The growth of Web3 wallets, digital applications that enable users to hold cryptocurrencies, interact with decentralized applications, and access blockchain-based services, is gaining real momentum. In industries like finance, companies are using these wallets to onboard customers into DeFi platforms seamlessly, while in gaming, players are increasingly using them to store NFTs and participate in tokenized ecosystems. This article unpacks the latest statistics around Web3 wallet adoption, user engagement, regional trends, and segmentation. Read on to explore how the numbers reflect both the promise and the practical reality.

Editor’s Choice

- 820 million unique cryptocurrency wallets are active globally as of 2025.

- The United States reports only 12% of adults using Web3 wallets in a recent survey.

- Retail users represent 82% of all crypto wallet holders worldwide in 2025.

- Institutional wallet ownership grew by 51% year-on-year, reaching over 31 million institutional wallets in 2025.

- Monthly active users (MAUs) of Web3 dApps globally range between 5 million and 10 million in 2025.

- Non-custodial wallet adoption is expected to increase by another 20-30% in H2 2025.

Recent Developments

- The narrative in Web3 is shifting from speculative hype toward actual use cases, particularly in decentralized finance (DeFi) and digital identity systems.

- Growth of embedded wallet services (Wallet-as-a-Service) is gaining traction as Web2 companies integrate Web3 wallet functionality.

- The usability of wallets (e.g., social login, gasless transactions) is being improved to reduce friction and drive adoption.

- Reports show that only 7% of informed adults feel very confident in the safety of crypto wallets, suggesting trust remains a barrier.

- Survey data indicates 14% of non-owners plan to enter the crypto wallet market in 2025, while 48% are open to doing so.

- Global crypto wallet ownership surpassed 820 million active users in 2025, accounting for approximately 15% of the global internet population.

- The H2 2025 forecast for wallets expects non-custodial adoption to rise by up to 30%, implying growth momentum continues.

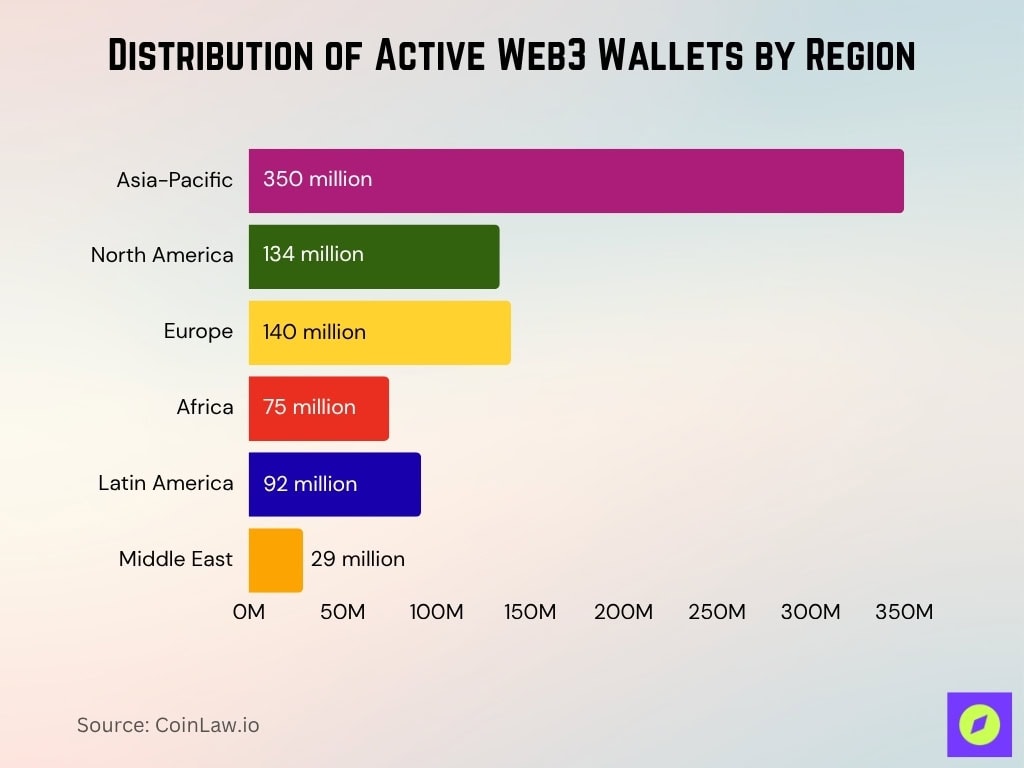

Web3 Wallet Adoption by Region

- Asia-Pacific is home to approximately 350 million active wallets in 2025, accounting for about 43% of the global total.

- North America had some 134 million wallet users in 2025, representing roughly 16% of global users.

- Europe recorded about 140 million active wallet users in 2025, showing a 12% year-on-year increase.

- Africa’s wallet adoption reached 75 million users in 2025, having doubled over the past two years.

- Latin America counted around 92 million wallet users in 2025, fuelled by inflation hedging and remittances.

- The Middle East reported 29 million active wallets in 2025.

- In the U.S., only 12% of adults use Web3 wallets, underscoring a gap between global adoption and U.S. mainstream uptake.

- Emerging market internet users show nearly 70% intention to use at least one Web3 service over the next few years.

User Demographics and Segmentation

- Users aged 18–34 account for 64% of crypto wallet holders in 2025.

- The share of female wallet holders rose to 29% in 2025, with Gen Z women seeing 31% growth in adoption.

- Among wallet owners, 34% earn over $100,000 annually, and 42% fall into the $50,000–$99,999 income bracket.

- The average retail user holds 2.7 wallets in 2025.

- Institutional wallets numbered over 31 million, growing 51% YoY in 2025.

- 67% of wallet users hold a college degree or higher in 2025.

- Rural and suburban regions recorded wallet adoption growth of 28% in 2025, showing reach beyond urban centers.

- Survey results show that 26% of all adults feel very unconfident in crypto wallet safety in 2025.

Leading Web3 Wallets by User Numbers

- MetaMask reports over 30 million monthly active users (MAUs) in 2025.

- MetaMask holds approximately 60% of non-custodial wallet users in the U.S. in 2025.

- In India, MetaMask dominates with 63% of users and 79% of wallet fund share in 2025.

- Trust Wallet (mobile-first) increased user installations by ~40% year-on-year in 2025.

- More than $250 billion in digital assets are held in non-custodial wallets globally in 2025, up from $180 billion two years prior.

- Custodial exchange-linked wallets such as Coinbase Wallet show ~3.2 million MAUs mid-2025, with the broader platform reaching ~8.7 million transacting monthly users.

- Browser-extension wallets represent roughly 12% of total crypto wallet usage in 2025, though their role remains vital for DeFi and dApp access.

- The top few wallet providers account for a large share of the ecosystem. For instance, in Nigeria, MetaMask holds ~12.7% of the country’s share among global users.

Daily and Monthly Active Wallet Users

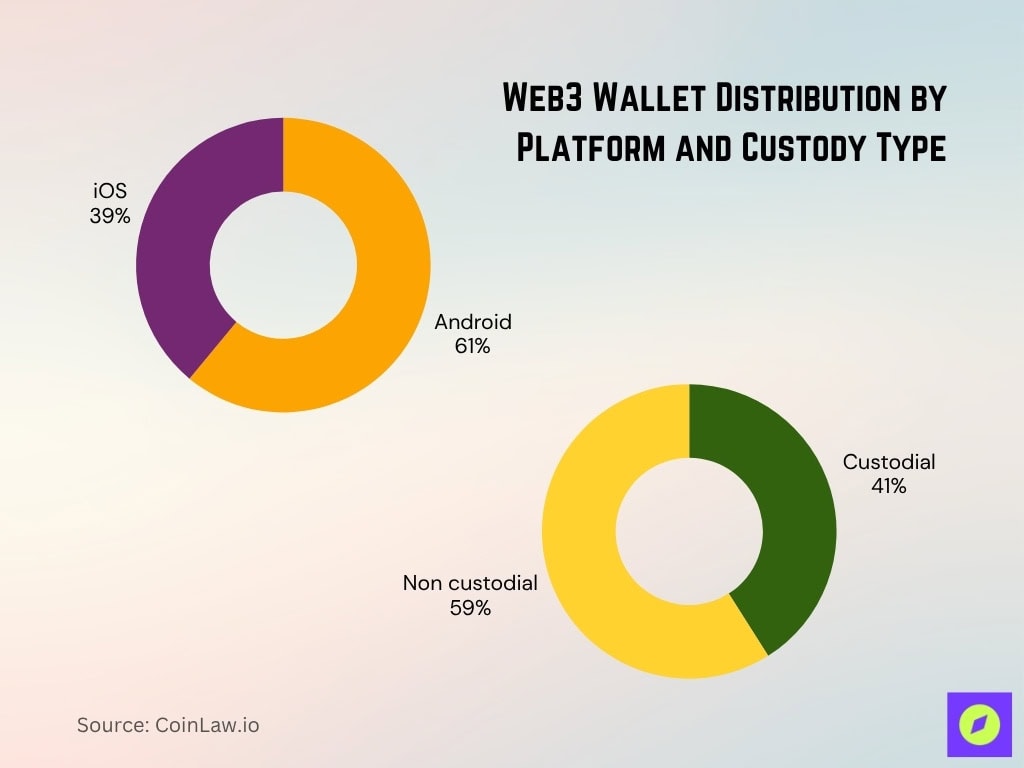

- In mobile wallet installs, Android represents 61%, while iOS is at 39% in 2025.

- Custodial wallet share is at 41% in 2025, with non-custodial at 59%.

- Global monthly active users (MAUs) of Web3 dApps are estimated at between 5 million and 10 million in 2025.

- One popular wallet, MetaMask, has reported over 30 million monthly active users, primarily in the Ethereum ecosystem.

- Mobile-first hot wallet usage shows 72% preference among users in 2025.

- Browser extension wallets account for only 12% of use in 2025, despite their importance for NFT and dApp users.

- Desktop wallet usage has fallen to about 9% of hot wallet usage in 2025, indicating a shift to mobile.

- Non-custodial wallet adoption is projected to grow 20–30% in H2 2025, reflecting future active-user growth.

Growth Trends by Blockchain (Ethereum, Solana, BNB Chain, etc.)

- BNB Chain crossed 58 million monthly active addresses in September 2025, overtaking Solana’s 38.3 million as of that month.

- In June 2025, Solana processed ~2.98 billion transactions, leading among blockchains by volume.

- The report of top-growing blockchains in 2025 highlights Solana and Arbitrum as the most rapidly expanding networks by active user growth.

- The total value locked (TVL) in DeFi surpassed $123.6 billion in 2025, marking a 41% year-on-year increase (primarily on Ethereum).

- Ethereum still dominates NFT and dApp transaction share; around 62% of NFT transaction volume remains on Ethereum in 2025.

- The number of smart contracts deployed on Ethereum exceeded 85,000 per month in 2025.

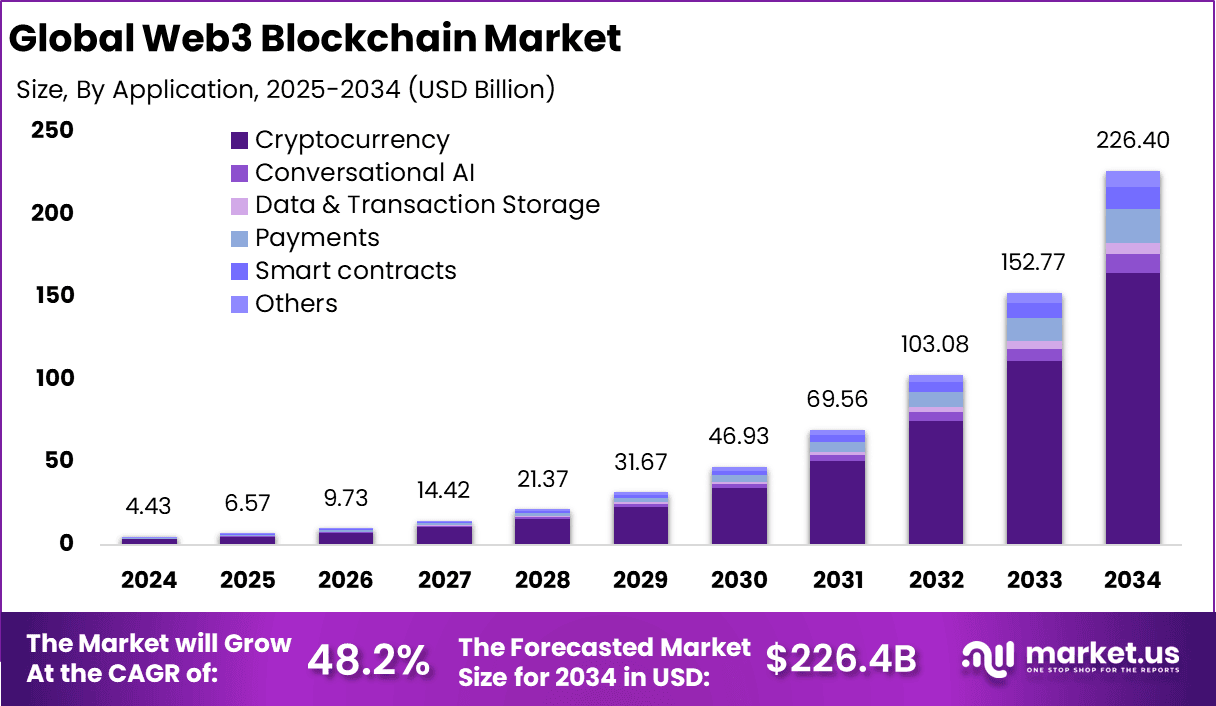

Global Web3 Blockchain Market Highlights

- The global Web3 blockchain market is projected to hit $226.4 billion by 2034, showing massive long-term expansion.

- Market size rises sharply from $4.43 billion in 2024 to $6.57 billion in 2025, reflecting early growth momentum.

- By 2028, the market will reach $21.37 billion, driven by rising adoption across crypto, payments, and smart contract applications.

- The market surpasses the $100 billion mark in 2032, reaching $103.08 billion as enterprise and dApp usage accelerates.

- Growth is strongest between 2032 and 2034, with the market jumping from $152.77 billion to $226.40 billion.

- The forecast indicates a powerful 48.2% CAGR from 2025 to 2034.

Web3 Wallet Usage in DeFi and dApps

- Global monthly active users for Web3 dApps (wallet-connected) in 2025 are estimated at between 5 and 10 million.

- In Q2 2025, the average daily active unique wallets (dUAW) for dApps reached 24.3 million, up ~247% from early 2024 but down ~2.5% quarter-on-quarter.

- Only 5–10% of users become repeat dApp users within 30 days of initial use.

- For many wallet-connected dApps, retention beyond 7 days remains below 20%, meaning most users don’t return after onboarding.

- GameFi and DeFi applications account for about 70% of wallet-connection activity across dApps in 2025.

- NFT marketplace wallet sessions represent roughly 25% of all wallet connection sessions in Web3.

- A wallet may connect to an average of 1.4 dApps monthly, indicating low multi-app usage per wallet.

- Despite wallet connection growth, high drop-off means that actual long-term engaged users remain a small fraction of connected wallets.

NFT and Gaming Wallet Adoption

- In Q3 2025, blockchain gaming recorded ~4.66 million daily active wallets, marking a 4.4% year-on-year increase.

- The number of daily active NFT wallets averaged around 410,000 in 2025, up ~9% year-on-year.

- Wallets interacting with gaming NFTs surged by ~17% in Q1 2025.

- The global NFT gaming market size is valued at about $0.54 trillion in 2025.

- Mobile games led with ~48.5% of the NFT-gaming market share in 2024 and continue to dominate in 2025.

- The secondary market in NFTs accounts for ~52% of all NFT transactions in 2025, signaling wallet users who are transacting, not just holding.

- Wallets used for NFT or gaming purposes increasingly support multiple chains (multichain), reflecting user demand for interoperability.

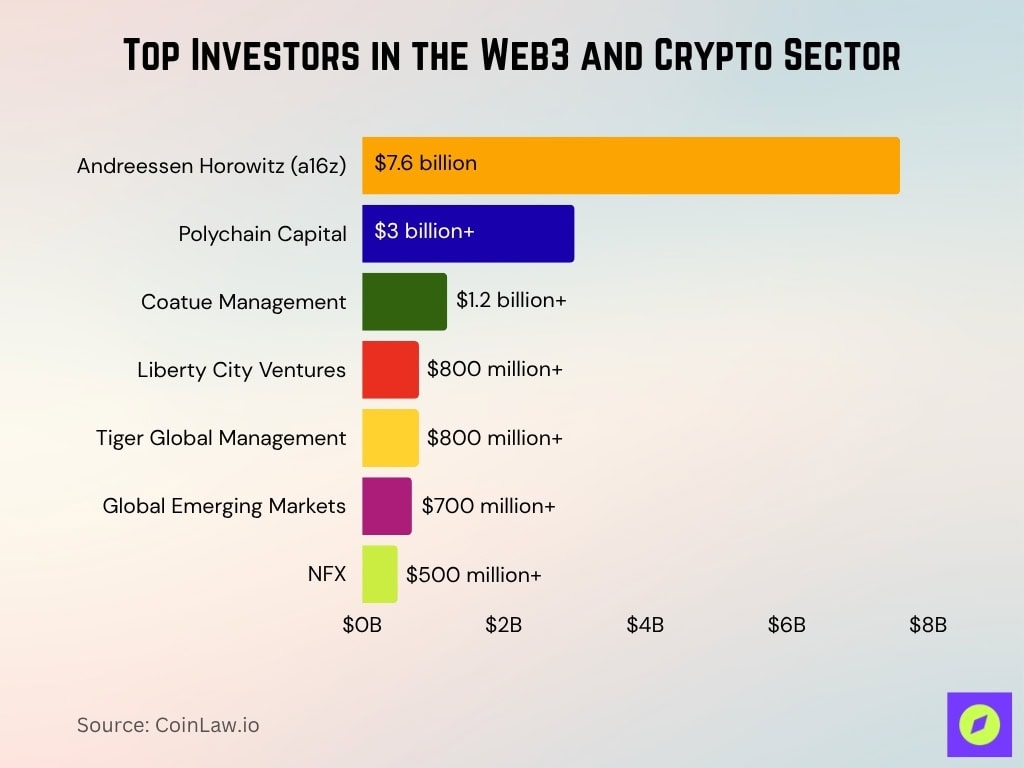

Top Investors in the Web3 and Crypto Sector

- Andreessen Horowitz (a16z) leads the space with a massive $7.6 billion committed to Web3 and crypto ventures.

- Polychain Capital follows with over $3 billion invested in blockchain ecosystems and emerging protocols.

- Coatue Management has committed $1.2 billion+, reinforcing its strong presence in late-stage crypto and Web3 funding.

- Liberty City Ventures has surpassed $800 million+ in total Web3-focused investments.

- Tiger Global Management matches that level with $800 million+ in crypto-related allocations.

- Global Emerging Markets has invested $700 million+ into blockchain startups and token projects.

- NFX rounds out the list with $500 million+ directed toward early-stage Web3 innovation.

Retention and Engagement Metrics

- According to cohort data, 70% of wallet users make only one transaction and then leave, meaning they do not engage further.

- A wallet that performs its core value action (deposit, first trade) and returns after 30 days has a retention rate (AWRR) of about 62% for well-performing products.

- For most dApps, 30-day retention rates are below 10%, particularly in gaming.

- Wallet-user activation costs (Cost Per Activated Wallet) have risen from ~$500 to ~$550 on average in 2025.

- Average wallet connection to dApps yields only about 1.1 to 3.8 engagement actions within the first week, depending on the product type.

- Retention improvements often result from embedded wallet features (smart wallets, account-abstraction), gamified flows, and seamless UX, improving retention from ~13% to ~30% in certain high-engagement cases.

Mobile vs Browser Extension Wallet Adoption

- Browser extension wallets account for approximately. 12% of total wallet usage in 2025, as the majority of users shift to mobile.

- Mobile-first wallet adoption in the Asia-Pacific region experienced a ~311% rise by 2025.

- On mobile wallet installs in 2025, Android accounts for ~61%, while iOS holds ~39%.

- Desktop wallet usage has fallen to around 9% of hot-wallet usage in 2025, reflecting user preference for mobile access.

- Wallets that offer integrated mobile apps with in-app staking, swaps, and dApp browser features (e.g., Trust Wallet) grew faster than pure browser-extension models.

- Browser-extension wallets remain important for specialized uses (DeFi, NFTs) but are no longer core for broad retail adoption.

- Mobile wallet UX improvements (social login, gasless transactions) are cited as key drivers of adoption in 2025.

- Hybrid wallets (mobile + extension) tend to show better retention by giving users cross-platform flexibility.

Institutional vs Retail Wallet Adoption

- In 2025, 86% of institutional respondents confirmed they either have digital-asset exposure or plan allocations.

- Among those institutions, 84% increased their crypto-related allocations in 2024.

- Reports indicate hot wallets (typically retail-oriented) account for about 63% of total wallet usage in 2025.

- Over 52% of users expressed demand for wallets supporting multi-chain tokens, hinting at advanced users bridging retail and quasi-institutional use.

- North America, home to many institutional players, accounts for roughly 39% of the crypto asset-management market in 2024.

Embedded Wallet and Wallet-as-a-Service (WaaS) Adoption

- Embedded wallet infrastructures processed 33 million swap transactions with about $9 billion volume in May 2025.

- Over 100,000 developers use Wallet-as-a-Service (WaaS), cutting integration times from weeks to hours.

- Embedded wallets in gaming allow instant play via Discord/Steam login and support gasless NFT transactions.

- WaaS market is valued at around $2 billion in 2025, with a CAGR of 30% expected through 2033.

- By 2025, digital wallets (including embedded ones) are expected to handle 39% of global POS transactions.

Smart Contract and Account-Abstraction Wallet Growth

- The smart-contracts market (which underpins smart wallet infrastructure) was valued at $2.14 billion in 2024 and forecast at $2.69 billion in 2025.

- Growing adoption of standards like ERC-4337 and EIP-7702 signals a shift toward account-abstraction wallet models.

- In 2025, smart contract vulnerabilities accounted for over 40% of blockchain-related financial losses, indicating risk tied to advanced wallet types.

- Account-abstraction wallets reduce onboarding friction by removing seed-phrase burdens and enabling sponsored gas.

- Smart wallet architectures are increasingly multi-chain compatible, allowing the same wallet address to operate across networks.

- While promising, smart wallet deployment cost (contract deployment, bundlers) remains a barrier to mass adoption in 2025.

Cross-Chain and Multichain Wallet Users

- Modern wallets increasingly support “anything-to-anything” token swaps across 100+ chains, according to major wallet providers.

- Alchemy’s dApp store lists 27 multi-chain wallets supporting Layer 1 and Layer 2 networks as of 2025.

- Cross-chain crime (illicit activity using multichain bridges) amounted to over $21.8 billion in 2025, underscoring the complexity of cross-chain flows.

- For some wallet users, interacting on multiple chains is becoming the default; over 90% of global users of one major wallet transact on multiple chains.

- As more dApps launch on diverse networks, cross-chain users are likely to become a core segment of high-activity wallet holders.

Market Challenges and Barriers to Growth

- Web3 wallets face a ~70% user drop-off rate during onboarding due to complexity and jargon.

- Over 23% of stolen crypto funds in 2025 are linked to wallet-related breaches.

- Regulatory uncertainty affects 85% of wallet providers, complicating institutional adoption.

- Cross-chain wallets increase security risks, with over $1-2 billion lost to bridge exploits in 2025.

- Global crypto wallet adoption is about 9.9% of internet users in 2025.

- Wallet fragmentation leads to users managing an average of 3-5 different wallets across chains.

- Wallet download activation rates remain low, with over 70% of users never completing meaningful transactions.

- Web3 wallet market size is forecasted to reach $19 billion in 2025 with a projected CAGR of 31.9% through 2029.

- The security market for Web3 wallets is growing at a 23.7% CAGR, aiming to hit $68.8 billion by 2033.

Future Trends and Web3 Wallet Forecasts

- Web3 wallets are forecasted to be a $19 billion market by 2025, with rapid growth expected.

- Institutional crypto wallet adoption is rising, with 86% of institutions planning or having digital asset exposure in 2025.

- Wallet UX innovations like social login and account abstraction are predicted to reduce onboarding friction by up to 50%.

- Embedded wallets and WaaS are projected to grow at a CAGR of 25-30% through 2033, expanding wallet access beyond crypto natives.

- Cross-chain compatibility is now a must-have, with 40+ blockchains supported by leading wallets in 2025.

- About 40% of global e-commerce payments are expected to be made via digital wallets by 2025.

- Biometric security adoption in Web3 wallets is increasing, currently used by over 30% of wallet users.

- More than 40% of blockchain developers are actively building or improving Web3 wallet technologies in 2025.

- Cross-chain DeFi wallet transactions increased by 27% globally in 2025, driven by better interoperability.

- Embedded wallets enabling non-crypto brands could expand the addressable wallet user base by 50%+ in the coming years.

Frequently Asked Questions (FAQs)

Over 820 million unique active cryptocurrency wallets worldwide as of 2025.

About 78 % of all crypto wallets in 2025 are hot wallets.

Around 48 % of all wallets in 2025 have connected with at least one dApp.

Approximately 198 million wallets are active in DeFi in 2025, representing about 24% of all wallets.

Conclusion

The landscape of Web3 wallet adoption is at a critical juncture. Retail and institutional users alike are scaling participation, but underlying infrastructure, user experience, and regulatory frameworks still pose meaningful obstacles. Embedded wallet services, account-abstraction architectures, and multichain support signal the next phase of evolution, moving wallets from niche crypto tools toward everyday digital-asset utilities. As these trends converge, the winners will be those wallets that deliver security, simplicity, and interoperability at scale.