Japanese Bitcoin treasury firm Metaplanet has boosted its Bitcoin holdings to over 30,000 BTC, cementing its place among the top global corporate holders of the cryptocurrency.

Key Takeaways

- Metaplanet acquired 5,268 BTC for $623 million, raising its total Bitcoin holdings to 30,823 BTC

- Now ranks as the fourth-largest publicly traded Bitcoin holder globally, trailing only Strategy, MARA Holdings, and XXI

- The company has spent $3.33 billion on Bitcoin to date, with an average purchase price of approximately $107,912 per coin

- Metaplanet plans further expansion through its newly formed U.S. and Japan-based subsidiaries

What Happened?

On October 1, Tokyo-based Metaplanet confirmed a massive Bitcoin purchase worth $623 million, adding 5,268 BTC to its treasury. The acquisition pushed the company’s total Bitcoin stash to 30,823 BTC, officially making it the fourth-largest publicly listed Bitcoin holder worldwide. CEO Simon Gerovich shared the update on X, noting the firm’s ongoing commitment to its crypto treasury strategy.

*Metaplanet Acquires Additional 5,268 $BTC, Total Holdings Reach 30,823 BTC* pic.twitter.com/Df8Kab9tSc

— Metaplanet Inc. (@Metaplanet_JP) October 1, 2025

Metaplanet’s Rapid Rise in the Bitcoin League

Metaplanet’s latest purchase was made at an average price of approximately 17.4 million yen or $118,300 per BTC. This follows a similarly large acquisition of $632 million just weeks prior, making 2025 a defining year for the firm’s crypto strategy.

Here are the standout figures:

- Total Holdings: 30,823 BTC

- Latest Purchase: 5,268 BTC for $623 million

- Cumulative Investment: $3.33 billion

- Average Purchase Price: About $107,912 per BTC

- 2025 Year-to-Date Yield: 497.1%

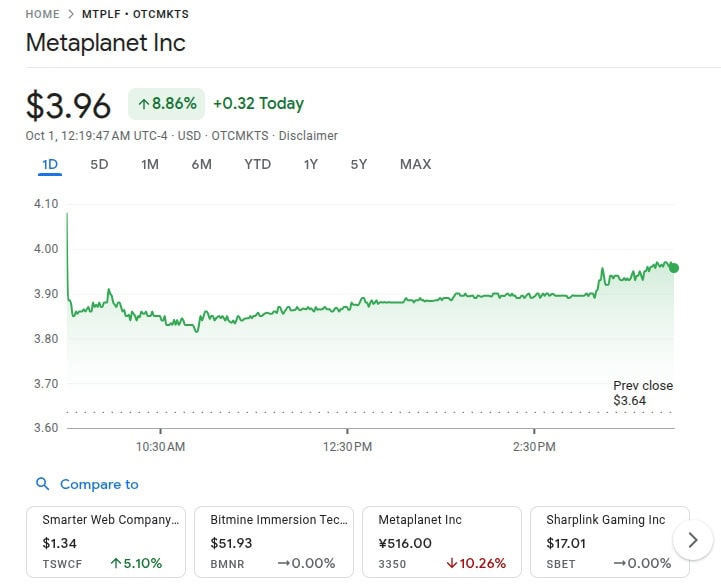

Despite aggressive accumulation, Metaplanet’s stock has experienced volatility. Its Tokyo-listed shares dropped 10.3% on September 29 and are down 38% over the past month, though still up 48.3% for the year. Meanwhile, its U.S.-traded shares (MTPLF) rose 8.86%, closing at $3.96.

Expanding Beyond Bitcoin Holdings

In parallel with building its Bitcoin treasury, Metaplanet is also reshaping its business model. The company announced the creation of two new subsidiaries, one in the United States and one in Japan.

- The U.S. subsidiary, Metaplanet Income Corp., will focus on income generation through derivatives trading and related services

- The Japan-based subsidiary will handle Bitcoin-related media, events, and community services

This move marks the firm’s first major business expansion since embracing a Bitcoin-centered treasury approach in 2024.

CEO Simon Gerovich emphasized that Metaplanet’s dual strategy is rooted in a belief in Bitcoin’s long-term potential, positioning the asset as both a hedge and a growth engine. The company also recently announced a plan to raise $1.4 billion through an international share issuance, with proceeds earmarked for further Bitcoin acquisitions.

Eyeing the Future: 100K BTC by 2026

With its 30,000 BTC milestone achieved, Metaplanet is already focused on ambitious future goals:

- 100,000 BTC by 2026

- 210,000 BTC by 2027

Whether the firm can maintain its current pace of acquisition remains to be seen, but its strategy and capital raises suggest no signs of slowing down.

CoinLaw’s Takeaway

In my experience watching corporate crypto strategies unfold, Metaplanet is doing something few companies dare – going all-in on Bitcoin in a very public and methodical way. This isn’t just about holding crypto for speculative gain. They’re building a business around Bitcoin, integrating trading, media, and education into the mix. I found their use of share offerings to fund this strategy incredibly bold. While their stock’s short-term dips might rattle some nerves, they’re playing a long game here, and so far, they’re executing with precision. If they hit that 100K BTC goal, we may be talking about Metaplanet in the same breath as MicroStrategy in a few years.