Imagine a world where contracts are not just pieces of paper but self-executing lines of code that seamlessly enforce themselves. This is not a distant dream but the reality of smart contracts. Their transformative potential has captured the financial sector, where efficiency, transparency, and trust are paramount. The adoption of smart contracts is accelerating, with data revealing how this technology reshapes finance. This article dives deep into the statistics and trends surrounding smart contract adoption in the financial domain.

Editor’s Choice

- In 2025, 53% of legal departments globally actively use smart contracts.

- Over $300 billion in transactions were settled via smart contracts by 2025.

- Blockchain-based contracts now cut cross-border processing times by ~40%, highlighting their efficiency.

- The US leads adoption (45%), followed by Europe (30%), in global smart contract usage.

- Platforms offering native token staking see ~30% higher adoption compared to those without staking options in 2025.

- Hybrid AI-driven auditing tools like SmartLLM aim for 100% recall in vulnerability detection to boost contract security.

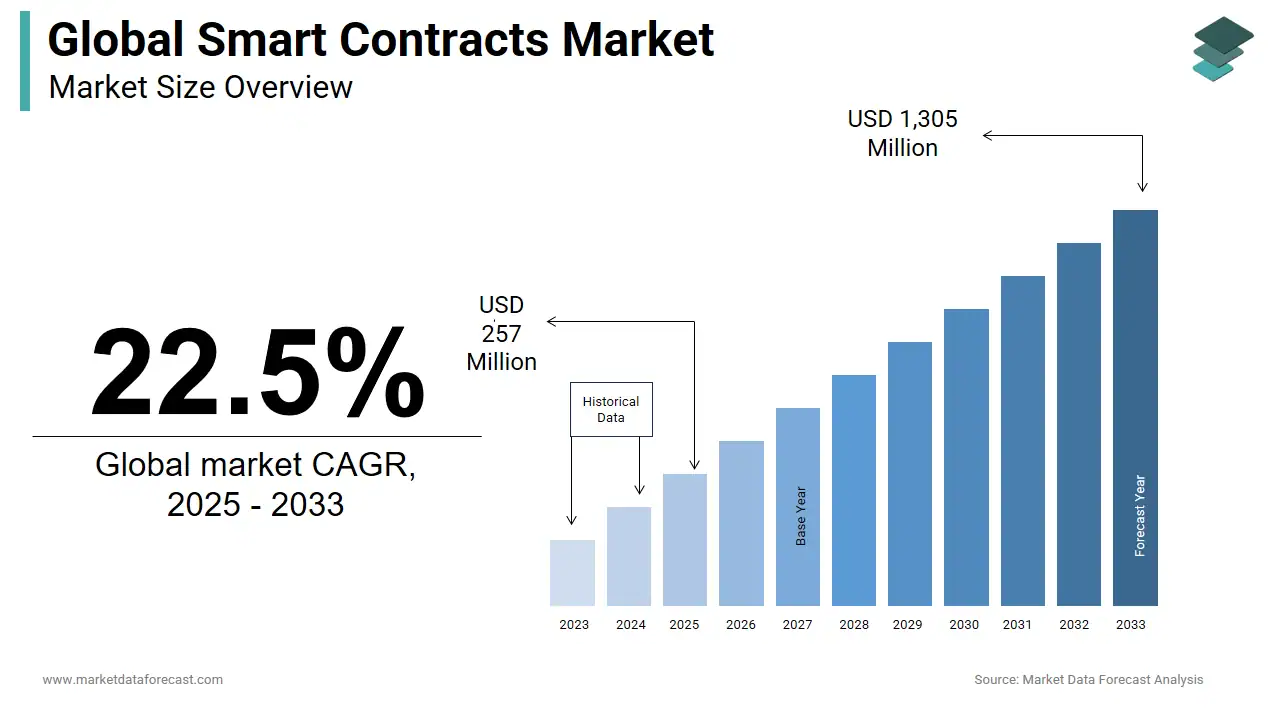

Global Smart Contracts Market Growth

- The global smart contracts market is projected to expand from $257 million in 2025 to $1.3 billion by 2033.

- This growth represents a strong compound annual growth rate (CAGR) of 22.5% over the forecast period.

- By 2027, the market value is expected to surpass $400 million, reflecting increasing adoption in financial and enterprise automation.

- By 2030, the sector could exceed $780 million, driven by blockchain integration in fintech and supply chain sectors.

- The sharp rise to $1.3 billion by 2033 underscores how smart contracts are becoming a mainstream technology for secure, automated digital agreements.

- North America and Europe are projected to lead growth, while emerging markets like Asia-Pacific and Latin America contribute new enterprise deployments.

- Rising DeFi adoption, tokenized assets, and enterprise-grade blockchain platforms remain key catalysts of this expansion.

Platform Insights

- Ethereum still dominates with ~70% share of smart contracts in 2025, thanks to its mature ecosystem and developer momentum.

- Binance Smart Chain now accounts for ~15% of smart contract deployments in 2025 due to its low fees and accessibility.

- Polygon saw a ~50% growth in adoption through 2025 as demand for scalable layer-2 solutions increased.

- Solana supports 8% of smart contracts in 2025, catering to use cases demanding high throughput.

- Around 70% of new platforms in 2025 are built with interoperability features to enable cross-chain collaboration.

- Enterprise blockchain platforms like Hyperledger increased adoption by ~20% in 2025, especially in private finance.

Blockchain Type Insights

- Public blockchains now power ~62% of smart contract deployments in 2025, maintaining dominance.

- Private blockchains represent ~25 – 30% of deployments in 2025 as enterprises emphasize control and security.

- Hybrid blockchains, such as Polkadot and Cosmos, have seen ~40% growth in adoption by 2025.

- Consortium blockchains still handle ~10% of deployments in 2025, especially in finance partnerships.

- Around 95% of organizations using private or hybrid chains in 2025 cite compliance as their main motivator.

- Permissionless (public) blockchains grew ~30% more in adoption in 2025 as decentralization gained favor.

AI Smart Contracts Transforming Business Efficiency

- Finance leads adoption with 40% share, using AI-driven smart contracts for automated settlements and DeFi systems.

- Supply Chain follows with 30%, leveraging smart contracts for real-time tracking and logistics transparency.

- Insurance holds 20%, adopting smart contracts for automated claims and fraud reduction.

- Healthcare accounts for 15%, applying smart contracts to secure patient data and streamline billing.

- Energy contributes 10%, focusing on decentralized energy trading and efficiency optimization.

Contract Type Insights

- Smart contract templates for trade finance have seen a ~50% surge in adoption by 2025, simplifying processes like letters of credit.

- Escrow agreements now account for ~20% of smart contract use cases in 2025, ensuring secure fund transfers.

- Over ~60% of companies in 2025 cite compliance automation contracts as critical to operations.

- Royalty and revenue-sharing contracts (notably in digital media) have increased by ~30% by 2025.

- Real estate contracts via tokenized property sales represent ~10% of deployments in 2025.

Enterprise Size Insights

- Large enterprises (10,000+ employees) now make up ~60% of smart contract usage in 2025, driven by scalability and cost efficiencies.

- SMEs experienced a ~35% adoption increase by 2025, leveraging smart contracts for leaner operations.

- Startups and fintechs contribute ~30% of deployments in 2025, reflecting their innovation focus.

- Enterprises with $1 billion+ in revenue are twice as likely to adopt smart contracts in 2025 compared to smaller firms.

- Over 80% of multinational corporations in 2025 plan to expand their blockchain and smart contract use.

- Adoption among mid-sized firms grew by ~45% by 2025, supported by access to BaaS platforms.

- Healthcare enterprises using smart contracts for records management increased by ~35% by 2025, illustrating cross-industry uptake.

Regional Insights

- North America leads with ~40% of smart contract activity in 2025, driven by US fintech innovations.

- Europe accounts for ~30% of deployments in 2025, emphasizing regulatory compliance and public blockchains.

- Latin America holds ~15% of global deployments in 2025, with use cases in digital identity and financial inclusion.

- Asia-Pacific grew by ~25% in adoption by 2025, propelled by fintech expansion in countries like India and Singapore.

- The Middle East saw a ~20% increase in adoption by 2025, fueled by blockchain-friendly policies in the UAE.

- Africa’s adoption remains emerging with ~10% year-on-year growth in 2025, especially in mobile banking and remittances.

- China, though constrained on public blockchains, maintains significant adoption through state-led blockchain projects in 2025.

End-Use Insights

- The banking sector leads smart contract adoption with ~48% of use cases in 2025.

- Insurance firms use about ~26% of smart contracts in 2025 for claims automation and fraud prevention.

- Supply chain applications saw ~22% growth in 2025, with companies integrating smart contracts for transparency and automation.

- The real estate industry represents ~15% of smart contract usage in 2025, focusing on tokenized sales and escrow services.

- Healthcare adoption rose by ~18% in 2025, leveraging smart contracts for secure data sharing and billing.

- In 2025, approximately 60% of fintech companies will adopt smart contracts to streamline lending, borrowing, and investment.

- Government sectors in 2025 are piloting smart contracts in recordkeeping and procurement in about 10% of projects.

Popular Use Cases of Smart Contracts in Fintech

- Peer-to-peer (P2P) lending platforms handled ~$15 billion in transactions via smart contracts by 2025.

- Automated insurance payouts now cut claim processing times by ~30% in 2025.

- Digital wallets integrated smart contracts for automated payments, representing ~25% of fintech use cases in 2025.

- Decentralized exchanges (DEXs) processed over $150 billion in trades via smart contracts by 2025.

- Microfinance platforms enabled ~15% greater accessibility via smart contracts in 2025.

- Tokenized asset management grew ~40% by 2025 through the use of smart contracts for managing digital and real assets.

- Cross-border payment solutions powered by smart contracts reduced remittance fees by ~25% in 2025.

Challenges and Barriers to Adoption

- Regulatory uncertainty remains a top barrier, with ~58% of businesses citing it in 2025 as a major challenge.

- Security vulnerabilities, including smart contract bugs, affected ~15% of deployments in 2025, causing financial losses.

- The scarcity of blockchain talent still persists, with ~45% of firms in 2025 struggling to recruit skilled developers.

- Scalability issues on leading public blockchains drove high transaction costs for ~20% of users in 2025.

- Integration challenges with legacy systems impacted ~30% of enterprises in 2025, slowing smart contract rollout.

- Interoperability concerns across blockchains were reported by ~40% of projects in 2025 as a barrier to asset transfers.

- Awareness and education gaps limited adoption in small businesses, with ~45% in 2025 saying they lacked understanding.

Recent Developments

- 85% of global financial institutions are now expected to adopt smart contracts in some form by 2025, signaling mainstream institutional uptake.

- Transaction volumes in permissioned networks and public rollups are forecast to grow 4×–8× from 2025 levels in high-activity sectors.

- Cross-chain and composability patterns are driving 30%–60% growth in multi-ledger smart contract deployments.

- In Ethereum, 59% of contract transactions involve multiple contract dependencies, highlighting architectural risk.

- Proposals in major markets are formalizing standards so that 24 billion+ in token value is secured via oracle networks like Chainlink’s CCIP across 50+ chains.

- Chainlink’s partnerships in 2025 with ICE and SBI accelerate on-chain data feeds and oracle use in institutional finance.

Frequently Asked Questions (FAQs)

About 85% of global financial institutions are expected to adopt smart contracts in some form by 2025.

Tokenized Treasury and money-market fund assets reached $7.4 billion in 2025, up about 80% YTD.

Total Value Locked across DeFi protocols sits at $123.6 billion in 2025, up 41% year over year.

In trade settlement workflows, financial institutions report about 40% faster settlement times using smart contracts in 2025.

Conclusion

The adoption of smart contracts in finance is not just a trend but a pivotal shift towards a more efficient and transparent future. With billions in transactions, rapid innovation across platforms, and increasing cross-industry applications, smart contracts are becoming indispensable in the financial world. However, challenges like regulatory uncertainty and integration hurdles must be addressed to unlock their full potential. The trajectory of smart contracts points to a transformative impact on global finance, making this an exciting era for technology and innovation.