A prominent European crypto exchange found itself at the center of a legal storm. Despite being one of the most reputable platforms in the region, a single oversight in adhering to the Markets in Crypto-Assets (MiCA) regulations led to a staggering €12 million penalty and the temporary suspension of their services. Stories like these aren’t rare. Across the European Union, regulators are stepping up enforcement, and Crypto Asset Service Providers (CASPs) are scrambling to comply.

The MiCA regulatory framework was designed to bring order to a once chaotic crypto landscape. But with its introduction comes stringent compliance requirements and, for those who fail to meet them, severe consequences. This article dives into the latest statistics on non-compliance penalties under MiCA, offering a comprehensive view of where things stand.

Editor’s Choice

- €486 million in cumulative financial penalties were issued for MiCA non-compliance by EU regulators in 2025, up 18% from 2024.

- 68% of sanctioned entities in 2025 were Crypto Asset Service Providers (CASPs) operating without proper registration.

- 41% of MiCA enforcement cases in 2025 involved stablecoin issuers failing to maintain adequate reserves.

- CASPs failing to implement AML measures under MiCA faced average fines of €6.8 million in 2025.

- 19 EU member states have reported at least one major enforcement action under MiCA regulations in the first half of 2025.

- Legal actions leading to criminal prosecutions under MiCA increased by 22% in 2025, with over 54 executives facing charges.

- Over 53 MiCA-compliant licenses were issued in 2025, reflecting a 36% increase as industry adaptation grows.

Overview of MiCA Regulations and Compliance Requirements

- 84% of CASPs in the EU had initiated the licensing process to comply with MiCA by late 2025.

- MiCA regulations in 2025 cover stablecoins, utility tokens, and asset-referenced tokens, with only NFTs functioning as financial instruments subject to MiCA.

- The European Securities and Markets Authority (ESMA) and European Banking Authority (EBA) oversee 67% of all reported enforcement actions in 2025.

- CASPs must maintain minimum capital reserves of €150,000 to €350,000, depending on service scope and prior year expenses.

- Over 89% of MiCA license applications in 2025 were delayed due to incomplete disclosure documentation, mainly linked to whitepapers and governance models.

- In 2025, 23 EU countries will have updated their local regulations to align with MiCA for national enforcement.

- MiCA compliance involves mandatory AML and KYC protocols, with 72% of CASPs required to upgrade their systems by Q1 2025.

- 48% of CASPs cited MiCA’s market manipulation rules as the most difficult to implement, per a January 2025 INATBA survey.

MiCA TFR Compliance

- 28.8% of European CASPs are already complying with the Transfer of Funds Regulation.

- A much larger 71.2% of CASPs missed the TFR deadline, showing significant compliance gaps.

Key Statistics on MiCA Non-Compliance Cases

- 224 MiCA non-compliance cases were recorded across the EU in 2025, up 19% from 2024.

- 63 CASPs had their licenses revoked by November 2025 due to ongoing non-compliance.

- 47% of non-compliance cases in 2025 involved inadequate AML and KYC procedures.

- CASPs without approved MiCA licenses operated illegally in 14 EU member states by 2025, triggering cross-border probes.

- 21% of firms penalized in 2025 were repeat offenders with prior violations.

- Stablecoin issuers accounted for 38% of MiCA violations in 2025, mainly for failing reserve standards.

- 19% of enforcement actions in 2025 resulted in criminal investigations, targeting fraudulent AML disclosures.

- 62% of penalized firms in 2025 cited lack of clarity in MiCA guidelines as a key compliance challenge.

- The average time from violation discovery to enforcement under MiCA dropped to 4.1 months in 2025.

Common Types of MiCA Violations and Their Frequency

- 49% of MiCA non-compliance cases in 2025 involved inadequate AML and KYC procedures as the most frequent violation.

- Stablecoin issuers represented 38% of cases where reserve requirements were not met in 2025.

- Failure to provide accurate or complete whitepapers accounted for 29% of breaches in 2025, frequently resulting in license suspension.

- 21% of CASPs failed to implement adequate custodial arrangements for safeguarding client assets, leading to fines in 2025.

- 19% of violations in 2025 stemmed from unauthorized marketing practices, including misleading promotions to retail investors.

- 11% of MiCA enforcement actions in 2025 were due to failure in IT security protocols, risking client data.

- 9% of cases in 2025 involved non-compliance with insider trading prohibitions, reflecting market integrity concerns.

- CASPs with incomplete incident reporting made up 16% of violations in 2025 as MiCA mandates prompt notifications.

- 13 EU member states reported above-average enforcement related to stablecoin governance failures in 2025, especially in Germany, France, and Italy.

Financial Penalties Imposed for MiCA Non-Compliance

- €5.6 million was the average fine for MiCA non-compliance in 2025, marking an increase of 17% from 2024.

- Total fines for MiCA violations across the EU climbed to €486 million in 2025, up from €412 million in 2024.

- Germany imposed the highest cumulative penalties with €142 million in 2025, followed by France at €101 million.

- 21% of CASPs fined in 2025 had prior compliance warnings, indicating ongoing regulatory failures.

- CASPs penalized for AML and KYC breaches faced average fines of €6.8 million in 2025, reflecting tough EU enforcement.

- 15 firms were fined over €10 million each in 2025 for multiple or severe violations.

- MiCA enforcement actions led to €41 million in settlement agreements in 2025, providing alternatives to court action.

- 62% of firms fined in 2025 publicly announced compliance overhauls within six months of penalties.

- Small and mid-sized CASPs, making up 48% of enforcement actions in 2025, faced average penalties of €1.4 million, threatening their viability.

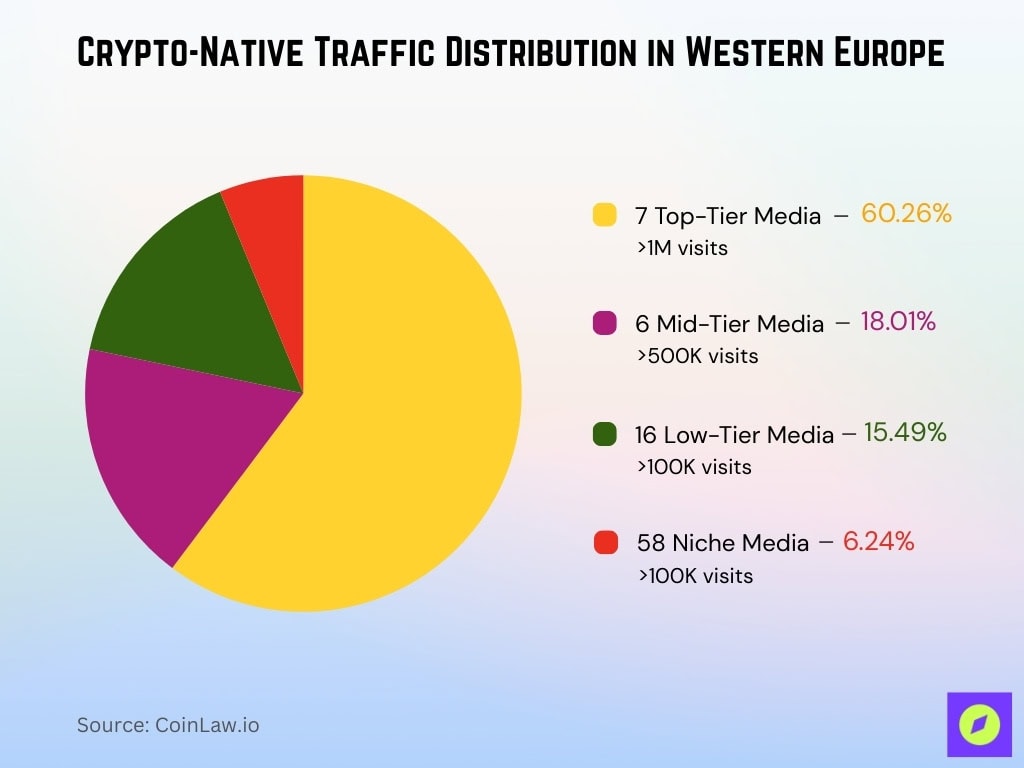

Crypto-Native Traffic Distribution in Western Europe

- Top-Tier Media dominates the landscape, with 7 outlets capturing a massive 60.26% share of crypto-native traffic.

- Mid-Tier Media accounts for 18.01%, driven by 6 outlets each attracting over 500K quarterly visits.

- Low-Tier Media contributes 15.49% of traffic, spread across 16 outlets with 100K+ visits.

- Niche Media represents only 6.24%, despite being the largest group with 58 outlets, each generating under 100K visits.

- The data shows a highly concentrated ecosystem where a small group of top-tier platforms controls over 60% of all crypto-native traffic.

Criminal Sanctions and Legal Actions Under MiCA

- 54 individuals, including CEOs and compliance officers, faced criminal charges under MiCA by Q4 2025.

- Criminal prosecutions for MiCA-related violations rose by 22% in 2025 compared to the previous year.

- Fraudulent misrepresentation of token reserves was the most frequent offense, accounting for 39% of cases in 2025.

- 31 CASPs were investigated for systemic AML violations under MiCA in 2025, leading to 15 criminal referrals.

- 8 high-profile executives received prison sentences in 2025, ranging from 20 months to 5 years for severe MiCA breaches.

- Authorities seized over €83 million in assets related to MiCA criminal investigations in 2025.

- Italy, Spain, and Austria recorded the highest rates of criminal prosecutions, each with over 11 major cases in 2025.

- Whistleblower reports leading to criminal probes under MiCA increased by 28% in 2025, per ESMA data.

- 36% of MiCA criminal investigations also uncovered GDPR violations tied to client data mishandling in 2025.

- Average criminal fines imposed on executives soared to €910,000 in 2025, excluding prison sentences.

Regional Breakdown of MiCA Enforcement Actions in the EU

- Germany accounted for 25% of all MiCA enforcement cases in 2025, with 61 reported actions.

- France handled 18% of enforcement cases in 2025, with emphasis on stablecoin issuer compliance.

- Italy conducted 37 MiCA enforcement actions in 2025, making up 15% of the EU total.

- Spain registered 25 MiCA-related investigations in 2025, up 38% versus 2024.

- Netherlands regulators reported 17 enforcement actions in 2025, focused on unlicensed CASPs.

- Poland and the Czech Republic saw 11 and 8 actions, respectively, in 2025, showing substantial growth.

- Luxembourg issued 12 MiCA sanctions in 2025, targeting custodial wallet providers.

- Portugal recorded 7 major cases in 2025, with total fines of €10.2 million.

- Cross-border MiCA investigations involving multiple jurisdictions grew by 36% in 2025, driven by ESMA coordination.

- Scandinavian countries (Sweden, Finland) saw minimal enforcement, with only 5 MiCA violations in 2025 due to a small CASP footprint.

Impact of MiCA Penalties on Crypto Asset Service Providers (CASPs)

- 72% of CASPs fined under MiCA in 2025 reported direct liquidity impacts, requiring emergency capital injections.

- 61% of penalized CASPs in 2025 experienced a loss of customer trust, with an average 27% drop in active user accounts six months post-enforcement.

- 46% of fined CASPs expanded internal compliance teams and resources by Q2 2025.

- 35% of CASPs receiving MiCA penalties in 2025 paused new EU market expansion due to regulatory risk.

- 31% of penalized firms discontinued certain crypto offerings in 2025, especially stablecoins and derivatives.

- The average cost of compliance upgrades for CASPs after MiCA penalties hit €2.1 million in 2025, with top firms spending over €5.9 million.

- 37 CASPs exited the EU market in 2025 owing to unsustainable costs and legal risk from MiCA non-compliance.

- CASPs fined in 2025 saw a 16% increase in cyberattack attempts attributed to perceived vulnerabilities after regulatory action.

- 68% of CASPs plan to deploy RegTech solutions in 2025 to streamline compliance and reduce the risk of sanctions.

- 76% of penalized CASPs enhanced internal governance by early 2025, including increased board oversight for compliance.

Trends in MiCA Enforcement Since Its Implementation

- MiCA enforcement actions surged by 87% in 2025 compared to 2024, driven by greater regulator capability and broader guidance.

- The average investigation length fell from 4.5 months in 2024 to 3.9 months in 2025, reflecting a more rapid regulatory response.

- Cross-border enforcements involving multiple EU regulators climbed by 36% in 2025, highlighting stronger collaboration.

- Regulatory sandboxes launched in 9 EU countries by 2025, enabling CASPs to test compliance strategies without full penalties.

- 61% of national regulators adopted real-time monitoring tech in 2025 for faster detection of MiCA violations.

- More RegTech solutions are tailored for MiCA, with 26% of CASPs using automated compliance by Q4 2025.

- Stablecoin issuers were most frequently targeted, accounting for 38% of MiCA violations in 2025.

- Public disclosure of MiCA penalties rose, with 67% of actions publicly announced in 2025, up from 58% in 2024.

- Non-EU firms aiming to offer crypto services in the EU under MiCA increased by 29% in 2025, leading to more complex compliance checks.

- Whistleblower programs in 2025 resulted in 28% more self-reported violations, facilitating earlier corrections and fewer severe penalties.

Recent Developments

- ESMA’s January 2025 guidelines clarified stablecoin reserve audit requirements, impacting compliance for asset-referenced tokens.

- The European Banking Authority (EBA) launched a MiCA Compliance Register in March 2025, listing all approved CASPs and sanctioned firms.

- AI-driven transaction monitoring will be mandatory for large CASPs by December 2025 to boost fraud detection and AML compliance.

- 5 EU member states, including Germany and France, introduced licensing fees for MiCA audits in 2025, ranging from €50,000 to €250,000 per year.

- Cross-border crypto transfers now face tighter scrutiny after 2025 TFR alignment with MiCA for improved transparency.

- ESMA standardized token whitepaper templates in April 2025, accelerating approval with fewer disclosure inconsistencies.

- The EU Council proposed MiCA amendments in 2025 to extend certain rules to NFTs deemed financial assets.

- Regulatory training for CASPs became mandatory in 8 EU countries in 2025, essential for license retention.

- EBA’s whistleblower hotline, launched in Q1 2025, processed 312 reports resulting in 28 enforcement actions.

- DeFi pilot programs under MiCA are active in Finland and the Netherlands in 2025, with outcomes expected by year-end.

Frequently Asked Questions (FAQs)

€5.6 million per case for CASPs failing key obligations.

68% of sanctioned entities were unregistered Crypto Asset Service Providers.

A €27 million fine was levied against a top stablecoin issuer for insufficient reserve disclosures.

At least €5,000,000 or up to 12.5% of annual turnover for severe breaches, whichever is higher.

Conclusion

The enforcement of MiCA regulations has transformed the European crypto-asset market. Financial penalties, criminal sanctions, and regulatory overhauls have made compliance not just a legal necessity but a business imperative. As regulators sharpen their focus and technology advances, Crypto Asset Service Providers (CASPs) must invest in robust compliance frameworks to navigate the evolving regulatory environment successfully.

Looking ahead, the introduction of stricter guidelines, enhanced transparency, and AI-driven compliance solutions points to a future where adherence to MiCA will be both more achievable and more essential than ever.