Transparency in stablecoin reserves has become central. Regulators, institutions, and users demand clearer proof of what backs stablecoins and how reliably. Real‑world scenarios like Tether’s push toward engagement with a Big Four audit firm or Circle reporting sharp growth in its USDC reserves revenue show the stakes in trust and reporting. This article digs into the numbers, frameworks, and trends shaping reserve transparency, and why what stablecoins say now matters more than ever.

Editor’s Choice

- The GENIUS Act, passed in the U.S. in July 2025, mandates stablecoin issuers publish monthly reserve composition reports, audited by third‑party accountants.

- In Q2 2025, Circle reported $658 million in reserve income (from backing assets for USDC), a 50‑53% increase year over year.

- USDC in circulation hit about $61 billion on average in Q2 2025, up ~90% year over year.

- Tether holds approximately $98.5 billion in U.S. Treasury bills as of Q1 2025, making it one of the largest non‑sovereign holders globally.

- Stablecoin market cap (fiat‑pegged) is over $230 billion as of mid‑2025.

- The vast majority, over 95%, of fiat-backed stablecoins are pegged to the U.S. dollar, reflecting its dominance in global finance and crypto markets.

- As of 2025, a growing number of leading stablecoins, estimated between 60–75%, publish real-time or near real-time proof-of-reserves dashboards, especially those using on-chain transparency tools.

Recent Developments

- The GENIUS Act in the U.S. now requires monthly public disclosures of reserve amounts, compositions, and outstanding stablecoins. Issuers above certain thresholds must submit full audits.

- Tether is in talks with a Big Four accounting firm to perform a full reserve audit. As of early 2025, Tether has still only provided attestation, quarterly reports, not a full audit.

- Circle went public in mid‑2025, and its regulatory reporting obligations increased, including disclosures required by GENIUS.

- Reserve reporting frameworks are being tightened globally, regulatory bodies are pushing for shorter lag times, standard formats, and more frequent third‑party attestations.

- More stablecoin issuers have begun offering proof of reserves (especially algorithmic or crypto‑collateralized stablecoins, which can show liabilities vs. assets on‑chain).

- U.S. Treasury bills and other high‑quality liquid assets (HQLA) are increasingly required as backing for large stablecoin issuers under new laws, regulations.

- Reserve reporting is no longer just for trust; it’s now tied to legal, regulatory compliance, and failure to comply can mean penalties or exclusion from issuing stablecoins in payment contexts.

- Global attention, cross‑border payments reliance on stablecoins has doubled over the recent 18 months, driving demand for more transparent reserve data.

How Stablecoins Were Used

- DeFi and trading dominated usage, accounting for 67% of all stablecoin activity. This includes decentralized exchange transactions, liquidity provision, and collateralized lending.

- Remittances made up 15% of stablecoin use, reflecting their growing role in cross-border money transfers, especially in regions with limited banking access.

- 10% of stablecoin activity was used as an inflation hedge, particularly in countries experiencing currency volatility or hyperinflation.

- Merchant payments represented 5% of usage, signaling early-stage adoption of stablecoins in retail and commercial transactions.

- The “Other” category made up 3%, which includes use cases like gaming, tipping, and experimental financial products.

Types of Stablecoin Reserve Backing

- Fiat‑backed (cash + highly liquid assets): USDC, for example, uses cash and U.S. Treasuries.

- Crypto‑collateralized: assets like DAI are backed by crypto collateral visible on‑chain; such backing allows more direct proof of reserve vs liabilities.

- Algorithmic or partly algorithmic: fewer in number now, algorithmic stablecoins often suffered depegging events, hence losing confidence.

- Hybrid backing: mix of fiat, Treasuries, and crypto, sometimes includes commercial paper or other low‑risk debt.

- Real‑world assets (RWA): Some stablecoins include tokenized real assets or physical commodities in their reserve mix.

- Treasury bills dominance: Tether holds ~$98.5 billion in U.S. Treasury bills alone.

- Commercial paper / corporate debt usage: Some portion of reserves in major stablecoins includes non‑government debt; risk depends on liquidity and creditworthiness.

- Segregated cash reserves: USDC segregates cash and cash equivalents into reserve accounts kept for stablecoin holders.

Reserve Attestation and Audit Standards

- U.S. issuers use AT‑C 205 (Examination Engagements Standard) for attestations.

- Internationally, ISAE 3000 is a common standard for attestations, audits.

- Under the GENIUS Act, issuers above certain issuance size thresholds must submit full financial audits and have the CEO, CFO attest to the accuracy.

- Many stablecoin issuers already issue quarterly reserve reports or attestations, but full audits are less common.

- Audits must include not just the amount, but also the composition, custody location, and risk exposure of reserve assets under new regulations.

- Some reports still lag, assets valued and reported quarterly, sometimes with 30‑ to 45‑day delays after period end.

- Independent auditor identity matters; issuers are under pressure to use Big Four or similarly reputable firms.

Confidence Signals for Stablecoin Adoption

- 86% of organizations have established partnerships to support stablecoin integration, indicating strong collaboration across fintech and blockchain ecosystems.

- 82% say their infrastructure is ready, including critical tools like wallets and APIs, showing high technical preparedness for stablecoin rollout.

- 77% report clear customer demand for stablecoin-based products, highlighting growing real-world interest in using stablecoins for payments, transfers, and finance.

Top Stablecoin Reserve Audits (by Project)

- Tether (USDT), as of Q1 2025, held about $98.5 billion in U.S. Treasury bills, making it one of the largest non‑sovereign holders.

- Tether is currently in talks with a Big Four accounting firm to conduct a full audit of its reserves, after previously relying mostly on quarterly reports or attestations.

- Circle (USDC) publishes detailed reserve reports, including compositions and assets held, and meets many audit/attestation standards.

- Other stablecoins like BUSD, DAI, and “TrueUSD / TUSD” have varying levels of external auditing or attestations; many are still at the level of attestation rather than full audits.

- Audit frequency for major stablecoins remains mostly quarterly or semi‑annual, not yet universally monthly.

- Audit scope differences, some audits focus only on liabilities vs assets, others include reserve composition, custody details, and risk exposure; gaps remain in standardization.

- Newer projects or emerging stablecoins (e.g., PYUSD, FDUSD) are still building out audit practices; some have published partial reserve attestations but not full financial audits yet.

- Legal pressures (like the U.S. GENIUS Act) are pushing major issuers to aim for more rigorous audits.

Frequency of Reserve Reporting

- Many top stablecoins now issue quarterly reserve reports as standard.

- Some issuers post monthly reserve compositions or summary reports, especially under newer regulation pressures like GENIUS.

- Attestation reports often lag by 30‑45 days after quarter end.

- Real‑time or near-real-time dashboards are rare but are gaining traction in projects pushing for open transparency.

- The GENIUS Act requires monthly or more frequent disclosures for certain stablecoin issuers above thresholds.

- Smaller or newer stablecoins tend to have less frequent reporting (semi‑annual or even annual) than the market leaders.

- Some issuers publish rolling attestations that update liabilities vs assets more dynamically.

- Regulatory frameworks in places like the EU (MiCA) are pushing for more frequent, standardized reporting by stablecoin issuers.

Top Benefits Driving Stablecoin Adoption

- 48% of respondents identified faster settlements as the leading advantage, allowing real-time or near-instant transfers across borders.

- 36% cited greater transparency as a key benefit, making stablecoin flows more traceable and auditable.

- 33% pointed to better liquidity management, especially useful for institutions handling high-frequency payments and treasury operations.

- 33% also highlighted integrated payment flows, streamlining how funds move across wallets, apps, and platforms.

- 31% valued enhanced security, showing confidence in stablecoins’ ability to protect assets through blockchain infrastructure.

- 30% emphasized lower transaction costs, making stablecoins attractive for reducing fees in domestic and international payments.

Reserve Composition Breakdown

- According to recent studies, Tether holds ~$98.5 billion in U.S. Treasury bills as part of its reserves.

- Stablecoin reserve portfolios include cash & government money market funds dominating ~60‑65% of backing for many major fiat‑backed stablecoins.

- Commercial paper and corporate short‑term debt appear as reserve components, though at smaller proportions (often under 10%).

- Corporate bonds and other fixed‑income instruments sometimes form part of reserve mixes for diversification.

- Some reserves include foreign currency holdings, though most fiat‑backed stablecoins keep U.S. dollar or U.S. dollar–denominated instruments.

- For crypto‑collateralized stablecoins, composition often includes over‑collateralized crypto assets plus stablecoins or other tokens.

- Liquidity of the reserve assets is increasingly important, with more holdings in highly liquid instruments (T‑bills, money market funds) to allow redemptions during stress.

- Some projects now show breakdowns by maturity buckets (e.g., short‑term vs medium‑term) to reveal interest‑rate and liquidity risk exposure.

Geographic Distribution of Stablecoin Reserves

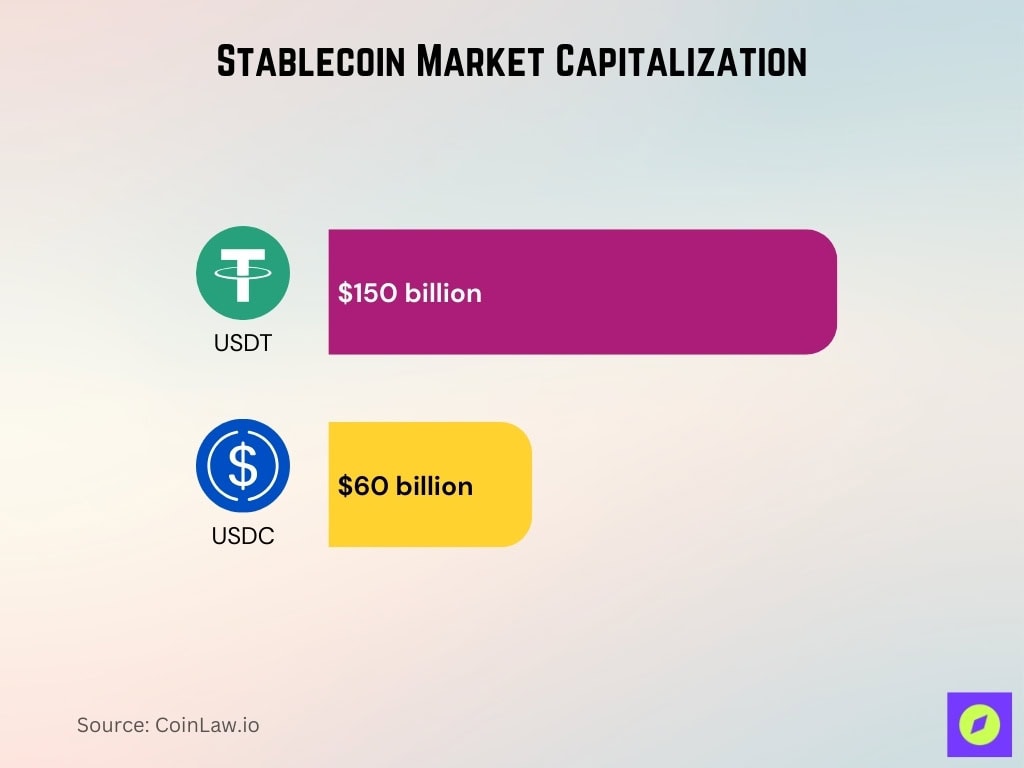

- Stablecoin market capitalization in Q2 2025, USDT $150 billion, USDC $60 billion; these two lead particularly in North America.

- U.S. stablecoin issuers hold a large share of reserves in short‑term U.S. Treasuries and cash equivalents. For USDC, about 98.9% of its reserves are in those instruments.

- Centralized stablecoins still dominate the market globally (~90%), led by U.S.‑based issuers with high transparency standards.

- Decentralized stablecoins (crypto‑collateralized) are more widely used in Latin America, Asia, and Africa for DeFi and local remittance flows.

- Stability and audit transparency are higher in jurisdictions with strong regulation, the US (GENIUS Act), the EU under MiCA, Singapore, UK.

- New stablecoins (e.g., native to Asia‑Pacific, Latin America) are increasingly compliant with local laws and participating in cross‑border payments.

Emerging Technologies in Reserve Verification

- AI‑powered PDF parsing tools (e.g., LedgerLens) reduce manual errors and speed up the conversion of custodial statements into machine-readable formats.

- Automated dashboards (widgets) like those from TNF that combine real‑time off‑chain and on‑chain data are gaining adoption.

- Smart contracts and Merkle‑tree proof mechanisms are being explored for decentralized, trust‑minimized verification.

- Protocol designs that allow over‑collateralization and dynamic rebalancing between risky assets and liquid assets (cash, T‑bills) to maintain reserves under stress.

- Use of compliance‑by‑design frameworks that integrate anti‑money‑laundering (AML), sanction screening, and risk metrics into reserve reporting.

Legal and Security Protections for Reserves

- The GENIUS Act (U.S., enacted July 18, 2025) gives stablecoin holders superpriority in bankruptcy over other creditors with respect to reserve assets.

- Under GENIUS, only “permitted payment stablecoin issuers” may issue stablecoins in the U.S., and they must meet reserve composition, audit, and operational standards.

- Issuers are required to hold 1‑to‑1 reserves for stablecoins issued; reserves can include physical currency, U.S. Treasuries, repurchase agreements, and other low‑risk assets approved by regulators.

- Stablecoin reserve assets are shielded from certain claims in bankruptcy proceedings, securing holders’ claims.

- International frameworks like MiCA impose oversight, redemption rights, and reserve disclosure requirements, enhancing legal protections in EU jurisdictions.

- Security protections are becoming stricter, custody standards, third‑party audits, internal controls, and risk management (liquidity risk, interest‑rate risk) are mandated under legislation, regulation.

Market Impact of Reserve Transparency

- Circle’s reserve income in Q2 2025 was $658 million, up 53% year‑over‑year, supported by its transparent reserve composition.

- The total stablecoin market cap exceeded $230 billion in mid‑2025.

- Transparent stablecoins (USDC, etc.) have stronger institutional adoption, more payment integrations, and lower financing costs.

- In cross‑border payments, stablecoin usage is increasing, though it still represents less than 1% of global cross‑border payment flows; however, its addressable market is large.

- Reserve transparency contributes to tighter peg stability. USDC typically shows daily price deviations within ±0.002 USD, while Tether (USDT) often exhibits slightly greater fluctuation, particularly during liquidity stress events.

- Liquidity risk reduces when reserve backing assets (T‑bills, cash equivalents) are high, leading to stronger redemption confidence.

Challenges and Controversies in Stablecoin Reserve Reporting

- Some issuers still haven’t completed full external audits, relying instead on attestations. Tether is one prominent example in 2025.

- Issues of custodian transparency, many reports omit exact banking or custodian institutions, making risk assessment harder.

- Off‑chain reserve assets create opacity; crypto‑collateralized reserves are more observable but carry their own risks (market volatility).

- Lag in reporting, audit, or attestation delays remain (30‑45 days post period), reducing the usefulness in times of stress.

- Regulatory fragmentation across jurisdictions, standards differ (GENIUS in the U.S., MiCA in the EU, others), creating mismatched expectations.

- Risks related to reserve asset quality, commercial paper, corporate bonds, and other less liquid assets carry credit and liquidity risk.

Frequently Asked Questions (FAQs)

The total stablecoin market cap is about $252 billion by mid‑2025.

Decentralized stablecoins like DAI and FRAX account for roughly 15–20% of the total stablecoin market capitalization as of mid-2025, depending on how algorithmic and hybrid models are categorized.

As of Q1 2025, Tether held approximately $98.5 billion in U.S. Treasury bills, which may represent around 1.5–1.6% of the total U.S. T-bill market, estimated at ~$6.3 trillion.

Stablecoin supply has increased by roughly 28% year‑over‑year in its average circulation.

Conclusion

Stablecoin reserve transparency has come a long way. New laws, tools, and user expectations are forcing issuers to publish clearer data, improve audit frequency, and use more liquid and observable assets. While dominant players like USDC and USDT set benchmarks in reserve composition and reporting, gaps remain, especially in full audits, custodian details, and consistency under stress. Emerging technologies like AI‑powered verification and real‑time dashboards offer promise, but legal protections and standardization across jurisdictions are becoming just as important.

As stablecoins continue weaving more tightly into global payments, DeFi, and traditional finance, what matters most is not just how much reserve an issuer holds, but how clearly and reliably they can prove it. Users, regulators, and institutions should keep watching disclosure practices closely. The simple truth: transparency isn’t optional; it’s foundational.