In recent years, virtual banking has redefined the financial landscape. Picture a world where banking happens without brick-and-mortar buildings, where transactions are instant, and customers manage their entire financial lives from a smartphone.

Virtual banking is rapidly changing the traditional concept of finance, making it more accessible, user-friendly, and tech-driven. This article will explore the key statistics shaping the virtual banking sector, with insights into its impact, growth, and future direction.

Editor’s Choice: Key Virtual Banking Milestones

- As of early 2025, over 2.5 billion people globally are estimated to use online or mobile banking services, with significant growth concentrated in Asia and Europe.

- Digital banking transactions reached an estimated $1.52 trillion in mobile payments in 2025, showing strong growth in digital activity.

- In the United States, 77% of consumers prefer managing bank accounts via mobile or online platforms in 2025.

- The global neobanking market is forecasted to reach between $180–220 billion in 2025, with rapid expansion across Europe, Asia-Pacific, and North America.

- Cybersecurity spending by global banks is expected to reach $32 billion in 2025 as institutions strengthen defenses against threats.

- Digital-first interactions accounted for over 70% of consumer banking engagements in 2025, according to industry estimates.

Digital Banking Trends

- 66% of the global population accessed mobile banking in 2025 as adoption continues to accelerate.

- The embedded finance market reached $125.95 billion in 2025, reflecting strong growth from integrated financial services.

- In 2025, AI-powered chatbots will resolve approximately 65–70% of routine banking inquiries, significantly reducing the need for human customer service agents.

- 85% of virtual banks offered 24/7 digital access in 2025 compared to 55% of traditional banks.

- 70% of customers value AI-driven personalized financial advice in digital banking apps.

- Biometric logins like face or fingerprint recognition became mainstream in 2025 among virtual banking customers.

- Cryptocurrency payment usage grew by 43% in 2025, showing rising demand within digital banking apps.

Global Adoption Rates and User Demographics

- Asia-Pacific leads virtual banking adoption with over 1.4 billion users, capturing around 65% of global digital banking users in 2025.

- In Europe, around 78% of adults used digital banking in 2025 as neobanks and virtual services continued to grow.

- The MENA region saw 45% adult adoption of digital banking in 2025.

- In the United States, 82% of adults were using digital banking in 2025.

- Millennials and Gen Z lead digital banking usage, with 90% of Millennials and 85% of Gen Z using online or mobile banking in 2025.

- Among the 65+ age group in the U.S., 25% now engage in digital banking.

- In Latin America, 109 million users are active in digital banking as of 2025, reflecting around 60% of the population.

Market Share and Competitive Landscape

- Five of the top 10 banks globally now offer fully digital services, capturing 25% of the virtual banking market in 2025.

- PayPal leads digital wallets with 28% U.S. market share in 2025 and 45% of the global payments market.

- Revolut reached 60 million global users by mid-2025.

- The global digital banking sector will generate $1.61 trillion in net interest income in 2025.

- The global digital wallet market is projected to surpass $50 billion in 2025, driven by increased mobile payments, contactless transactions, and embedded finance.

Revenue and Profitability Metrics

- Global digital banking revenue reached $1.61 trillion in 2025.

- Digital wallets will generate $56.77 billion in revenue in 2025.

- Online lending platforms boosted revenue by 35% year-over-year, driven by fast processing and reduced paperwork.

- Traditional banks with digital strategies report 20% higher profits than those without.

- In the U.S., digital payments revenue will climb to $540 billion in 2025, up from $470 billion in 2023.

- Virtual credit cards will generate $350 billion globally by 2026.

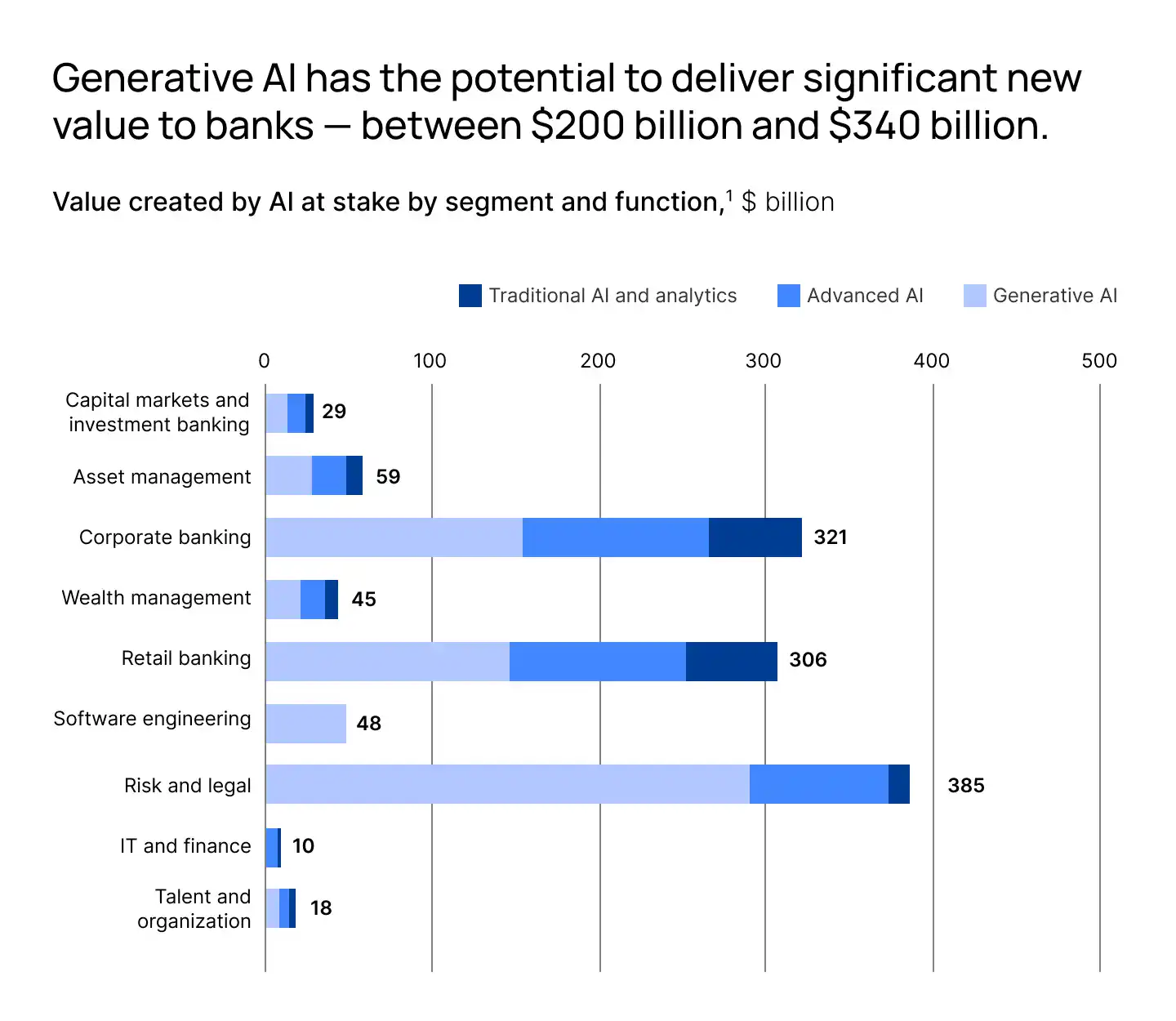

Value Created by AI in Banking

- Capital markets and investment banking could generate $29 billion in value from AI.

- Asset management may unlock $59 billion through AI adoption.

- Corporate banking shows the potential for $321 billion, one of the largest opportunities.

- Wealth management can benefit by about $45 billion from AI solutions.

- Retail banking could capture $306 billion, making it a core driver of AI value.

- Software engineering has an AI-driven value of around $48 billion.

- Risk and legal functions present the highest potential at $385 billion in AI impact.

- IT and finance roles could see $10 billion in AI value creation.

- Talent and organization management may contribute $18 billion in AI-driven efficiency.

Transaction Volumes and Growth Trends

- Global digital payment transaction value will reach $20 trillion in 2025.

- Mobile payment transaction volume will surpass $13 trillion globally in 2025.

- Peer-to-peer payments and mobile wallets drive growth, while biometric payments will exceed $3.1 trillion in 2025.

- In August 2025, India’s Unified Payments Interface (UPI) processed around 12.1 billion transactions, totaling approximately $180 billion in value.

Technological Innovations and Digital Services

- Over 75% of large banks will integrate AI into operations in 2025 to enhance customer service and reduce costs.

- Blockchain adoption in banking rose to 30%, with most major banks running blockchain projects by 2025.

- As of 2025, approximately 70–75% of digital banks have adopted biometric authentication methods such as fingerprint or facial recognition, particularly for mobile apps.

- Voice banking reached a value of $1.88 billion in 2025, delivering hands-free experiences for mobile users.

- Robo-advisors manage over $1 trillion in global assets in 2025, providing automated financial advice.

- Smart contracts were adopted by 85% of institutions in 2025 to streamline operations.

- 5G connectivity boosted mobile banking speed and user experience by 46% in 2025.

Digital-Only Bank Accounts in the UK

- 40% of Brits have already opened an account with a digital-only bank.

- 26% say they will not consider opening a digital-only bank account.

- 17% remain unsure about opening a digital-only account.

- 10% plan to open a digital-only bank account in the future (more than a year).

- 7% intend to open a digital-only bank account within the next year.

Regulatory Developments and Compliance

- Global regulatory fines for financial institutions, especially digital asset firms, have quadrupled in the first half of 2025.

- Banks and fintechs worldwide collectively spend around $206 billion annually on financial crime compliance in 2025.

- The global RegTech market is projected to exceed $22 billion by mid-2025, driven by demand for advanced AML and KYC tools.

- Reserve Bank of India’s draft digital banking guidelines now mandate customer choice between view-only and full transaction modes and prohibit promoting third-party products without explicit approval.

- The UK’s regulators have expanded oversight to include tech firms critical to banking operations, such as cloud or AI providers.

- Implementation timelines for Basel III final reforms remain staggered globally through 2027–2028 as regulators work toward alignment.

- Financial institutions are doubling down on risk and compliance operations in response to evolving regulatory pressures in 2025.

Security Measures and Fraud Prevention

- Global cybersecurity spending in banking is projected to reach $212 billion in 2025, reflecting escalating investment in fraud defenses.

- Multi-factor authentication is now implemented by 93% of digital banks in 2025 as a standard security measure.

- AI-driven fraud detection systems have contributed to a 30–35% reduction in transactional fraud rates across leading digital banks in 2025.

- Biometric authentication is used by 85% of virtual banks in 2025 to protect user accounts.

- End-to-end encryption is now employed by 85% of digital banks to effectively secure customer data.

- Phishing attack attempts remain elevated, but sophisticated AI-based detection systems have greatly mitigated successful breaches.

- Insider threats remain a concern, accounting for around 10% of data breaches in digital banking, prompting stronger internal monitoring.

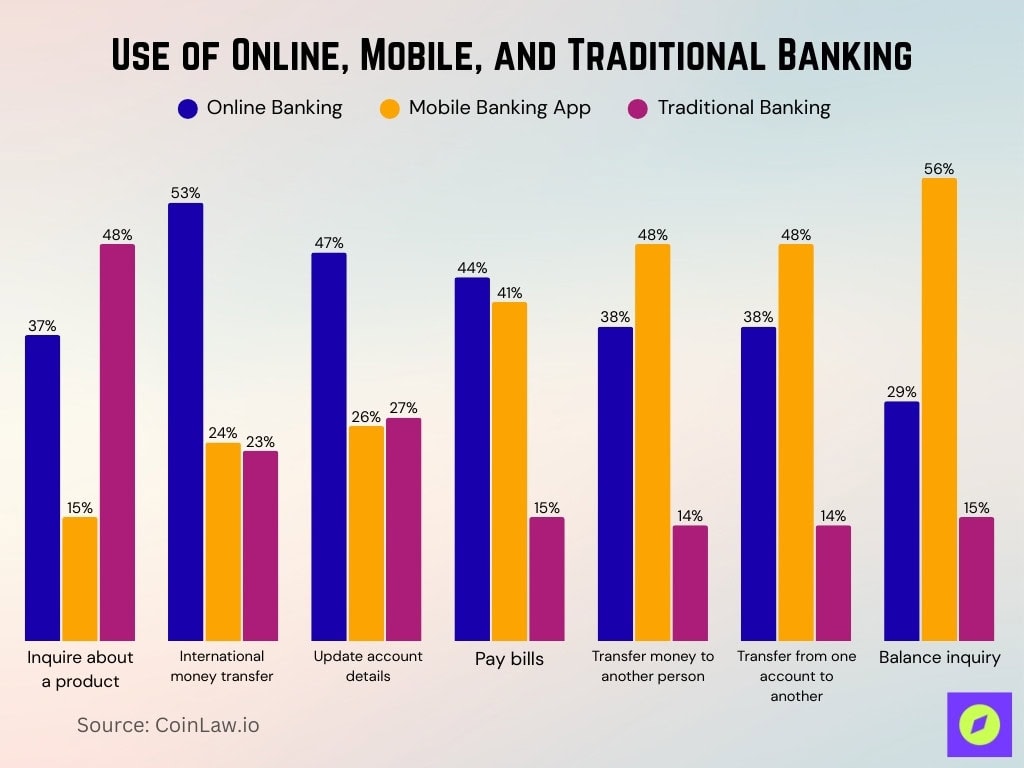

Use of Online, Mobile, and Traditional Banking

- 37% inquire about a product through online banking, while 48% still rely on traditional banking.

- 53% use online banking for international money transfers, compared to 23% with traditional channels.

- 47% update their account details online, while 26% prefer mobile apps and 27% use traditional methods.

- 44% pay bills online, closely matched by 41% via mobile apps, with just 15% through traditional banking.

- 38% transfer money to another person online, while 48% rely on mobile apps, and 14% use traditional banking.

- 38% transfer money between their own accounts online, but again, 48% prefer mobile apps.

- 29% check their balance online, while 56% do so with mobile apps, and only 15% stick to traditional methods.

Customer Satisfaction and User Experience

- 96% of consumers rate their mobile and online banking experience as excellent, very good, or good in 2025.

- 93% of customers say ease of navigation in digital platforms greatly impacts their satisfaction.

- 85% of users cite speed and reliability as the most critical features for mobile banking satisfaction.

- Personalized insights in apps boosted engagement by 25% in 2025.

- Nearly 90% of Gen Z and Millennials prefer apps with biometric login features.

- 73% of customers believe the quality of customer service heavily impacts overall satisfaction.

- Banks offering 24/7 live chat support achieved 88% satisfaction compared to 76% without.

- In the U.S., overall customer satisfaction with primary retail banking partners reached 655 on a 1,000-point scale in 2025.

- Net Promoter Scores in U.S. retail banking rose by 3 points in 2025.

Recent Developments

- Apple Pay offers 3.65% APY on its high-yield savings account in 2025.

- In 2025, Apple Pay is estimated to have over 550 million global users and process around $3.2 trillion in total transaction volume.

- Google Pay reached approximately 520 million users worldwide in 2025.

- Chime went public in June 2025 with a valuation of up to $9.47 billion and raised about $832 million.

- Chime’s shares surged 37% above their IPO price during debut trading.

- PayPal introduced its PYUSD stablecoin and expanded its use to the Stellar network in 2025.

- Revolut serves over 60 million users globally as of 2025.

- Revolut processes over $210 billion in transactions and generates more than $2.1 billion in revenue in 2025.

- In 2025, Zelle is expected to process over $1.6 trillion in U.S. peer-to-peer (P2P) payments, maintaining its dominance among real-time payment apps.

- Visa and Mastercard expanded cross-border collaborations and stablecoin initiatives in 2025.

Conclusion

Virtual banking is no longer a distant future; it’s the present reality, transforming how people manage, save, and grow their finances. The sector’s explosive growth, coupled with advances in AI, blockchain, and 5G, has reshaped financial services, making them more accessible and user-centered. As virtual banks and traditional institutions continue to compete and collaborate, the impact on customers worldwide will be profound.

Moving forward, the banking industry must balance innovation and security to meet evolving regulatory demands and user expectations. The future of banking is digital, and as the data suggests, its trajectory points toward more inclusive, efficient, and globally connected financial ecosystems.