockchain compliance has reduced operational costs by an average of 20–30% across industries.

AI-powered blockchain compliance solutions have cut fraud detection times by 40%, enabling faster mitigation actions.

AI technologies have improved compliance reporting accuracy from 27% to 39% for blockchain firms.

Conclusion

As blockchain technology matures, regulatory scrutiny will only intensify. AI and Machine Learning offer transformative potential in streamlining blockchain compliance processes, ensuring accuracy, and enhancing security. From real-time monitoring and fraud detection to cost reduction and predictive analytics, AI is at the forefront of making compliance smarter and more efficient.

However, challenges such as data privacy, integration hurdles, and regulatory ambiguity remain. But the future is clear, AI-driven compliance is no longer optional for blockchain enterprises; it’s a necessity. As we move, companies that invest in AI and ML for compliance will be better equipped to navigate complex global regulations, protect their customers, and remain competitive.