Imagine a world where digital assets provide the stability of traditional currencies yet retain the flexibility of blockchain technology. This is no longer a dream but a rapidly advancing reality. From central banks to startups, the stablecoin ecosystem has grown into a cornerstone of the digital economy. This article dives into the key milestones and cutting-edge developments that define stablecoins, offering a statistical perspective on their impact and future trajectory.

Editor’s Choice

- The total stablecoin market capitalization stands at $307.6 billion, down slightly from a $310 billion peak in December.

- Stablecoins recently surpassed $317.94 billion in total market capitalization at the start of the year, underscoring growing on-chain liquidity.

- Tether (USDT) leads the sector with a market cap of nearly $186.8 billion, representing roughly 60.8% of total stablecoin value.

- USD Coin (USDC) maintains a strong second place with a market cap of about $75.2 billion, reflecting continued institutional demand.

- USDT’s circulating supply is roughly 186.84 billion tokens out of a total supply of 190.78 billion, highlighting its deep issuance scale.

- USDT accounts for about 60.8% of the combined $307.57 billion stablecoin economy, far ahead of rivals in share of market cap.

Recent Developments

- BlackRock’s tokenized liquidity fund BUIDL surpassed $2 billion in assets and has distributed about $100 million in dividends since launch.

- Stablecoin transaction volume rose 83% between July 2024 and July 2025, reaching a record annual run‑rate by August.

- Payment giants such as Visa and Mastercard have facilitated more than $120 billion in crypto‑related purchases and spending volume, increasingly leveraging stablecoins.

- Business forecasts see stablecoins potentially supporting up to 10–15% of cross‑border B2B payment volumes by 2030.

- Retail and e‑commerce leaders, including Amazon and Walmart, are piloting stablecoin payment options as part of strategies in a $648 billion‑revenue retail sector.

- Bank and fintech platforms like Fiserv have launched interoperable stablecoins (e.g., FIUSD) designed to connect with PYUSD and USDC for institutional money movement.

- India is actively exploring GIFT City stablecoin corridors, with pilots targeting cross‑border trade and remittance costs below 1% versus traditional 5–7% fees.

Stablecoin Market Growth Outlook

- The global stablecoin market capitalization is projected to exceed $2 trillion by 2026.

- This forecast highlights the rapid expansion of stablecoins as a core component of the digital financial ecosystem.

- Reaching $2 trillion would mark a major milestone in institutional adoption and cross-border payment usage.

- The projected growth reflects rising demand for price-stable digital assets in trading, remittances, and decentralized finance.

Centralized Stablecoins

- Tether (USDT) is the leading centralized stablecoin with a market cap of about $186.6–186.8 billion, representing roughly 60% of total stablecoin value.

- USD Coin (USDC) has a market cap near $75.1–75.3 billion, after 73% growth in 2025 that helped it capture roughly 24–26% of stablecoin capitalization.

- Together, USDT and USDC account for over two-thirds of the global stablecoin market cap and dominate flows with a combined $31.6 trillion in transaction volume in 2025.

- Pax Dollar (USDP) maintains a relatively small but stable footprint with circulation around the $1–1.5 billion range among centralized stablecoins.

- In 2025, global stablecoin transactions reached about $33 trillion, with USDT processing roughly $13.3 trillion and USDC about $18.3 trillion in value.

- Monthly stablecoin volumes are projected to climb from roughly $739.2 billion in September 2025 to nearly $980 billion by December 2026, driven largely by centralized USD-pegged coins.

Decentralized Stablecoins

- Decentralized stablecoins represent about 20% of total stablecoin capitalization, with centralized designs still holding a roughly 80% share.

- DAI’s market capitalization is approximately $4.4–4.6 billion, supported by a circulating supply of nearly 4.5 billion tokens.

- Overcollateralization ratios for leading decentralized stablecoins like DAI and LUSD typically range between 150–180%, preserving resilience during market stress.

- Liquid staking‑backed stablecoins and LSD‑collateralized models helped lift decentralized stablecoin usage by about 25–30% year over year.

- Emerging decentralized stablecoins such as RLUSD reached a circulating supply above $500 million, posting 1,278% year‑to‑date market‑cap growth in 2025.

- User adoption of decentralized stablecoins expanded alongside global stablecoin usage, which hit $33 trillion in 2025 transaction value, up 72% year over year.

Stablecoin Interest Rates and Chain Distribution

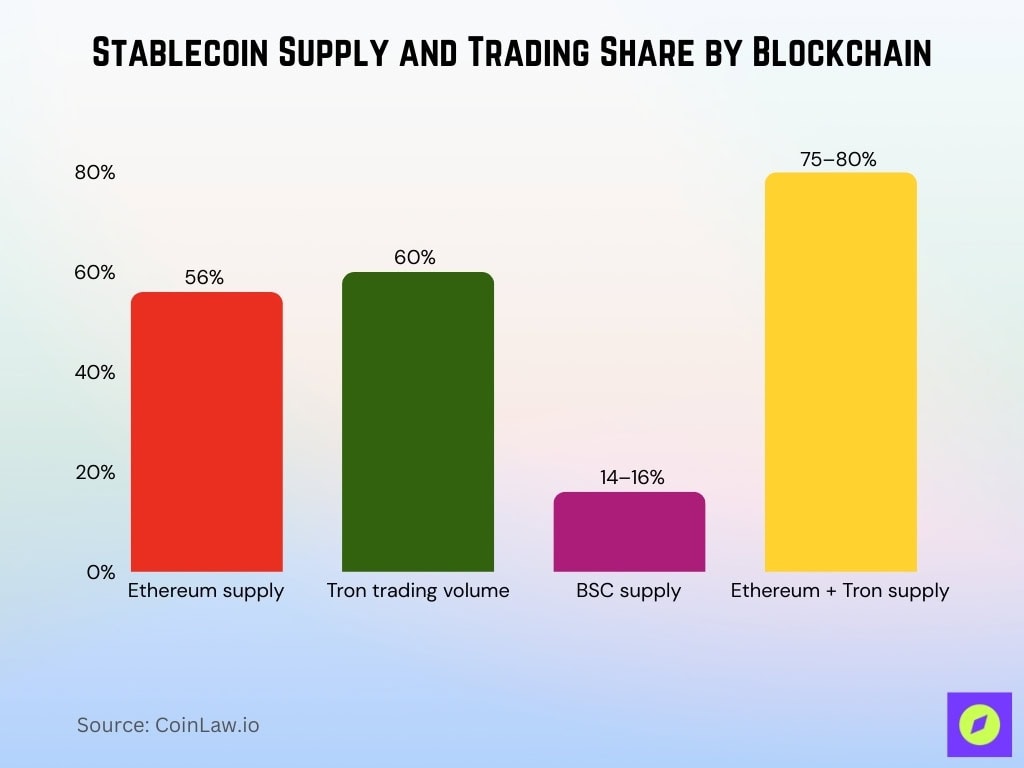

- Ethereum now hosts about 56% of the total stablecoin supply across major chains.

- Tron controls roughly 60% of on-chain stablecoin trade volume, reflecting its dominance in remittance-style payments.

- Binance Smart Chain captures around 14–16% of global stablecoin supply, ranking second by chain share.

- Ethereum and Tron together account for approximately 75-80% of all stablecoin supply across networks.

- Current DeFi lending platforms typically offer stablecoin yields in the 4–8% APY range, depending on borrowing demand.

- Around 42% of stablecoin pools offer yields below 5% APY, skewing toward lower-risk strategies.

- Approximately 32% of pools deliver between 5–10% APY, forming the most common mid-range yield band.

- Roughly 21% of pools provide higher returns between 10–15% APY, while about 5% exceed 15% APY.

Transaction Volume and User Adoption

- Stablecoin transactions reached $33 trillion in 2025, up 72% year over year, with Q4 alone hitting about $11 trillion in volume.

- USDC processed roughly $18.3 trillion in transactions in 2025, while USDT handled about $13.3 trillion, together dominating stablecoin payment flows.

- Total stablecoin market capitalization climbed about 49% in 2025, rising from roughly $205 billion in January to around $306 billion by November.

- Stablecoin payment flows are projected to reach about $56 trillion by 2030, more than 1.7x current annual volumes if growth persists.

- Stablecoin trading volume in Q4 2025 alone reached roughly $11 trillion, compared with about $8.8 trillion in Q3, reflecting accelerating adoption.

- Around 26% of U.S. adults reported using stablecoins for cross-border remittances in the past year, highlighting mainstream money-movement usage.

- Stablecoins are involved in about 43% of transaction volume in Sub-Saharan Africa, where users rely on dollar-pegged assets to hedge inflation.

- Global remittance volumes handled by stablecoin-focused platforms like Aspora grew from $400 million to $2 billion in a year, a 5x increase.

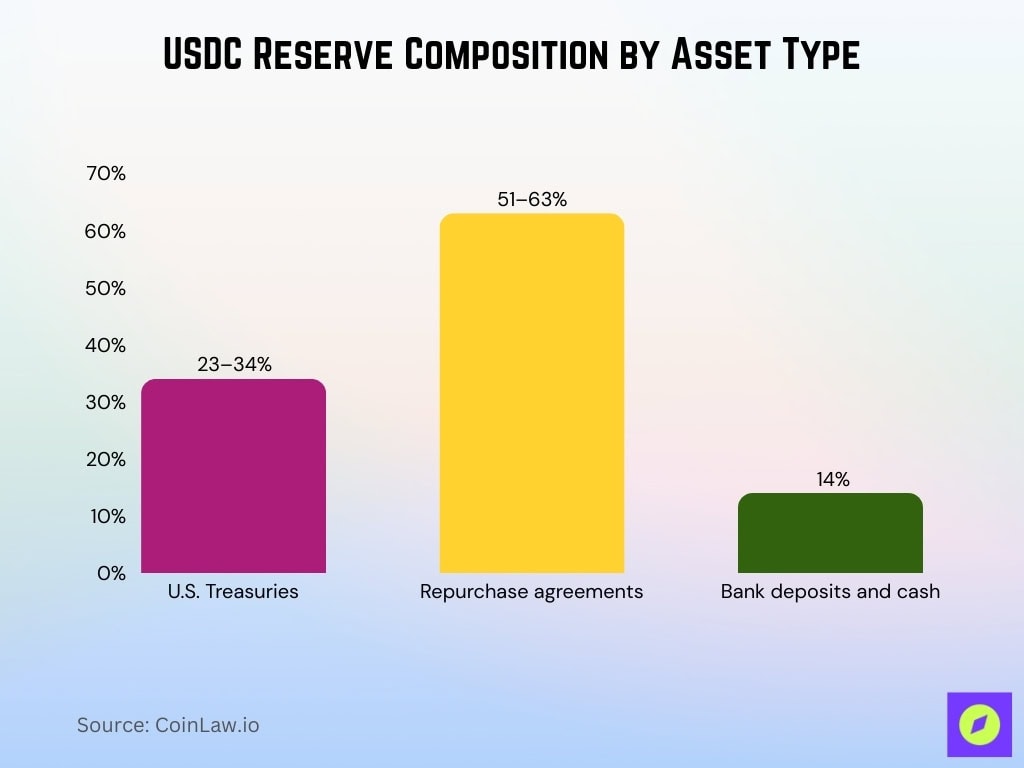

USDC Stablecoin Reserve Breakdown

- Earlier reserve disclosures showed roughly 23–34% in U.S. Treasuries, 51–63% in repurchase agreements, and about 14% in bank deposits and cash.

- USDC reserves are now backed 100% by highly liquid cash and cash-equivalent assets, redeemable 1:1 for U.S. dollars.

- Approximately 88% of reserves are in short-dated U.S. Treasury securities and overnight Treasury repurchase agreements.

- The remaining 12% of USDC reserves are held as cash deposits within the U.S. banking system.

- Current policy maintains zero allocation to commercial paper, corporate bonds, municipal bonds, or other risky credit instruments.

- The reserve mix implies that over four‑fifths of backing assets are interest‑bearing U.S. government exposures, maximizing safety and liquidity.

- Circle’s transparency reports confirm that USDC reserves are fully matched to circulating supply with a small excess buffer of cash and Treasuries.

Regulatory Developments and Compliance

- At least 20+ countries now have or are finalizing stablecoin-specific regimes across major jurisdictions, including the US, UK, EU, Singapore, Hong Kong, Brazil, and Canada.

- The EU’s MiCA framework is rolling out across 27 member states with reserve, disclosure, and supervision rules for stablecoin issuers.

- The US GENIUS Act, signed in July 2025, created a federal licensing and one-to-one reserve regime, with FDIC implementation proposals released in January 2026.

- Hong Kong’s Stablecoins Ordinance took effect on 1 August 2025, requiring HKMA licenses for fiat-referenced stablecoin issuers.

- Canada published a draft stablecoin law in November 2025, mirroring GENIUS-style 1:1 backing and qualified custody requirements.

- Global reviews show gaps remain, but over 80% of large issuers now align with FATF-style AML/CFT and Travel Rule standards.

- FATF reported 99 jurisdictions have adopted or are implementing virtual-asset AML rules covering major stablecoin providers.

- Leading issuers now publish frequent reserve attestations, with top payment stablecoins maintaining 100%+ backing in cash and short-term government securities.

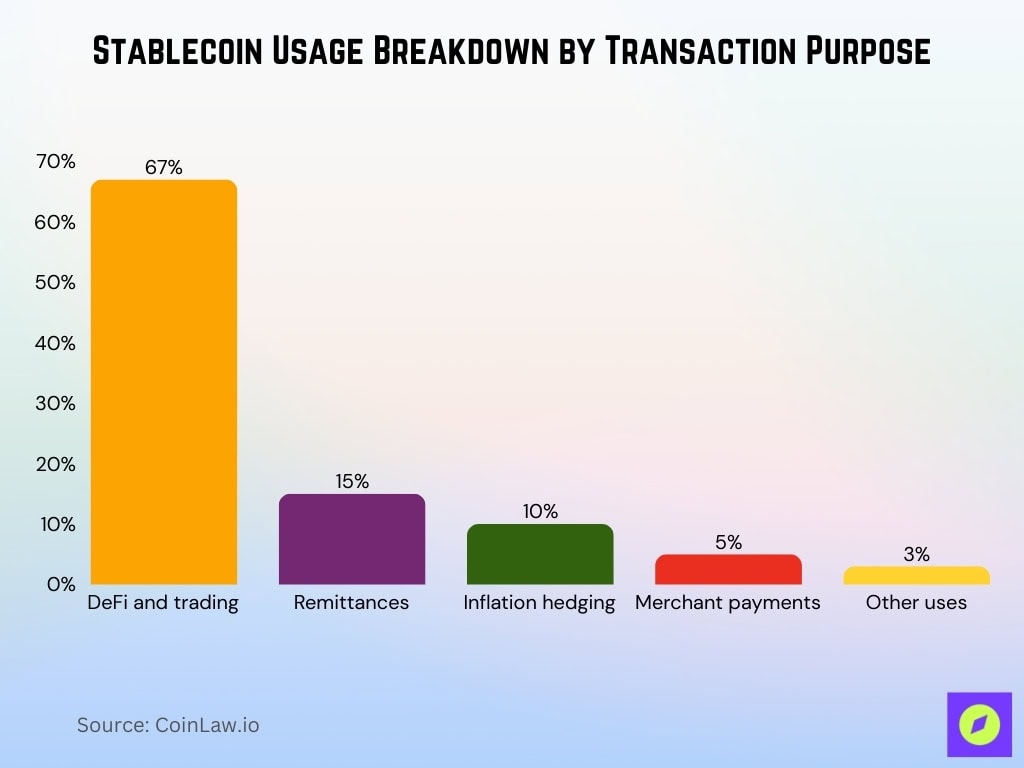

Stablecoin Usage by Purpose

- DeFi and trading accounts for 67% of total stablecoin transaction volume, confirming their role as the primary use case.

- Remittances represent about 15% of stablecoin usage, with cross-border transfers roughly 60% cheaper than traditional money transfers.

- Inflation hedging makes up around 10% of stablecoin activity, supporting savings in high‑inflation economies.

- Merchant payments capture roughly 5% of stablecoin usage, reflecting gradual adoption in e‑commerce and point‑of‑sale payments.

- The remaining 3% of stablecoin volume is attributed to other purposes such as payroll, treasury management, and niche on-chain services.

- Overall, payments beyond trading now represent nearly 30% of stablecoin transaction volume, underscoring broadening real‑world utility.

Literature on Stablecoins

- Academic output on stablecoins grew 18% YoY with 200+ new peer-reviewed papers and policy reports published recently.

- Survey research shows that about 60% of financial institutions expect 5–10% of global payments to involve stablecoins by 2030.

- MIT’s Digital Currency Initiative leads global research on Bitcoin and stablecoin use, including a new MIT-UnB course focused on the global south.

- Central-bank and international-organization research expanded with major stablecoin reports from the IMF, Federal Reserve, and ESRB in 2024–2025.

- Policy papers suggest stablecoins could reach $2 trillion in market cap by 2030, showing rising importance in digital money debates.

Frequently Asked Questions (FAQs)

USDT’s dominance of total stablecoin supply stood around 60 % in late 2025.

USDT and USDC together commanded roughly 90 % of the total stablecoin supply in 2025.

Ethereum and its rollups held over $170 billion in stablecoin supply.

Stablecoins were used by 13 % of financial institutions, with 54 % of non‑users expecting adoption within 6–12 months.

Conclusion

The stablecoin market has cemented itself as a cornerstone of the digital economy, bridging the gap between blockchain and traditional finance. From their growing adoption in cross-border payments to their integration in DeFi and institutional finance, stablecoins are no longer niche instruments but vital tools in the global financial infrastructure. As technological advancements and regulatory clarity continue to evolve, stablecoins will undoubtedly remain pivotal in shaping the future of financial ecosystems worldwide.