NVIDIA is reinforcing its AI leadership by joining a historic $40 billion deal to acquire Aligned Data Centers, alongside Microsoft, BlackRock, and Elon Musk’s xAI.

Key Takeaways

- NVIDIA joins Microsoft, xAI, and BlackRock in acquiring Aligned Data Centers for $40 billion

- The acquisition marks the first move by the AI Infrastructure Partnership (AIP)

- Deal aims to expand data center capacity to meet soaring global AI demand

- Aligned Data Centers will continue to operate from Dallas under its current CEO

What Happened?

The AI Infrastructure Partnership (AIP) announced a massive $40 billion deal to acquire Aligned Data Centers, one of the largest data center operators in North America. The partnership includes heavyweights like NVIDIA, Microsoft, BlackRock, xAI, and sovereign wealth funds from Kuwait, Singapore, and Abu Dhabi. This is the AIP’s first major investment since its formation last year and reflects the tech industry’s growing urgency to secure AI-ready computing infrastructure.

BlackRock, Nvidia, Microsoft, and xAI have formed a consortium to acquire Aligned Data Centers for $40 billion, according to the Financial Times.

— Wall St Engine (@wallstengine) October 15, 2025

The group, which also includes GIP, Abu Dhabi’s MGX, and backers like Temasek and Kuwait Investment Authority, plans to double… pic.twitter.com/AeSbHXLX5w

NVIDIA Bets on Infrastructure to Power AI Growth

NVIDIA, best known for its high-performance AI chips, is now taking steps to ensure long-term scalability by directly investing in the infrastructure that supports AI workloads. By joining this acquisition, NVIDIA is positioning itself to maintain a competitive edge in the AI ecosystem.

- Aligned Data Centers currently manages over 80 campuses with a combined operational and planned capacity of 5 gigawatts.

- The acquisition includes $30 billion in equity, with the potential to expand to $100 billion with debt.

- Aligned will remain headquartered in Dallas, Texas, under CEO Andrew Schaap.

This strategic shift helps NVIDIA secure compute capacity essential for generative AI and enterprise-grade applications, tightening the integration between hardware innovation and infrastructure deployment.

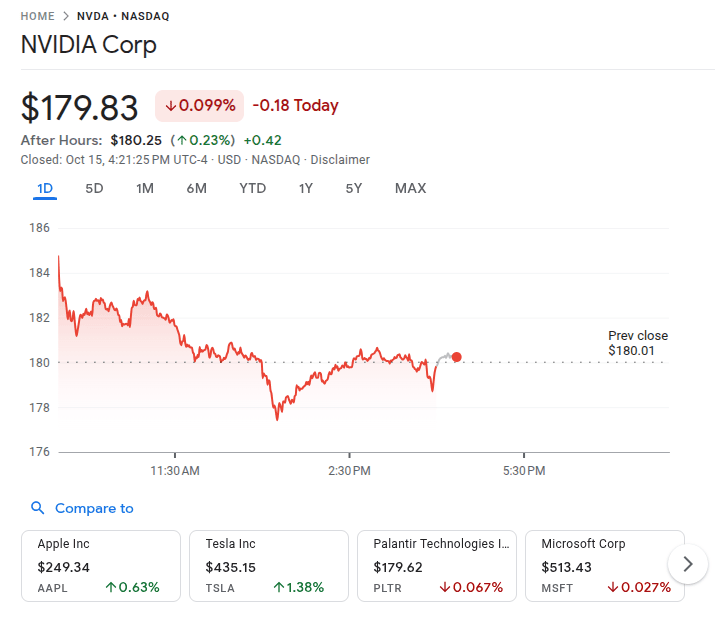

NVIDIA Stock is currently trading at $179 in with 0.09% drop after sharp rise in pre-market conditions.

A Global Power Grab for Compute Capacity

The deal comes as major players like OpenAI, Meta, and CoreWeave ramp up their own infrastructure spending. OpenAI has inked deals worth over $1 trillion to lock in 26 gigawatts of computing power. Morgan Stanley estimates that global AI infrastructure spending will hit $400 billion in 2025.

Other tech firms, including Alphabet, Amazon, and Meta, are building or buying multi-gigawatt AI data centers to meet surging demand. The race is not just about who has the best models or chips, but who controls the computing power to run them at scale.

Strategic Finance Meets AI Expansion

Leading the financial structure of the deal is BlackRock, with equity contributions from Temasek, Kuwait Investment Authority, and MGX of Abu Dhabi. This setup enables capital-efficient growth, allowing tech companies to lease rather than own data centers. It also reflects a broader shift where institutional capital is flooding into digital infrastructure.

Supporting partners like GE Vernova and Cisco will help ensure access to power, land, and components, minimizing supply chain bottlenecks. The group’s plan includes both acquisition of existing sites and greenfield development across the U.S. and Latin America.

Ripple Effects Across Crypto and AI Sectors

The infrastructure play is also influencing other tech sectors. Shares of companies like Hut 8, Bitfarms, and CleanSpark rose between 3% and 6% following the announcement, reflecting investor confidence in compute-heavy business models.

These firms, originally focused on crypto mining, are now leasing compute capacity for AI workloads. This shift shows the growing overlap between blockchain and AI sectors, especially in energy-intensive infrastructure development.

CoinLaw’s Takeaway

In my experience watching tech investments, this is one of the boldest and smartest moves NVIDIA has made. They are not just betting on GPUs anymore. They are locking in the entire pipeline from chip to cloud. I found it fascinating how this deal brings together sovereign wealth funds, chipmakers, and cloud providers into one coordinated push to meet exploding AI demand. This is the kind of strategic thinking that sets market leaders apart.