In today’s rapidly evolving digital economy, payment technology plays a crucial role in shaping consumer behavior and driving global commerce. Worldpay, a prominent player in this field, has been pivotal in facilitating secure and seamless payment solutions across various platforms. As digital payments expand globally, both consumers and businesses demand greater efficiency, security, and flexibility in their transactions. This article delves into Worldpay’s performance and trends in 2025, offering valuable insights into its market share, technological advancements, and the latest industry trends to watch.

Editor’s Choice: Key Insights

- Digital wallets now account for 53% of global e-commerce transaction value and 32% at POS, reinforcing their dominance.

- Worldpay processes 145 million transactions daily worldwide as of Q1 2025, showing steady growth.

- Shopify powers 31.2% of U.S. e-commerce websites, maintaining its leadership in the e-commerce software space.

- Worldpay operates in 147 countries and supports 136 currencies, reflecting its expansive global footprint.

- Worldpay remains independently operated, owned by GTCR (55%) and FIS (45%), valued at $18.5 billion post-separation.

- Worldpay’s 2025 revenue has reached $4.96 billion, with a gross profit of $2.54 billion, reflecting healthy growth.

- Annual transaction volume for Worldpay now exceeds $2.15 trillion, keeping it ahead of Fiserv and Global Payments.

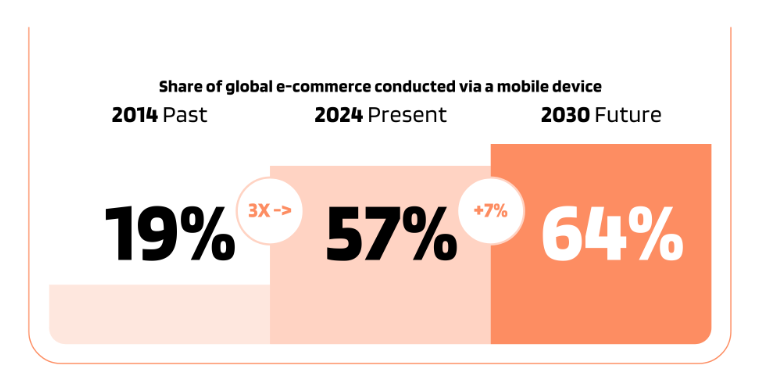

Growth of Mobile E-Commerce: Past, Present, and Future

- In 2014, only 19% of global e-commerce was conducted via a mobile device, showing early adoption levels.

- In 2024, this figure has tripled to 57%, highlighting a massive shift toward mobile shopping behavior.

- Looking ahead to 2030, the mobile share of global e-commerce is projected to reach 64%, a further 7% increase from 2024.

The data shows a clear trend: Mobile commerce is not just growing, it’s becoming the default platform for online shopping.

Growth and Market Share in Global Payments

- Worldpay holds 7.1% global market share in payment processing, ranking among the top five globally.

- In North America, Worldpay’s market share is 7.6%, with 31.5% of its revenue coming from the US.

- Contactless payments make up 43% of total transactions, boosted by widespread NFC adoption.

- The company partners with over 1,100 financial institutions worldwide, expanding its reach.

- Asia-Pacific payment volume grew 16.2%, led by rising e-commerce in India and China.

- Digital payments are growing 13.5% in 2025, with strong gains in the B2B and B2C segments.

- Cross-border transactions represent 32% of global volume, driven by international e-commerce.

- Worldpay’s market growth reflects a strategic focus on omnichannel payments and innovation.

Revenue and Financial Performance

Worldpay’s financial performance has demonstrated steady growth in recent years, driven by an expanding user base and the shift toward digital and mobile payments. Here are some critical revenue statistics:

- Worldpay’s annual revenue reached $5.8 billion, marking an increase of 8% from the previous year.

- The company recorded a net profit margin of 15%, reflecting effective cost management and operational efficiency.

- Revenue from e-commerce transactions alone contributed $3 billion, or 52% of total revenue, underlining the importance of online payments to Worldpay’s business model.

- Worldpay’s POS transactions brought in $1.5 billion, accounting for 26% of overall revenue, driven by partnerships with brick-and-mortar retailers.

- Mobile transactions saw a 22% increase in revenue, with mobile payments now representing 18% of Worldpay’s annual revenue.

- In the B2B sector, Worldpay has seen double-digit growth, with revenue from business clients increasing by 12%.

- The company invested over $600 million in R&D, focusing on security and AI-driven fraud prevention measures.

E-commerce and Point-of-Sale (POS) Statistics

As digital and in-store commerce evolve, Worldpay remains central to powering seamless transactions across all channels. Here’s how 2025 is shaping up:

- E-commerce payments now represent 63% of all transactions processed by Worldpay, driven by ongoing online shopping momentum.

- The total value of e-commerce transactions through Worldpay in 2025 has surpassed $278 billion, continuing strong year-on-year growth.

- 24% of POS clients have adopted mobile payment terminals, accelerating checkout and improving customer experience.

- POS transaction volume increased by 13% in 2025, supported by deeper retail integration and technology upgrades.

- Worldpay processes payments for 42% of the top 500 e-commerce sites in the US, reinforcing its digital commerce dominance.

- 43% of US-based Worldpay clients now use omnichannel solutions that unify online and offline payments.

- The “pay-by-link” feature grew by 35% in usage, proving especially effective for small and mid-sized merchants.

These updated 2025 figures reinforce Worldpay’s role as a versatile, secure, and scalable payments provider across both digital and physical retail environments.

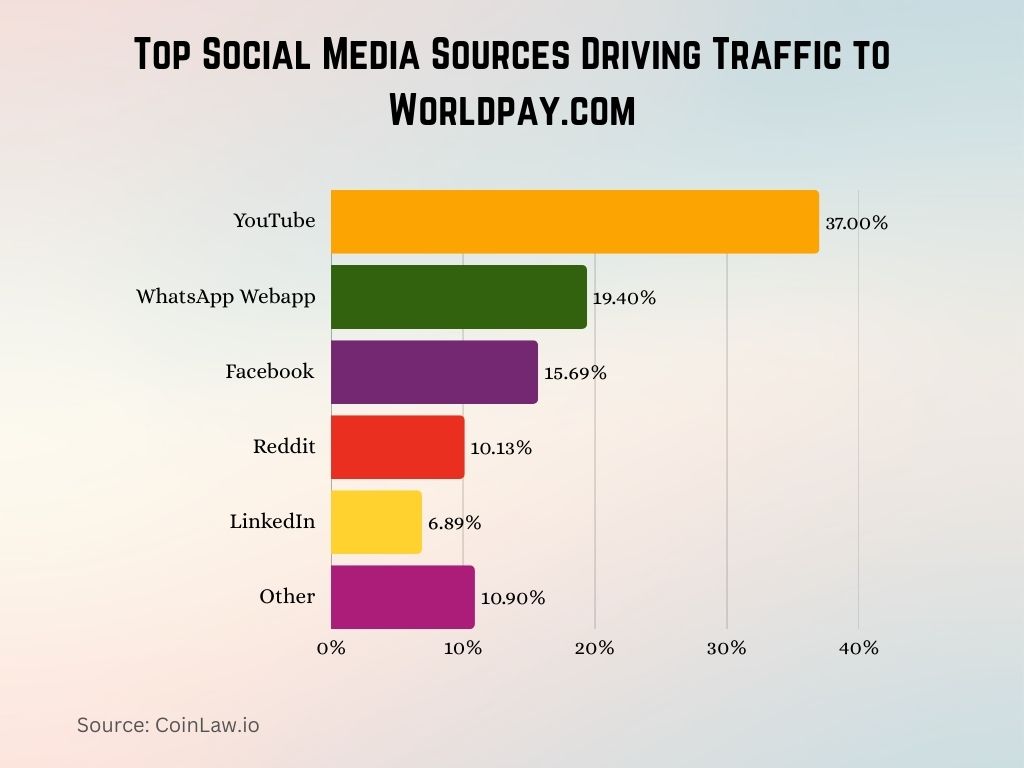

Top Social Media Sources Driving Traffic to Worldpay.com

- YouTube leads with a massive 37.00% share of social media traffic to worldpay.com, showing its dominance in video-driven referrals.

- WhatsApp Webapp contributes 19.40%, underlining the strong role of messaging platforms in website traffic generation.

- Facebook follows with 15.69%, maintaining its place as a major player in social referral despite rising competition.

- Reddit accounts for 10.13%, highlighting the value of community-driven platforms for niche traffic.

- LinkedIn delivers 6.89% of traffic, indicating its influence in professional and B2B contexts.

- Other platforms collectively bring in 10.90%, showing the significance of diversifying across multiple social channels.

Digital & Mobile Wallet Adoption Trends

With digital wallets becoming the norm, Worldpay continues to lead by ensuring seamless integration with top wallet providers. Here’s the updated 2025 snapshot:

- 51% of all transactions through Worldpay in 2025 are now completed using digital wallets like Apple Pay, Google Pay, and Samsung Pay.

- Mobile wallet adoption in the US increased by 21% year-over-year, driven heavily by users aged 18 to 34.

- Digital wallets account for 58% of Worldpay’s mobile transactions, showing continued migration away from cards and cash.

- 36% of Worldpay’s retail clients say digital wallets now represent the majority of their in-store payments.

- Digital wallet transaction volume in Latin America grew by 29%, with Brazil remaining Worldpay’s fastest-growing regional market.

- Cryptocurrency wallets now make up 2.7% of Worldpay’s digital wallet transactions, showing steady interest in crypto-enabled payments.

- The global digital wallet market is growing at 17.2% annually, with Worldpay securing a major share via strategic wallet partnerships.

These 2025 insights confirm that Worldpay is well-positioned to meet rising demand from mobile-first, convenience-driven consumers worldwide.

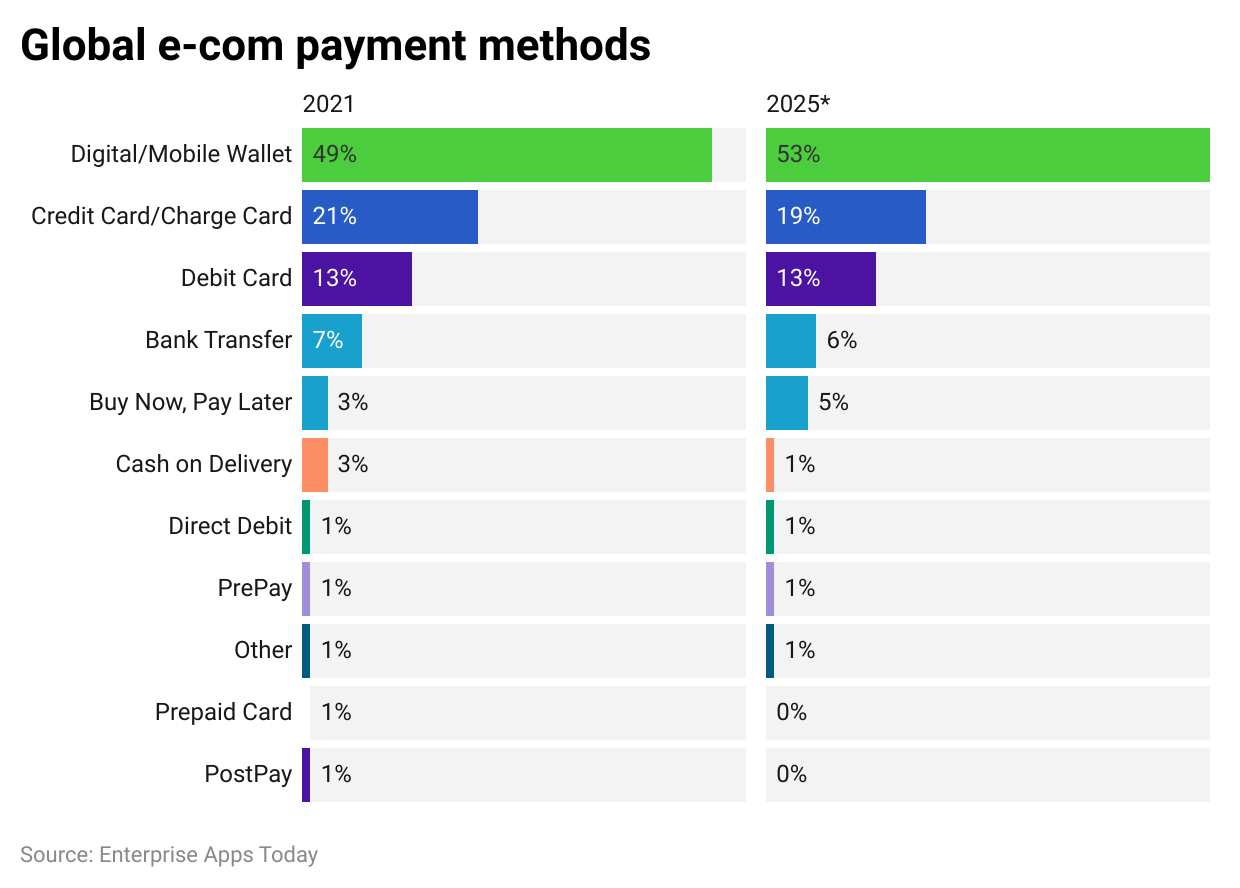

Global E-Commerce Payment Methods: 2021 vs 2025 (Projected)

- Digital/Mobile Wallets dominate globally, rising from 49% in 2021 to a projected 53% in 2025, solidifying their lead as the most preferred payment method.

- Credit/Charge Cards usage is expected to drop slightly from 21% in 2021 to 19% in 2025, indicating a gradual shift away from traditional plastic.

- Debit Cards maintain stability at 13%, showing consistent global user preference over the years.

- Bank Transfers are projected to decrease slightly from 7% to 6%, remaining a secondary method.

- Buy Now, Pay Later (BNPL) services are growing, increasing from 3% to 5%, driven by demand for flexible payments.

- Cash on Delivery is declining, falling from 3% in 2021 to 1% in 2025, as digital adoption expands.

- Other lesser-used methods like Direct Debit, PrePay, PostPay, and Prepaid Cards remain under 1%, with Prepaid Cards and PostPay dropping to 0% by 2025.

Buy Now, Pay Later (BNPL) and Alternative Payment Methods

The rise of Buy Now, Pay Later (BNPL) options continues to reshape consumer financing, with Worldpay remaining a key player in enabling flexible payments. Here are the latest 2025 statistics in this segment:

- BNPL transactions processed by Worldpay rose by 34% in 2025, reflecting strong consumer demand.

- BNPL now accounts for 9.1% of Worldpay’s total transaction volume, showing steady adoption growth.

- 66% of Millennials and 47% of Gen Z consumers using Worldpay prefer BNPL for purchases.

- 31% of Worldpay’s e-commerce merchants now offer BNPL as a payment option.

- The average BNPL transaction value on Worldpay stands at $325, led by electronics and fashion.

- BNPL makes up 18.4% of digital payments Worldpay processes in Europe, especially in the UK and Germany.

- Alternative payment methods now comprise 36% of Worldpay’s total volume, reducing credit card reliance.

These updated figures highlight how Worldpay is responding to changing preferences by focusing on convenience and flexibility.

Top Countries for Stores Using Worldpay

Worldpay continues to thrive globally in 2025, with strong traction in major markets and evolving digital payment trends:

- United States accounts for 42% of Worldpay’s merchant base, remaining its largest market with dominant e-commerce adoption

- United Kingdom contributes 27% of Worldpay’s European volume, especially in the retail and hospitality sectors

- Australia sees 14% of Worldpay transactions via Buy Now, Pay Later (BNPL), showing strong consumer adoption

- Germany records 33% of transactions through digital wallets and BNPL, indicating a shift from traditional cards

- Brazil drives a 17% increase in Worldpay transaction volume in Latin America, led by mobile commerce

- India processes 78% of transactions via smartphones, reflecting high mobile-first behavior

- Canada shows 38% of payments as contactless, led by NFC and digital wallets

These updated 2025 figures highlight Worldpay’s ability to support localized payment trends and maintain its global leadership in digital commerce.

Technological Advancements and Innovations

Worldpay’s commitment to technology continues in 2025 through strategic innovations that boost security, speed, and ease of payments. Here’s the latest overview:

- Worldpay’s fraud detection accuracy improved by 38% in 2025 with expanded AI-driven threat analysis across platforms.

- Real-time payment processing upgrades in 2025 further reduced delays by 27%, improving transaction speeds for merchants and consumers.

- Blockchain-based solutions now account for 7.2% of Worldpay’s cross-border transactions, lowering costs and increasing transparency.

- 63% of development resources are focused on AI and machine learning, driving advancements in personalization and fraud prediction.

- QR code payments are used by 18% of Asian retail clients, especially in mobile-first markets like Singapore and Malaysia.

- The Worldpay API saw a 51% increase in integrations in 2025, enabling seamless payment flow across e-commerce ecosystems.

- “Tap to phone” adoption rose by 31% among small businesses, supporting low-cost contactless payment acceptance.

These innovations show how Worldpay is staying ahead with future-ready tech that aligns with evolving business and consumer needs.

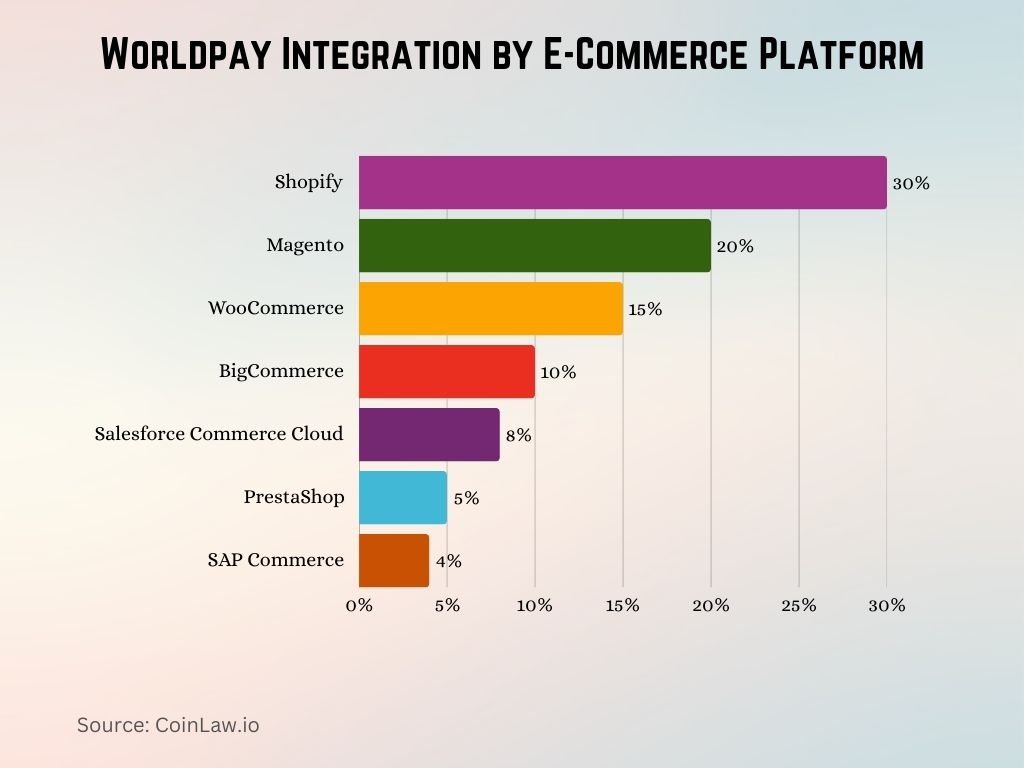

Worldpay Integration by E-Commerce Platform

- Shopify leads all platforms with 30% integration, making it the top choice for merchants using Worldpay’s payment solutions.

- Magento holds the second spot with 20%, reflecting its strong presence among mid to large-sized e-commerce businesses.

- WooCommerce comes in third at 15%, showing solid adoption among WordPress-based online stores.

- BigCommerce accounts for 10%, maintaining a moderate but notable share of Worldpay integrations.

- Salesforce Commerce Cloud captures 8%, underlining its appeal to enterprise-level merchants.

- PrestaShop shows 5% integration, indicating smaller-scale usage among niche e-commerce users.

- SAP Commerce rounds out the list with 4%, representing limited but strategic enterprise use cases.

Regional Payment Preferences and Trends

Worldpay’s global footprint provides a unique view of regional differences in payment preferences. Here’s a breakdown of notable trends:

- North America leads in credit card payments, with 55% of Worldpay’s transactions in this region using cards as the primary method.

- In Europe, digital wallets make up 40% of transactions, driven by the popularity of solutions like PayPal and Klarna.

- Asia-Pacific has the highest mobile payment adoption, with 65% of transactions conducted via mobile apps, particularly in China and Southeast Asia.

- In Latin America, cash-based methods remain common, yet 20% of Worldpay’s clients in the region have integrated digital wallets.

- The Middle East and Africa show a growing trend in QR code payments, used in 10% of transactions processed by Worldpay in urban areas.

- Cryptocurrency is emerging as a payment method in specific regions, making up 1% of transactions in North America and Europe.

- Buy Now, Pay Later is especially favored in Australia and New Zealand, where it accounts for 12% of Worldpay’s transaction volume in these markets.

These insights reflect Worldpay’s adaptability in serving diverse consumer behaviors and preferences across global regions.

Top E-commerce Platforms for Stores Using Worldpay

Worldpay continues to support a diverse ecosystem of e-commerce platforms in 2025, adapting to the growing needs of digital retailers:

- Shopify leads with 32% of Worldpay integrations, favored by merchants for ease of use and rapid deployment

- Magento powers 18% of high-volume Worldpay clients, supporting custom, enterprise-grade solutions

- WooCommerce holds 16% of integrations, popular with SMBs for its WordPress compatibility

- BigCommerce supports 11% of Worldpay users, chosen for its scalability and omnichannel capabilities

- Salesforce Commerce Cloud accounts for 9% of large-scale clients, enabling personalized, enterprise e-commerce

- PrestaShop remains strong with a 6% share among European small businesses for its open-source flexibility

- SAP Commerce serves 5% of clients focused on B2B e-commerce and complex workflows

These 2025 insights reaffirm Worldpay’s role in seamlessly integrating with top e-commerce platforms to enhance transaction efficiency and global retail success.

Recent Developments

In 2025, Worldpay continues to expand its global presence and strengthen its role in shaping modern payments. Here’s a snapshot of the latest developments:

- The global e-commerce market is set to grow by 57.6% from 2021 to 2025, reaching a transaction value of approximately $8.6 trillion.

- By 2027, digital wallets will account for 63% of global e-commerce payments and 48% of point-of-sale transactions worldwide.

- In the Asia-Pacific region, digital wallets now account for 74% of e-commerce value, surpassing 54% of POS spending, driven by mobile-first economies.

- BNPL services are projected to grow to 5.8% of global e-commerce transactions in 2025, fueled by demand for short-term credit.

- In the UK, digital wallet usage at point-of-sale is projected to rise from 14% to 31% of transaction value by 2028, doubling in just three years.

These 2025 trends reinforce Worldpay’s strategy of embracing digital-first, flexible, and globally scalable payment technologies.

Conclusion

Worldpay stands as a critical player in the global payments landscape, equipped with the technology and adaptability needed to meet diverse market demands. As consumers and businesses increasingly lean towards digital payments and alternative financing, Worldpay’s broad range of solutions positions it to lead the way in secure and seamless transactions. With ongoing innovation and regional expansion, Worldpay is set to continue driving growth and shaping the future of global payments, fostering connections between businesses and customers worldwide.