Imagine a world where managing your finances is as simple as scrolling through your favorite social media app. Just a decade ago, budgeting and investing required spreadsheets and constant financial oversight. Today, personal finance apps have transformed how we manage our money, putting the power of budgeting, investing, and financial planning right in our pockets.

With growing adoption rates and a constantly evolving tech landscape, the personal finance app industry is more vibrant and expansive than ever. These apps will not only help individuals track expenses but also integrate with broader financial services, providing users with tailored insights and automated wealth management options.

Editor’s Choice

- The global personal finance app market value reached $167.09 billion in 2025, reflecting strong growth.

- User growth is expected to rise by 14% annually, with about 1.8 billion users by the end of 2025.

- Mobile banking integration is now offered by most finance apps to facilitate seamless transactions.

- AI-driven insights usage increased significantly as more apps personalize budgeting and saving strategies.

- The U.S. holds around 35% of global users, with Europe next at 25%.

- Subscription-based models now account for about 48% of app revenue.

- Gen Z and Millennials make up over 70% of users, showing strong appeal among younger individuals.

User Demographics

- Personal finance apps appeal across ages and incomes, especially attracting younger users and those with mid‑ to high‑income levels.

- Millennials (ages 26–41) remain the largest group at 45 %, followed by Gen Z at 25 % and Gen X at 20 %.

- The average U.S. user income is about $70,000, with 60 % in the mid‑to‑high bracket.

- Over 80 % of Gen Z users prefer apps with AI features like automated savings and investment tracking.

- Men make up 55 % of global users, women 45 %, with women’s share rising to 48 % in Europe.

- Urban users account for 75 % of total users, with suburban and rural users comprising 25 %.

- In the U.S., Hispanic and African American users grew by 18 % and 15 % respectively.

- 89% of Gen Z report using digital banking tools, and a large majority prefer managing finances via mobile apps over traditional bank visits.

Key Growth Areas for Finance Apps

- Wealth management features are on the rise, with about 39 % of finance apps offering investment or robo‑advisory services in 2025.

- Crypto integration continues surging, with approximately 42 % of apps providing cryptocurrency tracking or trading features.

- Automated savings tools are highly popular, with over 55 % of users preferring apps that automate savings goals.

- About 32% of personal finance apps integrated gamification elements like badges and milestones to enhance user engagement and education.

- Buy Now, Pay Later (BNPL) integrations grew by 60 % year‑over‑year, reflecting rising demand for flexible payments.

- Expense management tools remain core, with 80 % of users citing budgeting features as a reason to adopt an app.

- Financial literacy–focused apps saw a 15 % increase in downloads among younger audiences seeking educational tools.

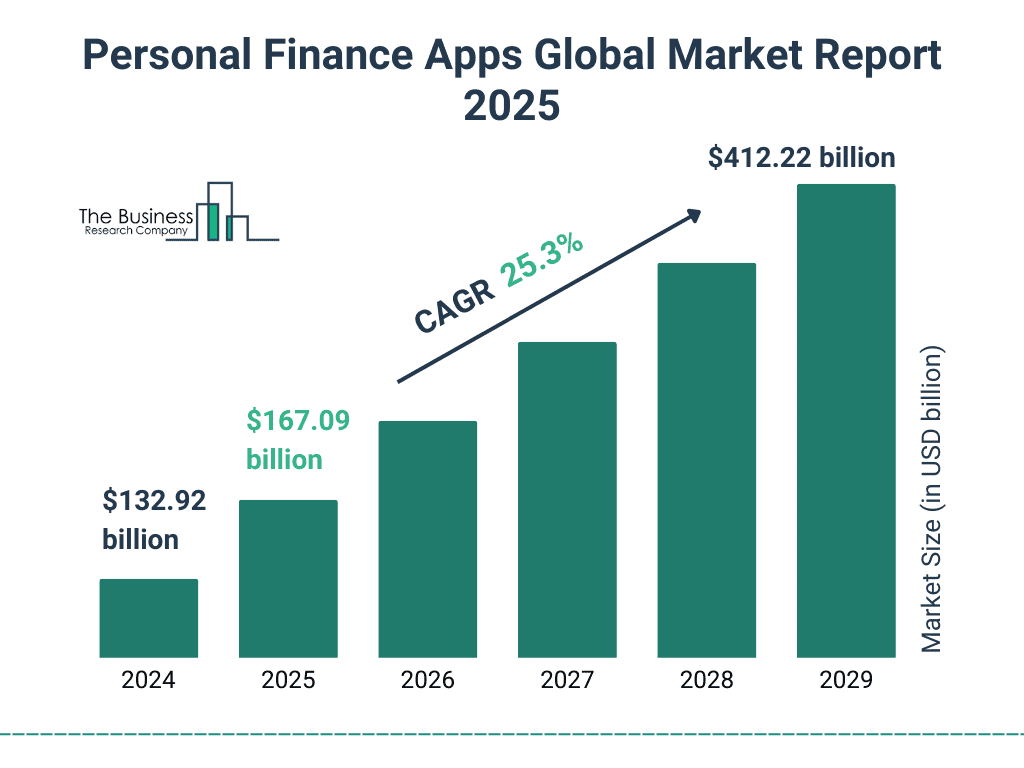

Global Market Growth of Personal Finance Apps

- In 2025, the market is projected to grow to $167.09 billion.

- By 2029, the market size is expected to hit $412.22 billion.

- The industry is expanding at a strong CAGR of 25.3% between 2024 and 2029.

- This rapid growth highlights rising consumer adoption and financial digitization worldwide.

Revenue Breakdown by Region and Platform

- North America remains the top revenue region with an estimated $167.09 billion in total app market value in 2025, driven heavily by subscription and premium services.

- Asia‑Pacific continues its strong contribution with around $149.27 billion in finance app revenue projected for 2025, supported by freemium models and in‑app purchases.

- Ad-supported models accounted for around 40% of revenue among finance apps in Europe, particularly those targeting Gen Z.

- Subscription models now account for approximately 50 % of app revenue globally in 2025, showing continued growth in recurring monetization.

- Freemium pricing remains essential, contributing around 30 % of global finance app revenue in 2025, maintaining its role in hybrid monetization strategies.

- iOS users continue to spend more, with much higher ARPU on iOS vs Android, although a precise 2025 percentage isn’t available yet.

- Approximately 65% of finance app revenue in Latin America and Africa came from low-tier subscriptions and basic in-app purchases.

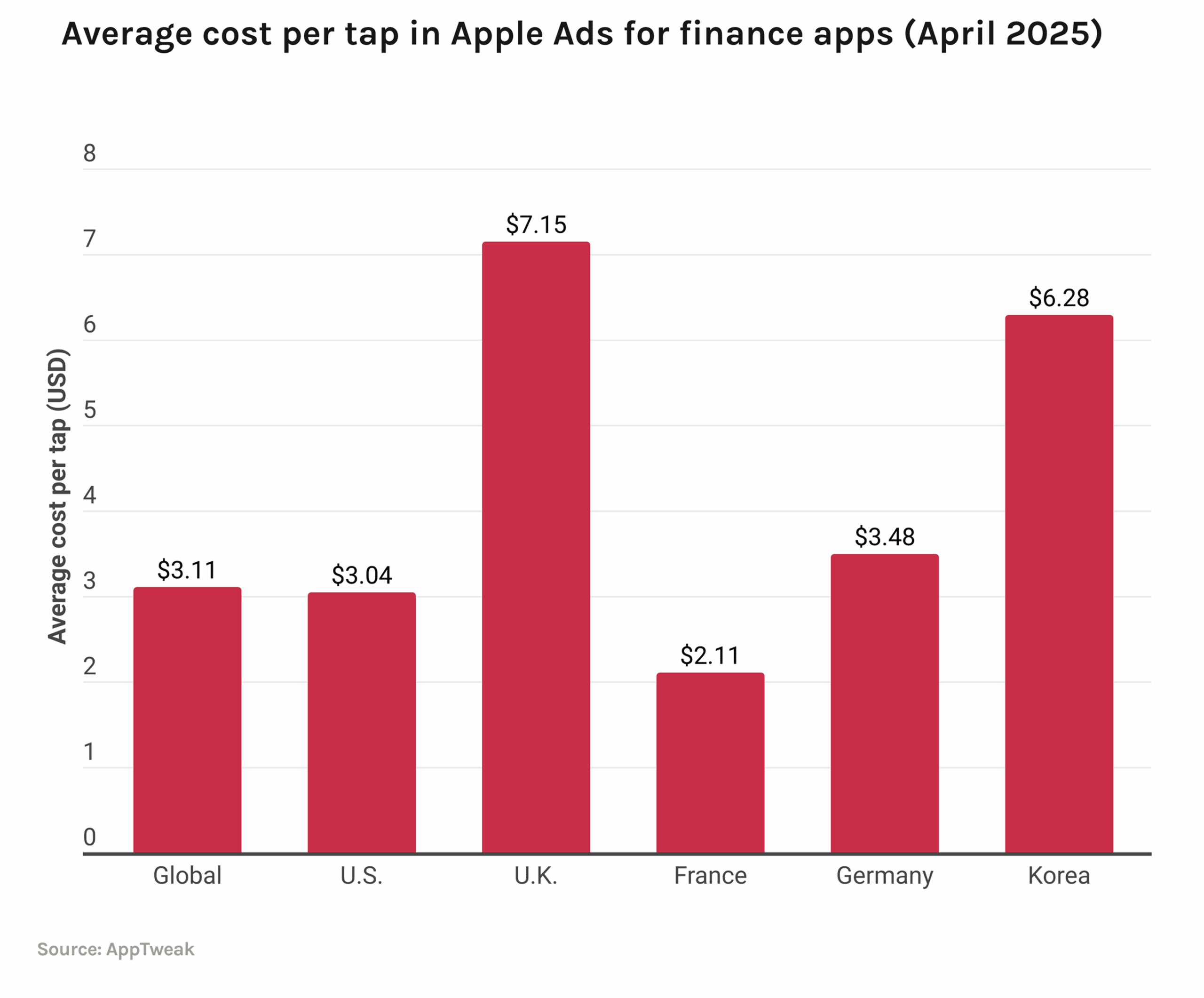

Average Cost per Tap in Apple Ads for Finance Apps

- The global average cost per tap stood at $3.11.

- In the U.S., advertisers paid around $3.04 per tap.

- The U.K. recorded the highest cost at $7.15, far above other regions.

- France had the lowest cost at just $2.11 per tap.

- Germany’s average reached $3.48, slightly above the global figure.

- Korea was also high, with an average of $6.28 per tap.

Finance App Retention and Engagement

- Retention rates for finance apps hold at about 35% after 90 days, improving from 30% in 2022.

- Apps with AI recommendations show retention about 40% higher, as users value tailored advice.

- The average session lasts 6.2 minutes per user, with logins around 4.5 times per week.

- Personalized push notifications increase weekly engagement by about 3x.

- Gamified financial goals raise retention by 28%, with users logging in more often to hit milestones.

- Usage rises during tax season, with engagement increasing by 45% in Q1.

- Personalized dashboards, featuring real-time expense insights and summaries, have been shown to increase daily active usage by up to 23%.

Top Finance Apps Ranking

- Mint remains a leading budgeting app with over 30 million active users, and is still highly regarded in 2025.

- Acorns has grown to about 15.5 million customers and over $26 billion invested as of 2025.

- Cash App maintains a strong user base of around 57 million users.

- YNAB continues its appeal to Gen Z with an 18 % increase in its user base.

- Robinhood leads in investment apps with about 25.9 million funded customers by April 2025.

- Chime heads the neobank sector with around 18 million users in 2025, up significantly year‑over‑year.

- Honeydue remains a standout for couples’ finance management, retaining strong relevance in 2025.

Technological Advancements in Personal Finance Apps

- AI now powers over 60 % of finance apps, enabling tailored budgeting, spending insights, and automated investment advice.

- By 2025, 30 % of investments are expected to be managed by AI-driven robo-advisors, reflecting rising AI influence.

- Biometric verification systems, such as facial and fingerprint ID, can reduce fraudulent activity by up to 66%.

- Open banking APIs enhance functionality, with roughly 52 % of finance apps offering direct bank connectivity for real-time updates and transfers.

- Voice‑activated commands are supported in around 15 % of apps, improving accessibility and allowing tasks like balance checks or transfers via voice.

- Wearable integration grows, with about 30 % of apps offering simplified versions for smartwatches to help users track finances on the go.

Personal Finance Investment Portfolio Allocation

- 32% of investments go into retirement funds (401k, IRA), making them the most popular choice.

- 24% of individuals allocate their money to high-yield savings accounts for safer returns.

- 24% invest in individual stocks, seeking higher growth potential.

- 20% choose CDs or mutual funds, reflecting a preference for stability.

Recent Developments

- Apple Pay Later surpassed 3.5 million users in 2025 and processed $2.1 billion in BNPL transactions, capturing 7.8 % of the U.S. BNPL market.

- Plaid’s Transfer now supports instant pay-ins and payouts via Request for Payment (RfP) across multiple rails for faster settlements.

- Venmo introduced a built-in 3.7 % annual yield on PayPal USD holdings, offering users a competitive savings feature.

- Google Pay now automatically categorizes expenses, bringing AI-powered budget tracking to its U.S. users.

- Cash App launched a Pools feature enabling groups to split payments easily via links that work with Google Pay or Apple Pay.

- Robinhood introduced an IRA match program offering up to 3 % match for Gold members and 1 % without, significantly boosting retirement offerings.

- Zelle usage by small businesses surged 35 % in 2025, and the platform handled over USD 1.92 trillion in transactions, with more than 145 million active users.

Conclusion

The personal finance app industry is booming, with rapid growth driven by technological innovations, expanding user demographics, and increased focus on financial literacy. As users demand more integrated and personalized tools, finance apps are adapting with advanced AI, blockchain integration, and seamless banking services. The industry’s leaders continue to evolve while emerging players carve niches with specialized offerings. This year marks a pivotal moment for finance apps, as they transition from basic budgeting tools to comprehensive financial management platforms, paving the way for an empowered, financially literate global population.