Imagine a world where your financial planning and investments are managed effortlessly, with precision and personalization, all through an algorithm. That’s the reality robo-advisors have brought to life. Robo-advisors are reshaping the financial landscape, making wealth management accessible to millions globally. With their ability to analyze data, minimize human error, and deliver tailored investment solutions, these digital advisors are not just a trend; they’re the future of personal finance. Let’s delve into the key statistics and milestones shaping this dynamic market.

Editor’s Choice

- Robo-advisors managed over $1.0 trillion in assets globally by 2025.

- As of 2025, U.S. robo-advisory platforms are projected to serve over 6 million users, with continued growth fueled by Gen Z and Millennial adoption.

- Millennials and Gen Z still make up ~75% of robo-advisory users in 2025.

- AI-powered customization features have increased user satisfaction by ~40% in 2025.

- Robo-advisory platforms cut operational costs by up to 30% in 2025.

- In 2025, hybrid robo-advisors captured ~45% of market share.

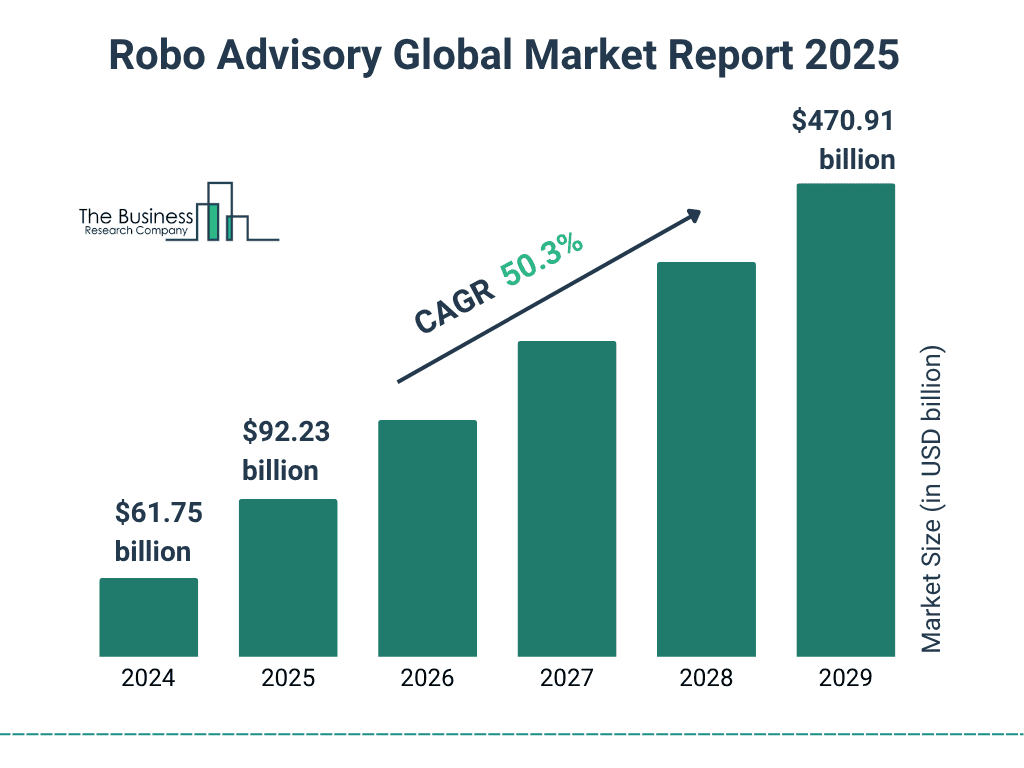

Robo Advisory Global Market Growth

- The global robo advisory is projected to rise to $92.23 billion in 2025.

- The market is expected to expand at a CAGR of 50.3% between 2024 and 2029.

- By 2029, the market size is forecasted to reach an impressive $470.91 billion.

Market Size and Trends

- The global robo-advisory market is forecasted to reach $13.87 billion by 2027 with an annual growth rate of ~29%.

- Asia-Pacific is emerging as the fastest-growing market with a projected CAGR of ~32% between 2025 and 2027, outpacing North America and Europe.

- In the US alone, robo-advisors are expected to manage $520 billion in assets by 2025, up from $350 billion in 2023.

- Customer acquisition rates surged by ~18% in 2025 as younger generations prioritize tech-savvy financial solutions.

- The rise of ESG-focused robo-advisors has led to a ~25% increase in investments in sustainable portfolios by 2025.

- More than 90% of users under 40 prefer robo-advisors due to their lower fees and ease of use in 2025.

- A significant trend in 2025 is the integration of AI for real-time portfolio adjustments, enhancing investment accuracy by ~35%.

Revenue and Monetization

- Subscription-based models dominate the market with nearly 60% of platforms charging flat monthly or annual fees in 2025.

- In 2025, transaction fees and portfolio management charges contribute ~62% of total revenue for robo-advisors globally.

- The average annual fee charged by robo-advisors hovers at ~0.20% of AUM in 2025, making them a cost-effective choice.

- Robo-advisory services in emerging markets generated ~$3.0 billion in revenue in 2025.

- Partnerships with banks and fintech companies account for ~28% of revenue growth in 2025 as traditional players adopt automation.

- Platforms offering customized advisory add-ons see a ~40% revenue boost in 2025.

- Freemium models with premium upgrades result in a ~22% increase in user retention in 2025, driving monetization success.

Leading Robo-Advisors by Assets Under Management

- Vanguard dominates with $47 billion AUM, far ahead of competitors.

- Schwab Intelligent Portfolios follows with $10.2 billion AUM, holding a strong second place.

- Betterment manages $7.36 billion AUM, making it one of the top independent robo-advisors.

- Wealthfront holds $5.01 billion AUM, continuing to grow its digital investing base.

- Personal Capital manages $3.6 billion AUM, combining robo-advice with human financial planners.

- Future Advisor (BlackRock) oversees $808 million AUM, reflecting a smaller share of the market.

- Nutmeg (UK) leads outside the U.S. with $751 million AUM.

- AssetBuilder manages $671 million AUM, maintaining a niche presence.

- Wealthsimple (Canada) holds $574 million AUM, standing out as Canada’s leading robo-advisor.

- Financial Guard manages $454 million AUM, with modest but steady growth.

- Rebalance IRA oversees $403 million AUM, specializing in retirement-focused portfolios.

- Scalable Capital (Germany) holds $125 million AUM, showing Europe’s emerging presence in robo-advisory.

Market Concentration and Characteristics

- The top five robo-advisory platforms globally hold ~55% of the market share in 2025, reflecting slight decentralization.

- Independent robo-advisors account for ~30% of total market revenue in 2025, while fintech-backed and traditional institutions capture the remainder.

- In North America, large financial institutions dominate, controlling ~65% of the robo-advisory market in 2025, while smaller platforms thrive in niche sectors like ESG investing.

- User retention rates for leading platforms exceeded ~85% in 2025, driven by enhanced user interfaces and personalized solutions.

- The average account size managed by robo-advisors globally reaches ~$35,000 in 2025, reflecting increasing adoption by mid-income earners.

- ~80% of users cite affordability and ease of use as the primary reasons for choosing robo-advisors over traditional advisors in 2025.

- The market shows significant growth in Europe in 2025, with fintech startups introducing specialized robo-advisory services tailored to local regulations and customer preferences.

Provider and Type Insights

- Hybrid robo-advisors combining algorithm-based automation with human expertise grew by ~40% in 2025, appealing to risk-averse investors.

- Fully automated platforms still lead the market with a ~68% adoption rate among millennial and Gen Z users in 2025.

- Financial institutions launching in-house robo-advisors have increased by ~35% in 202,5, highlighting a shift toward digitization.

- In 2025, B2B robo-advisory solutions for small businesses surged by ~25% addressing the need for affordable financial planning tools.

- White-label robo-advisory solutions account for ~30% of new entrants in 2025, allowing traditional financial institutions to leverage existing algorithms and infrastructure.

- Passive investment strategies dominate robo-advisory portfolios with ~65% focusing on ETFs and index funds in 2025.

- Micro-investment platforms offering entry with as little as $10 have attracted ~4.5 million new users globally in 2025.

Service Type Insights

- Portfolio rebalancing is used by ~85% of robo-advisory users in 2025 as a flagship service.

- Platforms offering tax-loss harvesting see a ~30% increase in user subscriptions in 2025, reflecting growing demand for tax efficiency.

- Retirement planning services constitute ~45% of robo-advisory activities in 2025, appealing to long-term investors.

- Sustainable investment options are available on ~75% of robo-advisory platforms in 2025, catering to ESG-conscious users.

- Real-time financial dashboards and analytics are the fastest-growing service segment, with demand increasing by ~38% in 2025.

- Robo-advisors targeting high-net-worth individuals (HNWI) experience ~25% growth in 2025 as premium features cater to complex needs.

- Platforms integrating AI-driven risk assessments report a ~32% rise in user satisfaction scores in 2025, enhancing their service appeal.

Technological Innovations

- Blockchain integration transforms data security, with ~25% of platforms adopting it by 2025.

- Voice-activated robo-advisory platforms gain traction, especially among users with accessibility needs, with ~18% adoption in 2025.

- Real-time risk assessment tools reduce portfolio losses by ~15% in 2025, showcasing the impact of AI.

- Robo-advisors using natural language processing (NLP) for customer interaction see a ~30% increase in user satisfaction in 2025.

- Machine learning algorithms help optimize portfolios, leading to ~7% higher return versus traditional methods in 2025.

- API integrations with third-party apps enhance platform functionality, with ~60% of robo platforms supporting full external integrations in 2025.

Regulatory Landscape

- The SEC introduced stricter guidelines for robo-advisors in 2025, requiring interactive websites and updated registration rules.

- European regulators mandated ESG disclosures, affecting ~75% of robo-advisors operating in the region by 2025.

- Asia-Pacific regulators are streamlining cross-border robo-advisory services, resulting in ~20% growth in regional platforms by 2025.

- Australia extended tax incentives for investments made through robo-advisory platforms in 2025 to spur digital finance adoption.

- Global anti-money laundering compliance efforts intensify, impacting ~85% of providers’ operational processes in 2025.

- Consumer data protection laws in the EU prompt ~60% of platforms to upgrade cybersecurity measures in 2025.

- Regulatory sandbox initiatives in emerging markets allow ~35 new robo-advisors to launch in 2025.

End-use Insights

- Individual investors account for ~80% of robo-advisory users in 2025, with the remainder split between small businesses and institutional clients.

- Retirees form ~15% of robo-advisory users in 2025, attracted by simple interfaces and retirement-focused portfolios.

- First-time investors make up ~45% of new users in 2025, with micro-investing features acting as a primary draw.

- The Gen Z segment accounts for ~30% of robo-advisory users in 2025, driven by a preference for digital-first solutions.

- Institutional clients adopting robo-advisors increase by ~15% in 2025, primarily for low-cost investment strategies and operational efficiency.

- Women investors represent ~40% of users in 2025, as platforms focus on inclusivity and targeted marketing strategies.

Market Opportunities

- Expanding into untapped markets like Africa and South America could yield a ~25% revenue boost by 2026.

- Collaborations with traditional financial advisors drive hybrid adoption, capturing an additional ~18% market share in 2025.

- AI-driven personalization features are predicted to increase user acquisition by ~35% especially among younger investors, by 2025.

- Offering crypto-focused portfolios could attract ~12% more users by 2025 as interest in digital assets grows.

- Retirement planning products tailored to aging populations present a ~$3 billion market opportunity globally in 2025.

- Developing robo-advisory services for SMEs is a growing trend with potential revenues of ~$2.0 billion by 2025.

- Integrating advanced ESG analytics tools can further tap into the sustainable investment movement with ~20% uplift in inflows in 2025.

Recent Developments

- Betterment acquired Ellevest’s automated investing business in 2025, strengthening its women-focused offerings.

- Wealthfront launched integrations with multiple fintech firms in 2025 to expand its planning tool ecosystem.

- Vanguard introduced AI-driven nudging and portfolio features in 2025, enhancing user experience and outcomes.

- Robinhood launched its full robo-advisory feature in 2025 following its 2024 acquisition of Pluto.

- Acorns rolled out a new educational content series in 2025 aimed at boosting financial literacy among users.

- European platforms like Scalable Capital expanded blockchain adoption in 2025 to improve transparency and security.

- SoFi revamped its robo-advisor in 2025, adding a 0.25% annual fee and broader investment options.

Frequently Asked Questions (FAQs)

The market is $10.86 billion in 2025 and is projected to reach $69.32 billion by 2032 at a 30.3% CAGR.

Industry AUM was estimated between $634 billion and $754 billion in 2024, with multiple trackers placing 2025 totals higher given continued inflows.

Vanguard Digital Advisor ranks first with about $311.9 billion AUM, followed by Empower ~$200 billion and Schwab Intelligent Portfolios ~$80.9 billion.

Typical management fees cluster around 0.15% to 0.25% of AUM, with multiple options at 0% for basic tiers.

North America leads with a 43.74% share in 2024, and hybrid robo-advisors held 63.8% of global revenue in 2023, trends that continue into 2025.

Conclusion

The robo-advisory market is on a transformative journey, fueled by technological advancements, demographic shifts, and growing global financial awareness. As the industry evolves, opportunities abound for innovation and market expansion. However, overcoming challenges like regulatory hurdles and data security concerns will be pivotal. By 2027, robo-advisors are expected to manage $2 trillion in assets, solidifying their role as a cornerstone of the modern financial ecosystem.