Silver stands at a crossroads today. After years of relative stability, recent shifts in industrial demand, supply constraints, and investor interest have combined to push silver into the spotlight. From green energy installations to retail bullion demand, silver is reshaping markets, and this article examines the data behind that shift.

In real-world terms, manufacturers of solar panels rely on silver’s conductivity in photovoltaics, while investors increasingly view silver coins and bars as a hedge against macroeconomic uncertainty. Read on to explore the full statistical picture.

Editor’s Choice

- Global mine production in 2024 rose modestly to 819.7 Moz, up just 0.9% from the prior year.

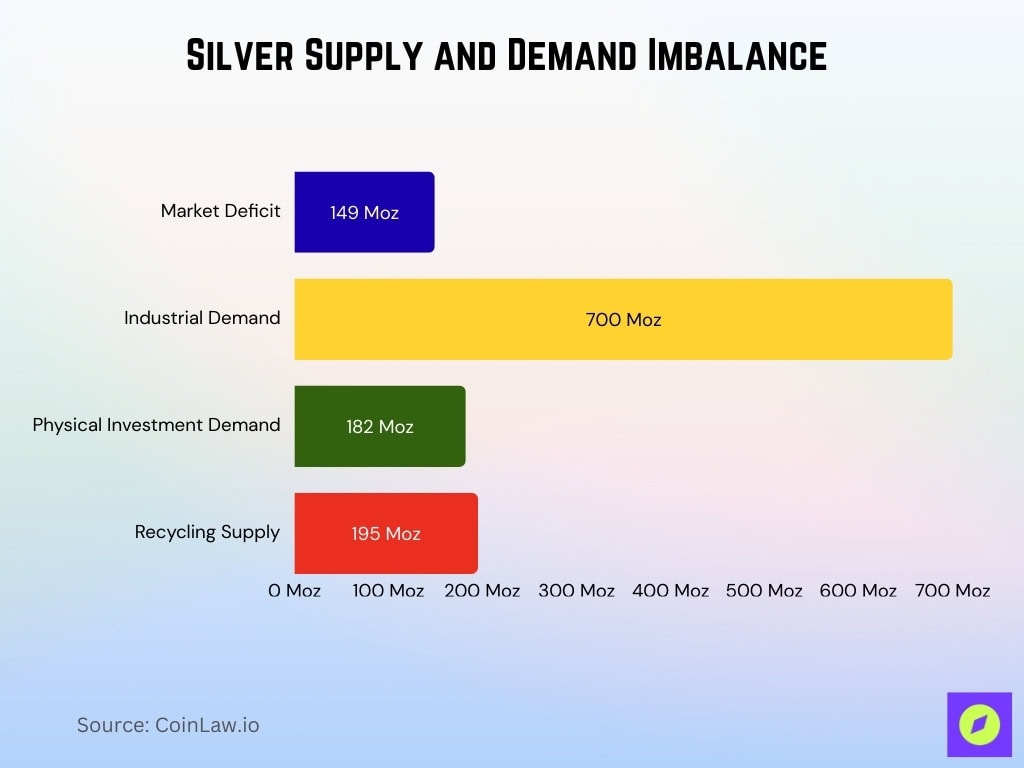

- The 2025 silver market is forecast to see a supply-demand deficit of roughly 149 Moz, marking a fifth consecutive year of shortfalls.

- For the first half of 2025, silver bullion prices climbed about 24.9%, following a 21.5% rise in 2024.

- Total global silver demand in 2024 is estimated at ≈ 1.21 billion ounces, among the highest on record.

- Physical investment in silver (bars and coins) in 2025 is projected at about 182 Moz, though this represents a drop compared with recent years.

Recent Developments

- Silver prices surged 102% year-to-date amid record highs above $61/oz.

- Global silver market faces 149Moz supply deficit, fifth consecutive year.

- Industrial demand expected to exceed 700Moz, up 3% year-over-year.

- Silver-backed ETPs saw 95Moz net inflows in the first half.

- Recycling supply rises to 195Moz, up 24.06%.

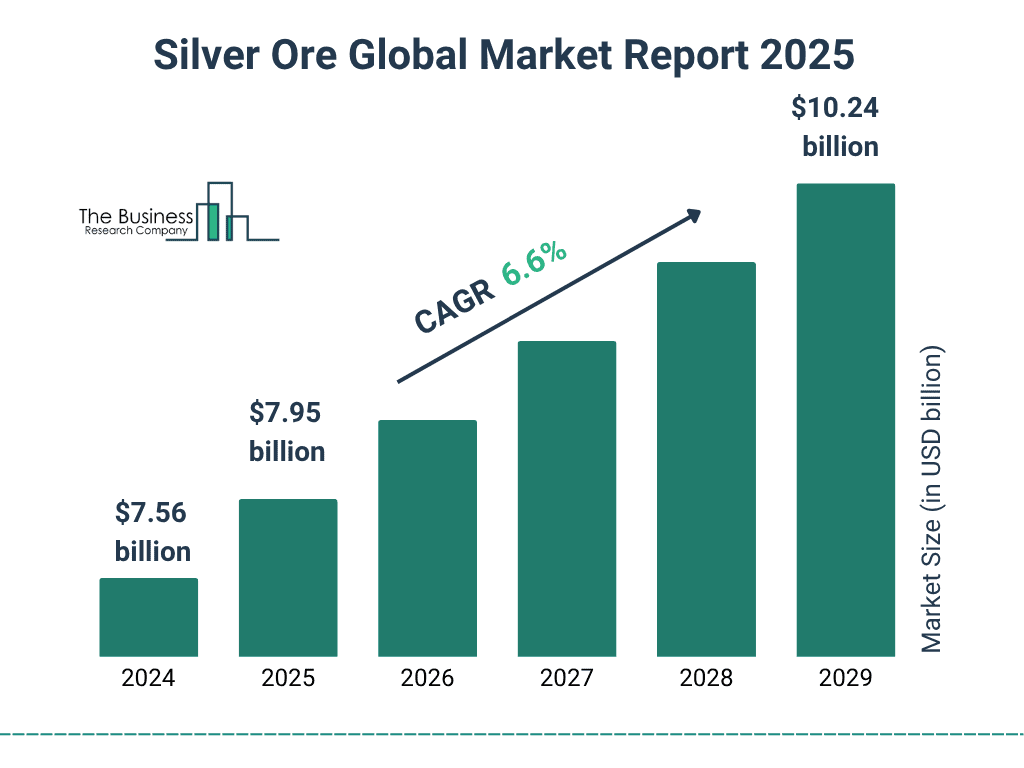

Silver Ore Market Size Growth

- The silver ore market is projected to reach $7.95 billion in 2025, showing steady growth.

- By 2026, the market size is expected to exceed $8.48 billion.

- The upward trend continues in 2027, with an estimated value of $9.05 billion.

- In 2028, the market is projected to rise to around $9.63 billion.

- By 2029, the global silver ore market is forecasted to hit $10.24 billion.

- This represents a compound annual growth rate (CAGR) of 6.6%, signaling robust demand and expansion in the sector.

Silver Price Performance

- In early 2025, silver bullion gained roughly 24.94%, after a 21.46% gain in 2024.

- That rally reflects growing investor interest, structural supply deficits, and strong industrial demand, not just speculative buying.

- Market analyses point out that total supply has trended lower over the past decade, from ~1.07 billion ounces in 2010 to an estimated 1.03 billion ounces in 2024.

- This long-term contraction adds structural support for price, even if demand dips temporarily.

- Silver’s dual identity, as both an industrial commodity and a precious metal, means price swings may be sharper than for metals used mainly for investment (like gold).

Global Mine Production

- Global silver mine production in 2024 was about 820 Moz, led by Mexico with roughly 24% of output, while 2025 forecasts cluster in the 835–844 Moz.

- Total silver supply hits 1.05 billion ounces, the highest in 11 years.

- Mine output from the US, Peru, and India totals 183.7Moz, 19.5% of global.

- Recycling supply projected at 195Moz, up 24.06%.

- By-product from gold mines rises while base metal output stays flat.

- China production grows to 119.1Moz from base metal, gold operations.

- Hecla’s Keno Hill, Gold Fields’ Salares Norte ramp-up boost output.

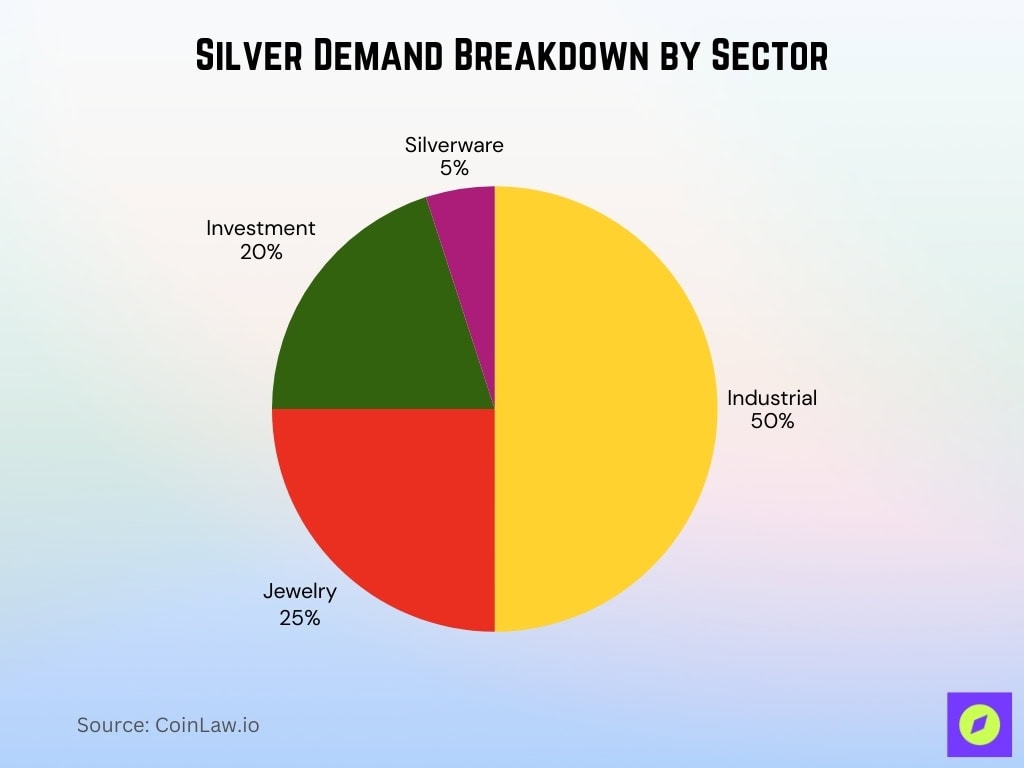

Silver Demand Breakdown by Sector

- Industrial applications account for 50% of global silver demand, dominating usage due to electronics, solar, and manufacturing needs.

- Jewelry represents 25% of total demand, reflecting silver’s continued popularity in the luxury and fashion sectors.

- Investment demand stands at 20%, including physical silver bars, coins, and ETFs held by investors.

- Silverware comprises the smallest segment at 5%, indicating a niche but steady demand in traditional markets.

Physical Investment Volumes

- Industrial demand for silver reached a record 680.5 Moz in 2024, a 4% increase over the previous year.

- The 2024 total demand-over-supply gap resulted in a structural deficit of 148.9 Moz.

- Between 2021 and 2024, the cumulative deficit reached approximately 678 Moz, equivalent to about 10 months of global mine production in 2024.

- For 2025, estimates suggest total demand could decline by ~4% to around 1.12 billion ounces, even as industrial demand holds steady.

- Despite that projected decline, the market is still forecast to remain in deficit in 2025, marking a fifth consecutive year of shortfalls.

- Another 2025 forecast pegs the deficit at around 117.6 Moz, reflecting a ~2% increase in total supply but only a modest drop in demand.

- Given this tight supply, many investors and funds are increasing their holdings, which further reduces the liquid silver available for other uses.

Regional Demand Leaders

- U.S. investors purchased 1.5 billion ounces of silver from 2010-2024.

- India’s silver imports drop 42% to 2,580 metric tons first eight months.

- U.S., India, Germany, and Australia account for 80% global bars/coins demand.

- Australia silver demand surges from 3.5Moz in 2019 to 20.7Moz in 2022.

- India silver ETFs record ₹17.59-19.04 billion inflows in July-August.

- Germany favors coins at 80% of the total silver investment demand.

- India silver imports fall 42% to 3,302 tons amid ETF surge.

Supply and Demand Deficit

- Market deficit projected at 149Moz, fifth straight year of shortfall.

- Industrial demand surges to exceed 700Moz, widening the gap.

- Physical investment demand drops to 182Moz, down 4%.

- Recycling contributes 195Moz, up 24% but insufficient.

- Total demand forecasted at 1.20 billion ounces against a tight supply.

- Supply growth is limited to 3-5% despite mining ramps.

- By-product constraints shrink supply amid 102% price surge.

- Jewelry demand softens, offset by a 3.4% automotive CAGR.

Top Silver Mining Stocks

- Pan American Silver delivers a 119.4% one-year return.

- Coeur Mining surges 174% year-to-date with 80.77% Q2 output growth.

- Silvercorp Metals posts 147.9% gain, current ratio 5.1x.

- Hecla Mining reports 45Moz silver, revenues $304 million in Q2.

- First Majestic Silver boosts production 75.94% to 3.7Moz Q2.

- Americas Gold and Silver increases output 36% year-over-year in Q2.

- Avino Silver & Gold Mines achieves 455% year-to-date gain.

- Southern Copper grows 13.8% to 5.44Moz in Q1.

- Fresnillo leads with 12.4Moz Q1 production despite -8.15% dip.

Investment Methods Overview

- Physical silver bars and coins demand totals 182Moz, down 4% year-over-year.

- U.S., India, Germany, and Australia claim 80% of global physical investment.

- Silver-backed ETPs record 95Moz net inflows through mid-year.

- Mobile silver inventory has drawn down by 1.1 billion ounces since 2019.

- U.S. silver use allocates 30% to bars 29% to electronics.

- Global ETP holdings rise 12% amid 149Moz market deficit.

- Mining equities deliver 119-174% returns for top performers.

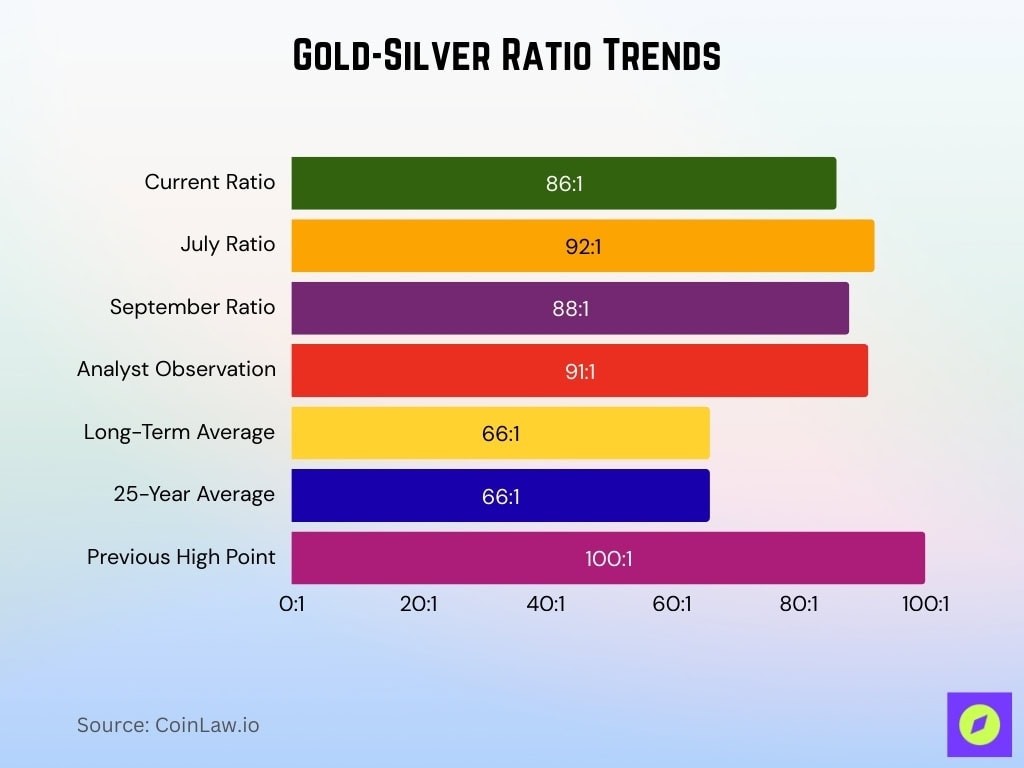

Gold Silver Ratio Analysis

- The current gold-silver ratio stands at 86:1, down from 100:1 earlier.

- Ratio at 92:1 in July, 40% above the 25-year average of 66:1.

- Historical average near 67:1, mid-2025 levels imply silver undervaluation.

- September ratio hits 88:1, signaling a silver discount to gold.

- Elevated 91:1 cited by analysts for silver upside potential.

- Ratio deviation 39% above the long-term mean of 66:1.

- On a volume basis, global silver mining output is approximately 7 times higher than that of gold.

Future Market Outlook

- Global silver supply rises 3% to 1.05 billion ounces.

- Total demand projected at 1.12 billion ounces, down 4%.

- Market deficit estimated at 206Moz, fifth consecutive year.

- Industrial demand sustains growth amid 149Moz overall shortfall.

- Price forecasts target $62/oz despite weaker segments.

- Cumulative 2021-2025 deficit reaches 796Moz.

- Supply growth is limited by 2% mine production.

- Long-term PV demand drives 3% industrial uptick.

- ETP inflows hold at 95Moz, supporting tightness.

Frequently Asked Questions (FAQs)

Demand is expected to drop by about 4% to 1.12 billion ounces in 2025.

Bar and coin demand is forecast to be 182 million ounces in 2025.

The 2025 silver market is on track for a deficit of around 149 million ounces.

Silver-backed ETPs saw net inflows of approximately 95 million ounces by mid‑2025.

Conclusion

The silver market sits at a critical inflection point. Industrial demand remains strong, physical investment continues to concentrate in key regional hubs, and supply constraints, driven by silver’s status as a byproduct and limited mining expansion, create persistent structural deficits. As a result, silver offers a compelling combination, potential upside from supply-demand imbalance, exposure to green energy and technology growth, and diversity across investment methods (physical metal, ETPs, mining equities). Long-term investors willing to ride volatility may find silver a valuable addition to a diversified portfolio.