Pig butchering scams have surged into one of the most financially damaging forms of cyber fraud. These schemes blend romantic messaging, trust building, and fraudulent investment pitches to trick victims into sending money, often via cryptocurrency, before disappearing with the funds. In the US, individuals and families have lost billions of dollars, while international law enforcement escalates efforts to disrupt the networks behind this fraud. The real cost is not just monetary: pig butchering also erodes trust in online communication and investment channels. Read on to understand how these scams work, why they’re growing, and what the latest data reveals.

Editor’s Choice

- Global losses from pig butchering scams likely exceed $75 billion, underscoring the scale of the threat.

- Americans alone lost an estimated $10 billion to Southeast Asia‑based scam operations in 2024, a 66% increase year‑over‑year.

- In 2024, cryptocurrency‑related losses reached about $9.3 billion, with investment scams leading the charge.

- Pig butchering scam revenues grew nearly 40% in 2024, while deposits into scams jumped an astonishing 210%.

- U.S. victims reported average individual losses exceeding $150,000 in cases linked to scam service providers.

- TRM Labs estimated over $4 billion lost in pig butchering schemes in 2023 alone.

- Nearly 10% of adults surveyed reported being targeted by a pig butchering scam.

Recent Developments

- In late 2025, the U.S. FBI seized scam domains tied to pig butchering operations that defrauded Americans via fake crypto investment sites.

- The U.S. Treasury sanctioned infrastructure providers aiding scam websites, driving home the role of intermediaries in facilitating fraud.

- Government estimates for 2024 showed a 66% growth in losses to Southeast Asia‑based fraud networks compared with the prior year.

- Federal agencies now label pig butchering under the broader cryptocurrency investment fraud category as part of Operation Level Up.

- Digital asset crime complaints involving crypto reached about 150,000 reports in 2024 in the U.S., highlighting continuing victimization trends.

- Law enforcement globally is moving to rename or reframe the term because of its stigmatizing connotations, per INTERPOL’s guidance.

- Intelligence reports suggest sophisticated AI tools are now aiding scammers to craft convincing fake personas.

- Public awareness campaigns and blockchain monitoring initiatives are expanding to counter scam growth.

Cybercrime Losses by Victim Loss Breakdown

- Investment scams dominate losses at $3.31 billion, making them the most financially damaging crime category.

- Business Email Compromise (BEC) caused $2.74 billion in losses, highlighting continued corporate targeting.

- Tech support scams generated $806.6 million, showing strong persistence among consumer-focused frauds.

- Personal data breaches resulted in $742.4 million, reflecting the high monetization value of stolen data.

- Confidence and romance scams accounted for $735.9 million, reinforcing the emotional manipulation factor.

- Data breach crimes totaled $459.3 million, affecting both individuals and organizations.

- Real estate fraud led to $396.9 million in losses, often tied to wire transfer manipulation.

- Non-payment and non-delivery scams reached $281.8 million, common in online marketplaces.

- Credit card and check fraud caused $264.1 million, driven by payment credential abuse.

- Government impersonation scams resulted in $240.6 million, exploiting fear and authority.

- Identity theft losses stood at $189.2 million, linked to account takeovers and fraud chains.

- Advanced fee scams still extracted $104.3 million, despite being widely known.

- Phishing losses reached $52.1 million, often acting as an entry point to larger fraud.

- Ransomware losses totaled $34.4 million, reflecting improved defenses but continued risk.

- Crimes against children reported $577,464, lower in dollar value but severe in social impact.

What is a Pig Butchering Scam?

- Pig butchering is a confidence fraud that combines romance, social engineering, and fake investments.

- Crypto scams reached an all-time high of $2.1 billion in the first half of the year.

- APAC law enforcement froze $47 million in scam funds.

- FBI Operation Level Up notified over 6,300 victims (Feb-Nov 2025), preventing $275 million in losses.

- Crypto losses from scams hit $9.3 billion nationwide.

- Funnull Technology facilitated over $200 million in victim losses.

- Pig butchering revenue grew nearly 40% year over year.

Origin of the Term

- Originated in China before 2016 as a regional scam targeting dating sites.

- 74% of trafficking victims were sent to Southeast Asia scam centers as of March.

- Victims trafficked from 66 countries into global scam centers.

- Scam centers in Burma, Cambodia, and Laos generated $43.8 billion in revenue.

- 220,000 people are held in forced labor in Cambodia and Burma scam centers.

- 90% of human trafficking facilitators are from Asia.

- 80% of facilitators are men aged 20-39.

- 81 Filipinos trapped in Myanmar scam hub shelter after rescue.

- Operations expanded during the pandemic amid crypto adoption.

- INTERPOL documented scam centers in West Africa as an emerging hub.

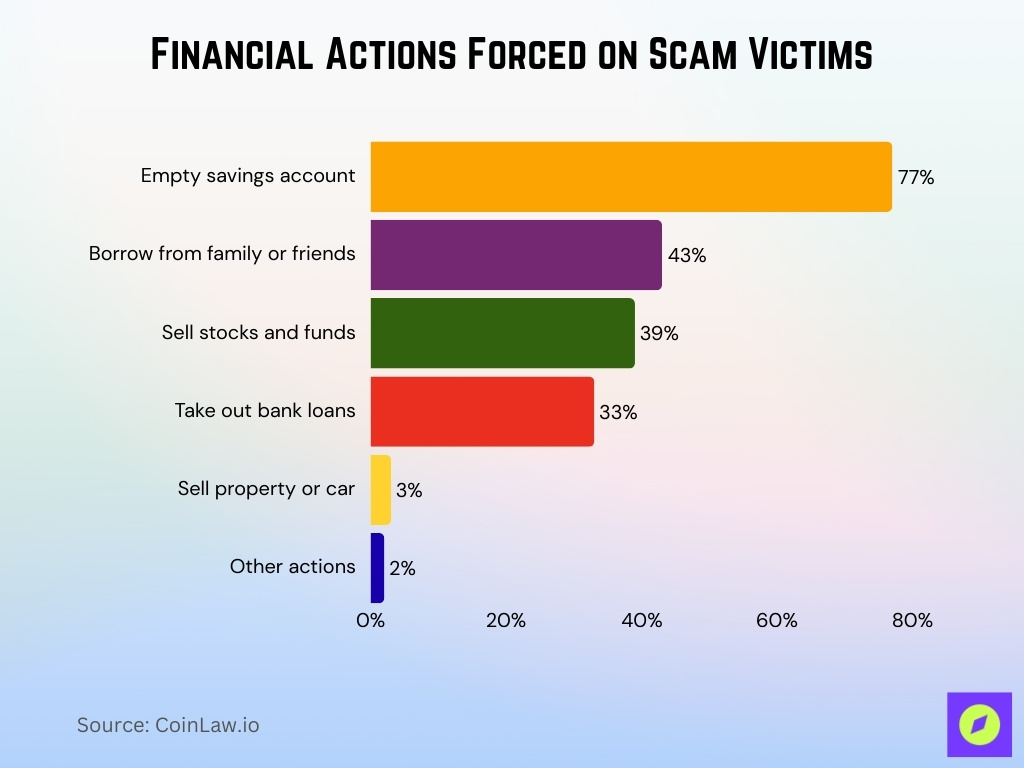

Financial Actions Forced on Scam Victims

- 77% of victims were forced to empty their savings accounts, showing how scams quickly drain personal reserves.

- 43% had to borrow from family or friends, spreading the financial impact beyond the direct victim.

- 39% were pushed to sell stocks or investment funds, often liquidating long-term assets at a loss.

- 33% took out bank loans, increasing debt burdens even after the scam ended.

- Only 3% were forced to sell property or vehicles, but these cases reflect severe financial distress.

- 2% reported other actions, highlighting additional, less common methods scammers use to extract funds.

How Pig Butchering Scams Work

- Scammers initiate contact on dating sites or social media platforms.

- Relationships are cultivated over weeks or months to build emotional trust.

- 76% of victims are unaware of the scam during the fake investment phase.

- Fake dashboards show fictitious returns to encourage further deposits.

- Victims make multiple payments, coached as additional investments.

- The number of deposits to scams grew 210% year over year.

- Average deposit amount declined 55% as scammers target more victims faster.

- Withdrawals are blocked with pretenses like fees or verification delays.

- Scammers disappear abruptly after final payments, leaving no recourse.

Stages of the Scam

- Initial Contact via dating platforms or messaging services using AI personas.

- Rapport Building lasts weeks to months with daily communication.

- The number of deposits per pig butchering scam grew 210% year over year.

- Small Test Investment shows fake profits on dashboards to build confidence.

- Escalating Investments with average deposit amount down 55% YoY.

- Victims make multiple payments before the withdrawal resistance phase.

- Withdrawal Resistance uses excuses like fees or verification delays.

- Disappearance occurs abruptly after the final fund extraction.

- Aftermath sees underreporting due to victim shame and trauma.

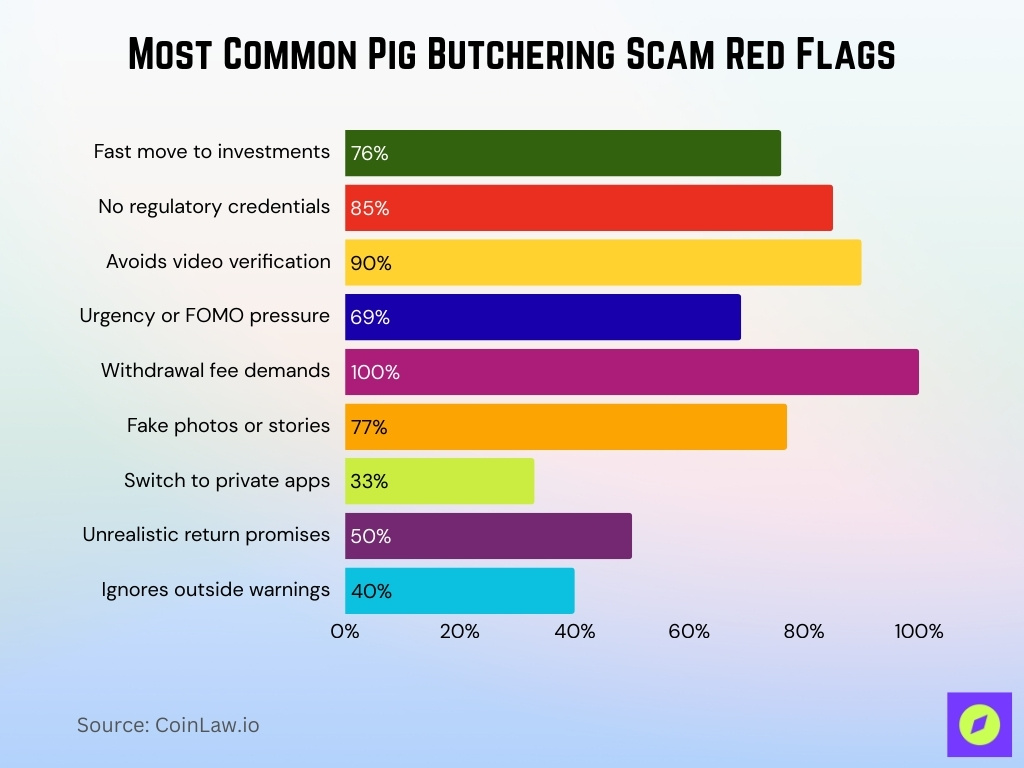

Red Flags to Watch For

- 76% of victims report a rapid shift from casual chat to investments.

- 85% of fake platforms lack regulatory credentials or registration.

- 90% of scammers avoid video calls or real-time verification.

- 69% use urgency or FOMO tactics in messaging.

- 100% demand unexplained fees before withdrawals.

- 77% show inconsistencies in photos or personal stories.

- 33% of contacts move to private apps within the first week.

- High-return promises exceed 50% annual yields with no risk.

- 40% of victims ignore friend warnings due to isolation.

Common Contact Methods

- 69.2% of victims contacted via unsolicited SMS pretending to be a wrong number.

- 23% approached on dating apps like Tinder, Bumble, and Hinge.

- 12% of U.S. dating app users were exposed to these scams in October.

- Scammers shift to WhatsApp or Telegram to mask phone numbers.

- 6.8 million WhatsApp accounts banned for scam activity.

- Social media platforms are used for initial fake profile contacts.

- Twilio observed a rise in conversational social engineering texts.

- VOIP apps are employed to hide scammer identities during calls.

- AI-generated photos boost credibility in 80% of profiles.

Building Trust Tactics

- Rapport building lasts 3-11 months with daily conversations.

- Scammers share fake personal stories and photos to create emotional bonds.

- 77% of victims connect on additional social media platforms for credibility.

- Fake profit screenshots were shown to 100% of victims during the trust phase.

- 7 participants report audio calls matching sent photos for authenticity.

- Emotional grooming uses mirroring, constantly agreeing with the victim’s views.

- Victims receive congratulatory messages on perceived successes daily.

- Scammers discourage consulting others, citing market confidentiality.

- AI-generated photos are used in 80% of scammer profiles.

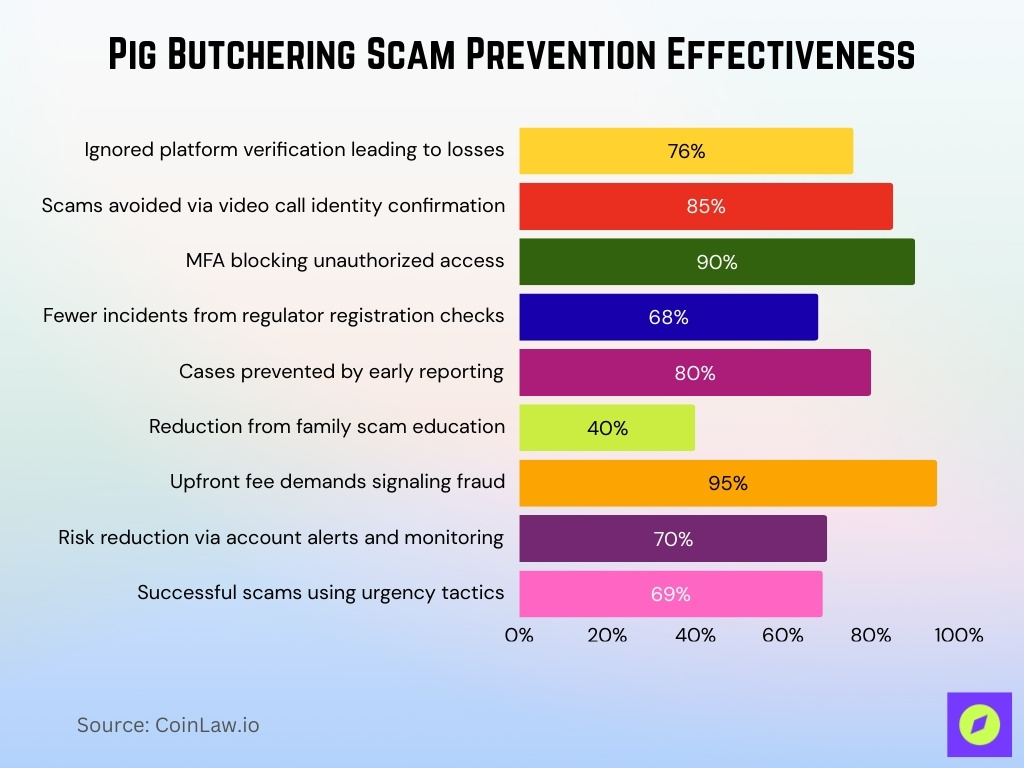

Pig Butchering Scam Prevention Tips

- 76% of victims ignored platform verification, leading to losses.

- 85% of scams are avoided by video call identity confirmation.

- 90% success rate for multi-factor authentication blocking access.

- 68% fewer incidents among users checking the regulator registration.

- 80% of cases were prevented by reporting suspicious messages early.

- 40% drop in victimization through family scam education.

- 95% of upfront fee demands signal confirmed fraud attempts.

- 70% reduced risk with account alerts and transaction monitoring.

- Urgency tactics are present in 69% of successful scams.

Introducing Fake Investments

- 33.2% of all scam crypto received by pig butchering operations.

- Fake platforms promise high yields, mimicking legitimate exchanges.

- $6.5 billion U.S. losses to crypto investment fraud.

- Initial profits were fabricated on dashboards for 100% of victims.

- Victims pay fake taxes or fees before blocked withdrawals.

- 40% year-over-year rise in pig butchering cases.

- 210% increase in the number of deposits to fake platforms.

- $5.5 billion+ global losses from fraudulent investment schemes.

Role of Fake Platforms

- Funnull Technology hosts hundreds of thousands of scam websites.

- $200 million U.S. victim losses tied to Funnull platforms.

- 33.2% of scam crypto received by pig butchering fake platforms.

- 210% increase in deposits to fraudulent trading sites.

- Fake platforms use domain generation algorithms for evasion.

- 85% of scams involve fully verified fake accounts.

- Platforms demand login credentials, risking identity theft.

- Withdrawal triggers mandatory fees, extracting more funds.

Victim Demographics and Statistics

- 40-60% of victims aged 30-49 with professional backgrounds.

- $10,000-$99,999 range in 40% of scam wallet deposits.

- Victims from 66+ nationalities tied to Southeast Asia scam centers.

- High financial literacy in 60% of documented victims.

- Underreporting rate exceeds 80% due to embarrassment.

- Six-figure losses in 25% of reported cases.

- 74% of victims experience anxiety or depression post-scam.

Geographic Hotspots

- Cambodia, Laos, and Myanmar generated $43.8 billion in scam revenue.

- 100,000-150,000 forced workers are exploited in Cambodian scam centers.

- 53 active scam compounds identified in Cambodia alone.

- 305,000 scammers operate across Myanmar, Cambodia, and Laos.

- $12.5-19 billion annual revenue from Cambodia’s scam industry.

- Scam operations account for 40% of the combined GDP in the region.

- Victims trafficked from 70+ nationalities to Southeast Asia centers.

- KK Park in Myanmar serves as a major pig butchering hub.

- 300,000+ people are involved in regional forced scam labor.

Pig Butchering Scam Real Victim Stories

- North Carolina man lost $3.4 million to a fake fashion designer “Jeanie”.

- Illinois woman lost $1 million in life savings, forced to sell her home.

- Bay Area widow lost $1 million from an IRA to a Facebook scammer “Ed”.

- Seven family members lost $5.5 million to a fake trading platform.

- Kansas banker embezzled $47.1 million for a pig butchering scam.

- $8.5 million seized from cryptocurrency investment fraud victims.

- $200,000 “withdrawal tax” extracted as final victim payment.

- Victims report suicide interventions after total life savings loss.

Law Enforcement Efforts

- The FBI’s Operation Level Up identifies and notifies victims of cryptocurrency investment fraud, including pig butchering, with 6,475 victims contacted as of mid‑2025.

- Law enforcement estimates show that 77% of victims were unaware they were being scammed before FBI contact.

- This operation is credited with saving victims an estimated $400 million in potential losses by early intervention.

- Federal agencies are collaborating internationally.

- Sanctions target not only operators but infrastructure providers that support scam networks, including those involved in money laundering and AI‑generated personas.

- Law enforcement and tech companies, such as Meta, are actively dismantling scam accounts and warning users about suspicious activities across social platforms.

- Cross‑border cooperation has expanded, as seen in multinational crackdowns on scam compounds in Southeast Asia.

- Arrests related to scam compound operations highlight ongoing prosecution efforts.

- Agencies are emphasizing rapid reporting and early detection to disrupt scam lifecycles and prevent further exploitation.

Recovery and Reporting Steps

- DOJ seized $8.5 million in cryptocurrency from investment fraud schemes.

- In one of the largest seizures, the U.S. DOJ recovered over $3.6 billion in Bitcoin related to a cryptocurrency fraud case.

- Recovery rate remains under 10% for reported cryptocurrency scams.

- USSS investigations led to $5 million+ victim fund seizures.

- Underreporting affects 80% of cases, hindering recovery efforts.

- Tax deductions available under IRC §165 for fraud theft losses.

Frequently Asked Questions (FAQs)

Studies have estimated that pig butchering scammers have stolen more than $75 billion globally over time.

Federal agents seized nearly $8.5 million in Tether tied to pig butchering scam proceeds in December 2025 operations.

U.S. victims of scam platforms tied to pig butchering have reported over $200 million in losses, with average individual losses over $150,000.

Analysts estimate that pig butchering and related crypto fraud account for part of an estimated over $53 billion in total crypto scams and fraud since 2023.

Conclusion

Pig butchering scams have evolved into a complex, multinational threat that inflicts severe financial and emotional harm on victims worldwide. From sprawling scam centers in Southeast Asia to tailored social engineering attacks targeting Americans, the scale and sophistication of these frauds demand coordinated responses. Law enforcement efforts, while increasingly proactive, succeed only when victims report early and accurately. By understanding geographic hotspots, recognizing common tactics, and following strict reporting and prevention protocols, individuals can protect themselves and others. Staying informed and vigilant remains the most effective defense against these emerging frauds.