OnePay, the fintech arm backed by Walmart, will introduce trading and custody features for Bitcoin and Ether in its app by the end of 2025.

Key Takeaways

- OnePay will allow users to buy, sell, and hold Bitcoin and Ether directly in its app starting in 2025.

- This move positions OnePay to compete in the U.S. superapp race alongside PayPal, Venmo, and Cash App.

- Crypto services will be powered by Zerohash, a startup providing infrastructure and regulatory compliance.

- Walmart’s access to 150 million weekly shoppers gives OnePay a unique edge in mainstream crypto adoption.

What Happened?

OnePay, the fintech venture majority-owned by Walmart and co-founded with Ribbit Capital, is gearing up to add cryptocurrency functionality to its mobile app. The company plans to let users buy, sell, and store Bitcoin and Ether in 2025, working with crypto infrastructure firm Zerohash to enable the backend services.

This development positions OnePay to expand its reach beyond traditional banking offerings and challenge existing fintech players in the evolving digital finance space.

JUST IN: 🚨 Walmart-owned fintech OnePay will integrate Bitcoin payments into their app.

— Simply Bitcoin (@SimplyBitcoinTV) October 3, 2025

Walmart is the world’s largest retailer with 240M customers per week. 👀 pic.twitter.com/Ho59gVcZ1o

OnePay Expands into Crypto

OnePay has spent the last few years building out a robust digital finance platform that includes high-yield savings, debit and credit cards, buy-now-pay-later options, and even wireless mobile plans. Adding Bitcoin and Ether support marks a major step toward making it a comprehensive superapp for American users.

- The crypto rollout is scheduled for later in 2025.

- Bitcoin and Ether will be available for trading and custody within the app.

- Customers can convert crypto to U.S. dollars to make purchases or pay down balances.

- Integration with Walmart’s online and in-store checkout systems may allow seamless crypto-to-cash transactions.

Powered by Zerohash for Compliance and Speed

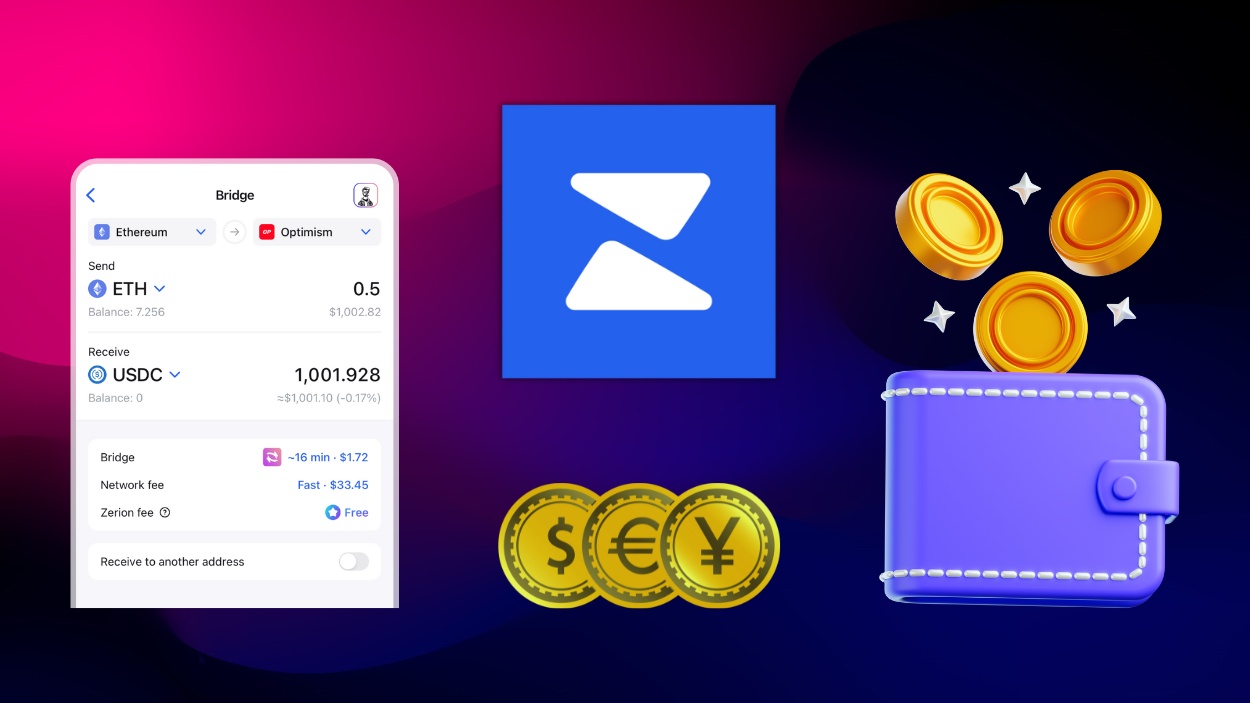

Zerohash, a Chicago-based crypto infrastructure firm, will power the backend of OnePay’s crypto services. The startup handles regulatory compliance and secure transaction processing, enabling OnePay to avoid the complications of building its own crypto custody systems.

- Zerohash recently raised $104 million from investors including Morgan Stanley and Interactive Brokers.

- The partnership enables OnePay to scale crypto features without added compliance burden.

- Future support for additional cryptocurrencies or blockchain features is likely.

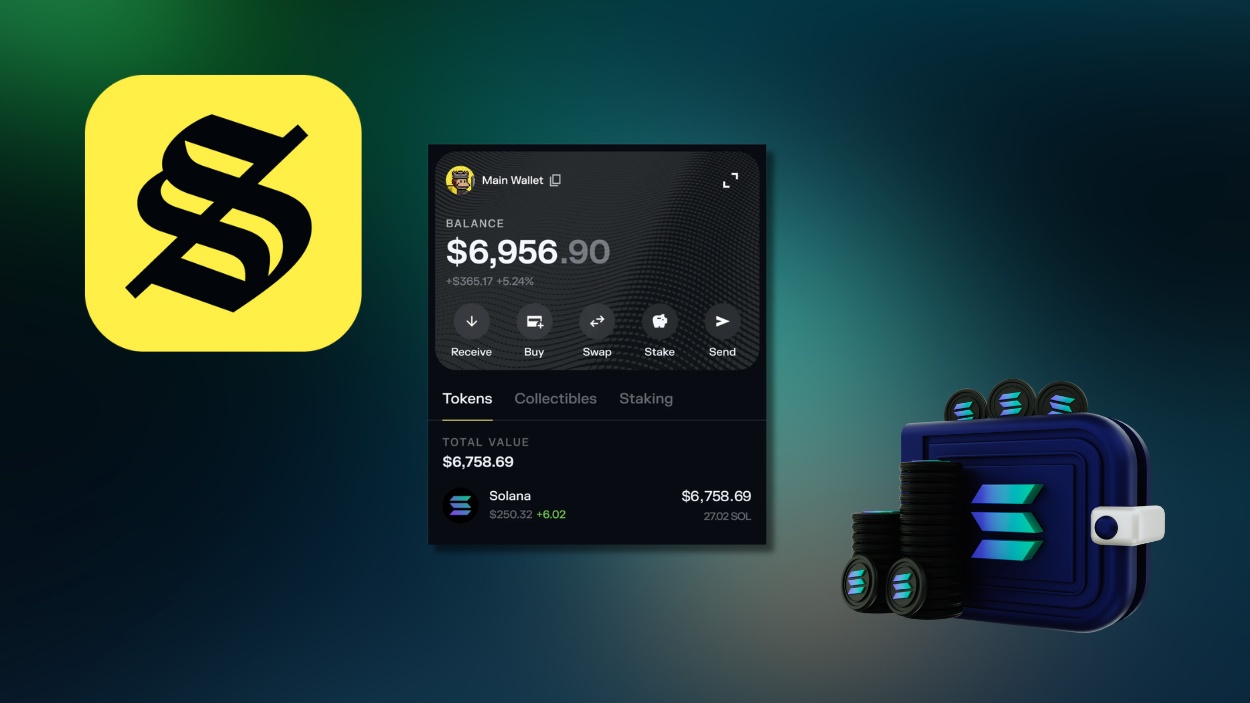

Competing with Fintech Giants

OnePay’s timing aligns with increasing mainstream acceptance of crypto. Apps like PayPal, Venmo, and Cash App already offer Bitcoin trading. PayPal even allows small businesses to accept more than 100 cryptocurrencies.

- OnePay is already ranked No. 5 in Apple’s App Store for free finance apps, ahead of JPMorgan Chase and Robinhood.

- Including crypto will close a key feature gap with rivals.

- Ether support signals readiness for more advanced blockchain features like staking and smart contracts.

Walmart’s Distribution Power

What sets OnePay apart is its deep integration with Walmart’s vast retail ecosystem. The app is accessible at both physical and online checkout points in Walmart stores, giving it reach into 150 million weekly U.S. shoppers.

Although OnePay is structured as an independent fintech firm, this massive distribution network provides a direct path to scale. Unlike pure fintechs, OnePay benefits from one of the most powerful retail footprints in the world.

CoinLaw’s Takeaway

I think this is a game-changing moment for both fintech and retail. OnePay is not just adding crypto because it’s trendy. This is a strategic move to become the go-to app for everyday finance. In my experience, most apps lack the kind of retail integration that Walmart can provide. OnePay bridges that gap, making crypto not just an investment tool but part of your daily spending habits. If they execute this well, it could turn OnePay into one of the most important apps in American finance.