On a brisk Tuesday morning, a Venezuelan freelancer completed a job for a US client. Instead of waiting days for a traditional bank transfer, she received payment instantly, in USD Coin (USDC). It wasn’t just faster, it was also stable, transparent, and verifiable on the blockchain.

This real-world scenario is increasingly common as USDC becomes a cornerstone of the digital economy. The statistics tell a deeper story, one of rapid adoption, institutional trust, and evolving utility. Whether you’re a crypto investor, fintech executive, or just crypto-curious, this data-led dive into USD Coin will give you a clear pulse on where this stablecoin stands today.

Editor’s Choice

- As of Q1 2025, USD Coin (USDC) has a market cap of $32.4 billion.

- In early 2025, USDC captured 27% of all stablecoin trading volume.

- Roughly 98.9% of USDC reserves are held in short-dated U.S. Treasuries and cash equivalents.

- USDC is now accessible in 195+ countries, with new integrations expanding across global banking and payment networks.

- In 2025, Ethereum processed over 500 million USDC transactions.

- Circle, the issuer of USDC, plans a public listing in 2025.

- Around 80% of fintech apps supporting stablecoin payments in North America include USDC as a supported currency.

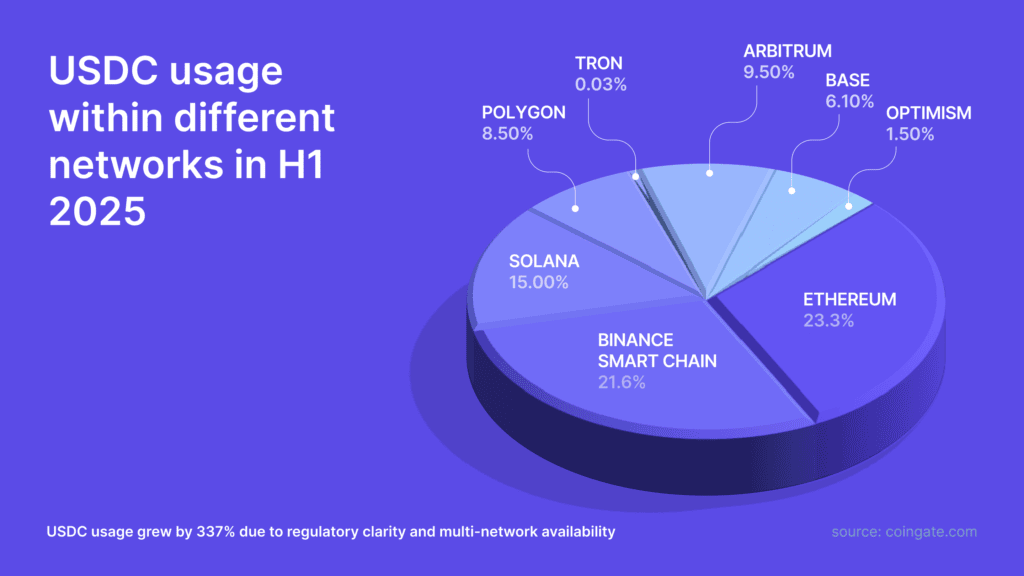

USDC Network Usage Highlights

- Ethereum leads all networks with 23.3% of total USDC usage.

- Binance Smart Chain closely follows, accounting for 21.6% of USDC activity.

- Solana ranks third, capturing 15.0% of usage share.

- Arbitrum, a major Layer 2, hosts 9.5% of USDC transactions.

- Polygon contributes 8.5%, supporting USDC across DeFi and gaming apps.

- Base, Coinbase’s L2, has grown to 6.1% USDC usage share.

- Optimism supports 1.5% of overall USDC network activity.

- Tron shows minimal adoption for USDC at just 0.03%.

Market Capitalization of USD Coin

- In March 2025, USD Coin (USDC) reached a market cap of $32.4 billion, up from $24.6 billion in October 2024.

- USDC’s all-time high market cap stands at $55.9 billion from mid-2022 before regulatory and macroeconomic shifts cooled demand.

- USDC consistently ranks #2 among stablecoins by market cap, trailing only Tether (USDT).

- In January 2025, USDC’s stablecoin market dominance was 24.3%, reflecting a 3 percentage point increase year-over-year.

- Since November 2024, USDC’s average monthly market cap growth has been 7.8%, signalling accelerating capital inflows.

- February 2025 marked USDC’s largest monthly surge, adding $5.2 billion in new issuance after a major crypto ETF approval.

- Circle’s reserve reports show 100% USDC backing with cash and U.S. Treasuries, supported by independent attestation audits.

- In early 2025, the USDC-to-total-crypto market cap ratio reached 2.1%, its strongest level since 2023.

- During a brief arbitrage window in March 2025, over $1.8 billion in USDC was minted within a single week.

- Circle has issued 41 consecutive monthly attestation reports on USDC reserves, reinforcing confidence in its capitalization.

Circulating Supply Trends

- As of March 2025, the total circulating supply of USD Coin (USDC) stands at 31.7 billion tokens, up from 26.2 billion a year earlier.

- This shift from 26.2 billion in March 2024 to 31.7 billion in March 2025 reflects a 21% year-over-year increase in USDC supply.

- In 2025, an average of 12 million USDC were minted per day, with nearly equivalent amounts burned to keep net supply growth controlled.

- Peak circulating supply in 2025 was logged on March 18, when outstanding USDC briefly reached 32.1 billion.

- After dipping to 22 billion in mid-2023 following a banking partner collapse, USDC’s circulating supply fully recovered by late 2024 and continued rising into 2025.

- Since launch, more than $39 billion in USDC has been burned through redemptions, helping maintain peg integrity and long‑term supply balance.

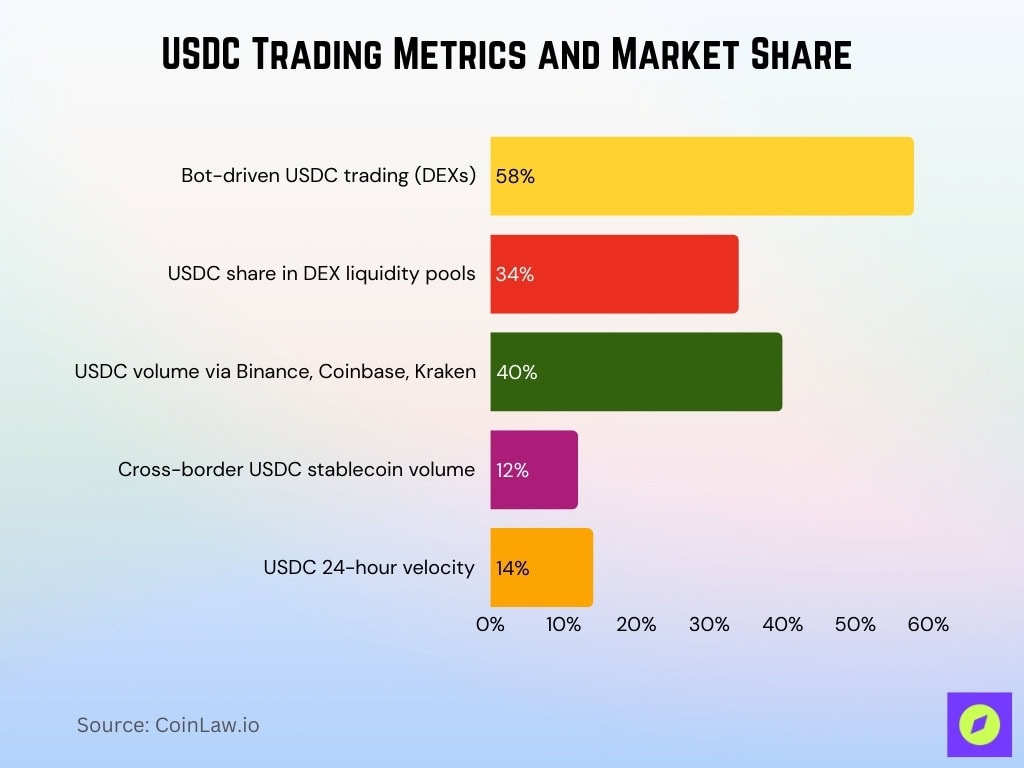

USD Coin Trading Volume Statistics

- Over 58% of USDC trading is now algorithmic or bot-driven, particularly on DEXs such as Uniswap and Curve, which dominate on-chain order flow.

- USDC is the leading stablecoin pair on decentralized exchanges, appearing in more than 34% of DEX liquidity pools across major networks.

- Binance, Coinbase, and Kraken together handle over 40% of centralized USDC trading volume in 2025.

- In 2025, cross-border USDC swaps represent about 12% of all stablecoin volume, reflecting its growing role in international payments.

- USDC’s 24-hour velocity has climbed to 14.1%, indicating a larger share of the circulating supply turns over each day.

- In Q1 2025, USD Coin (USDC) recorded an average daily trading volume of $4.9 billion, up from $3.6 billion in Q1 2024.

- In 2024, more than $1.1 trillion worth of USDC changed hands globally, cementing its position as the second-most traded stablecoin.

- On March 15, 2025, USDC’s trading volume surged to $11.3 billion in 24 hours amid heightened crypto market volatility.

- During 2024, USDC was used to settle approximately $312 billion in NFT and gaming-related transactions across major ecosystems.

- Flash loans involving USDC rose 33% year-over-year, with around $97 million executed in January 2025 alone.

Geographic Distribution of USD Coin Usage

- The United States accounts for 38% of all USDC transactions, making it the largest single market for the stablecoin.

- Latin America recorded a 31% increase in USDC adoption for cross-border payments between Q1 2024 and Q1 2025.

- Nigeria, Kenya, and South Africa together represent 12% of global USDC peer-to-peer usage, reflecting strong African demand for dollar stablecoins.

- Europe contributes 18% of global USDC on-chain activity, with the UK and Germany acting as primary regional hubs.

- In India, around 5.7 million wallet addresses interacted with USDC in 2024, driven largely by freelance and gig-economy payouts.

- As of March 2025, Latin America added over 2.3 million new USDC‑holding wallets, underscoring rapid regional expansion.

- Cross-border aid organizations operating in Ukraine and Gaza distributed over $140 million in USDC between 2023 and 2024.

- In Canada and Australia, the USDC user base expanded by 28%, helped by integrations with local banking and payment apps.

Institutional Adoption and Partnerships

- In 2025, Circle and BlackRock expanded their partnership so tokenized portfolios and private funds can be settled in USDC, with BlackRock now managing a multi‑billion‑dollar USDC reserve fund.

- Major banks, including Goldman Sachs and JPMorgan Chase, joined Q1 2025 pilots that used USDC to settle repo and tokenized collateral trades.

- Visa now supports USDC settlement flows in 30+ countries, processing over $225 million in stablecoin settlement volume by mid‑2025.

- Coinbase Commerce reports that 65% of crypto B2B settlements on its platform are denominated in USDC, reflecting strong business demand for dollar‑pegged rails.

- Shopify merchants processed more than $800 million in USDC‑denominated orders during the 2024 holiday season, highlighting growing e-commerce usage.

- A coalition of universities, including MIT, Stanford, and Oxford, is piloting USDC smart contracts for tuition, with pilot volumes already in the tens of millions of dollars in 2024–2025.

- USDC is used as collateral in institutional DeFi lending on Aave Arc, with about $2.6 billion in USDC‑backed value locked as of March 2025.

- Circle Yield, Circle’s crypto‑based treasury product, reached $1.1 billion in assets under management, with 87% of AUM held in USDC.

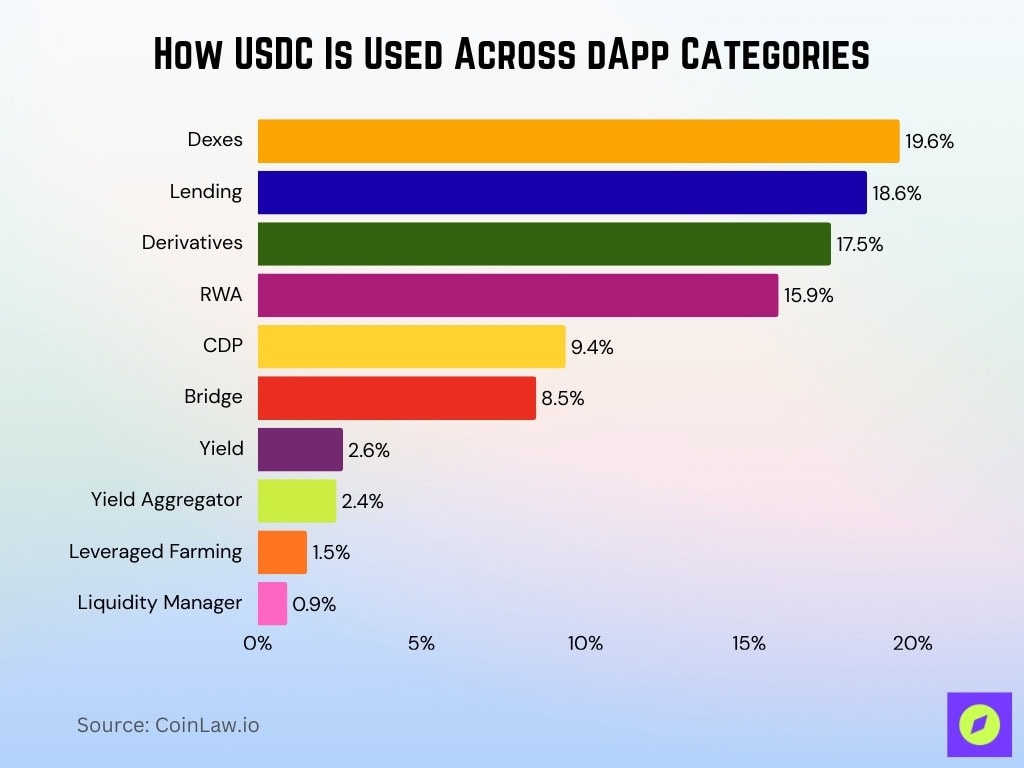

How USDC Is Used Across dApp Categories

- Decentralized exchanges (Dexes) account for 19.6% of total USDC usage.

- Lending platforms closely follow with 18.6% of usage.

- Derivatives protocols represent 17.5% of USDC activity.

- Real-world asset (RWA) applications use 15.9% of circulating USDC.

- Collateralized debt positions (CDPs) account for 9.4%.

- Bridges consume 8.5%, enabling cross-chain USDC transfers.

- Yield protocols hold a share of 2.6%.

- Yield aggregators contribute 2.4% to overall USDC deployment.

- Leveraged farming apps use 1.5% of USDC.

- Liquidity managers make up the smallest segment at just 0.9%.

Wallets and Exchanges Supporting the USD Coin

- Over 280 crypto exchanges support USDC as of March 2025, including both centralized and decentralized platforms.

- MetaMask and Phantom lead non-custodial wallets with a combined 19 million active monthly users.

- Over 450 DeFi protocols accept USDC for staking, lending, borrowing, or liquidity provision.

- Visa-enabled crypto debit cards enable direct USDC spending at over 70 million merchants globally.

- 2.1 million new USDC wallets created in February 2025 across Ethereum, Solana, and Avalanche.

- USDC is natively supported on 28 blockchain networks as of September 2025.

- 87 million unique wallet addresses hold USDC globally as of Q1 2025.

- 3.9 million wallets held at least 10 USDC by the end of 2024, up 86% in 24 months.

USDC Burn and Mint Trends

- Over $39 billion in USDC has been burned since inception to maintain peg integrity.

- In Q1 2025, $6.7 billion USDC was minted while $5.2 billion was burned, showing net growth.

- Largest single-day burn on March 6, 2025, removed $1.03 billion from circulation.

- Weekly burn rates increased 17% year-over-year in 2025.

- 90% of the 2025 burned USDC originated from Ethereum and Solana smart contracts.

- $450 million record mint in February 2025 after BlackRock-backed fund launch.

- Average USDC token lifespan before burn stands at 31.6 days.

- $9 billion net USDC burns in a single week during September 2025.

- $1.8 billion USDC was minted in one week in March 2025 during the arbitrage window.

User Demographics and Growth Metrics

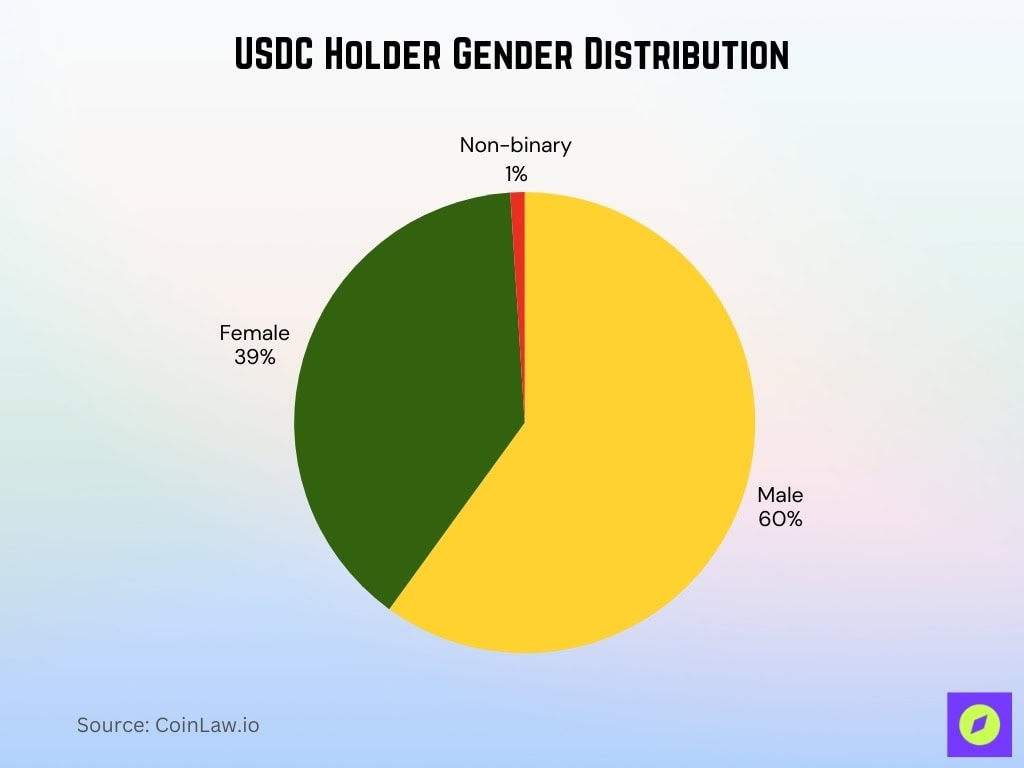

- Gender distribution among holders is 60% male, 39% female, and 1% non-binary.

- 87 million unique USDC wallet addresses globally as of Q1 2025.

- USDC active addresses grew by 38% year-over-year in 2024.

- The average USDC wallet balance is $1,920, higher in B2B and institutional accounts.

- 48% of USDC holders are aged between 25 and 39 years.

- 72% of retail USDC users use it weekly or more frequently.

- USDC adoption in the freelancer and gig economy increased by 43% in 2024.

- In the US, 36% of crypto-active users hold USDC, the highest in California, Texas, and Florida.

- Nearly 45% of new USDC users in 2025 were onboarded via mobile platforms like Coinbase Wallet and Trust Wallet.

Recent Developments

- Circle launched Programmable Wallets SDK in February 2025 for rapid USDC app integration.

- Circle filed for an IPO on the NYSE under ticker CRCL, pricing shares at $31 and implying a valuation of about $6.8–6.9 billion at its June 2025 debut.

- Circle Merchant Gateway debuted in January 2025, enabling QR code USDC payments for small businesses.

- Circle introduced Circle Gateway in July 2025 for instant cross-chain USDC liquidity under 500ms.

- Circle Payments Network (CPN) launched in May 2025 with 4 active corridors and a 100+ institutions pipeline.

- BlackRock tokenized fund BUIDL enables USDC redemptions via Circle smart contracts.

- Circle reported Q3 2025 profit beat with USDC circulation at $73.7 billion, up 108% YoY.

Frequently Asked Questions (FAQs)

98.9%.

$1,920.

78%.

87 million.

Conclusion

USD Coin isn’t just another digital dollar; it’s becoming a financial backbone for Web3, cross-border commerce, and programmable money. Today, the numbers show sustained growth, deepening institutional confidence, and expanding use cases around the world. While competitors exist, USDC’s stability, transparency, and regulatory alignment make it a standout in a crowded stablecoin landscape.

As digital finance continues to evolve, USDC is positioning itself not merely as a utility token but as infrastructure for the future of money.