Imagine a world where you can own a slice of a massive shopping mall, a bustling apartment complex, or a sprawling healthcare center without setting foot on the property. Real Estate Investment Trusts (REITs) make this possible. REITs continue to be a powerful vehicle for wealth creation, offering a way for individuals to invest in real estate without the headaches of direct ownership. Whether you’re a seasoned investor or a beginner exploring new avenues, the statistics and insights in this article will equip you with the knowledge to navigate the REIT landscape confidently.

Editor’s Choice

- $1.43 trillion total equity market capitalization of U.S. REITs as of mid-2025.

- 150+ million Americans directly or indirectly hold REIT shares.

- 12.3% average annual return delivered by REITs over the past 25 years.

- ~9.5% expected total return for REITs in 2025.

- $5 trillion+ global REIT assets projected to be exceeded in 2025.

- 6.5% average rental growth for industrial and e-commerce warehouse REITs in 2025.

- ~75% of REITs distributed more than 90% of taxable income to shareholders in 2025.

Commercial Real Estate Outperformance During Inflation

- In High Growth / High Inflation, Private Real Estate delivered the strongest returns at 17.23%.

- Stocks followed with a return of 7.90% during high growth and high inflation conditions.

- Government Bonds performed modestly at 3.16%, while Investment Grade Bonds were slightly higher at 3.38% under high growth and high inflation.

- In Low Growth / High Inflation, Private Real Estate again led with 15.98% returns.

- Government Bonds returned 9.41%, showing stronger resilience in low-growth periods compared to stocks.

- Investment Grade Bonds achieved 7.40%, outperforming stocks in a low-growth environment.

- Stocks underperformed with just 3.80% returns when both growth was low and inflation was high.

Types of REITs

- ~80% of the global REIT market is still made up of equity REITs focused on property ownership and rental income.

- ~$200 billion+ in assets remain under mortgage REITs (mREITs) specializing in real estate financing.

- ~5% of total REIT investments continue to be hybrid REITs combining equity and mortgage features.

- ~15% growth was seen in the industrial REIT sector in 2025, driven by expansion in warehousing and logistics.

- 96.6% average occupancy rate for retail REITs in 2025, reflecting post-COVID rebound.

- ~$250 billion in assets are held by residential REITs catering to urban housing demand in 2025.

- 8–10% annual growth is projected for specialty REITs (data centers, cell towers, etc.) through 2026.

Global Market Capitalization

- $5.5 trillion+ estimated global REIT market capitalization in 2025.

- > 40% of that total is contributed by the U.S. REIT market.

- ~25% of the global REIT market value comes from Asia-Pacific (Japan, Singapore, Australia, etc.).

- ~18% of global REIT capitalization is represented by European REITs (UK, Germany, etc.).

- ~12%+ annual growth expected for REIT presence in emerging markets like India and Brazil.

- 500+ publicly listed REITs are tracked by the global REIT index, reflecting broad sector coverage.

- $3.5 billion+ in cross-border REIT investments flowed into the U.S. in 2025.

Largest Real Estate Investment Trusts in the World

- Prologis (PLD) is the largest REIT with a market cap of $116.4 billion.

- American Tower (AMT) follows closely with a market cap of $109.8 billion.

- Crown Castle (CCI) holds a market cap of $76.8 billion.

- Public Storage (PSA) is valued at $65.9 billion.

- Equinix (EQIX) comes in at $64.4 billion.

- Simon Property Group (SPG) has a market cap of $48.9 billion.

- Welltower (WELL) stands at $44.3 billion.

- Digital Realty (DLR) is valued at $40.1 billion.

- Realty Income (O) also has a market cap of $40.1 billion.

- AvalonBay Communities (AVB) rounds out the top 10 with $34.6 billion.

Sector Performance Analysis

- ~8.0% average return for industrial REITs in 2025, driven by strong logistics demand.

- ~12.5% returns from retail REITs in 2025, reflecting resilient consumer spending and higher occupancy.

- ~18.0% growth for healthcare REITs in 2025 supported by aging demographics and demand for facilities.

- -5.5% return for office REITs in 2025 due to continued hybrid work pressures.

- ~21.3% gain in data center REITs in 2025 fueled by cloud and AI infrastructure expansion.

- ~9.0% average return for residential REITs in 2025 backed by urban housing demand.

- ~10–13% returns for lodging and hospitality REITs in 2025 during the travel rebound.

Dividend Yields and Returns

- ~4.0% average dividend yield by REITs in 2025, well above typical equity yields.

- ~10.4% average yield from mortgage REITs in 2025, appealing to income-focused investors.

- ~3.9% average yield from equity REITs in 2025, reflecting stable payout trends.

- ~11% dividend growth by Prologis in 2025, supporting industrial REIT strength.

- > 90% of U.S. REITs met or exceeded dividend distribution rules in 2025, underlining income reliability.

- ~5.5% average yield from specialty REITs (cell towers, infrastructure, etc.) in 2025.

- 2–3% incremental return from dividend reinvestment programs (DRIPs) in 2025.

Impact of Interest Rates on REITs

- ~2.8% increase in borrowing costs across the REIT sector in 2025 following the Fed’s rate adjustments.

- ~9.5% total return achieved by REITs in 2025 despite the elevated rate environment.

- ~1.0% yield compression faced by mortgage REITs in 2025 owing to higher financing costs.

- ~8.5% average return in low-rate environments, as historical REIT performance suggests.

- ~8.5% growth in industrial and ~12% in healthcare REITs in 2025, showing resilience under rate stress.

- ~33.5% debt-to-asset leverage ratio in 2025, reflecting efforts to reduce leverage.

- ~7.0% growth in foreign investment into U.S. REITs in 2025, driven by global yield seeking.

Net Asset Value

- ~6.5% average NAV growth for U.S. REITs in 2025 fueled by rising property valuations.

- ~11% NAV growth for industrial REITs in 2025 driven by continued demand for logistics facilities.

- ~5.5% NAV increase for healthcare REITs in 2025, reflecting heightened investment in senior housing and medical assets.

- ~4% NAV boost for retail REITs in 2025 signaling ongoing recovery in retail property values.

- -3% NAV decline for office REITs in 2025 due to persistent softness in leasing.

- ~5% NAV growth for residential REITs in 2025 supported by firm rental markets.

- ~$1.5 billion in foreign investment contributed to the NAV of emerging market REITs in 2025.

Benefits and Risks of REITs

- ~3.9% average dividend yield for U.S. equity REITs in 2025 remains attractive to income-seekers.

- 3%–11% dividend yields are still possible across REIT subtypes, offering higher income than many equities.

- The liquidity advantage of REITs is preserved in 2025 with daily trading on stock exchanges.

- The inflation hedge benefit remains, as real estate values and rents often rise with inflation.

- Volatility risk intensifies in downturns. REITs saw sharp price swings in early 2025.

- Rising interest rates in 2025 may compress margins via higher borrowing costs.

- Tenant default risk remains significant, especially in under-performing office and retail sectors.

- Climate and insurance exposure are rising cost pressures and property damage risk, threatening returns.

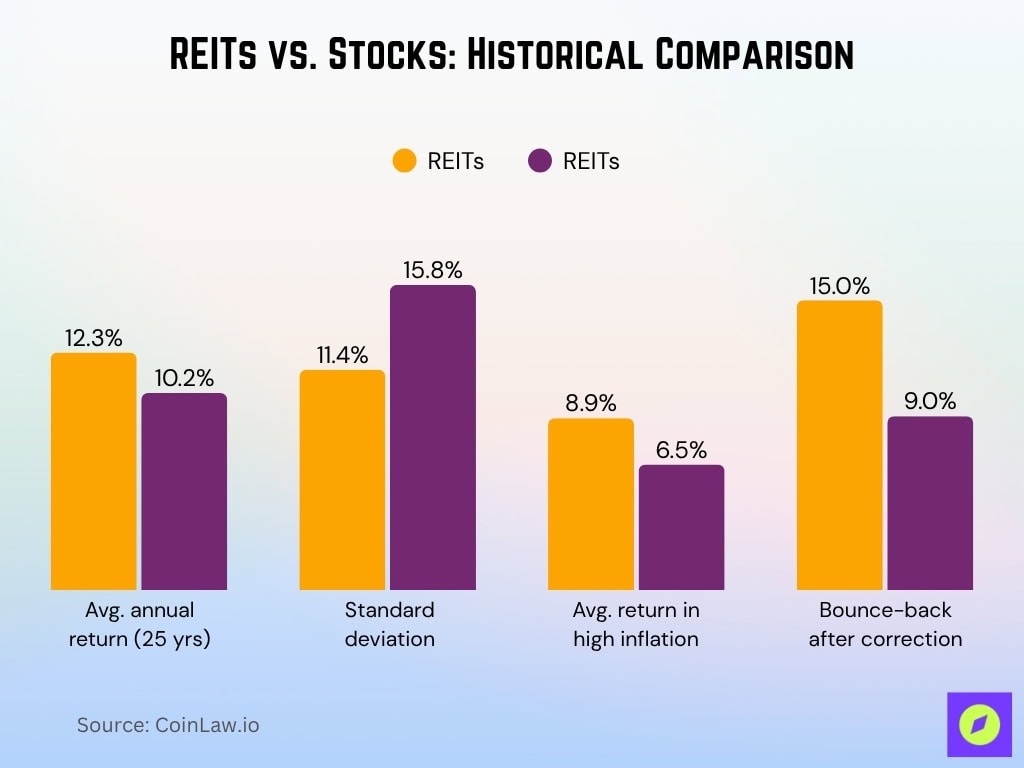

REITs vs. Stocks: Digging into the Historical Data

- ~12.3% average annual return by REITs over 25 years compared to ~10.2% for stocks.

- ~11.4% standard deviation for REITs versus ~15.8% for stocks, pointing to lower volatility.

- ~8.9% average return for REITs in high-inflation periods vs ~6.5% for stocks.

- ~15% bounce-back by REITs in a year after corrections vs ~9% for stocks.

Market Dynamics

- ~20% growth in industrial REITs in 2025 fueled by rising e-commerce demand.

- ~8–10% increase in average residential rents in 2025, driven by urbanization and housing scarcity.

- ~18% revenue growth for data center REITs in 2025 on surging cloud and infrastructure demand.

- ~80% occupancy rates for office REITs in 2025, reflecting ongoing challenges from hybrid work.

- ~10% year-on-year boost in retail foot traffic at malls and shopping centers in 2025.

- ~12–15% rise in healthcare REIT occupancy in 2025 supported by aging population trends.

- ~18% expansion of India’s REIT market in 2025, driven by institutional and regulatory momentum.

Technological Innovations in Real Estate

- 40% increase in PropTech adoption by REITs over two years through 2025, driving operations modernization.

- ~12% annual operational cost savings by data center REITs in 2025 via AI-driven energy optimization.

- ~85% of tenants in smart buildings report enhanced satisfaction in 2025 from integrated tech.

- ~30% greater transparency achieved in real estate transactions in 2025 due to blockchain pilot programs.

- ~22% boost in leasing rates in 2025 from the use of virtual tours and augmented reality tools.

- ~$1.5 million in annual savings by large REITs through cloud-based property management in 2025.

- ~18% higher tenant retention in eco-certified properties using sustainability tech in 2025.

Recent Developments

- ~$3 billion+ flowed into REIT ETFs focused on emerging markets in Q1 2025.

- ~$6 billion+ in major industrial acquisitions reshaped market dynamics in 2025.

- ~15% rise in sublease availability in urban office markets in 2025 due to remote work trends.

- ~12% boost in consumer dwell times at malls in 2025, driven by experiential retail.

- ~$7 billion+ allocated to 5G infrastructure upgrades by data center REITs in 2025.

- ~$20 billion+ invested in green building projects by REITs in 2025 under net-zero goals.

- ~$15 billion+ raised via REIT IPOs in 2025 signaling strong investor confidence.

Frequently Asked Questions (FAQs)

$1.371 trillion for All Equity REITs and $1.431 trillion for All REITs as of May 30, 2025.

4.32% for All REITs and 3.99% for All Equity REITs as of May 30, 2025, versus 1.24% for the S&P 500.

$26.692 billion across 62 offerings as of May 30, 2025.

Approximately 168 million Americans hold REITs directly or indirectly.

11.70% one-year total return for the All Equity REITs Index as of May 30, 2025.

Conclusion

REITs continue to prove their resilience and relevance in an evolving economic landscape. From delivering robust dividend yields to leveraging cutting-edge technology, REITs offer a compelling investment avenue for those seeking stability and growth. With diverse opportunities across sectors and geographies, REITs remain an indispensable part of the modern investment portfolio, providing both institutional and individual investors a gateway to the dynamic world of real estate.