PhonePe continues its journey as a formidable leader in the digital payments landscape, shaping the way Indians transact every day. From neighborhood stores to online shopping, PhonePe has not only expanded its reach but also profoundly influenced the digital payments ecosystem in India. The company’s user-friendly interface, constant innovation, and strategic expansion have made it one of the most relied-on payment platforms. Let’s explore the latest PhonePe statistics and understand the platform’s pivotal role in India’s financial digitization.

Editor’s Choice

- PhonePe holds a 46–48% share of UPI payments in India, solidifying its leadership.

- PhonePe processes 9.8 billion UPI transactions monthly with 45–47% market share.

- PhonePe revenue reached ₹7,115 crore in FY25, up 40% year-over-year.

- Total expenses rose to ₹9,394 crore, with employee benefits at ₹4,097 crore (44% of total).

- Payment processing expenses increased to ₹1,688 crore amid higher volumes.

- PhonePe eyes $15 billion valuation ahead of mid-2026 IPO filing.

- PhonePe handles around 330 million daily online transactions as of early 2025, supported by a robust infrastructure.

Recent Developments

- PhonePe posted ₹630 crore profit in FY25 with 74% revenue growth to ₹7,115 crore.

- UPI 30% market cap rule deferred to December 2026.

- PhonePe confidentially filed for a $1.5 billion IPO targeting a mid-2026 listing at a $15 billion valuation.

- Device tokenization rolled out, enhancing security with encrypted tokens.

- PhonePe exited the NBFC-AA model, partnering with licensed Account Aggregators.

- PhonePe launched quick commerce services in January 2025.

- Adjusted PAT positive for the first time in FY25.

- 9.8 billion UPI transactions in December, nearing 10 billion monthly.

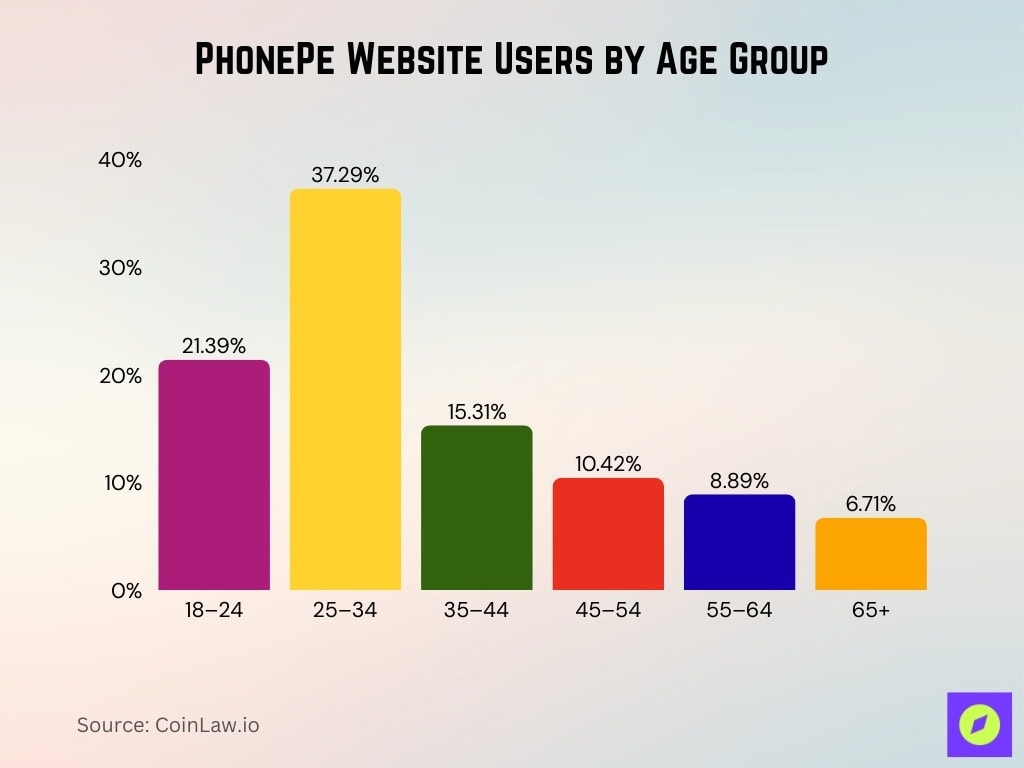

Age Distribution of PhonePe Website Users

- The 25–34 age group dominates PhonePe’s website traffic, accounting for 37.29% of total users, the largest demographic by a significant margin.

- Users aged 18–24 make up the second-largest group at 21.39%, highlighting strong traction among younger adults.

- The 35–44 age bracket contributes 15.31%, showing moderate engagement from mid-career professionals.

- Website usage decreases with age, as the 45–54 group represents only 10.42% of users.

- Older people aged 55–64 form 8.89%, while the 65+ segment accounts for just 6.71%, the smallest share.

- Overall, 74% of PhonePe users fall between 18 and 44 years, emphasizing appeal to millennials and Gen Z.

General PhonePe Statistics

- PhonePe has over 600 million registered users, making it India’s top finance app by downloads.

- Daily active users (DAUs) reached 140 million, reflecting rising daily engagement.

- PhonePe covers 99% of Indian districts, with acceptance across rural and urban areas.

- Monthly transaction volume exceeds ₹9.5 trillion, with 9.8 billion UPI transactions.

- 38% year-over-year growth in active user base sustains strong acquisition.

- Brand recall rate stands at 88%, underscoring deep market penetration.

- PhonePe processes over 330 million daily transactions as usage has scaled with its 600 million‑plus user base.

User Growth and Engagement Statistics

- 85 million new users joined PhonePe in 2025, reinforcing its appeal to digital users.

- User retention rate climbed to 76%, indicating deepening trust and reliance.

- Average transaction frequency per user grew by 28% year-over-year.

- 42% of PhonePe users are female, improving gender diversity in digital finance.

- Peak usage times remain 9 AM–12 PM and 5 PM–9 PM.

- 68% of users are aged 18–35, dominating the young digital-first segment.

- Customer satisfaction score rose to 91%.

- Over 600 million registered users as of early 2026.

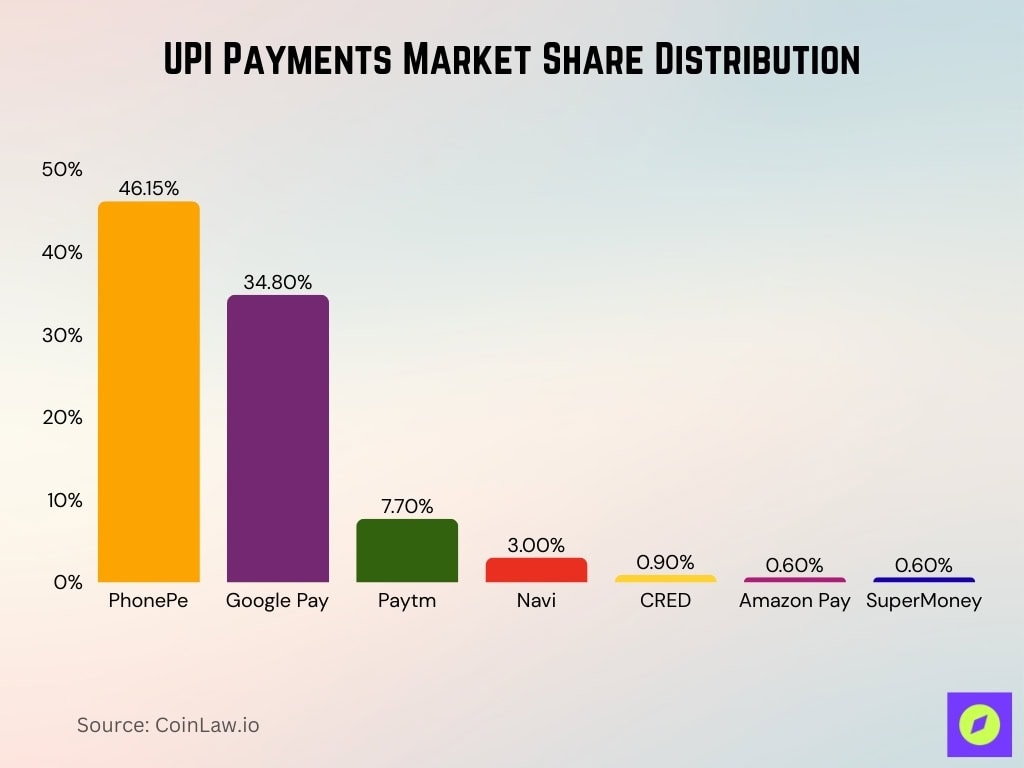

UPI Market Share Breakdown

- PhonePe holds 46.15% share of the UPI market, leading by a wide margin.

- Google Pay follows with 34.80% market share as the second-largest platform.

- Paytm accounts for 7.70% of the UPI market, maintaining a significant presence.

- Navi captures 3.0% of the market as a growing player.

- CRED and Amazon Pay hold 0.9% and 0.6% shares, respectively.

- SuperMoney records 0.6% market share.

Transaction Volume and Total Payment Value (TPV)

- Monthly TPV crossed ₹13.6 trillion in December with 9.8 billion transactions.

- 44% year-over-year growth in TPV reflects rising digital activity.

- Average transaction size stands at ₹520 across P2P and merchant payments.

- PhonePe now handles about 330–340 million daily transactions based on 9.8 billion monthly UPI payments in December 2025.

- B2B transactions grew by 36% driven by SME adoption.

- The recurring payments feature has over 35 million active users.

- Cross-border payments rose 13%, supporting international remittances.

- Annualized TPV exceeds ₹150 lakh crore ($1.8 trillion).

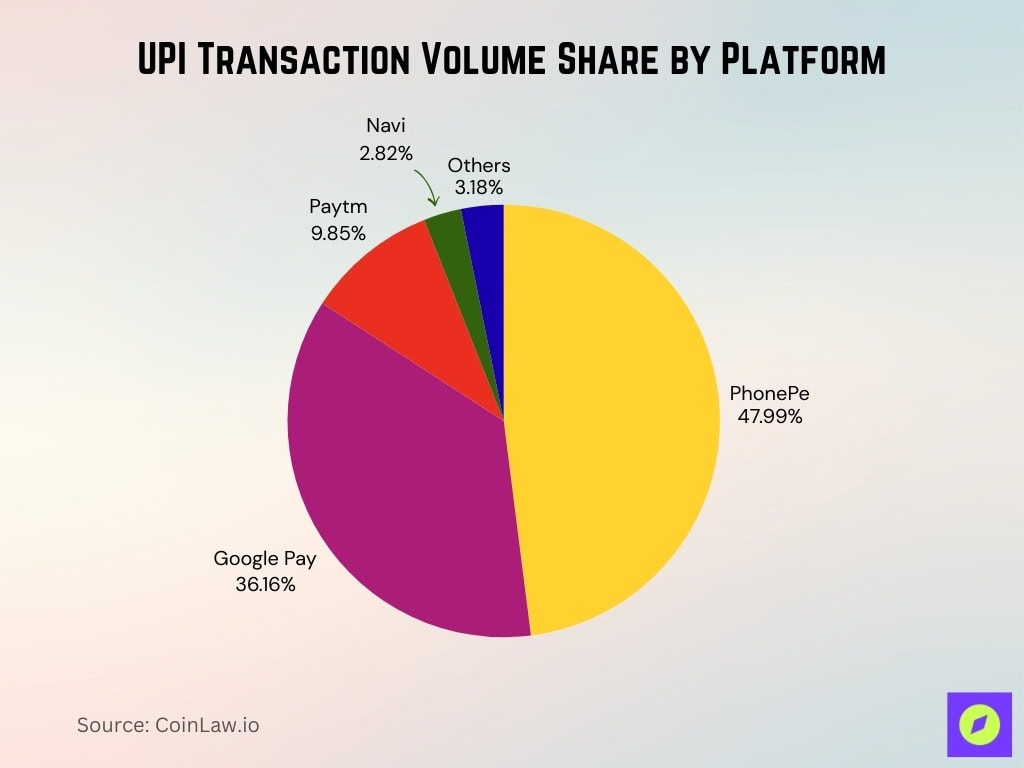

UPI Transaction Volume Share

- PhonePe leads UPI with 47.99% share of transaction volumes.

- Google Pay holds 36.16% share, second in digital payments.

- Paytm captures 9.85% of the market.

- Navi accounts for 2.82% of transactions.

- Others collectively make up 3.18%.

Factors Contributing to UPI Transaction Growth

- Cashback and rewards programs boosted transactions by 28%, appealing to value-seeking users.

- Streamlined interface and faster processing led to 37% higher satisfaction rate vs competitors.

- 92% of support queries were resolved through AI-driven tools, reducing drop-offs.

- 24/7 UPI availability sustained by strategic banking partnerships.

- PhonePe ATMs operate at over 120,000 local stores for cash access.

- 600,000+ rural merchants joined, strengthening digital inclusion.

- Government-backed digital literacy drives led to 22% rise in registrations.

- UPI Circle launched for family payments on feature phones.

Cyber-safety Measures

- Two-factor authentication (2FA) is mandatory for all accounts, enhancing transaction security.

- 24/7 cybersecurity team reduced fraud attempts by over 40%.

- 256-bit encryption protocols safeguard all user data and transactions.

- Daily threat scans maintain 99.95% service uptime with rapid patches.

- ₹1.5 crore invested in cybersecurity training for evolving threats.

- AI/ML tools block suspicious activity with 22% higher accuracy.

- Cyber awareness campaigns reached 6.5 million users quarterly.

- Zero-trust architecture is implemented across all platforms.

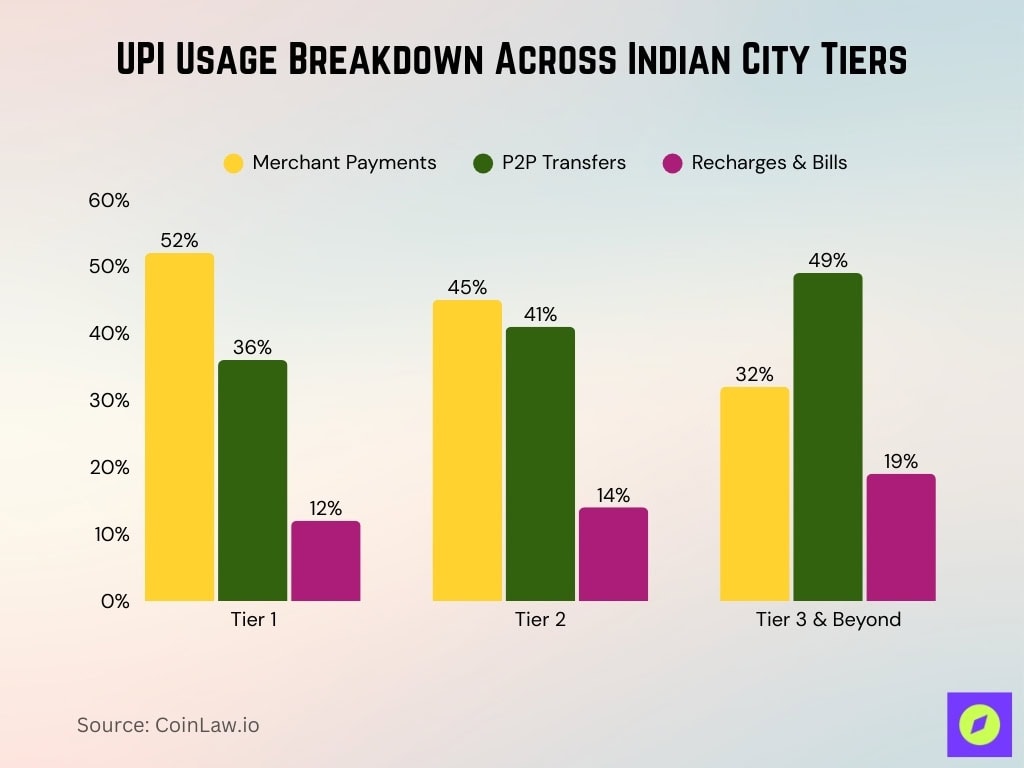

UPI Usage Patterns Across Indian City Tiers

- In Tier 1 cities, 52% of UPI transactions are merchant payments, 36% P2P, 12% recharges and bills.

- In Tier 2 cities, 45% are merchant-related, 41% P2P, 14% bill payments.

- In Tier 3 cities and beyond, 49% is peer-to-peer, 32% merchant payments, 19% recharges and bills.

- Tier 3-6 cities contribute 60-70% of new mobile payment customers.

- 72% of Tier 2/3 city users prefer PhonePe.

- Tier 2+ cities drive 55% of PhonePe transactions.

Frequently Asked Questions (FAQs)

PhonePe reported ₹7,631 crore in revenue in FY25.

Payment processing charges grew by 75 % to ₹1,166 crore.

PhonePe, Google Pay, and Paytm together processed about 98 % of UPI payments.

Conclusion

PhonePe’s journey from a simple payment platform to a comprehensive financial services provider underscores its pivotal role in India’s digital economy. As it continues to grow in terms of user base, transaction volume, and service offerings, PhonePe not only transforms the payments landscape but also drives financial inclusion across the country. By embracing technology and prioritizing security, PhonePe has established itself as a trusted and innovative force in the digital payments sector. With ambitious plans forfurther expansion and enhancements, PhonePe is well-positioned to lead India into a digital-first financial future.