Affirm has become a leading force in the buy now, pay later (BNPL) market by offering flexible payment solutions at checkout for consumers and merchants. The company reported significant growth across key financial and user metrics, demonstrating its expanding role in U.S. e‑commerce and fintech. From rising adoption rates among consumers to deepening merchant partnerships, Affirm’s progress reflects broader shifts in how people pay and how businesses sell online. Explore the detailed statistics below to understand how Affirm’s performance sets the stage for Affirm Statistics insights and projections.

Editor’s Choice

- 23 million active consumers on the Affirm platform as of fiscal Q4 2025, up about 24% year‑over‑year.

- Gross merchandise volume (GMV) reached $10.4 billion in Q4 2025, a 43% YoY increase.

- Revenue for Q4 2025 hit $876 million, a 33% YoY rise.

- Affirm’s fiscal 2025 total net revenue expanded nearly 39% YoY.

- 337,000+ merchants are part of Affirm’s network.

- Affirm raised its fiscal 2026 GMV guidance to above $47.5 billion.

- Active consumers have grown from approximately 18.7 million in 2024 to over 23 million in 2025.

Recent Developments

- Affirm increased GMV guidance for fiscal 2026 beyond $47.5 billion from prior expectations of near $46 billion.

- In its most recent quarter, Affirm reported profitability with an operating profit milestone after prior losses.

- Affirm stock saw significant movement following strong earnings reports, reflecting investor confidence.

- Partnerships expanded, with Affirm integrating further into large platforms like Amazon and Shopify.

- The company has broadened its offerings beyond BNPL to include debit cards and savings options.

- Affirm’s underwriting and AI‑driven risk tools contributed to higher transaction volumes with consistent credit performance.

- Competition intensified with rivals like Klarna capturing major retailer partnerships.

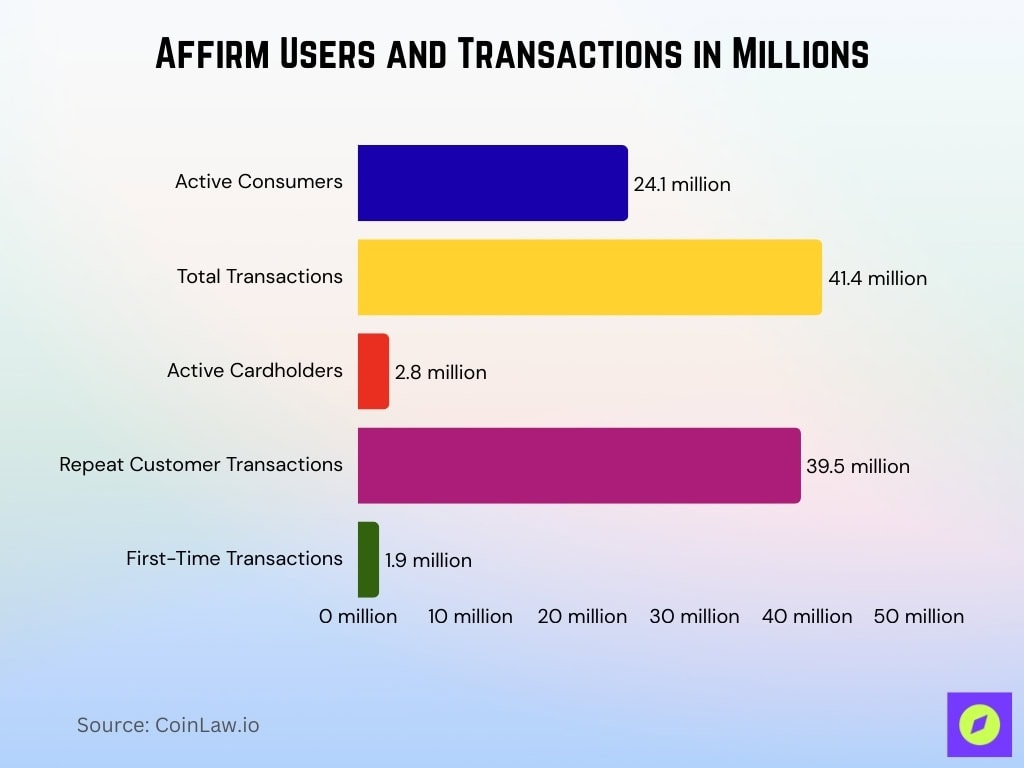

Affirm User and Customer Statistics

- Affirm reported 24.1 million active consumers as of Q1 FY2026, up 24% year over year.

- Transactions per active consumer reached 6.1 in Q1 FY2026, increasing 20% year over year.

- 96% of transactions in Q1 FY2026 came from repeat customers.

- Affirm processed 41.4 million total transactions in Q1 FY2026, up 51% year over year.

- Active Cardholders expanded to 2.8 million in Q1 FY2026, up 101% year over year.

- Repeat customer transactions totaled 39.5 million versus 1.9 million first-time transactions in Q1 FY2026.

- 95% of transactions stemmed from repeat users across recent quarters.

What Is Affirm?

- Affirm is an American financial technology firm specializing in buy now, pay later (BNPL) services.

- Affirm processed $10.8 billion in GMV in Q1 FY2026, up 42% year over year.

- Its active consumer base reached 24.1 million in Q1 FY2026, growing 24% year over year.

- Active merchants using Affirm rose to 419,000 in Q1 FY2026, an increase of 30% year over year.

- Transactions per active consumer climbed to 6.1 in Q1 FY2026, up 20% from the prior year.

- The Affirm Card generated about one-third of total GMV in fiscal Q1 FY2026.

- Direct merchant POS integrations contributed roughly 50% of Affirm’s GMV growth in fiscal Q1 FY2026.

- Affirm is projected to remain the leading US BNPL provider over Klarna by about $4.7 billion in US volume.

Merchant and Partner Statistics

- Affirm’s active merchant network reached 419,000 in Q1 FY2026, up 30% year over year.

- The merchant base grew from approximately 337,000 in Q4 FY2025 to 419,000 in Q1 FY2026.

- Partnerships like Amazon extended for 5 years, and Shopify expanded to the UK and Canada in 2026.

- Affirm integrates with 60%+ of US e-commerce platforms supporting its BNPL options.

- New 2026 partners include Costco, Garmin, Hotels.com, and Living Spaces.

- Merchant-funded 0% APR offers surged over 90% in recent quarters.

- POS integrations drove roughly 50% of Q1 FY2026 GMV growth via merchants.

- Shopify merchants using Affirm saw 28% lower cart abandonment rates.

- Affirm serves 420,000 merchant partners, including Amazon, Shopify, and Apple.

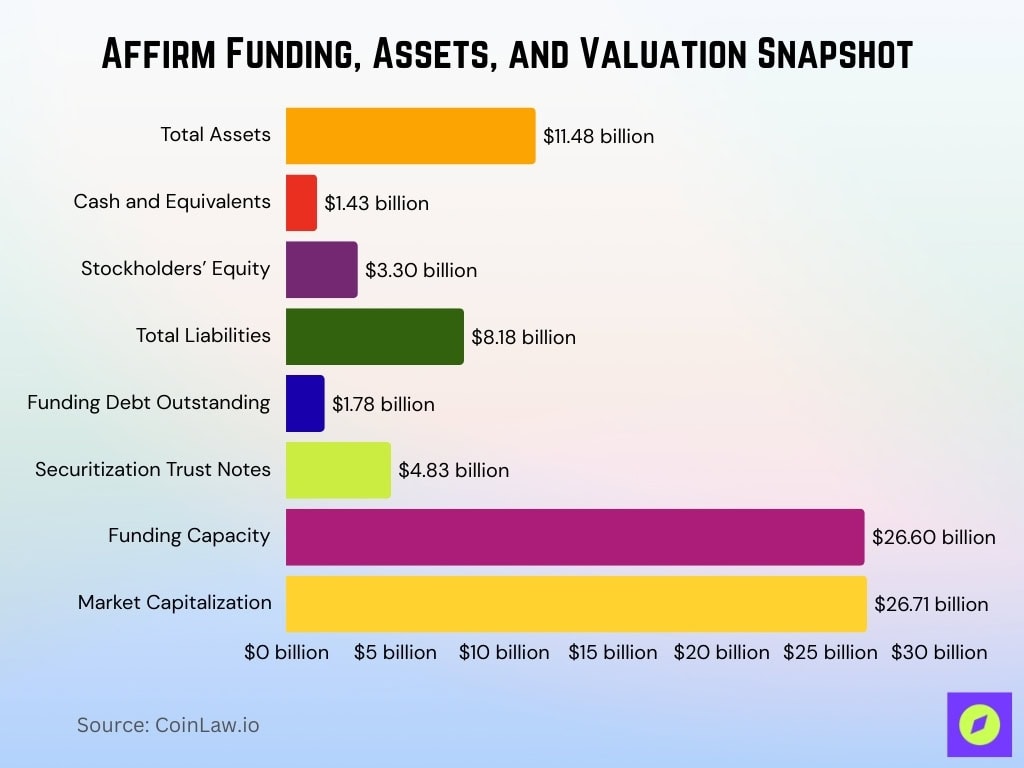

Funding, Assets, and Valuation Statistics

- Total assets stood at $11.48 billion as of Q1 FY2026 end.

- Cash and equivalents totaled $1.43 billion at Q1 FY2026 close.

- Stockholders’ equity reached $3.30 billion in Q1 FY2026.

- Total liabilities amounted to $8.18 billion as of Q1 FY2026.

- Funding debt outstanding was $1.78 billion in Q1 FY2026.

- Notes from securitization trusts hit $4.83 billion at the Q1 FY2026 end.

- Funding capacity expanded to $26.6 billion by the end of Q1 FY2026.

- Market capitalization approximated $26.71 billion as of early January 2026.

Transaction and GMV Statistics

- Affirm’s GMV reached $10.8 billion in Q1 FY2026, up 42% year over year.

- Total transactions hit 41.4 million in Q1 FY2026, surging 51% year over year.

- Average GMV per transaction stood at $261 in Q1 FY2026.

- Affirm Card contributed $3.6 billion in GMV during Q1 FY2026.

- Repeat transactions accounted for 96% of total volume in Q1 FY2026.

- Direct-to-consumer GMV grew 53% year over year to $2.6 billion in Q1 FY2026.

- Merchant-funded GMV increased 44% year over year in Q1 FY2026.

- FY2026 GMV guidance projects 21-24% growth over the prior year.

Revenue and Income Statistics

- In fiscal year 2025, Affirm reported approximately $3.22 billion in total revenue, showing a strong growth trajectory.

- Affirm achieved its first full‑year GAAP net income of about $52.2 million, reversing prior annual losses.

- Q3 calendar 2025 revenue was $933.3 million, up ~34% year‑over‑year, beating expectations.

- In Q1 FY26, Affirm also topped revenue consensus in early reports, reflecting ongoing sales momentum.

- Quarterly revenue figures for 2025 often exceeded 30–40% annual growth rates, underlining strong topline expansion throughout the year.

- Revenue growth continues to be supported by both merchant fees and consumer interest income.

- In late‑2025 outlooks, Affirm guided FY26 revenue range around $1.03 billion to $1.06 billion for the upcoming quarters.

- Compared to competitors in the BNPL space, Affirm often ranks among the top in annual revenue share.

- Highly seasonal periods like Q4 (holiday shopping) have boosted revenue performance historically.

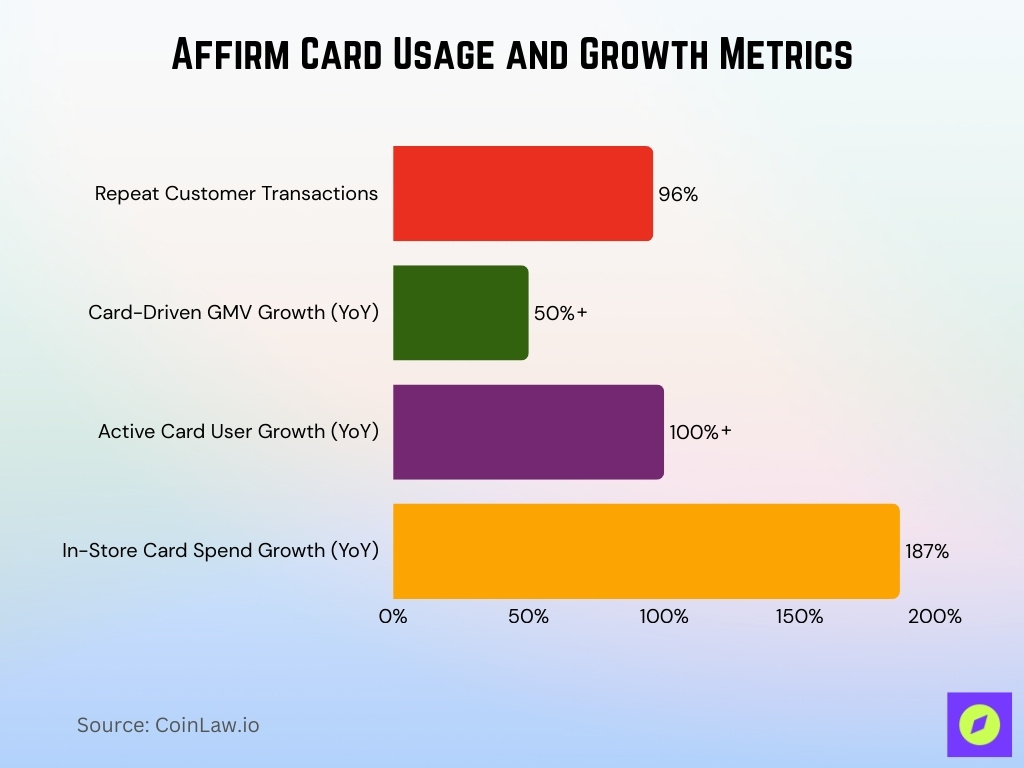

Card Usage Statistics

- 96% of Card transactions from repeat customers in Q1 FY2026.

- Card-driven GMV growth exceeded 50% year over year in Q1 FY2026.

- Affirm Card active users grew over 100% annually through Q1 FY2026.

- In-store Card spend surged 187% year over year in the recent quarter.

- Active Affirm Card users reached 2.8 million in Q1 FY2026, up 101% year over year.

- Affirm Card GMV hit $3.6 billion in Q1 FY2026, more than doubling the prior year.

- Card transactions accounted for one-third of total GMV in Q1 FY2026.

- Card users transacted 6.1 times on average in Q1 FY2026.

Profitability and Margin Statistics

- Affirm achieved net income of $80.7 million in Q1 FY2026, up 180% from the prior-year loss.

- GAAP EPS reached $0.24 in Q1 FY2026, reversing $0.31 loss year over year.

- GAAP operating income hit $64 million with 7% operating margin in Q1 FY2026.

- Adjusted operating income totaled $264 million at a 28% margin in Q1 FY2026.

- Revenue less transaction costs (RLTC) grew 60% to $455 million in Q1 FY2026.

- Revenue surged 33.6% to $933.3 million in Q1 FY2026, beating estimates.

- FY2026 adjusted operating margin guidance exceeds 27.1%.

- Provision for credit losses was $162.8 million in Q1 FY2026

Product and Feature Statistics

- Affirm Card active users reached 2.8 million in Q1 FY2026, up 101% year over year.

- Affirm Card generated $3.6 billion GMV in Q1 FY2026, more than double the prior year.

- In-store spend on the Affirm Card increased 187% year over year recently.

- 94% of transactions come from repeat users, showing strong product stickiness.

- AdaptAI deployments boosted merchant GMV by an average 5%.

- Loans offer 0%-36% APR with terms from 3 to 48 months.

- Pay in 4 remains 0% APR for short-term interest-free installments.

- New options include Pay in 2 and Pay in 30, both interest-free.

- 90%+ repeat transaction rate among existing users annually.

Demographic and Geographic Statistics

- 53.86% female and 46.14% male among primary Affirm users.

- Millennials (ages 30-44) comprise 28% of Affirm users.

- 64% of Gen Z (18-28) have used BNPL services.

- Baby Boomers (ages 60-78) represent 23% of Affirm users.

- 33.6% of U.S. Millennials use BNPL services.

- North America holds a dominant share of Affirm’s operations and revenue.

Mobile App and Platform Statistics

- Affirm app garnered ~12,400 daily downloads on average in 2025.

- Approximately 80% of 24.1 million active users downloaded the Affirm app.

- 96% of Q1 FY2026 transactions from repeat users via the platform.

- 96% repeat customer transactions indicate strong credit performance.

- Transactions per active user averaged 6.1 across app and web in Q1 FY2026.

- Mobile platform supports loan management and merchant discovery for 24.1 million users.

- 41.4 million total transactions processed via platforms in Q1 FY2026.

- Repeat usage drove 96% of platform transactions in fiscal Q1 FY2026.

Credit, Risk, and Delinquency Statistics

- Provision for credit losses totaled $162.8 million in Q1 FY2026.

- 30-day delinquency trends remained relatively healthy in Q1 FY2026.

- Delinquency rates for Affirm loans stayed below 2% overall.

- The credit loss provision rate was approximately 1.5% of the loan portfolio.

- Affirm’s BNPL delinquency is 3-4x lower than traditional credit cards.

- Underwriting models leverage ML for low-risk consumer selection.

- Charge-off rates averaged under 2.4% for top BNPL lenders recently.

Interest Rate and Fee Statistics

- Affirm charges 0%-36% APR on loans based on credit and merchant terms.

- Merchant fees constitute primary revenue, with no consumer late penalties.

- Interest-bearing loans average 10%-36% APR for longer terms.

- Zero profits derived from late fees per company policy.

- BNPL users report 41% late payments in the past year industry-wide.

Customer Behavior and Repeat Usage Statistics

- Repeat customers drove 96% of transactions in Q1 FY2026.

- Transactions per active consumer averaged 6.1 in Q1 FY2026, up 20%.

- 39.5 million repeat transactions vs 1.9 million first-time transactions in Q1 FY2026.

- BNPL monthly spend per user rose 21% from mid-2024 to mid-2025.

- Average BNPL transaction size reached $135 in the U.S.

- 41% of BNPL users reported late payments in the past year.

- Affirm users’ average outstanding balance of $660.

- Omnichannel BNPL users spend 72% more per transaction.

Market Share and Competitive Position Statistics

- Affirm holds 21.9% U.S. BNPL market share among top providers.

- U.S. BNPL market projected at $122.26 billion for 2025, growing 12.2%.

- Global BNPL payments to hit $560.1 billion in 2025, up 13.7%.

- Affirm leads alongside Klarna, Afterpay, and PayPal in the U.S. dominance.

- Active merchants reached 419,000, up 30% year over year.

- Affirm projects FY2026 GMV over $46 billion.

- BNPL captures 6% of U.S. e-commerce payments.

- U.S. BNPL spending forecast at $97.25 billion in 2025.

Regulatory and Compliance Statistics

- Affirm advocates a 36% national APR cap on BNPL and credit cards.

- Affirm CEO calls for a cap on BNPL late fees amid regulatory vacuum.

- CFPB scrapped Biden-era BNPL rules under Trump deregulation.

- State AGs have enforced actions against several BNPL firms over the past 5 years.

- 12% of BNPL borrowers charged late fees in 2021 data.

- States like California, Maryland require BNPL licensing.

- Affirm first BNPL to report to Experian, TransUnion, and FICO.

- No federal BNPL regulation; patchwork state laws apply.

Forecasts and Future Outlook Statistics

- Affirm FY2026 GMV guidance exceeds $47.5 billion.

- Consensus analyst price target stands at $84.56-$96.90 from 32 analysts.

- 20 of 38 analysts rate Affirm as Buy.

- Q2 FY2026 GMV outlook $13.0-$13.3 billion.

- U.S. BNPL market to grow 8.5% CAGR to $184.05 billion by 2030.

- U.S. BNPL projected $122.26 billion in 2025, up 12.2%.

- Global BNPL market size to reach $31.71 billion by 2030 at 16.15% CAGR.

- U.S. BNPL to surge to $224.65 billion by 2030 at 20.5% CAGR.

Frequently Asked Questions (FAQs)

Affirm raised its fiscal 2026 GMV guidance to more than $47.5 billion.

Affirm’s total Q1 FY26 revenue increased 33.6% year‑over‑year.

Affirm’s active consumer base grew 24% year‑over‑year in fiscal Q1 2026.

Conclusion

Affirm’s trajectory today highlights sustained user growth, expanding market reach, and solid financial performance, including profitability and rising merchant adoption. Across interest structures, customer behavior, and regulatory landscapes, the company is navigating opportunities and challenges typical of a maturing BNPL leader. With industry forecasts pointing to continued global market expansion and optimistic analyst sentiment, Affirm’s role in shaping flexible payment solutions remains central to the future of digital commerce. Explore how these trends could influence consumer finance and retail strategies in the evolving payments ecosystem.