Imagine you’re an insurer in today’s volatile world. Hurricanes sweep through coastal cities, data breaches escalate, and global regulations shift like quicksand. How do you safeguard against such risks while ensuring profitability? Risk management in insurance is no longer just a function; it’s a survival skill. This article delves into the landscape of insurance risk management, exploring the key trends, statistics, and strategies shaping the industry.

Editor’s Choice

- Management liability insurance rates stabilize at -5% to flat for private companies.

- Insurers’ return on equity in Europe rises to 11.6%.

- Property insurance rates soften for good risks with P&C growth at 3.4%.

- Global insured catastrophe losses hit $107 billion.

- Over 35% of insurers deploy AI agents across core functions.

- The telematics market penetration exceeds 35% with 12% growth.

- Non-Life premiums grow by 5.6% worldwide.

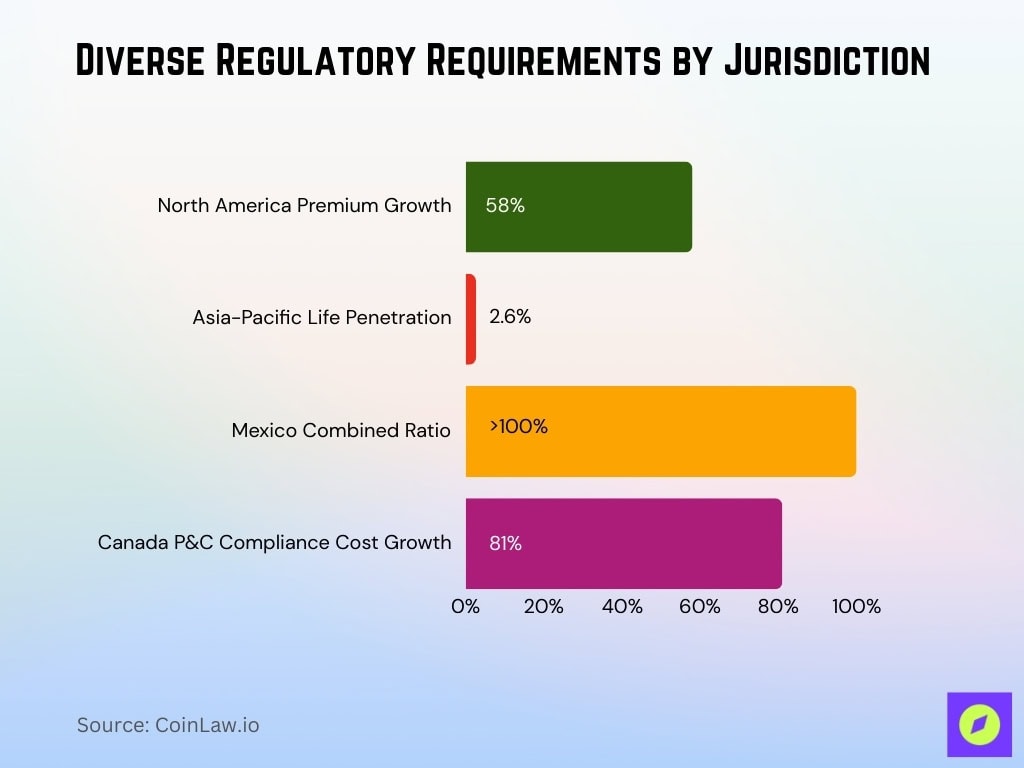

Diverse Regulatory Requirements by Jurisdiction

- North America NAIC scrutiny intensifies with state homeowners’ reforms amid a 58% premium rise since 2018.

- Asia-Pacific life insurance penetration is low at 2.6% in emerging markets.

- Latin America Mexico VAT reform raises claims costs with combined ratios above 100%.

- Global state insurance regulations exceed 2,700 requirements.

- Middle East and Africa mandatory motor insurance is enforced with heavy fines for non-compliance.

- Canada P&C compliance costs surge 81% amid regulatory demands.

Climate Change and Sustainability in Insurance Risk

- Global insured catastrophe losses reach $162 billion with a 38% uninsured rate.

- UK home weather damage payouts hit record £585 million.

- The green insurance market is valued at $3.8 billion, growing to $13.4 billion by 2031.

- Renewable energy insurance market hits $29,345.92 million at 4.22% CAGR.

- Climate resilience tech unlocks $1 trillion private capital opportunity by 2030.

- Factory Mutual allocates hundreds of millions annually to resiliency credits.

- Net-Zero Insurance Alliance represents 15% the world’s premium volume.

- Climate risk models integrate GCMs for tail behavior extreme value analysis.

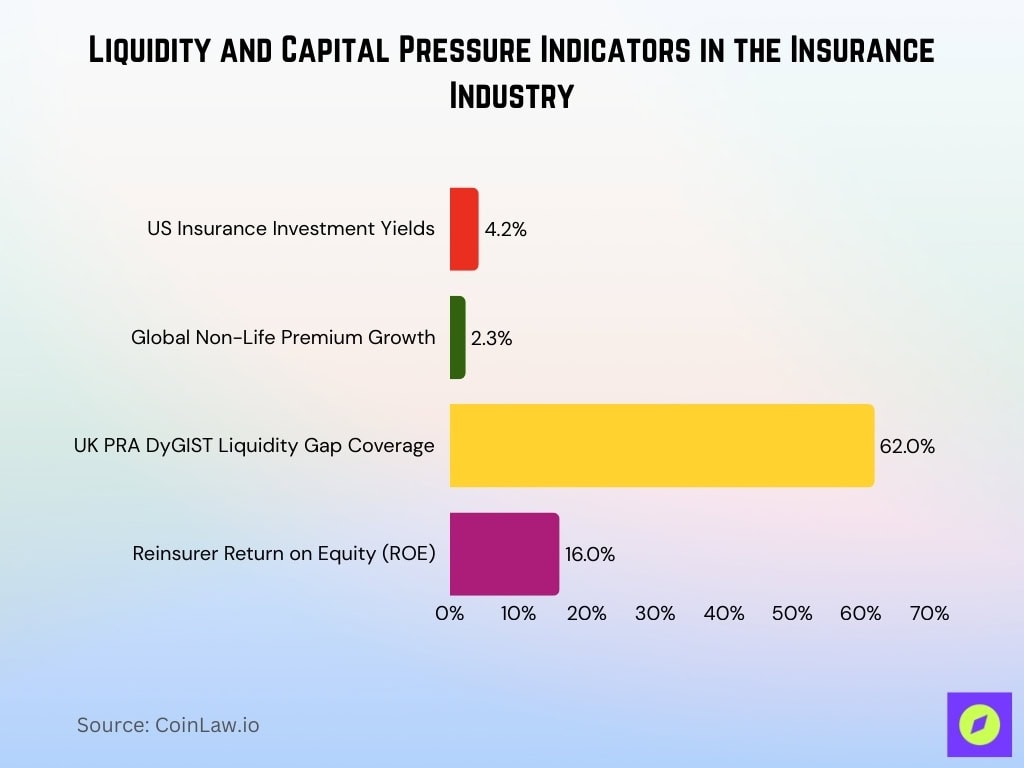

Economic Instability: Liquidity and Capital Management Challenges

- US insurance investment yields rise to 4.2%.

- Global non-life premiums grow 2.3% amid softening rates.

- UK PRA DyGIST stress tests assess 62% liquidity gaps in real-time.

- ROE averages 16% for reinsurers’ first nine months.

- Global reinsurer capital reaches record $760 billion, up $45 billion YoY.

- EMEA insurers enter with strong capital buffers against volatility.

- Reinsurance inflows exceed $45 billion, strengthening balance sheets.

- Solvency II unlocks securitization, enhancing liquidity by 2027.

- Captives grow for alternative risk transfer amid volatility.

Rapidly Evolving Regulatory Compliance Changes

- EU Solvency II cost of capital reduced to 4.75%.

- CSRD expands sustainability reporting from about 12,000 large public-interest entities to over 50,000 companies across the EU.

- 70% of banking firms use agentic AI, outpacing regulation.

- Australian large entities require mandatory ESG assurance from 2025-26.

- Texas DWC plans audits of 55 insurance carriers in FY2026.

- EU raises SCR thresholds to €15 million GWP or €50 million GTP.

- RegTech automates compliance for insurance amid complex regulations.

- 12,000 to 50,000 companies are now under CSRD sustainability metrics.

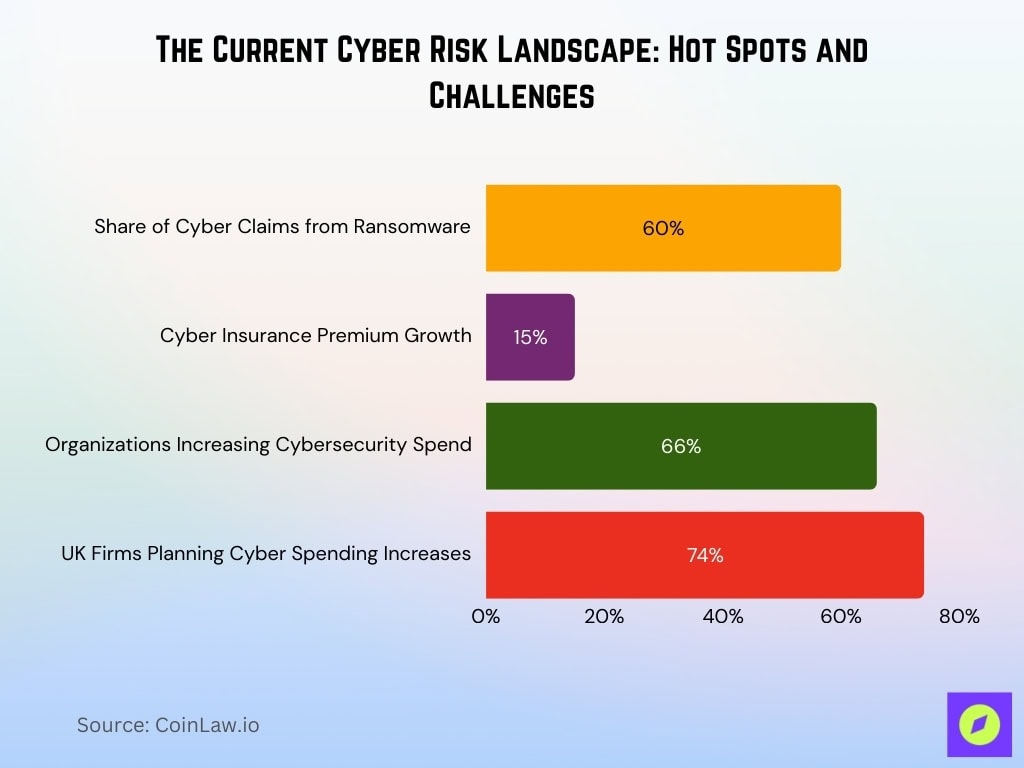

The Current Cyber Risk Landscape: Hot Spots and Challenges

- Ransomware drives 60% of large cyber claims.

- Cyber insurance premiums grow 15% amid AI threats.

- 66% of organizations increase cybersecurity investments.

- UK firms lead with 74% planning cyber spending hikes.

- Cyber insurance claims drop 50% with an average $115,000.

- Cybercrime costs hit $1.2-$1.5 trillion globally.

- The average breach costs $3.86 million worldwide.

- Expense ratios drop 2 points via AI automation.

Enhanced Risk Management Strategies and Frameworks

- EBA ESG guidelines mandate risk integration effective January 2026.

- FCA ESG rating rules strengthen risk management by Q4 2026.

- ERM lowers the marginal cost of risk reduction, enhancing firm value.

- Reinsurers optimize via rigorous ERM, protecting margins.

- 63% loss reduction from IoT wildfire prevention partnerships.

- AI fraud detection uncovers attorney-provider nexuses via network analysis.

- RMaaS provides scalable risk monitoring and scenario testing.

- Operational risk events cause a 2.7% TSR decline post-incident.

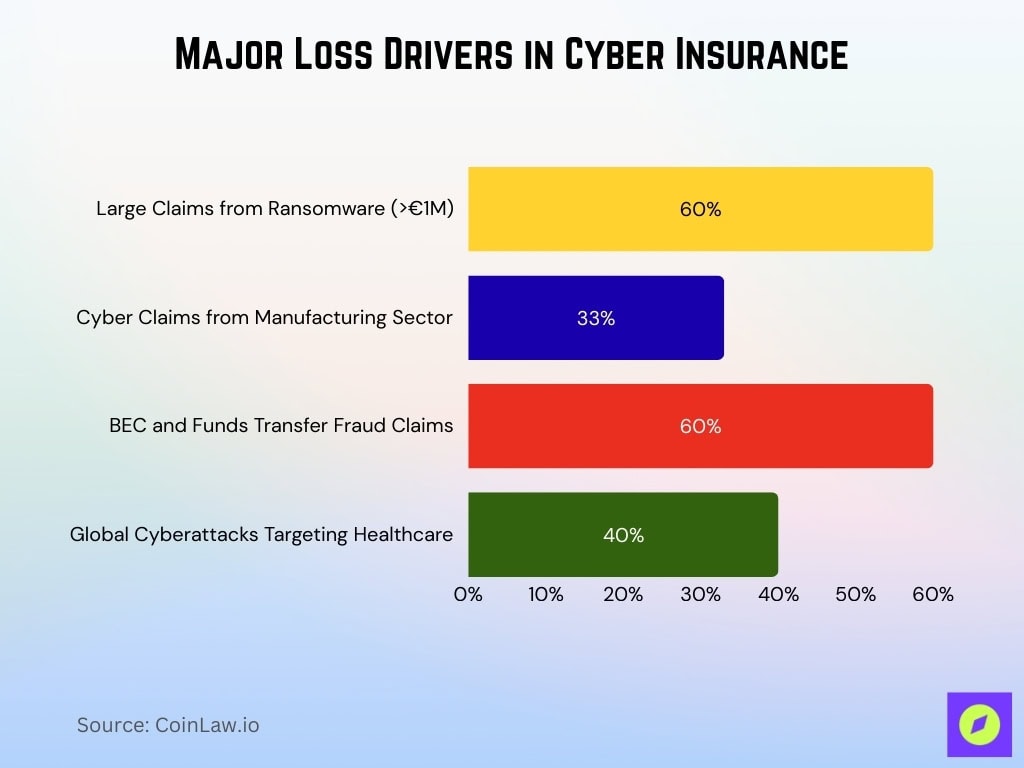

Major Loss Drivers in Cyber Insurance

- Ransomware accounts for 60% of large claims over €1 million.

- Business email compromise averages $98,000 per claim.

- Funds transfer fraud averages $185,000 per incident.

- Data breaches cause the highest losses, followed by business interruptions.

- The manufacturing sector files 33% of all cyber claims.

- BEC and funds transfer fraud comprise 60% of claims.

- Healthcare faces 40% of global cyberattacks.

Recent Developments

- 35% of insurers deploy AI agents across core functions, cutting processing by 70%.

- Insurers allocate 3-8% IT budgets to AI with under 5% measurable financial impact.

- Over 50% executives plan Agentic AI implementation within 12 months.

- Beazley secures $300 million cyber cat bond total $670 million outstanding.

- IoT enables continuous monitoring, reducing traditional insurance needs.

- DORA mandates incident report fines up to €15 million or 2.5% turnover.

- Climate losses total $600 billion past two decades 38% insured.

Frequently Asked Questions (FAQs)

About 60% of insurers have experienced at least one cyberattack over the past 12 months.

Cyber insurance premiums surged by 40% in 2023 as risk and claim costs climbed.

The average cost of a data breach for insurers reached around $4.9 million.

Conclusion

The landscape of insurance risk management today is shaped by technological advancements, climate-related challenges, and economic uncertainties. Insurers are adapting by integrating modern tools, strengthening cybersecurity frameworks, and focusing on sustainability. As risks evolve, so must the strategies, balancing innovation with caution to safeguard businesses and customers alike. With robust risk management practices, the industry is better equipped to weather future challenges while driving growth and trust.