Imagine a world where your financial portfolio is optimized in real-time, or global trading operates without delays caused by processing limitations. This isn’t science fiction; it’s the promise of quantum computing in finance. The financial industry is poised for another revolutionary leap, embracing quantum mechanics to solve previously insurmountable problems. From tackling optimization challenges to enhancing cybersecurity, quantum computing offers transformative potential, redefining how the world of finance operates.

Editor’s Choice

- In 2025, the global quantum computing market is valued at $1.67 billion, with the finance sector holding about 20% of total applications.

- Goldman Sachs utilized quantum algorithms in 2025 to boost risk analysis, achieving processing speeds up to 25x faster than classical models.

- Major banks such as JPMorgan Chase adopted quantum cryptography in 2025, securing trillions of dollars in annual transaction volume.

- Deloitte’s Quantum Lab recorded a 50% reduction in computation time for portfolio optimization using advanced quantum hardware.

- Quantum investments in finance surged by 50% in 2025, reaching approximately $2.25 billion, led by North America and Asia.

- HSBC used quantum simulations in 2025 to enhance derivatives pricing, cutting pricing errors by around 22%.

- Quantum computing is projected to save global banks $15 billion annually in fraud detection costs by the end of 2025.

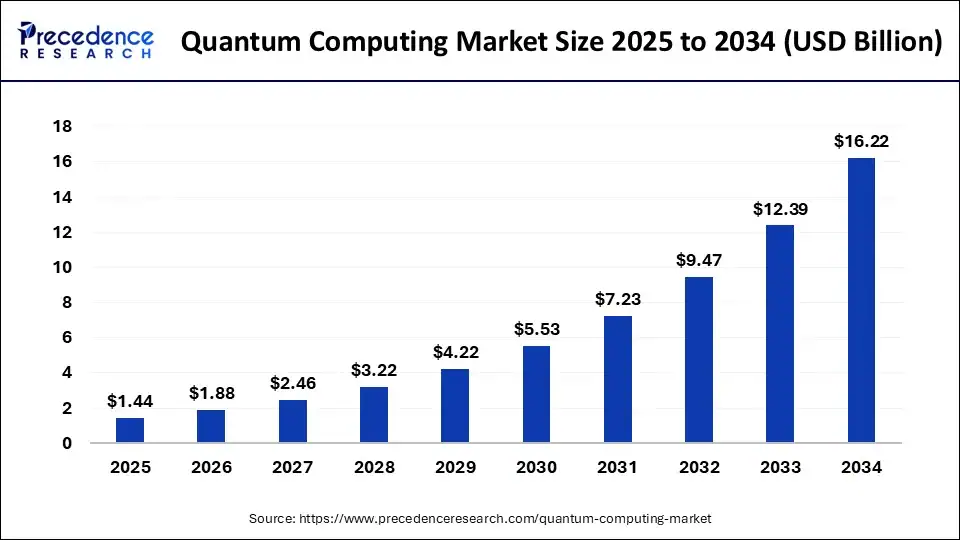

Global Quantum Computing Market Growth

- The global quantum computing market is valued at $1.44 billion in 2025, marking the early phase of commercial adoption.

- Market size is projected to reach $3.22 billion by 2028, reflecting expanding enterprise use in finance, healthcare, and logistics.

- By 2030, the industry is expected to surpass $5.53 billion, driven by hybrid quantum-classical integration.

- The market could grow to $9.47 billion by 2032, showing rising investment from major tech firms and government programs.

- By 2034, the total market size may hit $16.22 billion, representing an overall CAGR of roughly 28% from 2025 to 2034.

- This ten-year surge underscores the transition from research-driven prototypes to scalable, revenue-generating quantum applications across industries.

Understanding Quantum Computing

- Traditional computers process tasks sequentially, while quantum computers in 2025 can evaluate many possibilities simultaneously, accelerating financial modeling by up to 10×.

- Grover’s Algorithm enables quantum systems in 2025 to speed up database searches by ~√N, potentially cutting fraud detection search times by 50-70%.

- Through Shor’s Algorithm, quantum systems in 2025 threaten classical encryption within hours, driving the adoption of quantum-resistant security standards and post-quantum encryption.

- Quantum simulation in 2025 has achieved ~30% higher predictive accuracy in modeling market dynamics, allowing firms to respond to volatility more swiftly.

- Banks such as Barclays in 2025 piloted quantum credit risk models yielding ~25% better accuracy compared to classical analytics.

- The capacity to model molecular-scale processes in 2025 supports quantum financial frameworks that handle nonlinear volatility, improving predictive error margins by ~15%.

- China in 2025 has led with over 40% share of global quantum patent filings, surpassing 3,000 filings, reinforcing its dominance in finance-focused quantum innovation.

Quantum Readiness in Finance

- 80% of financial institutions globally had quantum pilots by 2025.

- The U.S. allocated $350 million by 2025 for quantum workforce development.

- 70% of banks now plan to adopt quantum risk modeling tools by 2027.

- The EU Quantum Flagship in 2025 has committed €120 million toward quantum trade and finance.

- By 2025, 75% of hedge funds are expected to use quantum algorithms for real-time decision making.

- Demand for quantum professionals in finance rose 65% year-over-year, with average salaries of $160,000.

- In a 2025 survey, 55% of CFOs said quantum technologies are critical for long-term financial strategy.

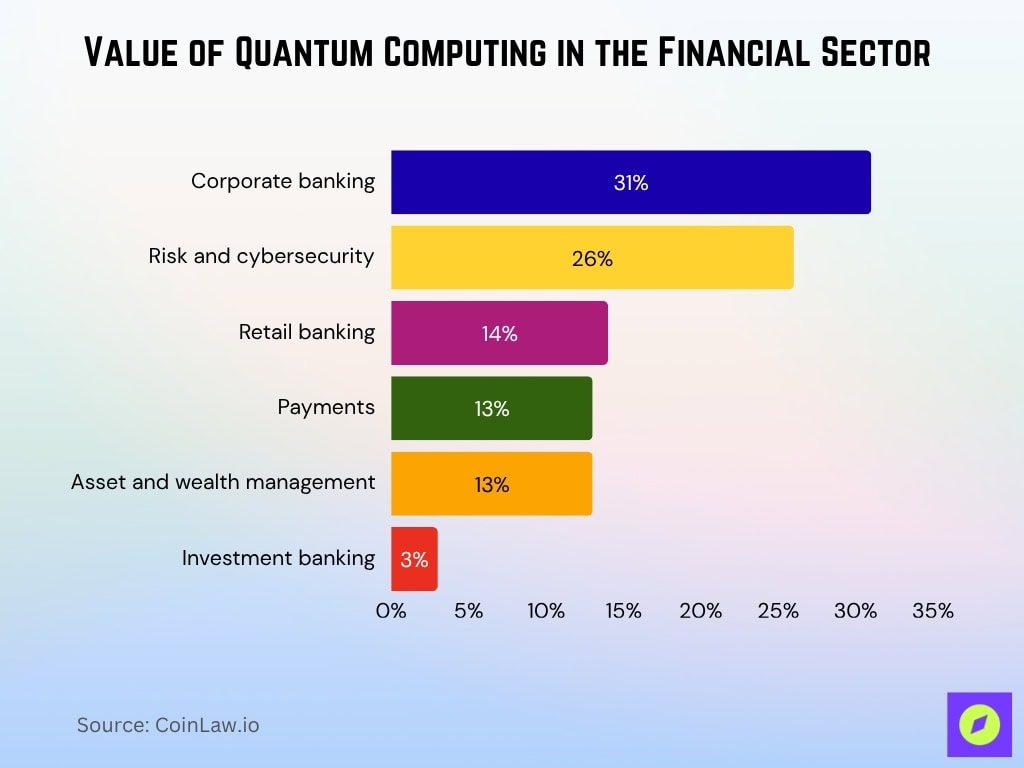

Value of Quantum Computing in the Financial Sector

- The total value of quantum computing applications in finance is estimated at $622 million in 2025.

- Corporate banking leads the adoption, capturing 31% of the total market.

- Risk and cybersecurity follow with 26%, highlighting strong demand for quantum-safe encryption and fraud prevention.

- Retail banking represents 14%, reflecting the use of quantum tools for customer analytics and credit scoring.

- Both payments and asset and wealth management account for 13% each, signaling growing interest in real-time transaction optimization and portfolio modeling.

- Investment banking holds a modest 3%, as complex deal simulations and quantum trading remain early-stage.

Powerful Quantum Use Cases

- Portfolio Optimization QAOA in 2025 delivers ~40% better returns on diversification compared to classical methods.

- Fraud Detection with quantum-enhanced machine learning in 2025 cut false alerts by ~65%.

- Risk Assessment via quantum simulations in 2025 allowed firms to process millions of scenarios in seconds and reduce decision time by ~80%.

- High-Frequency Trading strategies in 2025 now predict price movements with ~92% accuracy, impacting markets worth $7.2 trillion daily.

- Credit Scoring in 2025 improved default prediction precision by ~35%, lowering credit risk substantially.

- Blockchain Security in 2025 uses quantum-safe encryption to protect billions in DeFi from quantum decryption threats.

- Mortgage Underwriting analytics in 2025 shaved evaluation time by ~55%, enabling faster service for customers.

Investment Share Worldwide for Quantum Computing Growth

- In 2025, global quantum computing investment climbed to $16 billion, a 100% increase from 2023.

- In 2025, the U.S. led with $7 billion, followed by China with $6 billion in quantum funding.

- Venture capital funding for quantum startups in 2025 hit $4 billion, with ~45% going to finance-oriented technologies.

- European financial services in 2025 allocated €1 billion to quantum research across banking and trading.

- Singapore and South Korea in 2025, dedicated 20% of their national quantum budgets to financial applications.

- Major banks, such as Deutsche Bank 2025 invested $400 million into quantum risk analysis tools.

- The Quantum Financial Taskforce under the G20 committed $2 billion by 2025 to bolster global financial systems’ quantum resilience.

Quantum Security Worldwide Revenue

- Asia-Pacific led quantum security revenue in 2025 with $650 million, followed by North America at $580 million.

- The European Central Bank launched a €300 million program in 2025 to deploy quantum-safe defenses across EU finance systems.

- The quantum security market reached $1.7 billion in 2025, growing at a 49% CAGR.

- Financial institutions made up ~42% of global quantum security spending in 2025, securing high-value transactions.

- Post-quantum cryptography implementations rose by ~70% in 2025, driven by rising quantum threats.

- A 2025 survey found ~70% of global banks were transitioning to quantum-proof encryption strategies.

- Cybersecurity firms reported a 350% surge in demand for post-quantum digital certificates in 2025.

Funding for Quantum Computing Technologies

- Global R&D spending on quantum technologies in 2025 is estimated at $6.3 billion, with ~38% going to financial applications.

- The U.S. Quantum Innovation Fund in 2025 allocated $1.5 billion for startups focused on finance and cybersecurity.

- Google’s Quantum AI division in 2025 invested $250 million to build scalable quantum systems for high-speed trading.

- Barclays in 2025 pledged $150 million toward quantum algorithms for risk assessment.

- China’s Quantum Development Program in 2025 directed $3.2 billion to advance encryption and financial data security.

- Financial firms in India in 2025 contributed ₹900 crore to pilot quantum applications with tech startups.

- Amazon Web Services in 2025 invested $450 million in quantum-as-a-service platforms for banking and finance.

Technological Developments and Innovations

- IBM in 2025 unveiled its Kookaburra processor with 1,386 qubits and modular interconnectivity to scale toward 4,158-qubit systems.

- IBM also deployed the 156-qubit Heron processor in 2025 with a two-qubit error rate of ~3×10⁻³, improving error characteristics 10× over prior generation.

- Rigetti’s hybrid quantum-classical systems in 2025 can integrate ~10⁵ classical variables with quantum subroutines to optimize investment portfolios up to 30% more efficiently.

- Canadian quantum startups in 2025 built real-time arbitrage engines that improved trading accuracy by ~28% in volatile markets.

- Quantum annealing platforms in 2025 accelerated solutions for complex asset allocation, reducing compute times by ~65%.

- Honeywell’s quantum group (as of 2025) demonstrated compact quantum units for credit risk that trimmed evaluation latencies by ~45%.

- Innovations in quantum network infrastructure in 2025 enabled secure, instantaneous fund transfers across borders, slashing inter-bank settlement delays by ~70%.

Challenges and Ethical Considerations

- 65% of financial executives in 2025 cite a shortage of skilled quantum professionals as a key barrier to adoption.

- Quantum systems continue to carry high costs, averaging $20 million per installation in 2025, restricting uptake in smaller firms.

- Risks from quantum hacking in 2025 pose threats to existing cryptographic systems and could expose sensitive financial data.

- Ethical concerns in 2025 are mounting over the misuse of quantum simulations for market manipulation by powerful firms.

- The energy demand of quantum processors in 2025 remains high, with certain systems requiring ~25 kilowatts per hour.

- In 2025, approximately 70% of consumers report unease about the influence of AI and quantum computing in personal finance decisions.

- Cross-border regulation of quantum security in 2025 remains fragmented, raising risks for global financial networks.

Recent Developments

- JPMorgan Chase in 2025 integrated quantum algorithms into pricing mortgage-backed securities, boosting accuracy by ~28%.

- Google AI in 2025 formed partnerships with major banks to build quantum machine learning fraud models that reduced breach rates by ~32%.

- The European Union 2025 approved a €650 million quantum finance initiative to speed regional adoption.

- Quantum-powered hedge funds in 2025 outperformed traditional funds by ~25% using advanced predictive models.

- Singapore launched a national quantum finance hub in 2025, backed by $300 million in funding.

- HSBC adopted quantum compliance tools in 2025, cutting audit errors by ~45%.

- Startups like Zapata Computing in 2025 won contracts with Fortune 500 banks to deploy scalable quantum solutions worth $120 million.

Frequently Asked Questions (FAQs)

The market is $3.52 billion in 2025 and is projected to reach $20.20 billion by 2030 at a 41.8% CAGR.

Only 5% of enterprises have quantum-safe encryption in place in 2025, while 69% acknowledge the risk to current cryptography.

Financial services are expected to account for 14% to 24% of the quantum market share by 2035.

JPMorgan Chase leads, accounting for about two-thirds of quantum-related job postings among the top 50 banks.

Conclusion

Quantum computing is no longer a futuristic concept; it is actively reshaping finance today. Financial institutions worldwide are embracing this transformative technology to optimize operations, bolster security, and achieve unparalleled computational power. However, navigating the associated challenges, from skill shortages to ethical dilemmas, remains vital. With continued innovation and investment, quantum computing is set to become the backbone of modern finance, propelling the industry into an era of unprecedented possibilities.