Imagine a bustling online marketplace where businesses of all sizes, from indie coffee shops to global brands, rely on a seamless payment system to keep the wheels turning. At the heart of this revolution is Stripe, a fintech powerhouse enabling smooth, secure, and scalable transactions. Founded in 2010 by the Collison brothers, Stripe has transformed digital payments, becoming a key player in the global e-commerce ecosystem. Stripe continues to push boundaries with robust growth, innovative solutions, and record-breaking milestones. This article delves into the numbers behind Stripe’s success to paint a comprehensive picture of its current standing and future trajectory.

Editor’s Choice

- Stripe’s valuation hit $91.5 billion in 2025, backed by rising private market demand and robust growth.

- Stripe now powers 1.35 million live websites in 2025, with over 4.9 million domains having used it historically.

- Stripe’s full local account support extends to 46 countries in 2025, enabling payments in 195+ buyer markets and 135+ currencies.

- Stripe is onboarding approximately 22,000 new users daily as of 2025, driven by platform expansion and partner integrations.

- Stripe Climate contributions exceeded $11.2 million for carbon removal projects in 2025.

- More than 50% of Fortune 100 companies now depend on Stripe to power scalable payment infrastructure.

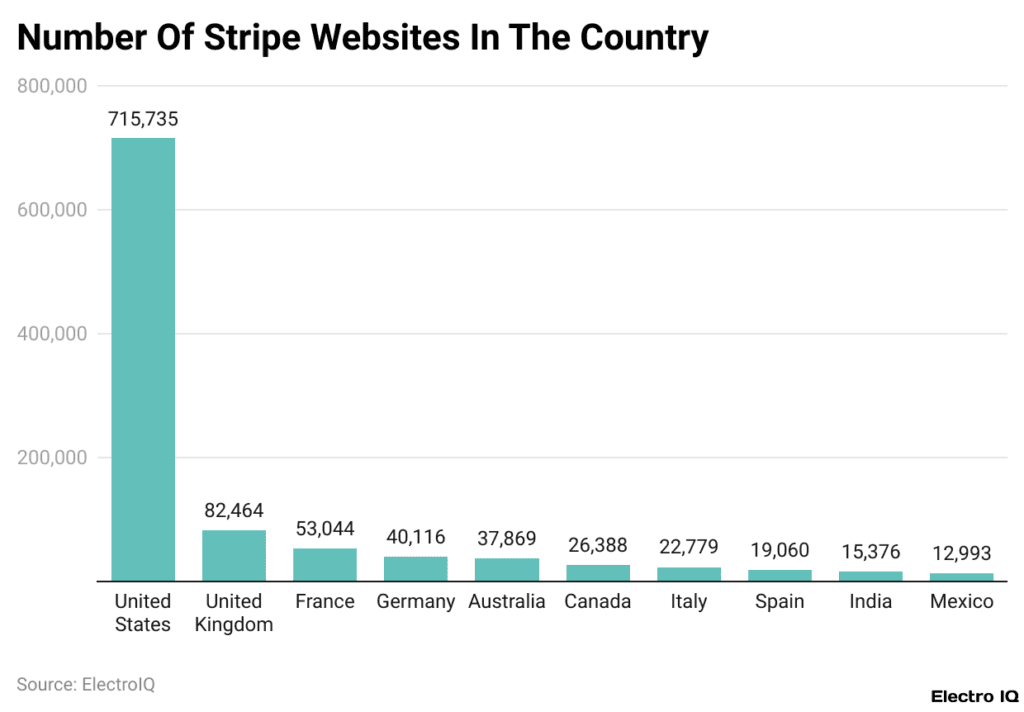

Number of Stripe Websites by Country

- United States leads globally with 715,735 websites using Stripe, showing its dominant market presence.

- United Kingdom ranks second with 82,464 websites, representing strong adoption in Europe.

- France follows with 53,044 Stripe-powered websites, highlighting steady growth among EU merchants.

- Germany records 40,116 websites, reflecting solid fintech integration.

- Australia has 37,869 Stripe-enabled websites, showcasing widespread adoption among SMBs.

- Canada stands at 26,388, supported by expanding cross-border e-commerce.

- Italy has 22,779 websites, indicating growing digital payment acceptance.

- Spain reaches 19,060, marking consistent uptake across Southern Europe.

- India has 15,376 Stripe users, driven by the rapid rise of online retail and startups.

- Mexico rounds out the list with 12,993 Stripe-integrated websites, showing emerging market momentum.

Growth and Usage Statistics

- The company reported a 30% increase in the volume of transactions from SMBs in 2025, highlighting accessibility.

- Over 45% of e-commerce businesses in the US use Stripe as their primary payment processor in 2025.

- The platform saw 22% growth in subscription-based payments in 2025, accelerated by SaaS adoption.

- The Asia-Pacific region recorded a 25% increase in Stripe adoption in 2025 compared to 2022, led by new market launches.

- Mobile payments made up 62% of transactions processed on Stripe in 2025, confirming a mobile-first shift.

Revenue and Financial Performance

- Stripe generated $19.4 billion in revenue in 2025, indicating 17% year-over-year growth from 2024.

- Subscription tools contributed $3.4 billion in revenue, solidifying their importance as a core business driver in 2025.

- The company posted a 10.6% net profit margin in 2025, maintaining profitability amid fintech competition.

- Annual recurring revenue (ARR) exceeded $6.1 billion in 2025, fueled by enterprise-scale adoption.

- Operating expenses rose by 7.5% in 2025, with continued investment in R&D and AI-powered customer experience tools.

- Stripe Capital disbursed $3.8 billion in loans to SMBs in 2025, generating $420 million in interest income.

Funding and Valuation

- Funding allocation in 2025 includes 38% for R&D, 28% for infrastructure, and 22% for acquisitions.

- Stripe raised $7.8 billion in its 2025 funding round, pushing its valuation to $91.5 billion.

- The company has now raised a total of $16.2 billion as of 2025, ranking among the world’s top-funded fintech firms.

- Venture capital firms Sequoia Capital and Andreessen Horowitz remain Stripe’s largest investors, contributing $3.2 billion collectively.

- Stripe remains the world’s second most valuable private fintech in 2025, still trailing Ant Group but closing the gap.

- Its global expansion fund reached $1.3 billion in 2025, targeting new growth markets.

- Analysts now project Stripe’s valuation could reach $75–$95 billion by late 2025, driven by enterprise adoption and AI-powered offerings.

Payment Volume and Processing

- In 2025, Stripe processed $1.05 trillion in total payment volume, marking a 16% year-over-year increase.

- The platform handled $58 billion in cross-border payments, supported by smarter FX and localized payout tools in 2025.

- Apple Pay and Google Pay transactions grew 31%, now making up 38% of Stripe’s mobile payment volume in 2025.

- Stripe’s fraud system blocked $2.3 billion in fraudulent activity in 2025, showcasing AI-powered risk prevention.

- Crypto-based payments jumped 35% in 2025, driven by stablecoin support and blockchain wallet integration.

- The average transaction size rose to $92 in 2025, largely due to enterprise-scale invoicing and B2B deals.

- Black Friday 2025 hit a record $9.7 billion in processed volume, Stripe’s busiest single day ever.

Investments and Acquisitions

- In 2025, Stripe acquired three startups focused on AI, fraud prevention, and real-time analytics to bolster platform intelligence.

- The company invested $320 million in infrastructure, expanding cloud and data center capacity across Europe, India, and LATAM in 2025.

- Paystack now generates $1.3 billion in annual revenue, validating Stripe’s $200 million acquisition as a long-term success.

- Stripe has built over 180 strategic partnerships worldwide with banks, fintechs, and platform providers in 2025.

- $65 million was allocated to minority-led businesses through Stripe’s expanded equity and inclusion initiative in 2025.

- Stripe’s acquisition targets in 2025 include firms in embedded finance, blockchain APIs, and digital identity verification.

- Partnerships with Shopify, Salesforce, and Adobe helped drive $3.9 billion in annual payment volume in 2025.

Stripe Market Share by Region

- North America dominates Stripe’s market with a massive 70.2% share, highlighting its strong presence in the U.S. and Canada.

- Europe (EU) holds 15.8%, representing Stripe’s growing footprint across key economies like the U.K., France, and Germany.

- APAC (Asia-Pacific) accounts for 7.9%, driven by rising e-commerce activity in countries such as Singapore, Japan, and Australia.

- LATAM (Latin America) contributes 1.5%, showing emerging but limited regional penetration.

- Africa represents 0.8%, signaling early-stage adoption of Stripe’s financial technologies.

- Other regions collectively make up 3.8%, reflecting expanding global diversification beyond core markets.

Security and Trust

- Stripe maintained 99.999% uptime in 2025, delivering continuous payment reliability for millions of global businesses.

- Stripe Radar blocked $2.3 billion in fraudulent activity in 2025 using real-time AI threat detection.

- 97.5% of users rated Stripe’s security as “excellent,” confirming strong customer trust in 2025.

- Stripe has upheld PCI DSS Level 1 compliance for over 11 consecutive years, maintaining top-tier security standards.

- In 2025, Stripe’s ML system analyzed over 2 million transactions per second for real-time fraud prevention.

- Biometric authentication adoption grew by 34% in 2025, thanks to Stripe’s frictionless fingerprint and facial ID integration.

- The company’s 24/7 security response team resolved incidents in under 2.5 minutes, improving reaction time by 17% in 2025.

eCommerce Integration and Websites Using Stripe

- Stripe powers 1.35 million live websites globally in 2025, with over 4.9 million historically using the platform across e-commerce, SaaS, and fintech sectors.

- Integration with Shopify, WooCommerce, and Wix grew by 18% in 2025, fueling adoption among small businesses.

- Stripe now supports 54 programming languages and frameworks in 2025, offering broad compatibility for developers.

- 73% of US eCommerce startups in 2025 integrated Stripe as their default payment gateway at launch.

- Websites using Stripe recorded a 14% increase in checkout conversions in 2025, thanks to optimized user experience and faster flows.

- Stripe’s WooCommerce plugin processed $18 billion in transactions in 2025.

- 42% of global crowdfunding platforms, including Kickstarter and GoFundMe, rely on Stripe for secure global payments in 2025.

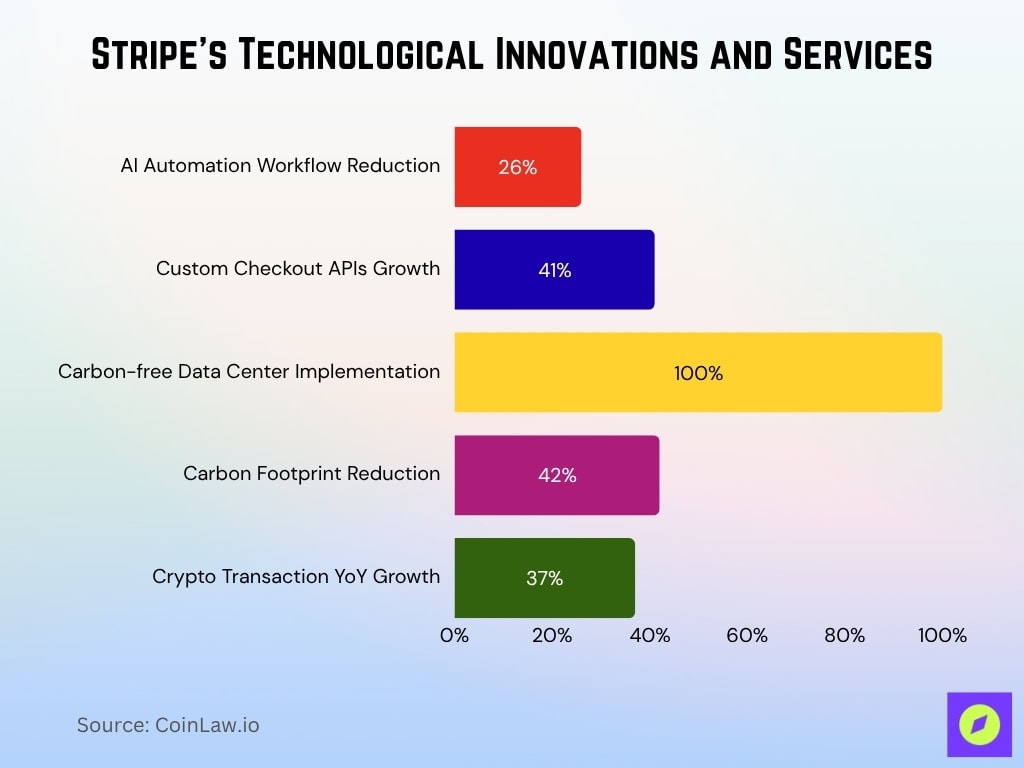

Technological Innovations and Services

- Stripe’s AI automation tools reduced manual workflows by 26% in 2025, boosting operational efficiency for businesses.

- The platform’s custom checkout APIs saw 41% growth in enterprise adoption, enabling highly personalized user experiences in 2025.

- Carbon-free computing reached 100% implementation across data centers, cutting Stripe’s carbon footprint by 42% in 2025.

- Crypto tools now support 150+ digital currencies, with cryptocurrency transactions growing 37% year-over-year in 2025.

- Stripe Issuing grew by 58%, processing over $13.4 billion in virtual and physical card transactions in 2025.

- Stripe Connect generated $340 million in new revenue streams in 2025, driven by platform economy expansion.

- Stripe’s ML fraud detection processed 1.4 billion new training data points per month in 2025, improving real-time accuracy.

Recent Developments

- Stripe expanded to 12 new countries in 2025, including Pakistan, Chile, and Serbia, boosting its global reach.

- Instant payouts adoption grew by 27% year-over-year, following launches in Southeast Asia, MENA, and Latin America.

- BNPL integrations with Klarna, Afterpay, and Affirm brought Stripe over $1.1 billion in new transaction volume in 2025.

- Stripe launched a RevOps Suite in 2025, upgrading its Revenue Recognition tool for multi-tier subscription models.

- Stripe Sessions 2025 welcomed 16,000+ global attendees, marking its largest developer event to date.

- Local currency support now includes 165+ currencies in 2025, enabling faster global onboarding for SMBs and platforms.

- Stripe is committed to 95% renewable energy use in 2025, moving closer to its 100% target by 2030.

Frequently Asked Questions (FAQs)

Stripe processed $1.05 trillion in total payment volume in 2025, reflecting a 16% year-over-year increase.

Stripe’s valuation reached $91.5 billion in early 2025, marking it as one of the world’s most valuable fintech companies.

1.35 million live websites were using Stripe for payment processing as of May 2025, with 4.9 million sites having used it historically.

Stripe generated $19.4 billion in revenue in 2025, reflecting a 17% year-over-year increase from 2024.

Conclusion

Stripe has cemented its position as a leader in the fintech space by consistently innovating and adapting to market demands. From securing billions in transactions to maintaining robust security and expanding global reach, the company has revolutionized digital payments. Stripe is poised to continue shaping the future of online commerce with cutting-edge technology, strategic partnerships, and an unwavering focus on user satisfaction. As businesses and consumers increasingly lean on digital solutions, Stripe’s blend of innovation and reliability ensures its place at the forefront of the fintech industry.