Visa, a global leader in digital payments, is a company that continuously shapes the future of money movement. Over the decades, Visa has evolved beyond traditional credit and debit cards to encompass cutting-edge digital payment solutions. Whether you’re tapping a card, scanning your phone, or transacting online, Visa is often behind the seamless transaction. Today, Visa is a key player in the global financial ecosystem. With every swipe, tap, or click, Visa empowers individuals and businesses to move money securely.

Editor’s Choice

- Visa’s Q1 $9.5 billion net revenue marked a 10% year-over-year increase.

- GAAP net income reached $5.1 billion, with non-GAAP net income at $5.46 billion, up 11% year-over-year.

- Operating margin stayed strong at approximately 62%, highlighting operational efficiency.

- Total payment volume hit $3.732 trillion, up 9% year-over-year.

- Trailing twelve months free cash flow stood at $20.5 billion, supporting investments.

- Non-GAAP EPS rose 11% to $2.75 per share.

- The stock price closed at approximately $352 per share as of early January.

Visa Cardholder Demographics

- 82% of U.S. adults hold at least one Visa credit card, with ownership highest among high-income households.

- 95% of households earning over $100,000 annually have Visa cards.

- 67% of Gen Z (ages 18-25) own Visa cards, averaging 2.3 cards per person.

- Millennials (26-41) hold 3.7 Visa cards on average, 44% carry revolving balances.

- Gen X (42-57) and Baby Boomers average 4.4-4.8 Visa cards each.

- 89% of Asian consumers and 86% of White consumers own Visa cards, the highest among racial groups.

- Gender gap minimal: men average 3.38 Visa cards, women 3.22 cards.

- 68% of Gen Z 18-24 own credit cards, including Visa, up from 50% in 2021.

- Gen Z is projected to drive 23.4% of all consumer spending growth through 2035.

Market Share

- Visa holds a 52.2% share of the global credit card market, maintaining its lead over Mastercard and American Express.

- In the debit card segment, Visa’s share is approximately 76%, driven by strong adoption globally.

- Visa processed 257.5 billion transactions globally, a 10% increase from the previous year.

- In the United States, Visa commands a 60% market share in the card network sector by purchase volume.

- Visa dominates the e-commerce space, with its payment solutions accounting for 90% of all online transactions.

- Visa’s contactless payment solutions capture nearly 80% of tap-to-pay transactions worldwide.

- The Visa Direct platform processed over 11 billion transactions, supporting real-time payments growth.

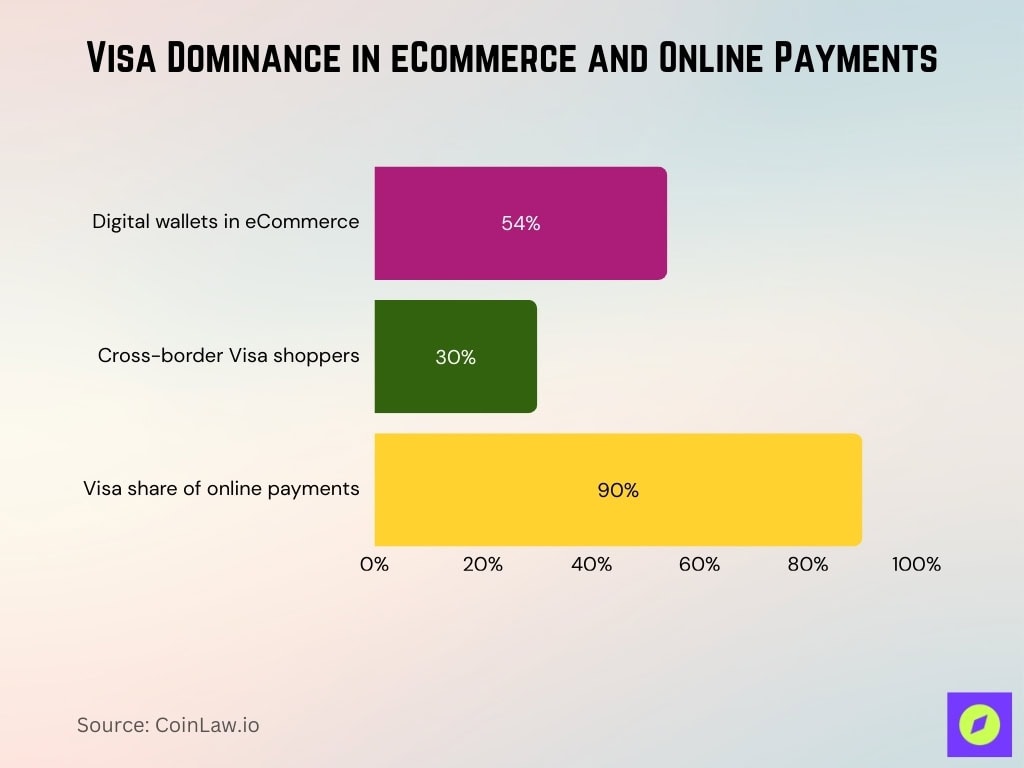

eCommerce Growth and Online Payments Using Visa

- Digital wallets are expected to account for 54% of global eCommerce payments by 2026.

- 30% of consumers make weekly cross-border eCommerce purchases using Visa.

- Visa processes 90% of online transactions among leading payment solutions.

- Visa eCommerce transactions using manual guest checkout dropped to 16% in 2025.

- 16 billion Visa tokens enable single-click checkouts across top eCommerce platforms.

- The cross-border eCommerce B2C market is projected to reach $8.3 trillion by 2026.

- Among Visa’s top 25 eCommerce sellers, guest checkout usage is in the low single digits.

Revenue Breakdown

- Service revenues reached $4.6 billion in Q4 FY25, marking a 10% year-over-year increase.

- Data processing revenues rose to $5.4 billion in Q4 FY25, a 17% increase year-over-year.

- International transaction revenues amounted to $3.8 billion in Q4 FY25, reflecting 10% growth year-over-year.

- Other revenues brought in approximately $1.0 billion in Q4 FY25, driven by value-added services.

- For the six months ended December 31, FY26, U.S. operations contributed about $8.0 billion to total revenue.

- International markets generated $12.5 billion in revenue for the same period, led by Europe and Asia-Pacific.

- Data processing revenues for FY25 totaled $19.99 billion, up 12.87% year-over-year.

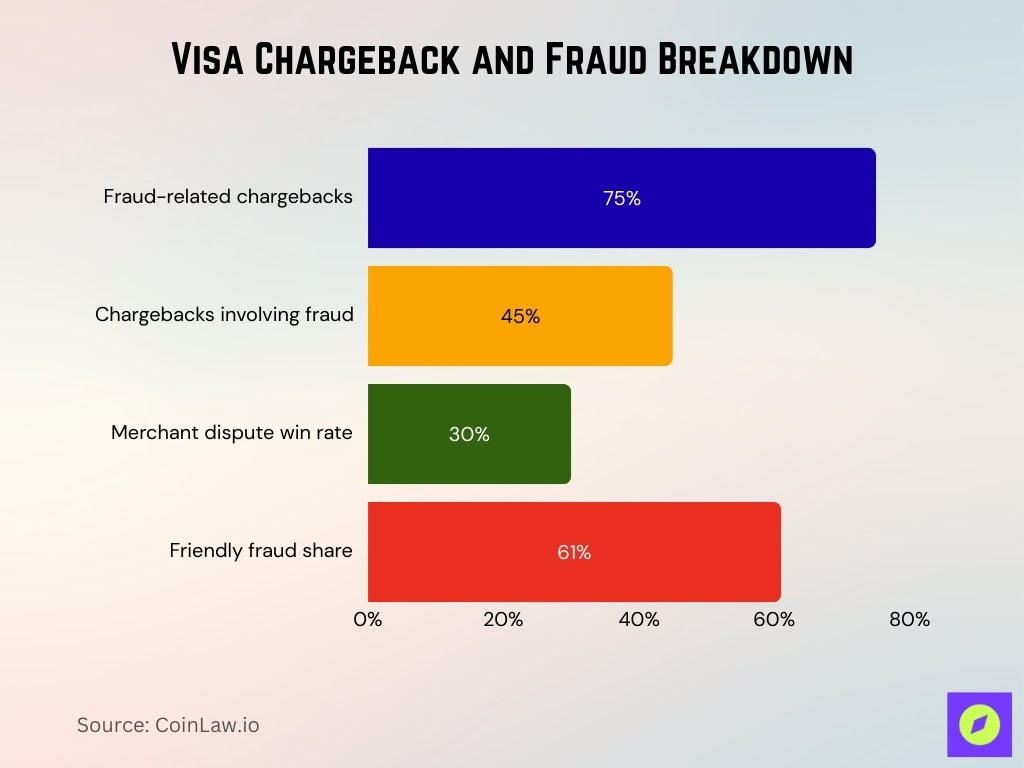

Chargeback, Fraud, and Security Statistics for Visa Cards

- Chargeback fraud accounts for 75% of all Visa chargebacks, costing merchants over $170 billion annually in the US.

- 45% of merchant chargebacks involve fraudulent disputes (first and third-party fraud).

- Merchants win 30% of Visa chargeback disputes with proper documentation.

- Friendly fraud drives 61% of all Visa card chargebacks from legitimate purchases.

- Global chargeback volume expected to reach 324 million transactions by 2028, up 24% from 2025.

- Average chargeback value for Visa transactions reaches $110 in the US, the highest globally.

- Visa’s global fraud rate remained below 0.1% for card-present transactions.

- Travel/hospitality sector sees the highest Visa chargeback value at $120 per dispute.

- Visa’s VAMP monitoring flags merchants exceeding 0.9% chargeback-to-transaction ratio.

Cardholder and Usage

- 4.7 billion Visa cards are in circulation globally, accepted at 150 million merchant locations worldwide.

- Visa debit cards account for approximately 2.9 billion of the total, reflecting strong adoption.

- The average transaction value for a Visa card is $86, supporting everyday and larger purchases.

- Visa cardholders make an average of 257 transactions per year, indicating high engagement.

- Contactless transactions represent 76% of all Visa card payments globally.

- 500 million Visa cards are linked to mobile wallets worldwide.

- Visa’s prepaid cards saw a 13.8% year-over-year increase in usage.

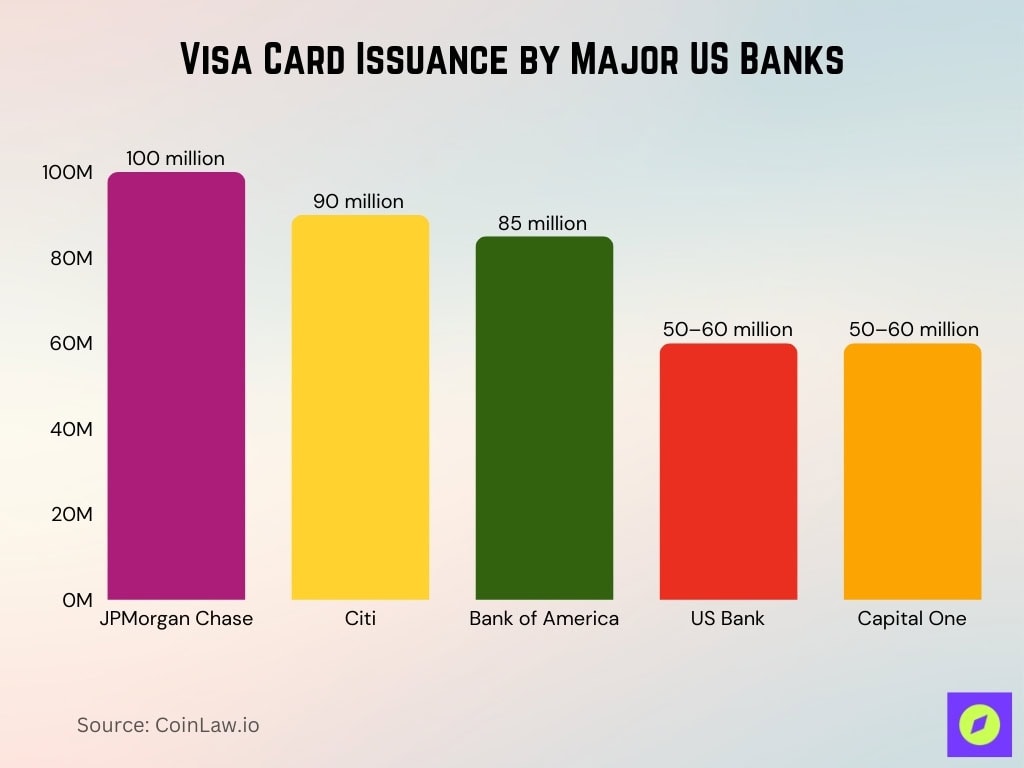

Issuing Banks and Merchant Acceptance Statistics

- JPMorgan Chase issued over 100 million Visa credit cards in the US, holding 17% market share.

- Citi ranks second with 90 million Visa cards issued, focusing on premium rewards segments.

- Bank of America issues 85 million Visa cards, strong in debit portfolio.

- Visa is accepted at 150 million merchant locations worldwide.

- 52.2% global credit card market share by purchase volume for Visa.

- US Bank and Capital One issue 50-60 million Visa cards each.

- Visa debit cards number 2.9 billion globally, dominant in 76% US debit market.

Technological Developments and Innovations

- Visa invested $5 billion over the past decade in AI and data infrastructure for fraud prevention.

- Visa Tokenization Service covers 50% of global eCommerce transactions, reducing fraud rates.

- Visa partnered with Bridge to launch stablecoin-linked cards in 6 Latin American countries.

- VisaNet handles up to 83,000 transaction messages per second worldwide.

- Fintech Fast Track program supports over 2,000 fintechs globally.

- Visa Tap to Phone technology grew 200% year-over-year, active in 118 markets.

- Visa integrates biometric authentication via Payment Passkey for enhanced security.

Security and Fraud Prevention

- Advanced AI systems prevented over $40 billion in fraud attempts on the payment network.

- Scam Disruption Practice thwarted more than $1 billion in attempted fraud globally.

- Visa Advanced Authorization analyzes over 400 risk attributes to prevent $25 billion in annual fraud.

- Global fraud rate for Visa transactions remains below 0.1%.

- Adoption of biometric payment cards reached 20.6 million units.

- Zero liability policy protects 4.7 billion cardholders from unauthorized transactions.

- CyberSource Risk Manager assists over 450,000 merchants in real-time fraud detection.

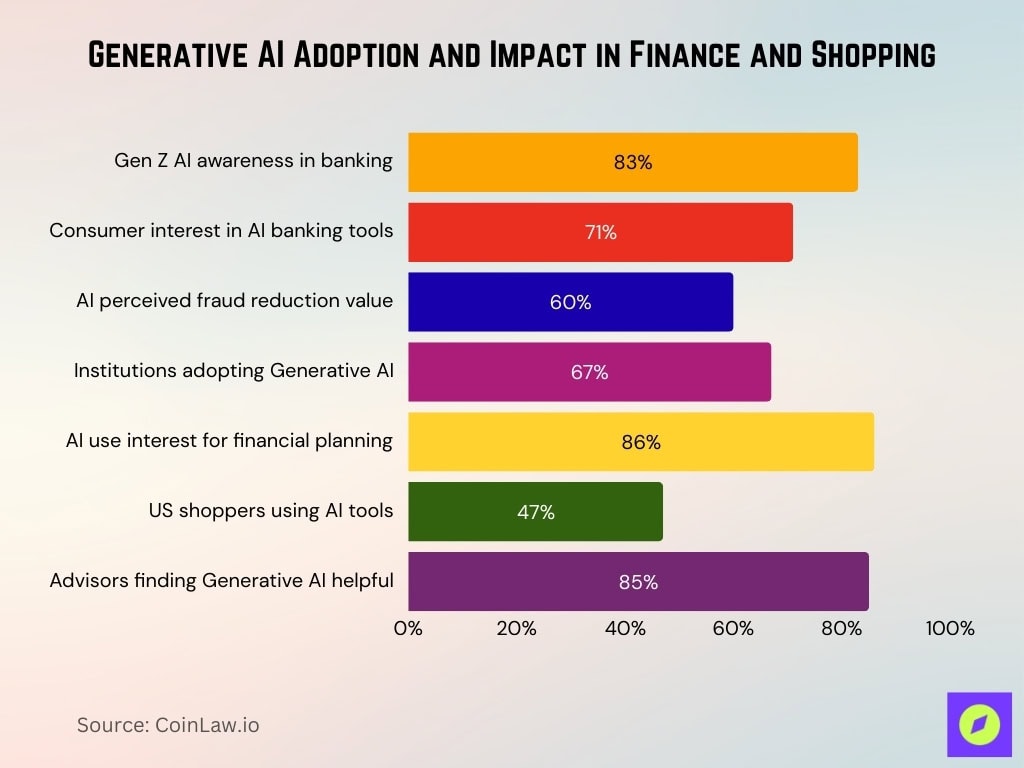

How Generative AI Is Transforming Spending, Shopping, and Banking

- 83% of Gen Z consumers are aware of Generative AI’s potential in banking.

- 71% of consumers show interest in trying Generative AI tools for banking services.

- 60% of consumers recognize Generative AI’s value in reducing fraud risk.

- 67% of financial institutions will implement Generative AI strategies by the end of the year.

- 86% of consumers are interested in using Generative AI for financial planning.

- 47% of US shoppers use AI tools for shopping journey tasks.

- 85% of financial advisors report Generative AI as helpful to their practice.

Recent Developments

- Visa completed the acquisition of the Pismo banking platform for $1 billion, expanding core banking services.

- Cross-border payment volumes surged 16% year-over-year in Q1 FY26.

- Visa Direct enables funds availability in U.S. bank accounts within 1 minute.

- Visa partnered with Bridge to launch stablecoin-linked cards in 6 Latin American countries.

- Visa achieved carbon neutrality across operations since 2020, targeting net-zero by 2040.

- Visa is preparing a post-quantum cryptography rollout, including AES-256 standards.

Frequently Asked Questions (FAQs)

Visa holds a 52.2% share of the global credit card market.

Visa Tokenization Service covers 50% of global eCommerce transactions.

4.7 billion Visa cards are in circulation globally.

Visa is accepted at 150 million merchant locations worldwide.

Conclusion

Visa’s commitment to innovation, security, and growth positions it as a global leader in the evolving financial ecosystem. From expanding its reach in emerging markets to investing heavily in technology, Visa continues to shape the future of payments. With a vast cardholder base, cutting-edge technologies, and a dedication to secure transactions, Visa is set to remain at the forefront of the payment industry for years to come.