In 2014, Razorpay emerged as a disruptive force in the Indian fintech industry. The idea was simple yet revolutionary: to simplify online payments for businesses of all sizes. From single-line code integration to enabling seamless transactions, Razorpay’s journey reflects the pulse of India’s digital economy. Today, it stands as a leader, driving innovation and trust in the payments ecosystem.

With the fintech space poised for exponential growth today, let’s dive into Razorpay’s milestones, financial performance, and market presence. This article offers a comprehensive view of how Razorpay continues to shape the future of payments.

Editor’s Choice

- $490 million raised in Series G funding, pushing valuation to $9.2 billion.

- Over 12 million merchants onboarded.

- RazorpayX Payroll now supports over 40,000 businesses.

- Magic Checkout adoption reduced cart abandonment by 22%.

- Secured RBI approval for cross-border payments aggregator operations.

- Targeting IPO in late 2026 with up to Rs 4,500 crore fundraise.

Recent Developments

- Rolled out RazorpayX Payroll Engine 2.0 with AI-powered payslip explanations.

- Introduced RAY Concierge for 10x faster onboarding with AI document analysis.

- Acquired majority stake in POP with $30 million investment for UPI rewards.

- Launched Q-Zap, reducing offline billing time by 40% and costs by 20%.

- Partnered with NPCI and Curlec to enable UPI payments in Malaysia.

- Released Optimizer for real-time transaction rerouting to avoid failures.

- Launched RazorpayX Line of Credit up to INR 25L at 1.5% monthly interest.

- Launched Payments as a Service (PaaS), saving enterprises up to 80% on payments management.

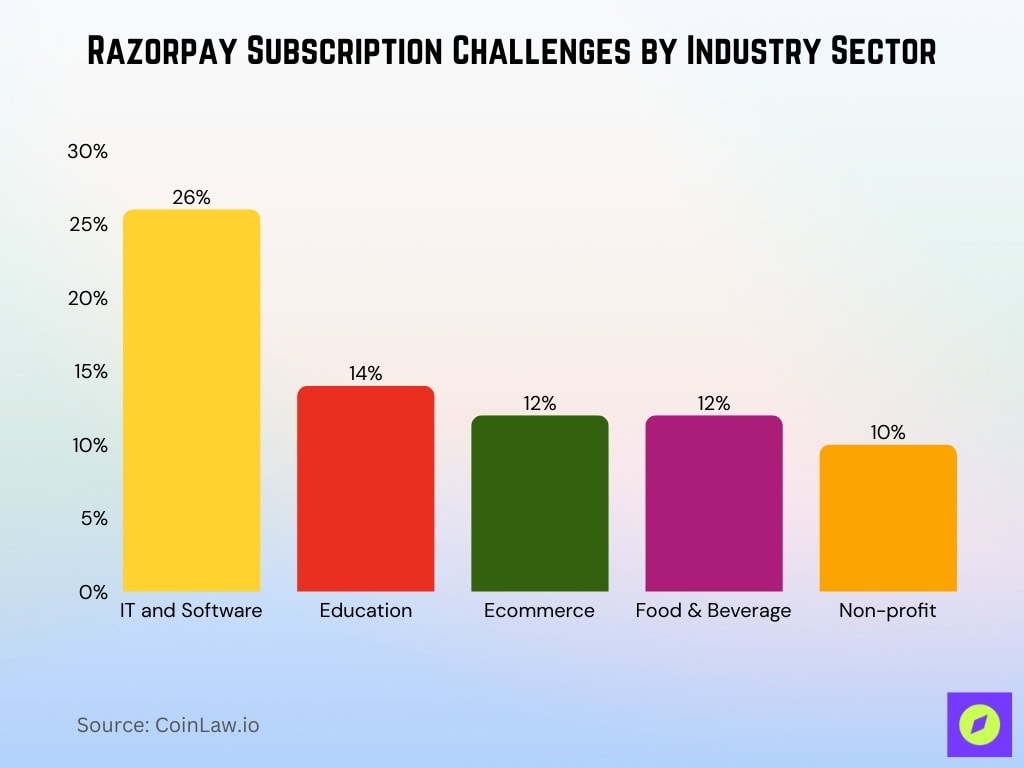

Challenges Faced by Subscription Businesses: Sector-wise Breakdown

- IT and Software sector faces the highest challenges, accounting for 26% of the total.

- The Education sector makes up 14% of the challenges reported.

- Both Ecommerce and the Food & Beverage sectors are equally impacted, each contributing 12%.

- Non-profit organizations face 10% of the challenges in the subscription business space.

Razorpay Financial Performance

- Revenue climbed to Rs 3,783 crore in FY25, reflecting 65% YoY growth.

- Gross profit rose 41% to Rs 1,277 crore in FY25.

- Adjusted revenue zoomed 756% to Rs 9,891 crore in Q2 FY26.

- Processed over 7.4 billion transactions.

- Merchant retention rate boosted to 94%.

- Controls 55% market share in India’s online payment gateways.

- Leads UPI processing with 35 million daily transactions.

- Disbursed over $620 million in business loans through Razorpay Capital.

- Annualized TPV reached $180 billion.

- Powers 16% of e-commerce businesses in India.

Top Competitors and Alternatives of Razorpay

- Paytm Payment Gateway holds 25% market share with a strong mobile focus.

- CCAvenue processes over 1 billion transactions annually for traditional businesses.

- Instamojo targets small businesses with affordable integration.

- PayU operates in 50+ countries, processing $55 billion annually.

- Stripe entered India, aiming for 10% market share.

- Easebuzz focuses on hyperlocal businesses and startups.

- Cashfree Payments serves 300,000+ merchants in digital payouts.

- BillDesk ranks among the top 5 payment gateways in India.

- One97 Communications (Paytm) leads in merchant payments.

- PayU Payments dominates with global operations.

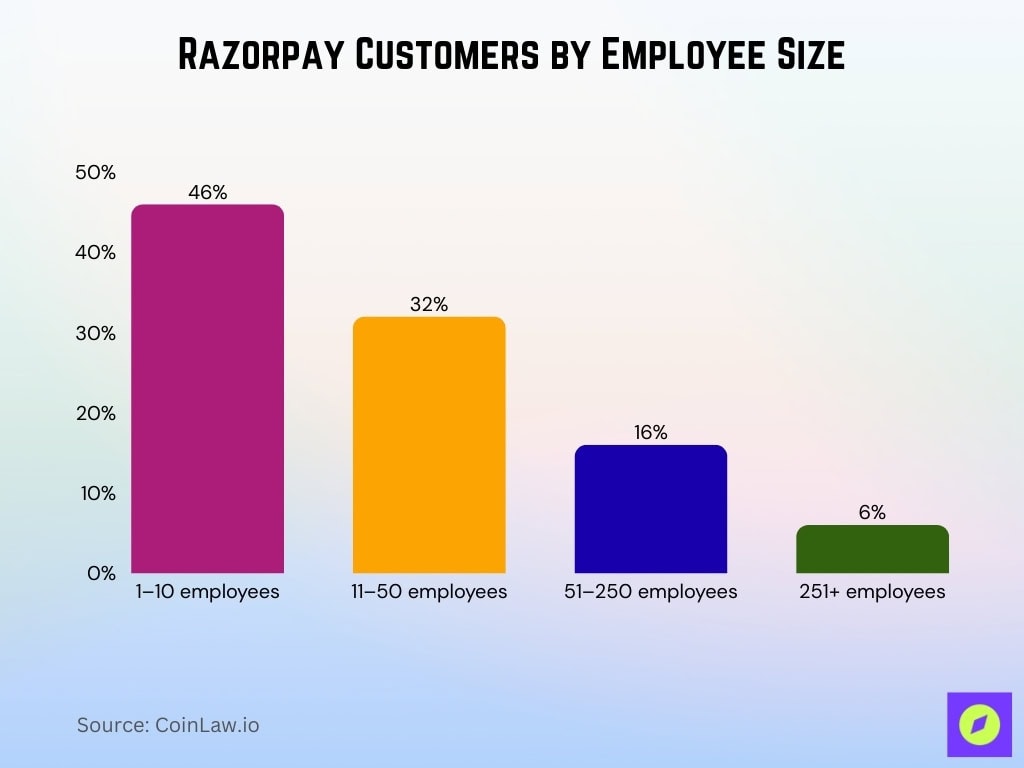

Razorpay Customers by Employee Size

- Micro-businesses (1–10 employees) represent 46% of customers.

- Small businesses (11–50 employees) account for 32% of the user base.

- Medium businesses (51–250 employees) make up 16%.

- Large enterprises (251+ employees) comprise 6%.

- Freelancers and solo professionals exceed 28,000 active users.

- Startups span 45% of India’s funded tech ecosystem.

- SMEs contribute 50% of revenue despite 20% transaction volume.

- Tier 2/3 city SMEs drive 54% of digital transaction volume.

Customers by Products and Services

- Razorpay Payment Gateway is used by 65% of e-commerce platforms in India.

- RazorpayX is adopted by over 25,000 businesses for payroll and payments.

- Razorpay Capital serves 150,000+ SMBs with credit solutions.

- Razorpay Magic Checkout improves the experience for 30% of D2C brands.

- Recurring Payments Platform is utilized by 70% of SaaS companies.

- QR Code Payments are preferred by over 2 million local merchants.

- Payouts by Razorpay processes $1 billion monthly.

- Serves over 12 million total merchants.

- Small e-commerce businesses represent 45% of the merchant base.

- Subscription platforms dominate 30% of transaction volumes.

Razorpay Customers by Geography

- Tier 1 cities constitute 60% of customers.

- Tier 2 and Tier 3 cities grown to 35% of the user base.

- Rural markets account for 5%.

- International markets expanded to the Middle East with 2,000+ merchants.

- West India holds 35% share.

- South India has a predominant with 30% share.

- Tier 2/3 city SMEs drive 54% digital transaction volume.

- Bengaluru leads with 25% of total merchants.

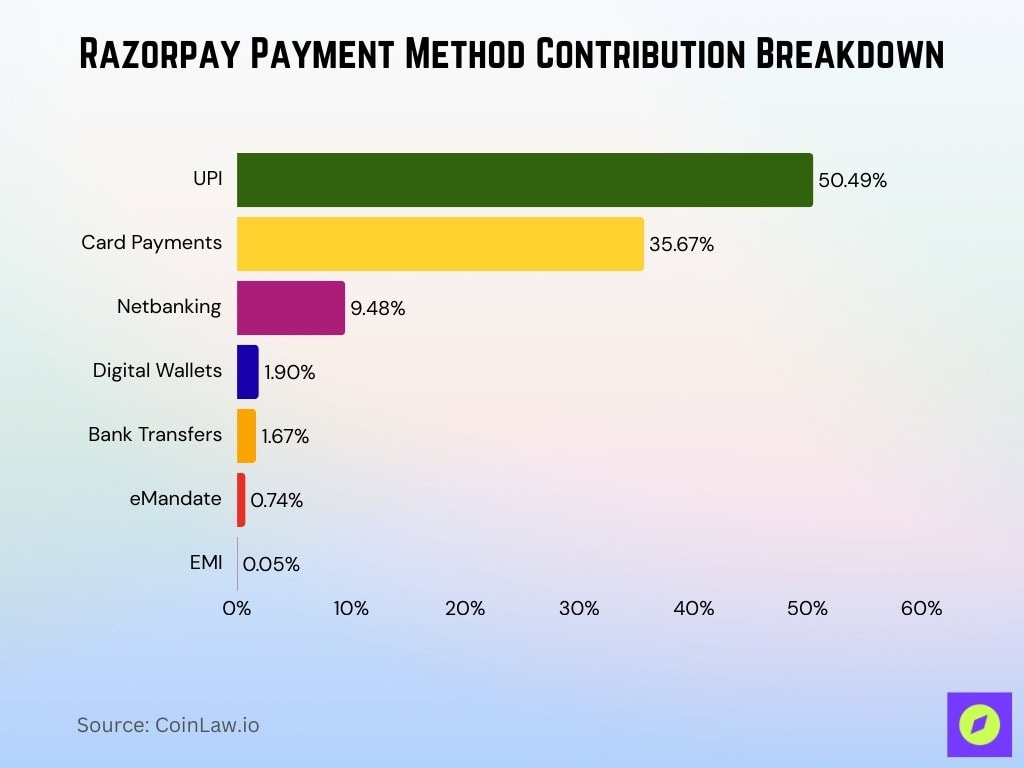

Payment Method Contribution Breakdown

- UPI dominates with 50.49% of total transaction volume, processing 3.7 billion monthly transactions.

- Card payments secure 35.67% share, driven by premium credit and debit card usage across e-commerce.

- Netbanking maintains a steady 9.48% contribution from traditional banking customers.

- Digital wallets account for 1.90%, popular among mobile-first urban consumers.

- Bank transfers represent 1.67%, favored by B2B and high-value transactions.

- eMandate adoption reaches 0.74% for recurring subscription billing.

- EMI options contribute 0.05%, supporting installment purchases.

- UPI Autopay growth accelerates subscription payments by 25% YoY.

Top Stores Using Razorpay

- Swiggy processes millions of daily food delivery transactions.

- Zomato handles millions of restaurant orders monthly.

- CRED utilizes Razorpay for reward disbursements and user payments.

- Urban Company routes 90% of service payments through Razorpay.

- Mamaearth integrates Magic Checkout across D2C sales.

- Nykaa processes over 1 million beauty orders monthly.

- Lenskart simplifies eyewear checkout with a custom gateway.

- Meesho relies on Razorpay for vendor payouts and transactions.

Top Categories for Stores Using Razorpay

- Retail and e-commerce dominate at 47% of Razorpay’s merchant base, processing $110 billion in TPV.

- Education and edtech platforms account for 22%, driven by 15 million annual course enrollments.

- Healthcare and wellness services contribute 11%, handling $8.2 billion in telehealth payments.

- Travel and tourism businesses represent 9%, with 12 million bookings processed yearly.

- Food delivery covers 8%, supporting 450,000 daily restaurant orders.

- Entertainment platforms make up 6%, powering 8 million OTT subscriptions.

- Professional services comprise 17%, serving 1.2 million freelancers and agencies.

- SaaS category leads subscription revenue at 25% share with 98% renewal rates.

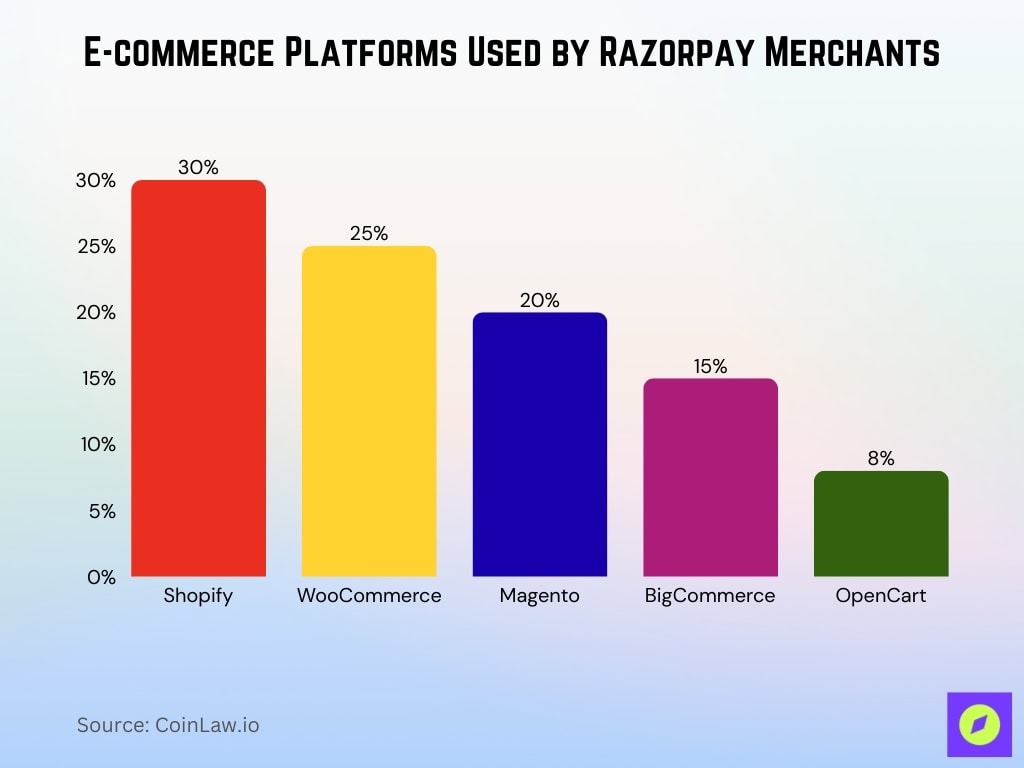

E-commerce Platforms for Stores Using Razorpay

- Shopify represents 30% of Razorpay integrations.

- WooCommerce accounts for 25% of stores.

- Magento powers 20% of Razorpay-enabled stores.

- BigCommerce is used by 15% of new users.

- OpenCart supports 8% of the Razorpay merchant base.

Cyber-safety

- Achieved PCI DSS Level 1 compliance, the highest payment security standard.

- Tokenization technology protects 95% of card transactions.

- Multi-layered authentication secures 100% of UPI payments.

- Reduced phishing attacks by 22% YoY through education campaigns.

- Prevented $50 million in cyber fraud using ML anomaly detection.

- Bug bounty program awarded over $200,000 to researchers.

- Data encryption safeguards 99.9% of transactions.

- Zero data breaches were maintained across 7.4 billion transactions.

- SOC 2 Type II certified for enterprise-grade security compliance.

Regulatory Environment

- Achieved RBI Payment Aggregator license renewal.

- Fully aligned with the Digital Personal Data Protection Act 2025.

- Collaborated with NPCI to raise UPI limits by 30% for SMBs.

- Secured approval for international payments in 35+ countries.

- Partnered with SEBI-recognized brokerages for real-time flows.

- Integrated with GST 3.0 e-invoicing for 1 million+ merchants.

- Complies with ISO 27001 for information security management.

Frequently Asked Questions (FAQs)

Razorpay controls over 55% of India’s online payment gateway market.

About 87.9% of Razorpay’s customers are from India.

Razorpay powers transactions for about 16% of e‑commerce businesses in India.

Conclusion

Razorpay’s trajectory showcases its commitment to innovation, security, and customer satisfaction. From enhancing e-commerce efficiencies to pioneering financial inclusivity in Tier 2 and 3 cities, the company has firmly established itself as a leader in the fintech space. Razorpay is poised to push the boundaries of what’s possible in digital payments, shaping the future of commerce.