Imagine a world where you don’t have to choose between your pet’s health and your wallet. Pet health insurance is stepping in to fill that gap, offering pet parents peace of mind while ensuring their furry friends receive the best care possible. As the demand for veterinary services grows and pets are increasingly viewed as family members, the pet health insurance industry is booming. In this article, we’ll uncover the latest statistics, trends, and key milestones shaping the pet insurance landscape in 2025.

Editor’s Choice: Key Industry Milestones

- $3.2 billion in pet insurance premiums were written in the United States in 2023, marking a significant increase of 28% year-over-year from 2022.

- Over 5.36 million pets in North America were insured as of 2023, with cats and dogs leading the way in policy adoption.

- The compound annual growth rate (CAGR) of the pet insurance market globally is projected at 16.7% from 2023 to 2030, fueled by rising awareness of veterinary costs.

- California led the US in pet insurance adoption, accounting for 15% of all policies nationwide in 2023.

- The most common claim category in 2023 was illness-related expenses, making up 70% of total reimbursements.

- Top providers like Nationwide, Trupanion, and Healthy Paws collectively held over 60% market share in the United States in 2023.

- Accident-only policies saw a 12% increase in adoption in 2023, reflecting budget-conscious pet owners seeking coverage for emergencies.

Market Size & Trends

- The global pet insurance market was valued at $11.1 billion in 2023 and is expected to exceed $16 billion by 2025.

- In the US alone, the pet insurance market is anticipated to grow at a CAGR of 18.4% from 2024 to 2030, driven by advancements in veterinary technology and consumer awareness.

- Europe dominates the market with over 40% of the global market share, thanks to robust policies in countries like the UK and Sweden.

- The UK pet insurance market generated approximately $1.5 billion in premiums in 2023, making it the second-largest market after the US.

- Emerging markets, including India and Brazil, are experiencing rapid growth, with annual increases in policyholders exceeding 25%.

- Customized coverage plans have grown popular, with over 30% of new policies in 2023 offering add-ons like dental care or behavioral therapy.

- Digital-first platforms, such as mobile apps for claims and renewals, contributed to a 40% faster processing time compared to traditional channels in 2023.

- Veterinary care costs continue to rise, with an average increase of 7.5% annually, pushing pet owners toward insurance adoption.

- A survey in 2023 revealed that 78% of pet owners view insurance as a necessary part of pet care, a significant increase from 65% in 2020.

Policy Types and Coverage

- Comprehensive policies, covering accidents, illnesses, and preventive care, accounted for 55% of policies sold in 2023, showing the highest demand among pet owners.

- Accident-only policies saw a 12% rise in adoption in 2023, catering to budget-conscious owners who primarily seek emergency coverage.

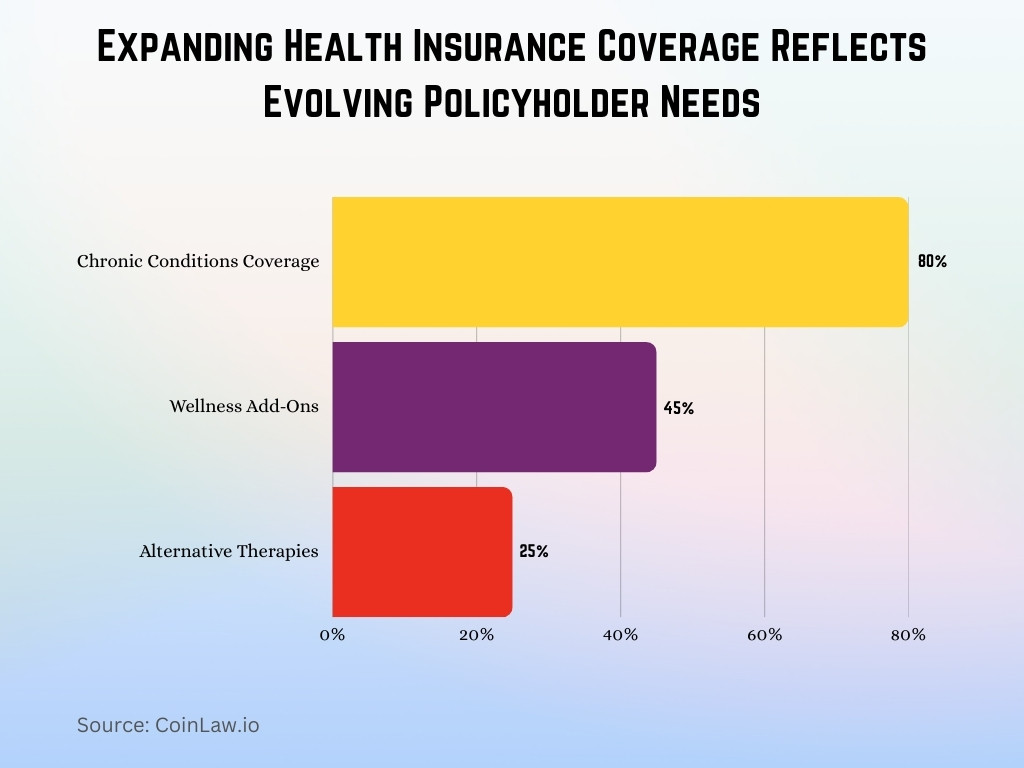

- Coverage for chronic conditions such as diabetes and arthritis is now included in 80% of comprehensive plans.

- Wellness add-ons, including routine check-ups and vaccinations, were opted for by 45% of policyholders, reflecting a growing interest in preventive care.

- New trends in coverage include alternative therapies like acupuncture and hydrotherapy, available in 25% of policies in 2023.

- Peculiar pet insurance, covering animals like birds and reptiles, witnessed a 30% growth in policy sales, although it still represents a niche segment.

- Lifetime policies gained popularity, with 20% of new subscribers opting for plans that guarantee coverage without age limits.

- A flexible deductible system introduced by leading insurers allowed 40% of policyholders to customize premiums based on their financial capabilities.

- Virtual veterinary services, often included in policies, saw a 70% increase in utilization in 2023, spurred by convenience and accessibility.

- Policies with 100% reimbursement options increased, catering to pet owners wanting full-cost recovery despite higher premiums.

Average Costs of Routine Medical Care for Dogs and Cats

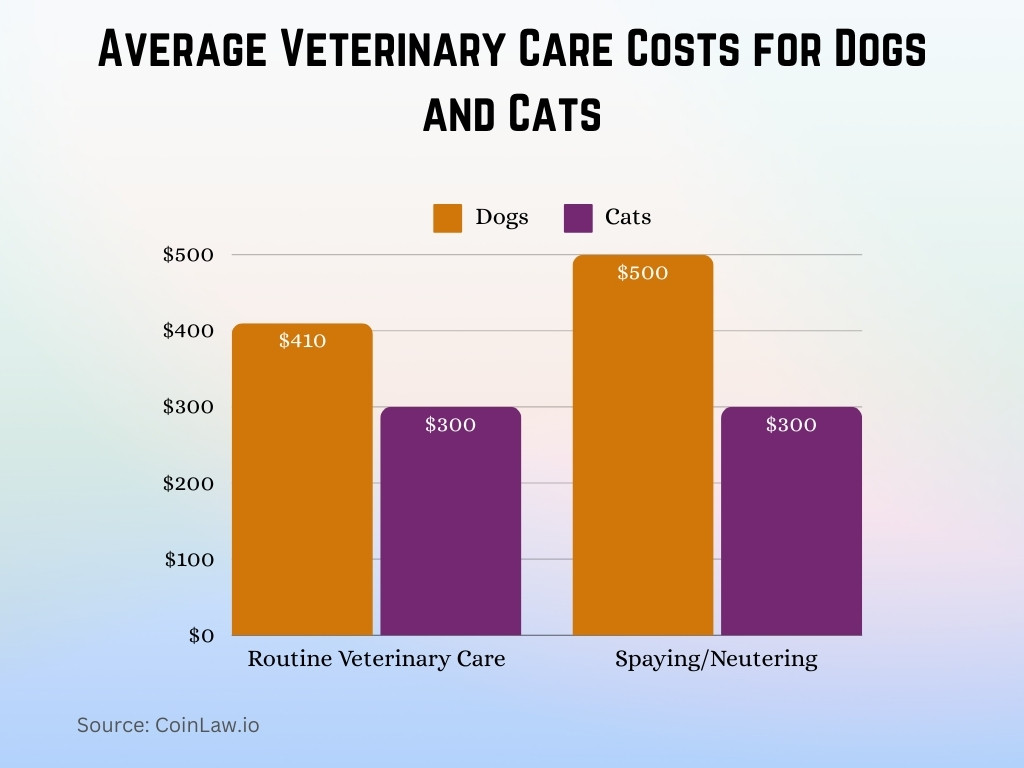

- The average annual cost for routine veterinary care in the US in 2023 was $410 for dogs and $300 for cats, an increase of 6% from 2022.

- Spaying or neutering costs ranged from $500 for dogs and $300 for cats, depending on location and clinic type.

- Vaccinations, a common expense, averaged $115 annually per pet, with bundled packages providing some savings.

- Preventive measures like flea and tick control cost an average of $150 per year, increasing in warmer climates where treatments are essential year-round.

- Dental cleanings, crucial for pet health, cost $300 to $700, with 10% of pet owners delaying this procedure due to high expenses.

- Pet medications, including deworming treatments and antibiotics, averaged $75 per incident, adding significantly to out-of-pocket expenses.

- Emergency visits cost an average of $800, with surgeries like foreign object removal reaching upwards of $3,000.

- Diagnostic tests such as X-rays or blood work averaged $250 to $500, depending on the complexity of the case.

- Senior pets, requiring specialized care, incurred annual costs of $1,000 or more, prompting owners to explore insurance as a cost-saving measure.

- Routine grooming expenses, including nail trimming and fur maintenance, averaged $100 to $300 annually, often overlooked in budgeting.

Penetration and Awareness

- 3% of pets in the US were insured by the end of 2023, showcasing growth but leaving significant market potential untapped.

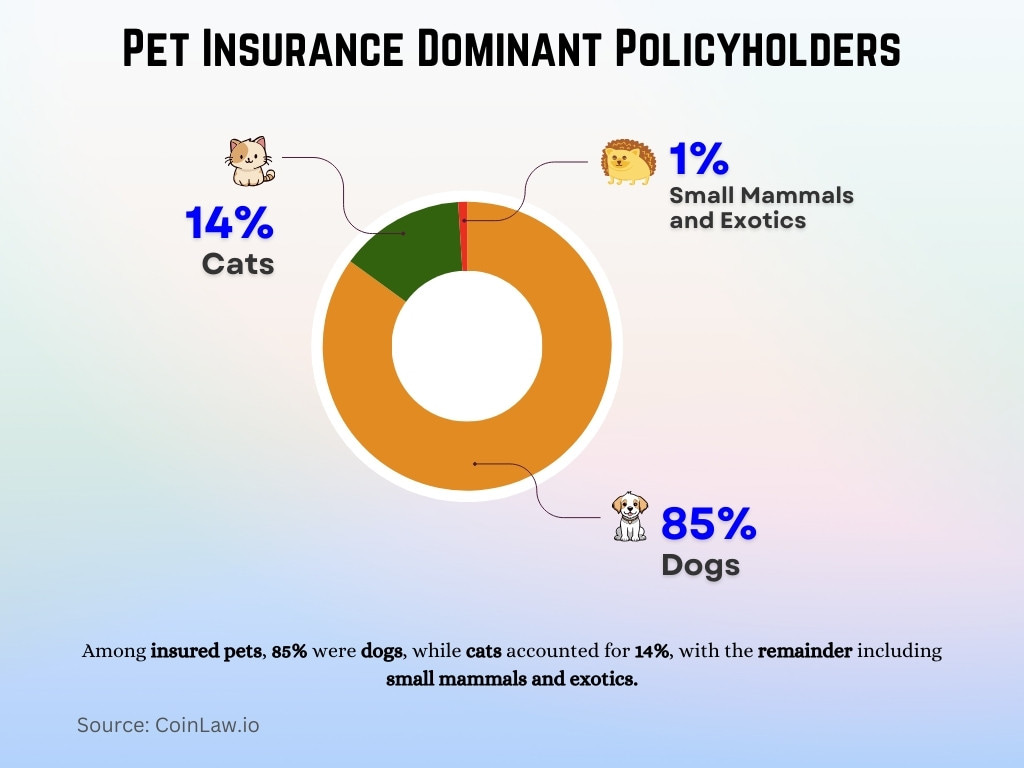

- Among insured pets, 85% were dogs, while cats accounted for 14%, with the remainder including small mammals.

- In Europe, the pet insurance penetration rate was significantly higher at 25%, led by countries like Sweden (90%) and the UK (50%).

- A 2023 survey revealed that 42% of pet owners were aware of pet insurance, compared to 35% in 2020.

- Online searches for “pet insurance” grew by 18% in 2023, reflecting increasing consumer interest in coverage options.

- Millennials and Gen Z accounted for 65% of new policy purchases, with an emphasis on digital convenience and affordability.

- Insurers reported a 20% rise in first-time buyers in 2023, driven by younger pet owners seeking financial security.

- Educational campaigns launched by veterinary organizations increased awareness, reaching 10 million pet owners through social media platforms.

- Subscription-based models gained traction, offering pay-as-you-go coverage and attracting 12% of first-time buyers.

- Premium costs were cited as the top barrier, with 28% of surveyed owners stating they felt unsure about the return on investment.

Ownership Demographics

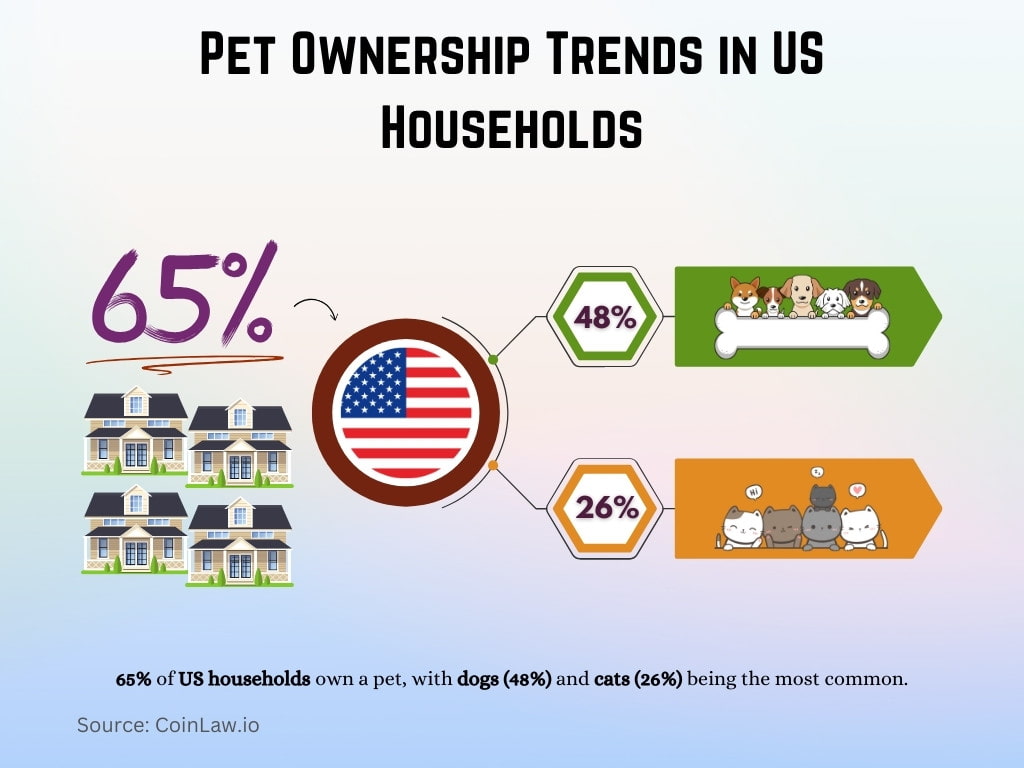

- 65% of US households own a pet, with dogs (48%) and cats (26%) being the most common.

- Among pet owners, 42% are Millennials, making them the largest demographic purchasing pet insurance in 2023.

- High-income households (earning $100,000+ annually) are twice as likely to invest in pet insurance compared to lower-income groups.

- Urban pet owners are 30% more likely to purchase insurance compared to those in rural areas, driven by higher veterinary costs in cities.

- Single-person households account for 28% of pet insurance policies, reflecting a trend among individuals seeking financial stability for their pets.

- Women are 15% more likely to purchase pet insurance than men, often citing emotional bonds and preparedness.

- Owners of purebred dogs, particularly expensive breeds like French Bulldogs, are 3 times more likely to insure their pets due to higher healthcare costs.

- Adoption of insurance among cat owners is growing, with a 12% year-over-year increase, though overall penetration remains lower than for dogs.

- The average age of insured pets is 4 years, with puppies and kittens often covered through bundled wellness plans.

- Older pets (7+ years) are 20% less likely to be insured due to higher premiums and limited policy availability.

Leading Companies and Market Share

- Trupanion held the largest market share in North America in 2023, accounting for 28% of total policies.

- Nationwide followed with a 23% market share, offering comprehensive plans and coverage for unfamiliar pets.

- Healthy Paws saw a 15% growth in new policies, attributed to its high customer satisfaction ratings.

- Emerging players like Spot and Pumpkin are gaining traction, each reporting over 30% growth in policy sales in 2023.

- Global leaders such as Petplan (UK) and Agria (Sweden) dominate the European market, contributing significantly to the region’s 40% global share.

- Figo reported a 50% increase in mobile app users, showcasing the importance of digital-first strategies in attracting younger pet owners.

- Mergers and acquisitions, like MetLife acquiring PetFirst, consolidated the market, enhancing policy offerings and outreach.

- Pet insurance aggregators, allowing comparisons across providers, influenced 25% of sales in 2023, reflecting consumer demand for transparency.

- Companies offering unlimited lifetime benefits, such as Embrace, saw a 10% rise in policy renewals.

- USAA and GEICO entered the market with competitive plans, catering to military families and cost-conscious customers.

| Company | Market Share (2023, US) |

| Trupanion | 28% |

| Nationwide | 23% |

| Healthy Paws | Growth: 15% |

| Spot/Pumpkin (growth) | 30%+ |

| Petplan (Europe) | Significant regional share |

| Figo | 50% increase in app users |

| Embrace | 10% rise in renewals |

Market Regional Analysis/Insights

- North America accounted for 45% of the global pet insurance market, led by the United States and Canada.

- Europe (40%) follows closely, with the UK, Sweden, and Germany leading adoption due to long-standing policies and high awareness.

- The Asia-Pacific region is experiencing rapid growth, with markets like Japan and South Korea seeing a 20% annual increase in policy purchases.

- Emerging markets, including Brazil and India, are growing at a CAGR of 25%, driven by urbanization and rising disposable incomes.

- California, New York, and Texas are the top states for pet insurance adoption in the US, representing 35% of total policies.

- Sweden boasts the highest pet insurance penetration globally, with 90% of cats and dogs covered.

- Latin America is a nascent market but shows promise, with 10% annual growth in countries like Chile and Argentina.

- Telehealth services, often bundled with insurance, are driving adoption in remote regions, where veterinary care access is limited.

- Regional pricing disparities exist; for example, premiums in the US are 20% higher on average compared to Europe.

- Government regulations in countries like Australia, mandating transparency in policy terms, have boosted consumer confidence.

Claims and Reimbursement Statistics

- In 2023, the average claim payout for insured pets was $280, reflecting an increase of 8% from 2022.

- Illness-related claims accounted for 70% of reimbursements, with digestive issues being the most common.

- Accident claims, including broken bones and lacerations, represented 25% of total claims.

- Claims for chronic conditions such as cancer and diabetes saw a 15% increase, reflecting longer lifespans for pets.

- Emergency care claims had the highest payouts, averaging $2,500 per incident.

- The average claim processing time was 5 days in 2023, with digital claims platforms cutting this time by 40%.

- Reimbursement rates varied, with most policies covering 70% to 90% of eligible expenses.

- Claims related to dental care grew by 12%, driven by increased awareness of oral health’s role in overall wellness.

- Behavioral therapy claims, including those for anxiety, rose by 10%, reflecting a growing emphasis on mental health in pets.

- Denied claims accounted for 5%, often due to exclusions for pre-existing conditions or lapsed policies.

| Metric | Value |

| Average claim payout (2023) | $280 |

| Illness-related claims | 70% |

| Accident claims | 25% |

| Emergency care payout | $2,500 (avg.) |

| Claim processing time (2023) | 5 days |

| Denied claims | 5% |

| Dental claims growth | 12% |

| Behavioral therapy claims growth | 10% |

Recent Developments

- The introduction of AI-powered underwriting tools in 2023 reduced policy approval times by 30%.

- Blockchain technology is being explored for claims processing, aiming to enhance transparency and speed.

- Insurers are increasingly partnering with pet tech companies, offering discounts for wearables like activity trackers.

- Telehealth services, bundled with policies, saw a 70% utilization rate among policyholders in 2023.

- The US Department of Agriculture announced potential tax incentives for pet insurance, aiming to boost adoption.

- Companies are piloting customizable policies, allowing owners to select coverage for specific needs like breed-specific conditions.

- Growth in subscription-based models reflects changing consumer preferences, with 20% of new policies adopting this format.

- Wellness plans now include preventive genetic testing, addressing hereditary risks in purebred pets.

- Mobile-first platforms dominate, with 80% of claims filed through apps in 2023.

- Climate change considerations have led to tailored policies covering natural disasters and evacuation costs for pets.

Conclusion

The pet health insurance industry is poised for continued growth as pet ownership trends evolve and veterinary costs rise. With advancements in technology and increasing consumer awareness, insurance providers are meeting the demand for comprehensive and customizable coverage. By 2024, the industry is expected to achieve new heights, driven by innovative solutions and expanded adoption across diverse demographics and regions.