In the world of crypto, trust is a currency. For early adopters and seasoned investors alike, the thrill of decentralized finance (DeFi) often comes with a silent question: Is this project safe?

Just ask Jenna, a small business owner from Texas. In late 2023, she invested in what seemed like a promising decentralized exchange. Overnight, the developers vanished, and her funds were gone. What she had encountered was a rug pull, one of the most prevalent scams in today’s crypto ecosystem. Jenna’s story isn’t unique; it’s echoed in thousands of wallets worldwide.

As crypto continues to innovate, so do bad actors. This article breaks down the latest rug-pull and Ponzi scheme statistics, helping you navigate this volatile yet exciting space with caution and clarity.

Editor’s Choice

- Rug pulls alone accounted for 65% of all DeFi scams last year.

- 70% of rug pull victims were retail investors, most investing less than $10,000.

- The average time it takes for a rug pull to unfold is now 12 days, down from 21 days in 2023.

- Soft rug pulls have increased by 35%, outpacing hard rug pulls in 2025.

- The United States remains the most targeted country, accounting for 40% of all Ponzi-related crypto losses.

- Regulatory enforcement actions on crypto Ponzi schemes increased by 48% globally compared to 2023.

Overview of Rug Pulls and Ponzi Schemes in Crypto

Rug pulls and Ponzi schemes are the most common types of scams plaguing the cryptocurrency market today. While they differ in mechanics, both rely on misleading investors and eventually stealing funds.

- As of Q1 2025, rug pulls make up 68% of all crypto-related scams, with Ponzi schemes contributing 22%.

- In 2024, over 350 crypto rug pulls were documented globally, a 15% rise from 2023.

- Ponzi schemes in crypto have defrauded over 2.3 million people worldwide as of 2025.

- More than $6.7 billion has been siphoned off through Ponzi schemes since 2020.

- Decentralized Finance (DeFi) platforms are the most common hunting grounds, with 82% of rug pulls targeting DeFi tokens.

- 72% of crypto Ponzi schemes promote fake staking or yield farming opportunities.

- 76% of rug pulls involve tokens launched on Binance Smart Chain (BSC) due to its lower listing costs and less stringent vetting process.

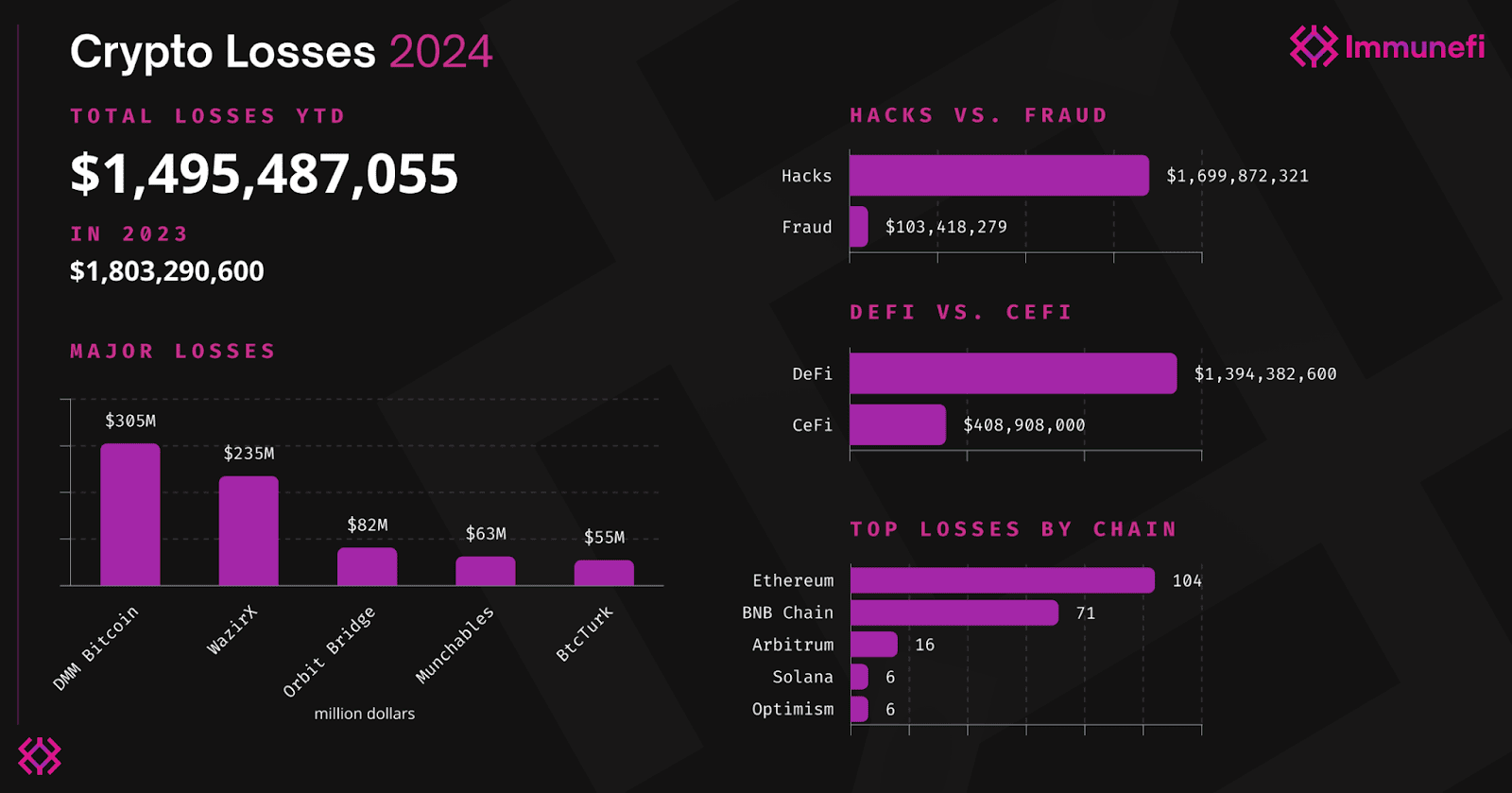

Crypto Losses

- Total Losses YTD (2024): $1.49 billion, reflecting significant impacts on the crypto ecosystem.

- 2023 Total Losses: Higher, at $1.80 billion, indicating a slight decrease in 2024 so far.

Major Incidents

- DMM Bitcoin: Suffered the largest single loss of $305 million.

- WazirX: Lost $235 million.

- Orbit Bridge: Experienced losses of $82 million.

- Munchables: Faced losses of $63 million.

- BtcTurk: Reported a $55 million loss.

Hacks vs. Fraud

- Hacks: Account for the vast majority of losses, totaling $1.70 billion.

- Fraud: Significantly lower but still notable at $103.4 million.

DeFi vs. CeFi

- DeFi platforms: Bear the brunt of losses, with $1.39 billion lost.

- CeFi platforms: Reported losses stand at $408.9 million.

Top Blockchains Impacted

- Ethereum: Leads with 104 incidents.

- BNB Chain: Follows with 71 incidents.

- Arbitrum: Logged 16 incidents.

- Solana & Optimism: Both recorded 6 incidents each.

Rug Pulls: The Latest Innovation in Scamming

Rug pulls have evolved from simple “exit scams” to more elaborate and deceptive schemes, utilizing advanced tactics that make them harder to detect until it’s too late.

- In 2025, flash loan attacks have been used in 18% of rug pulls to inflate token values artificially.

- Soft rug pulls (where founders drain liquidity over time) rose by 33% between 2024 and 2025.

- Liquidity locking promises were broken in 45% of the rug-pull cases in the last 12 months.

- Developers using anonymous identities were behind 92% of successful rug pulls in 2025.

- 30% of rug pulls involved a pre-sale scam, where tokens are never listed on an exchange post-launch.

- AI-generated whitepapers and fake audits were featured in 27% of rug pull scams last year.

- The average amount stolen per rug pull increased from $410,000 in 2023 to $510,000 in 2025.

- NFT rug pulls are now a notable trend, making up 14% of all rug pulls in 2025.

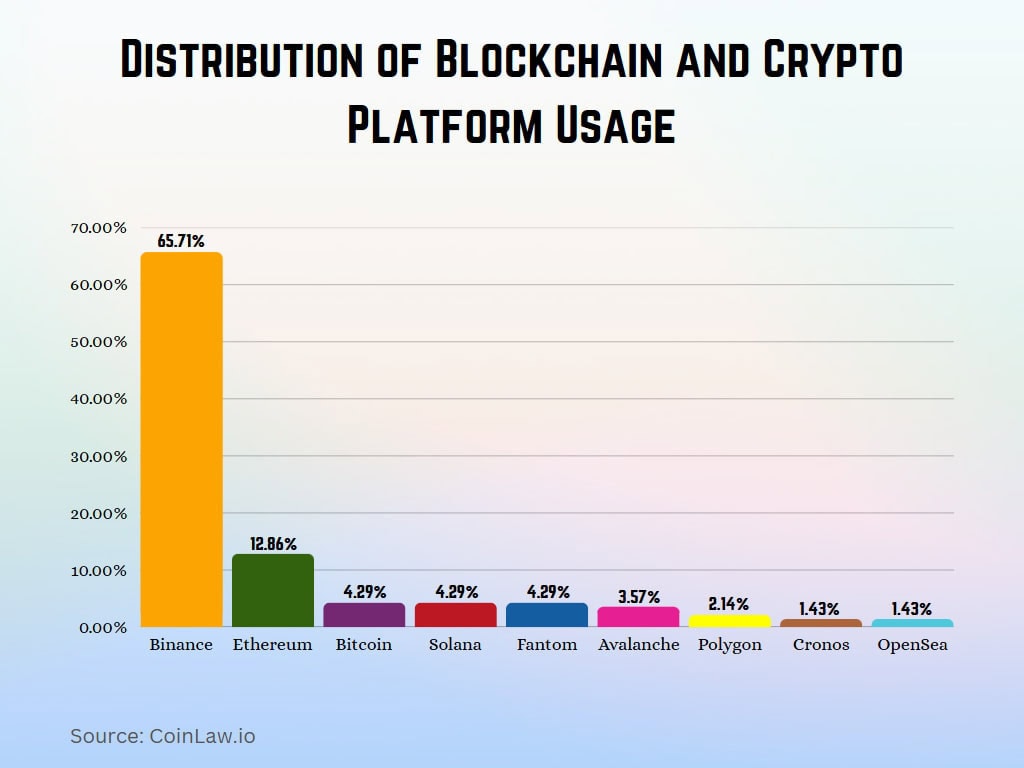

Distribution of Blockchain and Crypto Platform Usage

- The Binance Smart Chain dominates the space with a massive 65.71% share, indicating its strong preference among users and developers.

- Ethereum holds the second-largest share at 12.86%, maintaining its position as a leading platform for decentralized applications and smart contracts.

- Bitcoin, traditionally known as a store of value, represents 4.29% of the usage in this distribution.

- Solana and Fantom also both capture 4.29% each, reflecting growing interest in faster and more scalable blockchain solutions.

- Avalanche accounts for 3.57%, showing steady traction as an alternative Layer 1 blockchain.

- Polygon, known for its Layer 2 scaling solutions for Ethereum, has a 2.14% share.

- Cronos and OpenSea each hold 1.43%, highlighting their niche yet important roles in the blockchain ecosystem.

Rug Pulls in the Crypto Market

Rug pulls continue to undermine investor confidence in the crypto space. These statistics highlight their scope and impact in 2024 and 2025.

- $3.4 billion was lost to rug pulls in 2024, a 22% increase from 2023.

- More than 58% of rug pulls in 2024 happened on decentralized exchanges (DEXs) like Uniswap and PancakeSwap.

- 75% of projects with unaudited smart contracts were identified as rug-pull scams.

- On average, rug pull scams attract 2,100 investors before disappearing.

- BSC (Binance Smart Chain) hosted 71% of rug pull scams due to its ease of use and lower fees.

- Ethereum was the second most popular chain for rug pulls, accounting for 19% of cases.

- Investors under the age of 35 make up 63% of rug-pull victims.

- Social media promotions drive 80% of rug-pull investor traffic, particularly through Telegram, Twitter, and Discord.

- In 2025, 31% of rug pulls involved projects claiming to offer real-world utility or metaverse integrations.

- The largest single rug pull of 2025 so far drained $290 million from investors in a DeFi project dubbed “MetaYield Farm”.

Destination of Funds Leaving Investment Scam Addresses (2017 – 2025)

- In 2017, over 55% of scam funds were sent to Exchanges, with a significant portion going to Unnamed Services.

- 2018 followed a similar pattern, with Exchanges maintaining dominance and Unnamed Services receiving substantial transfers.

- By 2019, Exchanges still captured the majority, but there was a noticeable increase in funds moving to Illicit destinations and Unnamed Services.

- The year 2020 saw Illicit destinations rise sharply, accounting for a large share, while DeFi platforms appeared for the first time as a destination for scam funds.

- In 2021, DeFi platforms grew in importance, and Unnamed Services saw a sharp decline, while Exchanges continued to dominate fund destinations.

- In 2022, Exchanges still accounted for 60% of scam fund destinations, but DeFi platforms grew to 10%, and Illicit services rose to 15%.

- The year 2023 marked a shift, with Exchanges dropping to 55% as regulatory pressures increased. DeFi platforms climbed to 15%, and Illicit services reached 20%.

- By 2024, Exchanges further declined to 50%, while DeFi platforms surged to 25%, reflecting their increased usage by scammers due to their decentralized and anonymous nature.

- 2025 projections indicate Exchanges could fall to 45%, while DeFi platforms might rise to 30% as they become the preferred destination for scam proceeds. Illicit services are expected to hold steady at 15%.

Hard Rug Pulls vs Soft Rug Pulls

Understanding the distinction between hard and soft rug pulls is crucial for identifying risk early. Both are dangerous, but their methods differ.

- Hard rug pulls (instant liquidity removal) accounted for 55% of rug pull cases in 2025.

- Soft rug pulls, which involve gradually reducing token value or draining funds, make up 45% of cases.

- The average duration of a soft rug pull is 8 months, compared to less than 24 hours for hard rug pulls.

- Soft rug pulls frequently rely on overhyped roadmaps and false partnerships; 62% of soft rug pulls in 2024 made such claims.

- Soft rug pulls resulted in $1.2 billion in investor losses in 2024 alone.

- Hard rug pulls usually occur within 7 days of project launch in 38% of cases.

- Soft rug pull victims tend to reinvest in other projects faster; 47% return to the market within 3 months.

- Deceptive tokenomics, such as hidden minting functions, are present in 36% of hard rug pull cases.

- 2025 data shows NFT soft rug pulls increasing by 29%, with founders disappearing after delivering incomplete products.

Notable Rug Pull Incidents and Their Impact

The crypto market has seen some devastating rug pulls over the past few years. Each incident not only resulted in staggering financial losses but also eroded investor trust in DeFi projects.

- The Thodex exchange rug pull in 2021 saw the founder flee with over $2 billion, affecting 391,000 users in Turkey.

- AnubisDAO, an Ethereum-based DeFi project, vanished with $60 million in investor funds in under 24 hours in 2021.

- In 2023, the Squid Game Token rug pull scammed over $3.38 million from investors after gaining media hype on Twitter.

- MetaYield Farm, the largest rug pull of 2025, drained $290 million from more than 14,000 participants before disappearing.

- The Safuu protocol collapsed in 2024, with investors losing $50 million after liquidity was suddenly removed.

- Zookeeper Finance, launched on Binance Smart Chain, executed a soft rug pull in 2024, slowly draining over $12 million.

- DeFi100, a high-profile scam, posted a taunting message to investors after exiting with $32 million in 2022.

- In 2025, BabyMusk Coin vanished shortly after launch, stealing $5.5 million through a manipulated token dump.

- The Pixelmon NFT project, despite raising $70 million in 2022, delivered low-quality assets and disappeared, an example of an NFT soft rug pull.

The Number of Detected Smart Ponzi Schemes and Scores (Probability)

- The majority of detected smart Ponzi schemes scored in the 0.9 ~ 1.0 probability range, with a count of 210, representing the highest confidence detections.

- 77 schemes fall into the 0.7 ~ 0.8 range, indicating moderately high probability scores.

- Lower confidence ranges like 0.5 ~ 0.6 and 0.6 ~ 0.7 contain 38 and 28 detections, respectively.

- The 0.8 ~ 0.9 range includes 33 schemes, showing a slight drop before the significant peak at the highest probability.

Worst Rug Pulls in Crypto History

Certain rug pulls have become cautionary tales, not just for their financial damage but also for their audacity and impact on the crypto community.

- OneCoin remains the largest crypto Ponzi scheme to date, defrauding investors out of $4.4 billion globally by 2017.

- PlusToken, a wallet scam that promised high yields, defrauded users of $2 billion before its collapse in 2019.

- The Thodex rug pull, mentioned earlier, still holds the record for the largest centralized exchange exit scam.

- WoToken, an offshoot of PlusToken, lured investors with AI-driven trading promises and stole $1 billion in 2020.

- The BitConnect scheme, often mocked for its infamous marketing, scammed users out of $1 billion before collapsing in 2018.

- Carpediem Coin vanished in 2020 after collecting $15 million, leaving investors with worthless tokens and no recourse.

- PolyWhale Finance, a yield farm on Polygon, was drained of $1 million by its developers in 2021.

- Uranium Finance exploited a smart contract vulnerability to steal $50 million from users in 2021, leading many to speculate on an inside job.

- The Compounder Finance DeFi project rug pulled $12.5 million from investors in late 2020, exploiting backdoor functions in their code.

- Meerkat Finance, another DeFi project, saw $31 million disappear within one day of launch on the Binance Smart Chain in 2021.

Ponzi Scheme Detection in Ethereum Transaction Network

- The two most critical features for detecting Ponzi schemes are count_in and count_out, with feature importance scores of 20 and 19, respectively. These indicate that the number of incoming and outgoing transactions plays a major role in identifying fraudulent activity.

- values_max_in, representing the maximum incoming transaction value, holds a significant importance score of 15, highlighting its role in spotting large, potentially suspicious deposits.

- lifetime_in, which measures the active lifespan of incoming transactions, is another key indicator with an importance score of 13.

- values_sum_in, the total incoming transaction value, also stands out with a score of 11, emphasizing the cumulative value flow into suspect accounts.

- Features like lifetime_out (score: 8) and values_min_out (score: 6) suggest that both the outgoing transaction patterns and minimum transaction amounts can signal Ponzi behavior.

- Less influential, yet still noteworthy, are features such as values_mean_out (score: 4), values_min_in and values_max_out (both around 3), and values_std_in/values_std_out (each with a score of 2).

- The least impactful feature is values_mean_in, with an importance score of just 1, suggesting that the average incoming transaction value has a minimal effect on Ponzi detection models.

Ponzi Scheme Prevalence in the Crypto Industry

Ponzi schemes in the crypto space continue to evolve. Many scammers use familiar tactics, promising outsized returns, while cloaking their schemes in complex DeFi or staking products.

- As of 2025, 22% of reported crypto scams were Ponzi schemes, targeting both retail and institutional investors.

- Staking scams account for 48% of modern crypto Ponzi schemes, often disguised as legitimate DeFi yield farming.

- In 2024, 1.7 million individuals globally fell victim to crypto Ponzi schemes.

- The average promised return for crypto Ponzi schemes in 2025 is 35% APY, luring in risk-tolerant investors.

- Telegram and WhatsApp groups are the primary recruitment channels for 67% of Ponzi schemes in the crypto industry.

- Smart contract-based Ponzi schemes make up 29% of all crypto Ponzi activity, with Forsage being a notable example.

- Chain referral programs account for 40% of crypto Ponzi structures, rewarding early investors to encourage recruitment.

- Asia-Pacific is the most targeted region for crypto Ponzi schemes, accounting for 41% of victims in 2024.

- North America accounts for 27% of Ponzi-related losses, with the United States leading in reported cases.

- NFT Ponzi schemes have increased by 30% since 2023, often involving promises of metaverse land or exclusive digital assets.

Financial Losses Attributed to Crypto Scams

The financial toll of crypto scams, particularly rug pulls and Ponzi schemes, is staggering. The numbers keep climbing as scammers exploit new technologies and trends.

- Rug pulls alone caused $3.4 billion in losses in 2024, with Ponzi schemes contributing $2.5 billion.

- DeFi platforms accounted for 72% of all crypto scam losses in 2024.

- The average loss per victim in rug-pull scams was $9,800 in 2024.

- In 2025, corporate investors lost over $500 million in a single rug pull involving XToken Finance.

- Institutional losses in crypto Ponzi schemes rose by 18% in 2024, with venture capital funds often misled by fake due diligence.

- 95% of financial losses in crypto scams are unrecoverable due to the anonymity of blockchain transactions.

- In 2024, only 6% of stolen funds were recovered through legal actions or technical exploits.

- Losses from NFT rug pulls totaled $450 million in 2024, marking a 35% increase year over year.

- The largest individual victim loss in 2024 was $19.3 million, invested in an elaborate Ponzi scheme called EcoStake Network.

Most Targeted Cryptocurrencies and Platforms

Some cryptocurrencies and platforms are more frequently exploited by scammers due to their popularity, ease of use, and lower security barriers.

- Binance Smart Chain (BSC) was involved in 72% of rug pulls in 2024 due to its low transaction fees and lax vetting processes.

- Ethereum accounted for 19% of scam tokens and Ponzi schemes, particularly in DeFi projects.

- Solana saw a 37% increase in scam activity in 2024, mostly due to its rise in NFT popularity.

- Polygon (MATIC) was the fourth most targeted chain, linked to 7% of rug pulls and Ponzi projects in 2024.

- PancakeSwap, a decentralized exchange on BSC, was the launchpad for 60% of tokens involved in rug pulls.

- Uniswap, despite being audited and more secure, was the starting point for 12% of all DeFi scams.

- Metamask wallets were the most targeted in phishing scams related to Ponzi projects, responsible for 65% of wallet drains in 2024.

- Telegram is the communication channel for 80% of fraudulent crypto projects, with fake communities luring investors.

- NFT marketplaces, especially OpenSea and Magic Eden, reported 150+ scam collections linked to Ponzi and rug pull schemes in 2024.

- TRON-based Ponzi schemes have increased 20% year over year due to low fees and fast transactions, with scams like Forsage operating on its network.

US Dollar vs. Bitcoin: Is Money a Ponzi Scheme?

Neither the US Dollar nor Bitcoin offers high, guaranteed returns.

- US bonds are considered “risk-free” but offer low returns.

- Bitcoin is risky and provides no guaranteed returns.

The US Dollar depends on new participants to fund its government debt, while Bitcoin can operate independently of its adoption rate.

There is no deception in the value structure of either system:

- The US Dollar system is transparent, though often misunderstood.

- Bitcoin is fully transparent and open-sourced.

Issuance control differs greatly:

- The US Dollar is centralized, issued by the Federal Reserve.

- Bitcoin is decentralized, controlled by a distributed network.

Performance comparison is striking:

- The US Dollar has lost 96% of its purchasing power since 1913.

- Bitcoin has delivered an average annual return of +80% over the past 10 years.

Geographic Distribution of Crypto Rug Pulls and Ponzi Schemes

Crypto scams don’t discriminate by geography, but certain regions have emerged as hotspots for rug pulls and Ponzi schemes due to factors like regulation gaps, crypto adoption rates, and investor demographics.

- In 2024, the United States led in reported crypto rug pulls and Ponzi schemes, accounting for 40% of global cases.

- Southeast Asia follows closely, being responsible for 25% of scam incidents in 2024, especially in countries like Vietnam and the Philippines.

- Europe accounted for 15% of reported cases, with Germany and France being the most affected nations.

- Latin America, led by Brazil and Argentina, represented 12% of crypto scam cases in 2024.

- Africa, while an emerging market, saw 6% of global crypto scams, with Nigeria experiencing the majority of Ponzi-related losses.

- The Middle East experienced a 17% year-over-year increase in crypto scam incidents, especially in the UAE and Turkey.

- China, despite strict crypto regulations, saw 8% of global crypto Ponzi activity conducted through underground platforms in 2024.

- India ranked fifth in Ponzi scheme prevalence, with $570 million in reported losses during 2024.

- Cross-border scams are increasing; 32% of Ponzi schemes investigated in 2024 operated in multiple regions simultaneously.

- Eastern Europe, particularly Russia and Ukraine, has become a hub for launching fraudulent crypto projects targeting Western investors.

Regulatory Actions and Legal Cases Against Crypto Scams

Governments and regulatory bodies have intensified their efforts to clamp down on fraudulent crypto activities, though enforcement often lags behind the pace of innovation.

- In 2024, the US Securities and Exchange Commission (SEC) initiated 110 enforcement actions targeting crypto scams, a 35% increase from 2023.

- The Commodity Futures Trading Commission (CFTC) filed 34 new cases against crypto Ponzi operators in 2024, seizing over $450 million in assets.

- Europol coordinated the arrest of 20 individuals linked to cross-border Ponzi schemes that defrauded investors of $400 million.

- The Financial Conduct Authority (FCA) banned 87 crypto firms from operating due to suspected fraudulent activity in 2024.

- In India, authorities froze $240 million in crypto assets tied to Ponzi schemes through enforcement by the Enforcement Directorate (ED).

- Interpol issued 18 red notices for crypto scam masterminds involved in multi-million dollar rug pulls and Ponzi schemes in 2024.

- Regulatory fines on crypto companies for inadequate Know Your Customer (KYC) procedures reached $150 million in 2024.

- South Korea’s government proposed new crypto regulations in 2025, mandating smart contract audits for DeFi projects before launch.

- Australia’s ASIC took action against 22 entities operating illegal crypto Ponzi schemes in 2024, resulting in 10 criminal convictions.

- Legal recovery for scam victims remains limited; only 5% of stolen funds were recovered via legal processes in 2024, with most jurisdictions lacking comprehensive frameworks.

Emerging Trends in Crypto Fraud Prevention

While scams continue to evolve, so do the tools and strategies aimed at preventing them. Here are the latest innovations in crypto fraud prevention as of 2025.

- AI-powered fraud detection systems now monitor 70% of DeFi projects, flagging suspicious behavior in real time.

- Decentralized autonomous organizations (DAOs) focused on scam prevention have grown by 25% in 2024, leading community-driven investigations.

- On-chain analytics tools like Chainalysis and Elliptic helped recover over $480 million in stolen funds in 2024.

- Multi-sig wallets are required for 65% of DeFi protocol treasury management, reducing insider rug-pull risks.

- Bug bounty programs have paid out over $120 million to ethical hackers identifying vulnerabilities in 2024, preventing potential exploits.

- Smart contract audit firms like CertiK and Hacken audited 1,800 crypto projects in 2024, a 40% increase from 2023.

- Reputation scoring systems for crypto developers have been integrated into 20% of decentralized exchanges, improving trust indicators.

- Layer-2 solutions implementing fraud-proof mechanisms are rising, with Arbitrum and Optimism leading adoption in 2025.

- NFT verification tools reduced counterfeit NFT scams by 18% in 2024, enhancing buyer confidence in platforms like OpenSea.

- Educational initiatives from platforms like Binance Academy and Coinbase Learn have trained 5 million users in crypto scam avoidance as of 2025.

Role of Blockchain Transparency in Detecting Scams

Blockchain technology itself offers transparency and immutability, which can be used as powerful tools in identifying and preventing scams.

- Blockchain explorers like Etherscan are used in 85% of forensic investigations into rug pulls and Ponzi schemes.

- Public ledger visibility allowed analysts to trace $1.3 billion in stolen funds in 2024 back to their sources.

- Transparency in DeFi protocols offering real-time liquidity data helped reduce rug pulls by 21% in 2024.

- Immutable smart contracts, when properly audited, reduce backdoor vulnerability by 80%, making them safer for investors.

- Proof of Reserves is now adopted by 60% of centralized exchanges, providing greater transparency in user fund management.

- Zero-knowledge proof (ZKP) technologies are being piloted to offer both privacy and verification, balancing transparency with confidentiality.

- Public blacklists, maintained by platforms like MetaMask and Phantom, automatically flag wallets associated with known scams.

- On-chain governance voting records now offer clearer accountability, reducing the potential for project founders to act unilaterally.

- Token lock audits, viewable on-chain, have become standard in 40% of new DeFi project launches as of 2025.

- Community-powered whistleblowing DAOs helped expose 12 major rug-pull schemes in 2024, showcasing blockchain’s role in scam detection.

Expert Predictions on the Future of Crypto Scams

Industry experts agree that as the crypto industry evolves, so too will the tactics of bad actors. But they also foresee stronger defenses and smarter investors ahead.

- By 2027, experts predict rug pulls will account for less than 40% of all crypto scams, thanks to improved vetting and audits.

- Ponzi schemes are expected to become more sophisticated, often integrating AI-generated content and deepfake videos to build trust.

- The rise of Decentralized Identity (DID) systems could curb anonymous scam launches by 30% by 2026.

- NFT scams will shift toward utility-based Ponzi schemes, offering false promises of metaverse land and staking benefits.

- Cross-chain scams are projected to increase by 50%, exploiting bridges and interoperability gaps between blockchains.

- Central Bank Digital Currencies (CBDCs) may create new scam opportunities by 2027, particularly in under-regulated markets.

- Experts predict that smart contract insurance offerings will grow by 40%, compensating victims of verified smart contract failures.

- Quantum-resistant cryptography is expected to protect assets against potential future hacks starting in 2028.

- Regulatory sandboxes, already implemented in Singapore and the UAE, are expected to expand to 25+ countries by 2026, improving scam oversight.

- AI-driven KYC/AML solutions are forecasted to become standard for 90% of exchanges by 2027, automating fraud detection.

Recent Developments in Rug Pulls and Ponzi Schemes

The landscape of crypto fraud is constantly shifting. Here are the most notable developments in 2025 so far.

- In February 2025, MetaYield Farm executed the largest rug pull of the year, stealing $290 million before vanishing.

- BlockScan, an on-chain analytics firm, launched ScamWatch, a real-time monitoring tool now used by 50+ DeFi platforms.

- The Polygon Network saw a 15% rise in Ponzi schemes disguised as staking programs in early 2025.

- Interpol arrested five individuals in Dubai linked to a $210 million cross-border Ponzi scheme in March 2025.

- Chainalysis reported that 40% of funds stolen in 2024 rug pulls were moved through Tornado Cash or similar mixers.

- CertiK released an AI auditing tool that reduces smart contract audit time by 60%, leading to faster scam detection.

- The Crypto Fraud Task Force, a multinational initiative, recovered $380 million in stolen funds in Q1 2025 alone.

- NFT platform Blur suspended 75 projects flagged as Ponzi schemes offering false staking rewards.

- South Korea implemented a crypto scam victim fund, compensating verified victims with up to 50% of their losses.

- AI-generated phishing scams promoting Ponzi schemes rose by 27% in 2025, often using deepfake influencers.

Conclusion

The rise of rug pulls and Ponzi schemes in crypto is a sobering reminder that while innovation fuels opportunity, it also opens the door to exploitation. Today, scammers have become more sophisticated, blending traditional fraud tactics with cutting-edge technology. Yet, the industry isn’t standing still. With tighter regulations, advanced auditing tools, and increased investor awareness, the future promises a safer, more transparent crypto ecosystem.

Whether you’re an investor, developer, or casual observer, staying informed is your first line of defense. Knowledge, alongside caution, remains the most valuable asset in navigating crypto’s ever-evolving landscape.