The S&P 500 remains the benchmark for U.S. large‑cap equity performance, reflecting the broader economy’s health and investor sentiment. This index influences retirement portfolios, institutional asset allocations, and global capital flows. Across industries, fund managers use S&P 500 data to calibrate risk models, while corporate strategists gauge competitive positioning against this broad market barometer. In this article, we unpack the latest 2025 S&P 500 statistics, from performance and methodology to market structure and risk measures.

Editor’s Choice

- The S&P 500 closed at a record high of 6,932.05 on December 24, 2025, underscoring ongoing market strength.

- As of late 2025, the index comprised ~503 constituents with free‑float market‑cap weighting.

- The S&P 500 captures ~80% of U.S. equity market capitalization.

- The market cap of all constituents recently exceeded $61 trillion.

- The top 10 firms account for ~38% of the total index weight.

- Technology dominates with sector allocations above ~30% of the index.

- Minimum market cap for inclusion rose to $22.7 billion in 2025.

Recent Developments

- In December 2025, the S&P 500 notched a record close at ~6,909.79, propelled by tech gains.

- Sectors outside technology have shown broadening participation, easing narrow market breadth concerns.

- Banking giants added ~$600 billion in market value in 2025, outperforming the broader index.

- Analysts see 2026 as a year of modest growth (3–5%) after three double‑digit years.

- Several consumer and cyclical stocks rallied strongly in 2025, diversifying leadership.

- AI and data center infrastructure trends continue to influence stock upgrades.

- Equal‑weight S&P 500 ETFs briefly outperformed cap‑weighted indexes early in 2025.

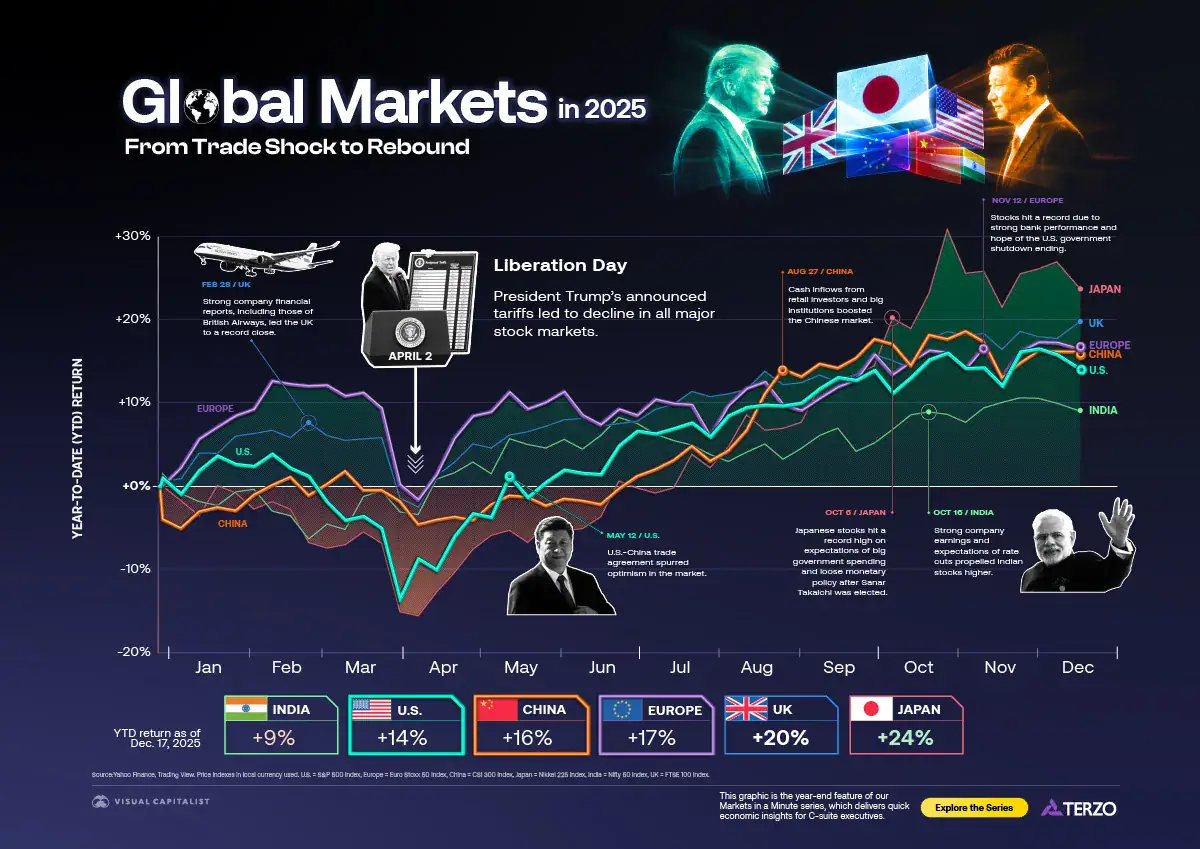

Global Markets Performance

- Japan led global equity markets in 2025, finishing the year with a +24% year-to-date return, the strongest performance among major economies.

- UK stocks delivered a solid +20% YTD gain, supported by strong earnings momentum and improving investor sentiment late in the year.

- European equities ended 2025 up +17%, reflecting steady recovery across major EU markets despite mid-year volatility.

- China recorded a +16% YTD return, rebounding strongly after mid-year weakness and renewed institutional inflows.

- The U.S. market posted a +14% YTD increase, recovering sharply after April and maintaining upward momentum into year-end.

- India closed 2025 with a +9% return, remaining positive throughout the year with comparatively lower volatility than peers.

S&P 500 Index Definition and Methodology

- S&P 500 total market capitalization reached $57.05 trillion in September.

- Index hit an all-time high of 6,906 points with $61.6T market cap on December 23.

- Year-to-date total return stands at 19.35% including 1.49% dividends.

- Comprises 503 stocks from 500 large-cap companies due to dual-class shares.

- Minimum market cap requirement increased to $22.7 billion effective July 1.

- Top constituent Nvidia holds 7.5% weight in the index.

- The top 10 stocks account for nearly 40% of the total index weight.

- September rebalance added 3 companies (APP, HOOD, EME) and removed 3.

- Quarterly rebalancing typically sees 20-25 changes annually.

Calendar Year and YTD Performance Highlights

- The index opened in 2025 at 5,868.55 on January 2.

- YTD total return reached 19.35% with 17.86% price return and 1.49% dividends as of December 24.

- Closed at 6,932.05 on December 24 after hitting 6,937.32 intraday high.

- January delivered a 2.3% return amid early volatility.

- Q3 total return contributed 8.1% bringing YTD to 14.8% through September.

- August posted a 2.75% gain while November saw a -0.48% dip.

- The tech sector led with a 21.8% YTD gain, driving overall performance.

- Index hit all-time highs 28 times through Q3.

S&P 500 End-of-Year Forecasts Overview

- Forecasts cluster tightly around the mid-6,000 range, with several major institutions targeting 6,500 for the S&P 500.

- Long Forecast stands out as the most bullish, projecting an aggressive 8,848 year-end level, well above the consensus.

- Wells Fargo expects the index to reach 7,007, signaling confidence in sustained equity momentum.

- Deutsche Bank and Ed Yardini both forecast 7,000, reinforcing a strong upside outlook among top strategists.

- Bank of America projects a moderate 6,666, aligning closely with broader market expectations.

- CoinPrice Forecast estimates 6,791, positioning it slightly above the central forecast band.

- Traders Union anticipates 6,571, reflecting a cautious but positive market trajectory.

- Benzinga expects 6,506, placing it near the lower end of institutional projections.

- Morgan Stanley, Goldman Sachs, UBS, and JP Morgan converge at 6,500, highlighting a clear consensus anchor for year-end expectations.

Volatility, Drawdowns, and Bear Market Statistics

- VIX averaged around 20 through most of the year before settling at 17.77 on December 24.

- VIX spiked above 60 during April’s “Liberation Day” crash from under 17 in eight sessions.

- The maximum intra‑year drawdown measured about 19% during the spring 2025 selloff.

- April 3 saw a 4.84% single-day drop amid $6.6 trillion two-day market value loss.

- Early-year maximum drawdown hit 10% below the historical average of 14% intra-year.

- No bear market occurred as declines stayed above the -20% threshold.

- VIX closed at 14.00 on December 23 with 10.84% 30-day realized volatility.

- S&P 500 experienced a 19% intra-year decline during the tariff uncertainty period.

- Volatility peaked at 25.76 on November 20 before the year-end decline.

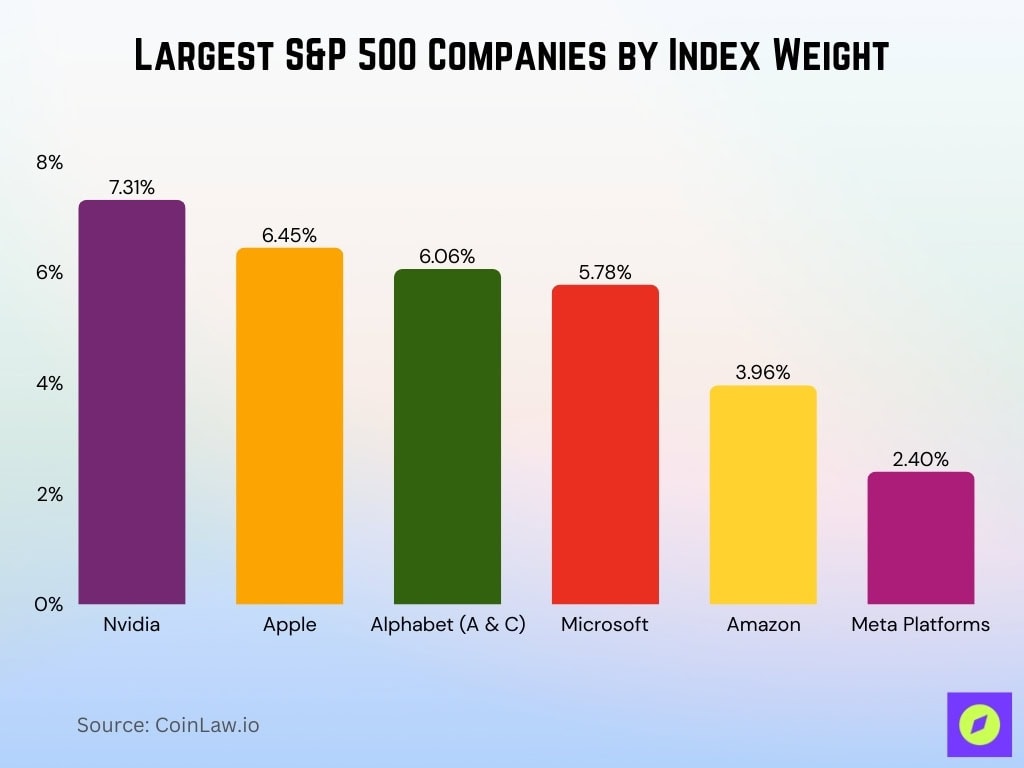

Market Capitalization and Index Weighting Breakdown

- As of late 2025, the total index market cap exceeded $61 trillion.

- The top 10 stocks accounted for roughly 38% of the total weight.

- Nvidia alone held about 7.31% of the index’s weight.

- Apple and Microsoft followed with ~6.45% and ~5.78% weight, respectively.

- Amazon contributed ~3.96% of the total weight.

- Alphabet’s class shares added ~6.06% collectively.

- Smaller constituents make up the balance of the market cap beyond the mega‑caps.

- The concentration of top firms shapes index dynamics and risk exposure.

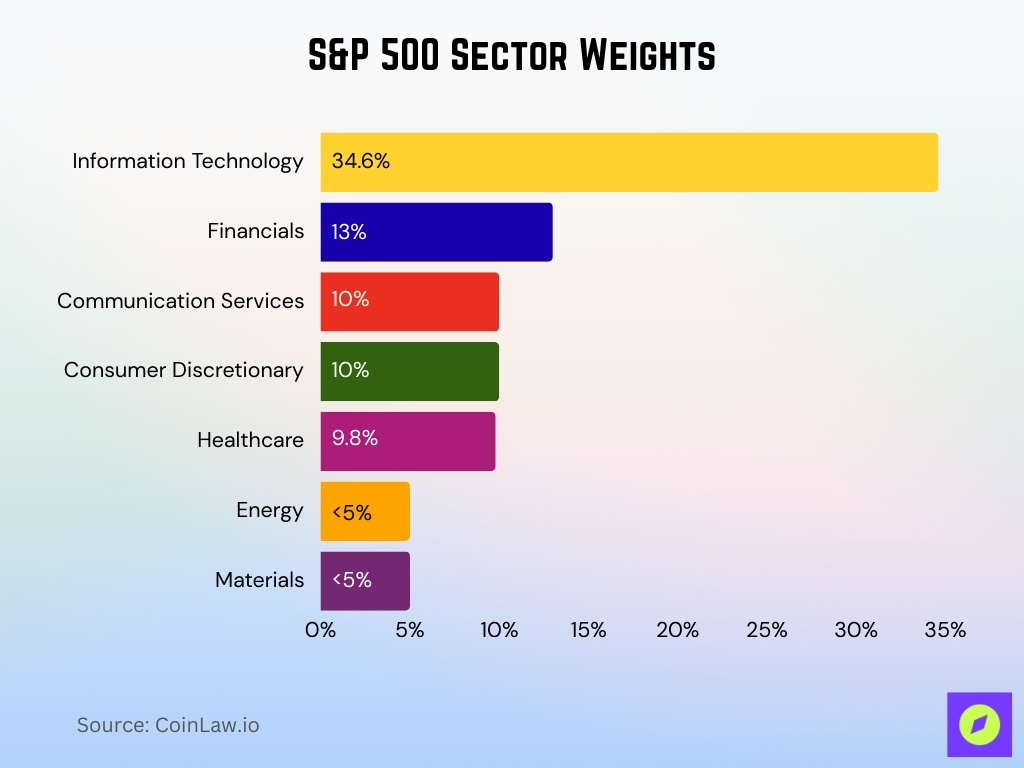

Sector Allocation and Industry Composition

- Information Technology dominated at ~34.6% of the index weight.

- Financials were next with over 13% weighting.

- Communication Services and Consumer Discretionary each hovered near ~10%.

- Healthcare comprised close to ~9.8%.

- Energy and Materials represented smaller allocations under ~5% each.

- Sector diversification evolves with market rotations and economic cycles.

- Performance across sectors varied significantly year‑to‑date.

S&P 500 vs Other U.S. Indices (Dow, Nasdaq, Russell)

- The S&P 500 captures ~80% of U.S. equity market capitalization, making it broader than many benchmarks.

- At the end of September 2025, the S&P 500 finished up ~3.5%, compared with the Nasdaq up ~5.6% and the Dow up ~1.9% for the same period.

- Historically, since 2000, the S&P 500 has grown ~131% in real terms, close to the Nasdaq’s inflation‑adjusted increase.

- The Russell indexes (e.g., Russell 1000) follow slightly different inclusion rules and often show broader midcap exposure versus the S&P 500’s large‑cap tilt.

- The S&P 500’s float‑adjusted market cap weighting contrasts with the Dow’s price‑weighted methodology, leading to different performance dynamics.

- Over long cycles, tech‑heavy benchmarks like the Nasdaq often outperform during innovation‑led rallies, while Dow stocks may lag in high‑growth periods.

- The S&P 500 is more representative of the broader economy than the narrower Dow’s 30 stocks.

- Equity ETFs tracking each index show variations in sector exposures, contributing to performance differences during market rotations.

Risk and Risk‑Adjusted Return Measures

- Year‑to‑date total return measured about 19.3% through late December 2025, including price gains and dividends.

- Sharpe ratio reached 0.92 over a 1-year period and 0.89 long-term.

- Sortino ratio stood at 1.26, focusing on downside volatility.

- 3-year annualized Sharpe ratio hit 1.45 amid strong performance.

- 5-year annualized return delivered 14.95% with 0.9 Sharpe.

- Daily VaR forecast measured 2.48% on December 12.

- Expected Shortfall reached 3.02% for tail risk estimation.

- 25% drop probability calculated at 4.6% short-term.

- Annual volatility averaged 19.53% over the past year.

Largest S&P 500 Companies by Weight and Market Cap

- Nvidia led with ~7.31% weight.

- Apple held about ~6.45%.

- Microsoft represented around ~5.78%.

- Amazon stood at roughly ~3.96%.

- Alphabet (Classes A & C) combined near ~6.06%.

- Meta Platforms hovered above ~2.4%.

- Broadcom, Tesla, Berkshire Hathaway, and JPMorgan Chase rounded out the top ten.

Valuation Metrics (P/E, P/B, CAPE) Over Time

- Trailing P/E ratio stands at 31.28 versus the historical mean of 16.19.

- Forward P/E multiple measures 23.39 above the 10-year average of 18.7.

- Shiller CAPE ratio reached 39.42, exceeding the long-term average of 27.68.

- Price-to-book ratio hit 5.62 compared to the historical median of 2.91.

- Q2 P/B value recorded 5.008, up 6.84% quarter-over-quarter.

- September forward P/E peaked at 28.72 amid earnings expectations.

- Market trades 90% overvalued by P/E compared to historical norms.

- August trailing P/E measured 28.80 with 4.66% year-over-year growth.

Earnings, Revenue, and Margin Trends

- 85% of S&P 500 companies beat EPS estimates in Q3, highest in four years.

- Q3 blended EPS growth accelerated to 9.2% year-over-year with 7.0% revenue growth.

- 82% beat rate and 77% revenue beats exceeded five- and ten-year averages.

- Q3 net profit margin improved to 13.1% from 12.5% prior year.

- Consensus EPS growth hit 13.1% marking the fourth straight double-digit quarter.

- The top seven stocks accounted for 26% of total index earnings.

- Information Technology sector delivered 27.1% EPS growth and 15.4% revenue.

- Forward 12-month EPS reached $292, up 7.4% year-to-date.

- The financial sector posted 23.7% EPS growth, led by insurance and capital markets.

S&P 500 Inclusion Criteria and Eligibility Rules

- Minimum unadjusted market cap requirement stands at $22.7 billion effective July 1.

- Float-adjusted market cap must equal at least 50% of the $22.7 billion total company threshold.

- S&P 500 targets companies at the 85th percentile of the S&P Total Market Index market caps.

- January 2 update raised threshold from $18.0 billion to $20.5 billion.

- June 30 announcement increased the minimum by 10.7% to $22.7 billion from $20.5 billion.

- Public float requires a minimum of 50% of shares outstanding available for trading.

- Companies need positive GAAP earnings in the most recent quarter plus the sum of the prior four quarters.

- Quarterly rebalances added 24 companies and removed 21 through year-end.

- S&P DJI committee evaluates U.S. domicile with primary listing on NYSE or Nasdaq.

Rebalancing, Additions, and Deletions Statistics

- 24 companies added and 21 removed through quarterly rebalances.

- December rebalance added CRH, CVNA, and FIX effective December 22.

- September additions included HOOD, APP, and EME replacing MKTX, CZR, and ENPH.

- August added IBKR amid mid-year eligibility reviews.

- March 24 added DASH, TKO, WSM with EXE in the energy sector.

- July 23 incorporated HES, and July 18 added ANSS in technology.

- May 19 added COIN while removing DFS in financials.

- Total turnover reached 15 additions and 15 deletions from June 2024 to May.

- Rebalances typically occur third Friday of March, June, September, and December.

Frequently Asked Questions (FAQs)

The S&P 500 represents about 80% of U.S. equity market capitalization.

The S&P 500’s YTD price return was around ~12.0% to ~13.7% in 2025, depending on the reference period.

The S&P 500 market cap grew by around 17% year‑over‑year compared to the previous year.

The S&P 500 includes 11 major industry sectors defined by the GICS framework.

Conclusion

The S&P 500 continues to reflect dynamic market shifts, from elevated valuations and strong earnings growth to periodic rebalancing and evolving inclusion criteria. Its performance against other major U.S. indices underscores its central role in global investing, while risk and valuation trends highlight both opportunities and caution points for portfolios. Whether through historical return patterns, sector rotations, or changing corporate fundamentals, the S&P 500 remains a vital lens into the U.S. equity landscape. Investors should monitor how earnings trajectories, market concentration, and macro signals will shape returns ahead.