Thumzup Media Corporation has bought about 7.5 million Dogecoin tokens for $2 million, reinforced its crypto strategy with mining expansion and advisory board upgrades, as interest in DOGE ETFs grows.

Key Takeaways

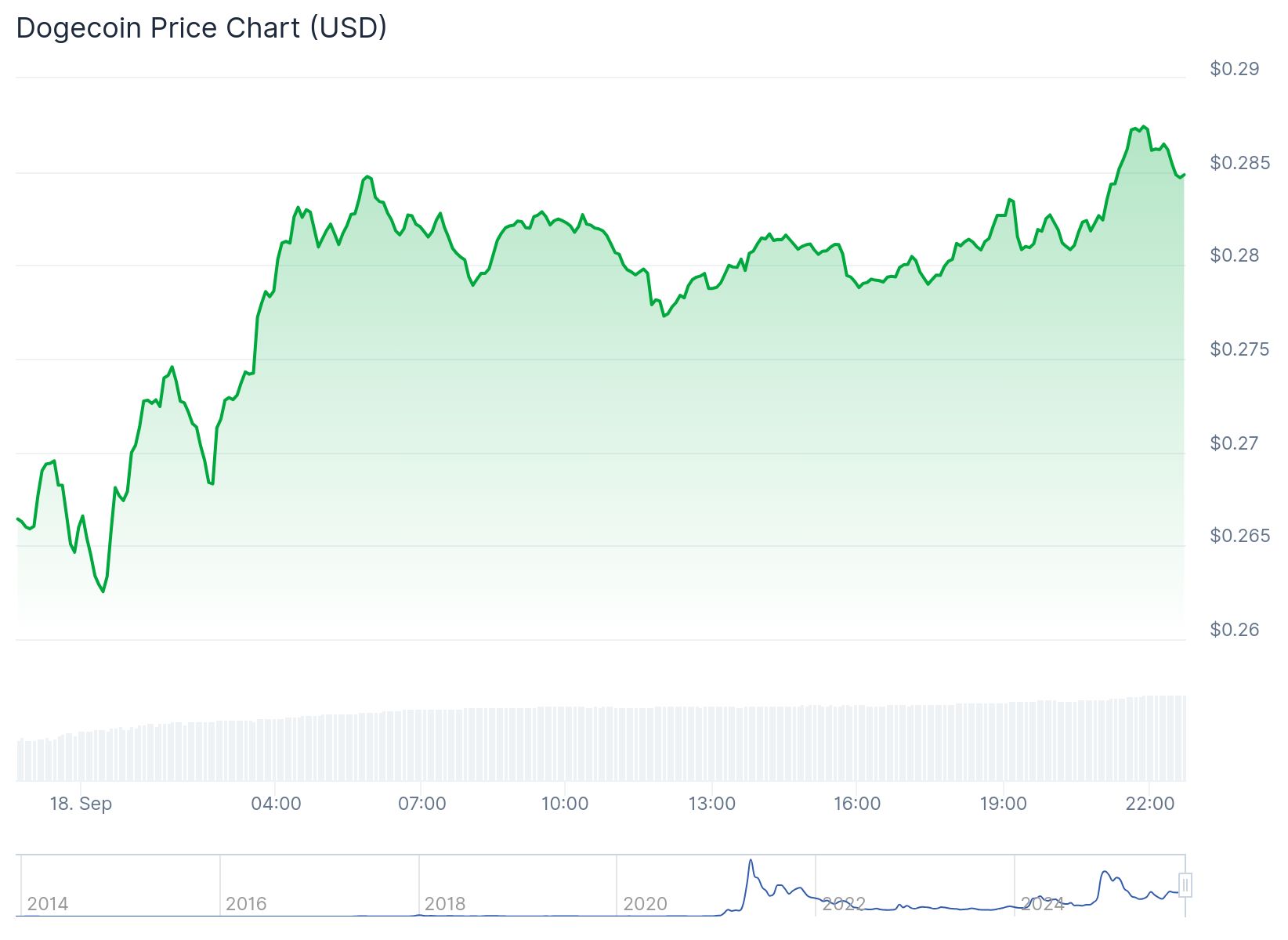

- Thumzup Media purchased ~7.5 million DOGE at an average price of $0.2665, spending roughly $2 million from its treasury.

- The purchase follows a $50 million capital raise in August aimed at acquiring digital assets and mining equipment.

- Thumzup is moving to acquire DogeHash, which runs 2,500 high‑end mining rigs and has 1,000 more planned, subject to customary approvals.

- Jordan Jefferson (CEO of DogeOS & MyDoge cofounder) and Alex Hoffman (Head of Ecosystem at DogeOS) have joined the Crypto Advisory Board to guide Thumzup’s DOGE‑focused expansion.

- The move comes amid anticipation of the first Dogecoin ETFs, which could drive institutional demand and broader adoption of DOGE.

What Happened?

Thumzup Media Corporation, listed on Nasdaq (TZUP), revealed in an SEC filing that it has made its first open market acquisition of Dogecoin (DOGE), purchasing about 7.5 million tokens for approximately $2 million, at a weighted average price of $0.2665 per token. This decision forms part of a broader strategy to build a Dogecoin treasury.

Thumzup is increasing its #Dogecoin ecosystem involvement!

— Thumzup Media Corporation (@thumz_up) September 18, 2025

Today, we announced an open-market acquisition of $DOGE, securing approximately 7.5 million tokens, amid the expected launch of the first Dogecoin ETFs.

Learn more about this transformative moment for the entire… pic.twitter.com/T4gP5ECJZB

The company had raised $50 million in August via a public stock offering at $10 per share. Proceeds from that raise were explicitly allocated to accumulating digital assets and acquiring high performance mining rigs.

To deepen its involvement in the Dogecoin ecosystem, Thumzup is advancing plans to acquire DogeHash, a mining operator with 2,500 rigs currently operating and another 1,000 planned for installation later this year. The acquisition is yet to be closed, pending shareholder approval, Nasdaq consent, and other routine closing requirements.

Thumzup also strengthened its leadership in this domain by appointing Jordan Jefferson, a figure tied to DogeOS and MyDoge wallet, along with Alex Hoffman of DogeOS ecosystem. The two will serve on its Crypto Advisory Board.

In addition to DOGE, Thumzup’s crypto holdings include major digital assets such as Bitcoin, Ethereum, Solana, Ripple, Litecoin, and USD Coin.

Background: Why DOGE Now

The move comes during renewed optimism in the cryptocurrency market around the likely approval and launch of Dogecoin ETFs, which many believe will open the door to much larger institutional investment.

DOGE has seen strong price action, trading near $0.28 around the time of the announcement. In short periods the token has gained about 4 to 5 percent in 24 hours, roughly 12 percent over one week, and nearly 18 percent over a month.

Thumzup’s financial health has been under scrutiny, with indicators of tight short term liquidity. For example, its current ratio is reportedly 0.27, suggesting it may have more current liabilities than current assets. Despite this, the company is using its capital raise to make aggressive moves in crypto accumulation and mining.

CoinLaw’s Takeaway

In my experience watching digital asset plays, what Thumzup is doing feels like bold positioning rather than incremental steps. They are not just acquiring tokens. They are building infrastructure, adding advisory expertise, and tying their finances to the Dogecoin narrative at a moment when ETFs could shift market dynamics.

It is a risky strategy especially for a company with weak liquidity and financial metrics, but if DOGE ETFs get approved and institutional interest follows through, Thumzup could ride a wave of adoption. There is potential for high reward, but also significant exposure to volatility.