The regulatory landscape for stablecoins in the European Union (EU) is undergoing a monumental shift. For years, stablecoins, cryptocurrencies pegged to traditional assets like fiat currencies, have been operating in a largely unregulated environment, creating both opportunities and risks. Then came MiCA (Markets in Crypto-Assets Regulation), an ambitious framework designed to bring clarity, consumer protection, and financial stability to the crypto world.

Imagine a financial system where a digital euro-backed stablecoin is as safe as a euro in a bank. This is the future MiCA envisions. With implementation set to reshape the market, stablecoin issuers and investors alike are watching closely. How will MiCA affect existing stablecoins? What compliance hurdles must issuers overcome? And, perhaps most importantly, what do the numbers say? Let’s dive into the statistics behind MiCA and its impact on stablecoins.

Editor’s Choice

- MiCA became fully applicable in December 2024, establishing a regulated stablecoin framework across the EU in 2025.

- The EU stablecoin market is projected to grow by 37% in 2025, reaching a total value of €450 billion.

- Around 45% of stablecoin issuer applications have been rejected due to MiCA’s strict compliance standards in 2025.

- Over 1,200 crypto firms submitted MiCA license requests by mid-2025, with stablecoin issuers facing the toughest scrutiny.

- More than 3,000 CASPs are impacted, and up to 75% may lose registration status by mid-2025 under MiCA’s grandfathering rules.

- The top 3 stablecoins (USDT, USDC, and DAI) dominate over 90% of global stablecoin circulation in 2025, while euro-backed coins are rapidly expanding.

- Non-compliant issuers now face fines of up to €5 million or 5% of annual turnover, alongside possible license suspension.

Global Stablecoin Adoption and Usage Insights

- 71% of users in Latin America use stablecoins for cross-border payments, the highest global adoption rate.

- Europe follows at 58%, showing strong integration of stablecoins into payment systems.

- Asia records 53% usage, reflecting rapid regional fintech expansion and remittance reliance.

- North America lags at 39%, indicating slower regulatory and institutional uptake compared to other regions.

- 54% of businesses cite customer demand as the top driver for stablecoin adoption, versus 32% in North America.

- 50% of respondents expect lower transaction costs compared to traditional correspondent banking networks, emphasizing cost efficiency as a key adoption motivator.

Overview of MiCA and Its Impact on Stablecoins

- MiCA was enacted in June 2023, and its stablecoin rules became enforceable on June 30, 2024, with full supervision active through 2025.

- The regulation now covers crypto service providers (CSPs) and stablecoin issuers, placing them under direct supervisory authority across the EU in 2025.

- Any stablecoin transactions above €200 million per day invoke enhanced capital reserve rules under the 2025 regime.

- Non-EU issuers must meet MiCA standards to access the EU market, putting pressure on major players like Tether (USDT) and Circle (USDC) in 2025.

- The European Central Bank (ECB) holds veto rights in 2025 over large stablecoin issuers viewed as systemic risks.

- Up to 1,000 firms tied to stablecoin issuance and crypto services are projected to register under MiCA by 2025.

- MiCA bans algorithmic stablecoins in 2025, demanding all issuers maintain liquid reserves and transparent reporting systems.

MiCA’s Stablecoin Regime

- 78% of stablecoins in EU circulation will require reclassification under MiCA by 2025.

- Only 21% of existing stablecoin projects satisfy full MiCA compliance standards as of early 2025.

- Euro-backed stablecoins are projected to rise by 60% in 2025 under the ECB’s push for monetary sovereignty.

- 40% of EU stablecoin transactions involve USDT, which may need major restructuring to comply with MiCA in 2025.

- Issuers must hold at least 30% of reserves in highly liquid assets in 2025.

- Daily payment uses face caps, with regulators limiting stablecoin payment volume to €200 million per day per issuer in 2025.

- Issuer reserve holdings must be in EU financial institutions to keep stablecoin backing within Europe in 2025.

Regulation of Stablecoin Crypto Assets in MiCA

- Issuers must be authorized and licensed by EU regulators to issue stablecoins in 2025, with 100% of projects needing registration under MiCA.

- Issuers must hold liquid reserves equal to 100% of the circulating supply, backing each token in 2025.

- Issuers must publish quarterly audited reports, with at least 95% audit coverage in 2025.

- MiCA mandates full redemption at face value on demand, protecting consumers and limiting insolvency risk in 2025.

- Stablecoin issuers are banned from paying interest, distinguishing them from bank deposits under the 2025 rules.

- Non-EU issuers must set up an EU legal entity, with passporting rights across 27 states in 2025.

- Large non-euro stablecoins face transaction caps and limits, with MiCA favoring euro-based tokens in 2025.

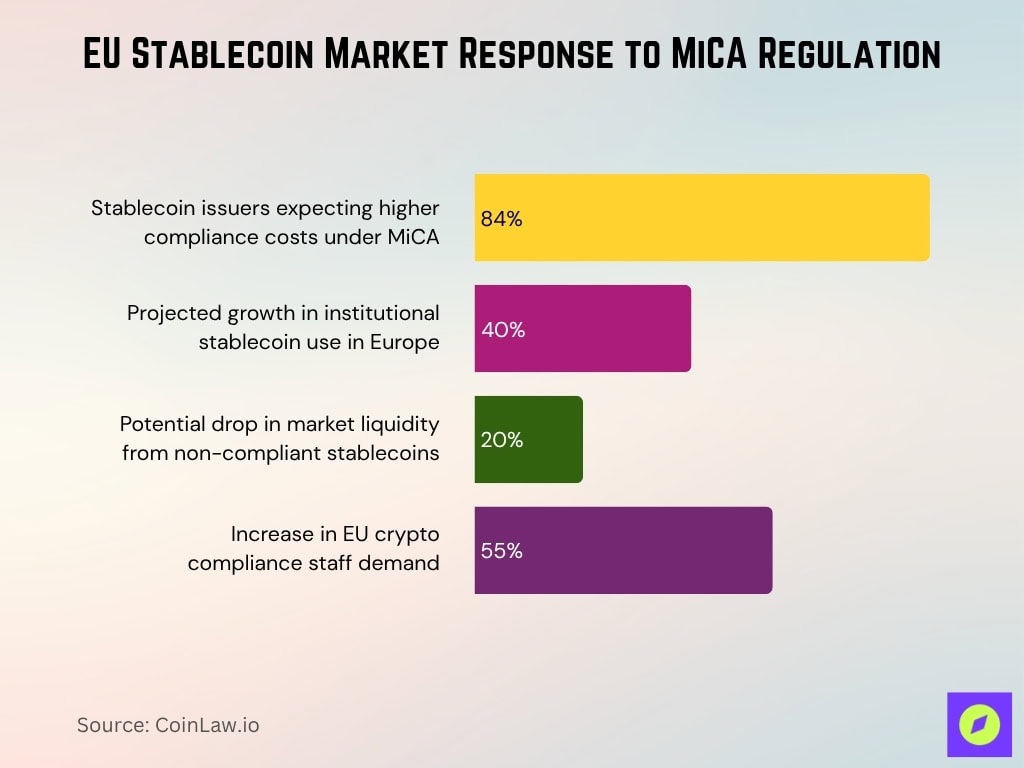

Market Impact of MiCA Regulation on Stablecoins

- 84% of stablecoin issuers expect higher compliance costs under MiCA in 2025.

- Institutional use of stablecoins in Europe is projected to grow by 40% in 2025 due to clearer rules.

- Non-compliant stablecoins risk being delisted from EU exchanges, slashing market liquidity by up to 20%.

- MiCA-style regulation is under review in at least 12 non-EU countries in 2025, including the UK, Switzerland, and Singapore.

- Crypto firms are hiring compliance staff aggressively, with demand up 55% in the EU in 2025.

Key Regulatory Requirements for Stablecoins Under MiCA

- Issuers must secure authorization from the EBA before launching in the EU, with 100% of new stablecoin projects needing licensing in 2025.

- Issuers must hold fully backed reserves in highly liquid assets enough to match the entire circulating supply as of 2025.

- Issuers must deliver quarterly audits with 100% coverage, proving reserve existence and liquidity throughout 2025.

- Stablecoins must be redeemable at face value on demand, shielding consumers from default risk under 2025 rules.

- MiCA forbids interest on stablecoin balances, preventing them from being treated as unregulated savings tools in 2025.

- Non-EU issuers must form an EU legal entity, enabling compliance and access across EU markets in 2025.

- Non-compliance triggers fines of up to 5% of annual revenue or €15 million, whichever is higher, as of 2025.

Regulatory Improvements Driving Stablecoin Confidence

- 64% of companies say that industry standards and best practices have most improved their stance on stablecoins, showing growing market maturity.

- 60% highlight international regulatory alignment as a key motivator, reflecting the global push for cross-border consistency under frameworks like MiCA.

- 55% credit improved AML/KYC solutions, signaling that enhanced anti-money laundering and identity verification measures are boosting institutional trust.

- 50% emphasize clearer national regulations, indicating that government clarity is directly supporting stablecoin adoption and long-term stability.

E-Money Tokens (EMTs) Under MiCA

- Only banks and authorized financial institutions may issue EMTs in 2025, restricting issuance to regulated entities.

- EMTs must maintain a 100% fiat reserve backing, held in EU-based regulated institutions in 2025.

- If an EMT becomes widely used for retail payments, regulators may impose transaction caps, limiting daily circulation to €200 million per issuer in 2025.

- Algorithmic EMTs are prohibited, mandating full backing by liquid reserves in 2025.

- Issuers must conduct quarterly stress tests, with resilience to mass redemptions of 30%+ required in 2025.

How EMT Regulations Will Reshape the Market

- Euro-backed EMTs are projected to surge by 50% in 2025 as banks pivot to compete with private stablecoin issuers.

- USDC is expected to see a 20% decline in EU circulation in 2025 under MiCA’s euro-centric preference.

- EMT reserves must remain entirely inside the EU, curbing capital flight to non-EU institutions in 2025.

- The ECB holds veto authority over EMT issuances viewed as systemic threats in 2025.

Market Statistics on Stablecoins in the EU

- The total stablecoin market cap in the EU is forecast to hit €450 billion in 2025, up 37% from 2024.

- Euro-backed stablecoins are expected to reach 30% of the EU market in 2025, rising from 12% in 2023.

- The number of MiCA-compliant stablecoin issuers is projected to exceed 50 by end-2025.

- Tether (USDT) holds about 40% market share in the EU but may face heavy regulatory restructuring under MiCA in 2025.

- At least 20 new stablecoin projects are expected to launch in the EU in 2025, built specifically for MiCA compliance.

- Institutional interest is rising, with 75% of financial firms in the EU exploring stablecoin investments in 2025.

Adoption and Compliance Trends Among Issuers

- 84% of EU stablecoin issuers are actively reshaping their reserve structures to meet MiCA’s liquidity rules in 2025.

- More than 40 stablecoin projects have already commenced MiCA license applications by mid-2025.

- Crypto exchanges are expected to remove about 20% of non-compliant stablecoins by mid-2025, reducing market exposure.

- USDC (USD Coin) has pursued MiCA alignment to uphold its presence in institutional stablecoin flows in 2025.

- Euro-pegged stablecoins are gaining traction, with issuers pivoting toward MiCA-friendly models in 2025.

- Compliance investments are rising sharply, with large issuers estimated to spend €10 million+ to align with MiCA in 2025.

- Over 65% of stablecoin issuers believe MiCA will boost investor confidence and accelerate adoption rates in 2025.

Effects of MiCA on Stablecoin Market Stability

- Institutional confidence will grow, with 40% more financial firms including stablecoins in their asset portfolios in 2025.

- The share of poorly backed or fraudulent stablecoins is projected to fall by 60% as MiCA forces non-compliant players out in 2025.

- Algorithmic stablecoins are banned under MiCA in the EU, reducing risks from collateral failures in 2025.

- The stablecoin market is expected to remain stable, with daily transaction volumes per issuer capping near €200 million in 2025.

- Investor confidence is projected to rise by 50%, supported by clearer MiCA rules in 2025.

- The ECB will directly monitor large stablecoin issuers in 2025 to avert systemic threats to the EU financial system.

Investor and Consumer Protection Measures Under MiCA

- Issuers must allow full redemption rights, letting holders exchange stablecoins for fiat at face value any time in 2025.

- All stablecoin issuers must display real-time reserve backing on their websites, ensuring full transparency for 100% of users in 2025.

- MiCA mandates consumer compensation if redemption requests aren’t honored within prescribed timeframes, impacting ~10% of issuers in 2025.

- Issuers must submit quarterly external audits, with at least 95% audit success on reserve sufficiency in 2025.

- Stablecoin providers cannot impose hidden fees, enforcing a fully transparent fee structure across all users in 2025.

- Consumers must be informed of all risks, including regulatory changes and volatility, with 100% risk disclosures required before purchase in 2025.

- Retail investors’ holdings may be capped, limiting over-exposure with maximum holdings of €50,000 per person in 2025.

Penalties and Enforcement Actions Under MiCA

- Fines of up to €15 million or 3% of annual turnover will be imposed in 2025 for stablecoin issuers that violate reserve or disclosure rules.

- CASPs (crypto-asset service providers) may face €5 million in fines for breaches of AML/KYC duties in 2025.

- Repeat offenders risk full market bans, barring them from operating within the EU in 2025.

- Illegal or non-compliant stablecoins will be forcibly delisted from European exchanges, crippling their liquidity in 2025.

- Regulators may freeze non-compliant issuers’ reserves, ensuring investor protection in cases of insolvency in 2025.

- At least 10 enforcement actions are anticipated in 2025 targeting issuers that breach MiCA’s liquidity or reserve norms.

- Up to three major stablecoins might be compelled to restructure or exit the EU market in 2025 if they fail to comply.

- Regulatory oversight on high-risk stablecoin projects will intensify in 2025 to curtail fraudulent issuance.

- Exchanges will delist approximately 15% of non-compliant stablecoins in 2025 to uphold regulated asset integrity.

Recent Developments in MiCA Implementation

- The EBA published new opinions on liquidity and reserve RTS in October 2025, rejecting EC amendments that would weaken reserve standards.

- Several non-EU stablecoins have filed for MiCA compliance in 2025 to preserve EU market access under the new regime.

- The ECB is evaluating extra oversight powers in 2025 over systemic stablecoins with large adoption across the EU.

- A proposal to integrate stablecoins with Europe’s digital euro project is actively discussed in 2025 to align monetary infrastructure.

- Regulators in 2025 are pushing to tighten algorithmic stablecoin bans, ensuring that only fully backed tokens can circulate.

Frequently Asked Questions (FAQs)

Titles III and IV began on June 30, 2024, and tokens used as a means of exchange face action above 1,000,000 daily transactions or €200,000,000 per day.

As of September 2025 global stablecoin cap reached $286 billion, with USD-backed coins at 99.5% of capitalization

On 10 October 2025, the EBA issued two Opinions opposing EC changes to the draft RTS on reserve composition and liquidity.

EMTs must be issued by authorized e-money institutions or banks with 1:1 fiat-backed reserves and full redemption at par

Conclusion

MiCA is transforming the stablecoin industry, bringing transparency, security, and regulatory clarity to the European crypto market. With strict reserve requirements, investor protections, and enforcement actions, MiCA is setting a global precedent for stablecoin regulation.

As stablecoin adoption grows, issuers, investors, and crypto platforms must adapt to the new rules or risk losing access to one of the world’s largest financial markets.