Picture this: a casual weekend lunch where you split the bill with friends using just a few taps on your smartphone. This seamless exchange is the hallmark of peer-to-peer (P2P) payment apps, revolutionizing how we handle money. These apps have become ubiquitous, with millions relying on them for transactions ranging from shared meals to rent payments. Their rise isn’t just about convenience; it’s a transformative shift in global finance.

Editor’s Choice

- Venmo reported a $325 billion transaction volume in 2025, growing 33% year-over-year.

- PayPal’s P2P segment accounted for 30% of all transactions in 2025.

- Cash App reached 58 million monthly active users in September 2025, an annual increase of 2%.

- Zelle processed nearly $600 billion in transactions during H1 2025, a 23% YoY increase.

- Gen Z adoption rate passed 76% in 2025, signaling strong growth among younger users.

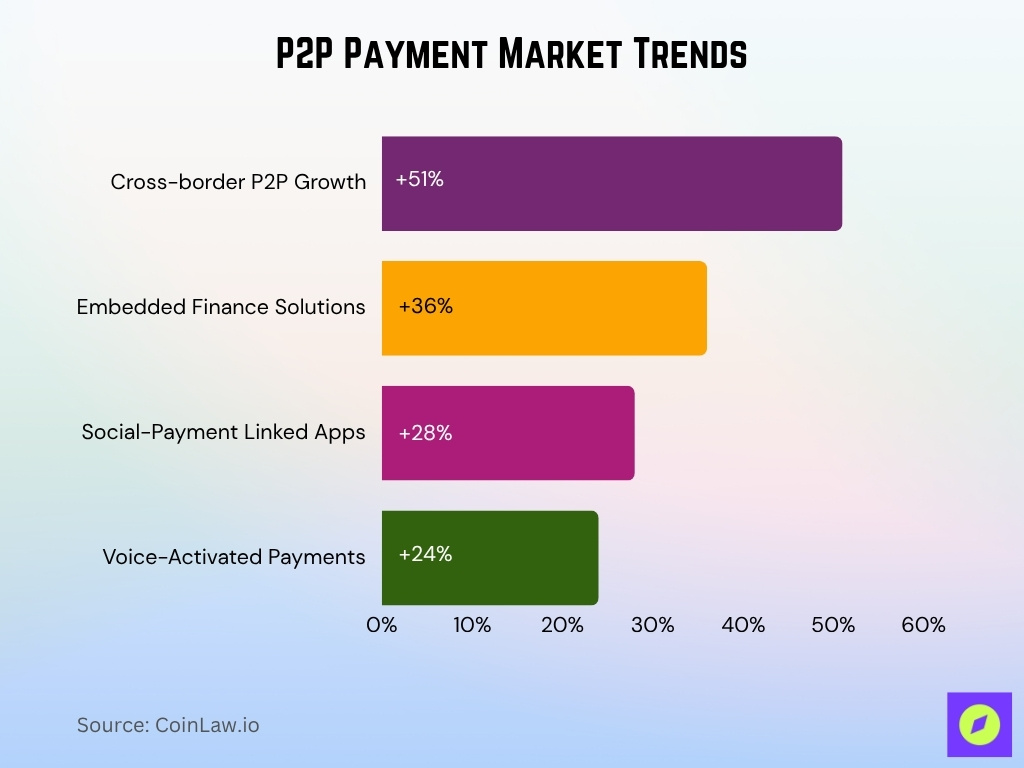

P2P Payment Market Trends

- Cross-border P2P transactions grew by 51% in 2025, driven by lower fees and broader access.

- Embedded finance solutions saw 36% growth, with more brands integrating P2P options directly into digital ecosystems in 2025.

- Gen Z and millennials drove a 28% increase in social-payment-linked P2P apps in 2025, favoring social features.

- Voice-activated payments via AI assistants like Alexa and Siri surged 24% in 2025, reflecting growing demand for convenient digital payments.

- 71% of users preferred apps with contactless scan-and-pay features in 2025, fueling innovation.

- 58% biometric authentication adoption rate across major P2P apps in 2025, boosting user trust and security.

- Real-time payment processing apps like Zelle completed transactions in seconds, continuing the industry standard in 2025.

Revenue and Monetization

- The P2P payment industry generated $3.63 billion in revenue globally in 2025, primarily from transaction fees and premium features.

- Venmo’s monetization strategies, including instant transfer fees, contributed to $1.1 billion in revenue this year.

- Cash App’s Bitcoin trading feature accounted for 71% of its revenue in 2025, highlighting surging crypto adoption.

- Subscription models grew by 20% in 2025, with premium tiers offering perks like higher transfer limits.

- PayPal’s total revenue from its P2P segment reached $29.5 billion in 2025, marking a 13% YoY growth.

- Apps offering business payment solutions like Square’s Cash for Business saw revenues grow by 28% in 2025.

- Advertising revenue within P2P platforms increased by 12% in 2025, as brands utilized these apps for targeted promotions.

Types of P2P Payment Methods

- Bank-linked transfers accounted for 57% of global P2P transactions in 2025, maintaining market dominance.

- Mobile wallets like Google Pay and Apple Pay saw a 42% YoY growth in P2P payments, driven by ease and security in 2025.

- Cryptocurrency P2P transfers increased by 23% in 2025, with platforms like Paxful gaining significant traction.

- QR code-based payments experienced 21% growth in emerging markets like Southeast Asia in 2025.

- NFC technology powered 75% of contactless payments in developed regions such as Europe in 2025.

- SMS-based payments retained a 4% share in rural markets with limited internet access in 2025.

- Peer-to-peer credit systems, where users lend within the app, reached 11% market traction in 2025, spotlighting alternative lending.

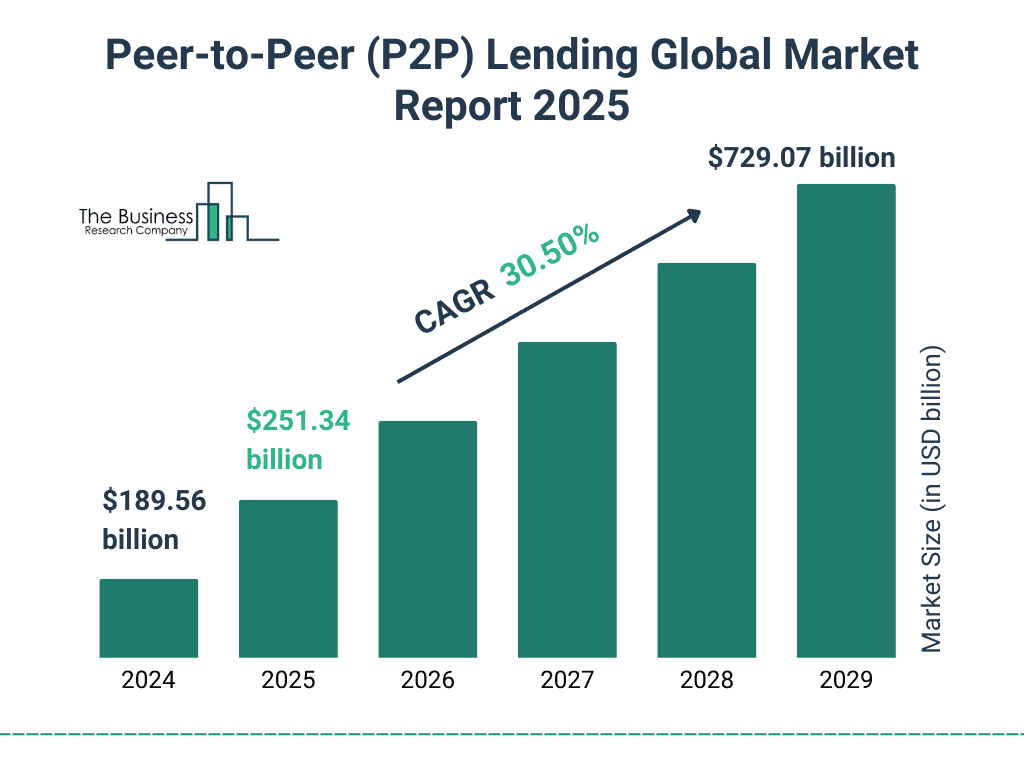

Global P2P Lending Market Growth Highlights

- The peer-to-peer (P2P) lending market is projected to reach $729.07 billion by 2029, showing rapid expansion across fintech ecosystems.

- In 2024, the market size stood at $189.56 billion, underscoring the strong base of digital lending platforms worldwide.

- By 2025, it is expected to grow to $251.34 billion, reflecting an accelerating adoption curve among borrowers and investors.

- The industry is forecasted to expand at a compound annual growth rate (CAGR) of 30.50% between 2024 and 2029.

- This surge is fueled by rising internet penetration, alternative finance adoption, and technological innovation in financial services.

- The P2P lending sector’s exponential growth positions it as one of the fastest-growing segments in the global fintech market.

- If trends continue, the total market value could grow by nearly four times within just five years.

Benefits of P2P Money Transfers

- 84% of users say P2P money transfers simplify splitting bills and shared expenses in 2025.

- International P2P transactions cost up to 70% less in fees compared to bank transfers in 2025.

- Over 90% of P2P transactions are completed within seconds, providing instant payments in 2025.

- Users in over 150 countries can connect financially through P2P apps, bypassing traditional banking barriers in 2025.

- Enhanced security features, such as end-to-end encryption, make P2P apps safer than cash transactions in 2025.

- Integrated budget management tools help 68% of users better track their finances using P2P apps in 2025.

- Multi-currency support benefits expats and travelers by allowing seamless transfers across currencies in 2025.

Technological Developments and Innovations

- AI-powered fraud detection systems reduced fraudulent transactions by 32% in 2025, with industry-wide adoption.

- Blockchain technology gained global traction in P2P apps, with 75% of Fortune 100 companies using blockchain for payments and ledgers in 2025.

- Tokenization secured over 67% of P2P payment apps in 2025, protecting user data and transactions.

- Machine learning algorithms enabled apps to predict and block suspicious activities, with 71% of financial firms using AI for risk management in 2025.

- Wearable payment integration, such as smartwatches, saw a 26% YoY increase in 2025.

- Interoperability standards allowed platforms like Venmo and Zelle to link with multiple financial ecosystems, with 60% of apps adopting open standards in 2025.

- Low-bandwidth functionality investment increased 21% in 2025, expanding usability in areas with poor connectivity.

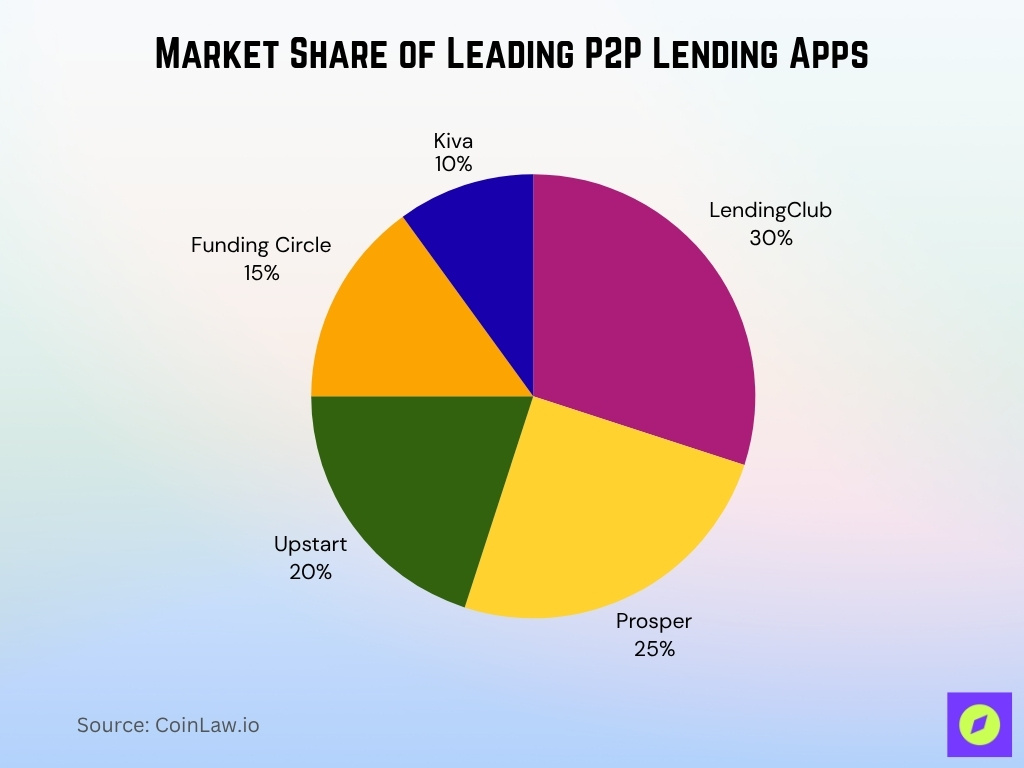

Market Share of Leading P2P Lending Apps

- LendingClub dominates the market with a 30% share, making it the top global peer-to-peer lending platform.

- Prosper follows closely with a 25% market share, reflecting strong borrower trust and repeat investor participation.

- Upstart holds 20%, leveraging AI-driven credit risk models to attract younger and tech-savvy borrowers.

- Funding Circle accounts for 15%, with a focus on small business financing across the U.S. and Europe.

- Kiva secures 10%, maintaining its niche in microloans and social impact lending.

AI-Powered Fraud Prevention

- 98% of suspicious transactions were intercepted by AI-driven fraud systems on top platforms like Zelle and Venmo in 2025, reducing fraudulent activity.

- Predictive analytics are deployed in 82% of P2P apps in 2025, proactively identifying irregularities before losses occur.

- Machine learning algorithms reduced false-positive alerts by 35% in 2025, improving user experience.

- Real-time fraud monitoring lowered fraud-related losses by $1.6 billion in 2025 across global P2P payments.

- Behavioral biometrics are used by 66% of apps to prevent account takeovers in 2025.

- AI systems flagged over 185 million high-risk transactions in 2025, saving users considerable financial losses.

- Facial recognition technologies integrated in platforms like PayPal reduced identity theft by 46% in 2025.

Security Measures in P2P Transactions

- Over 90% of P2P apps now use end-to-end encryption to secure data during transactions in 2025.

- Multi-factor authentication adoption grew by 22% in 2025, making it a standard for most platforms.

- Tokenization is used by major P2P apps in 2025, ensuring zero exposure of bank details and sensitive user information.

- Apps like Cash App and Google Pay will enforce transaction time limits to block unauthorized access in 2025.

- Regulatory compliance with GDPR and CCPA strengthened global trust in P2P payment platforms in 2025.

- Device-specific verification, including fingerprint and face ID, is mandatory on 65% of P2P apps in 2025.

- Real-time monitoring and fraud alerts protect 85% of active user accounts on P2P apps in 2025, ensuring a fast response to threats.

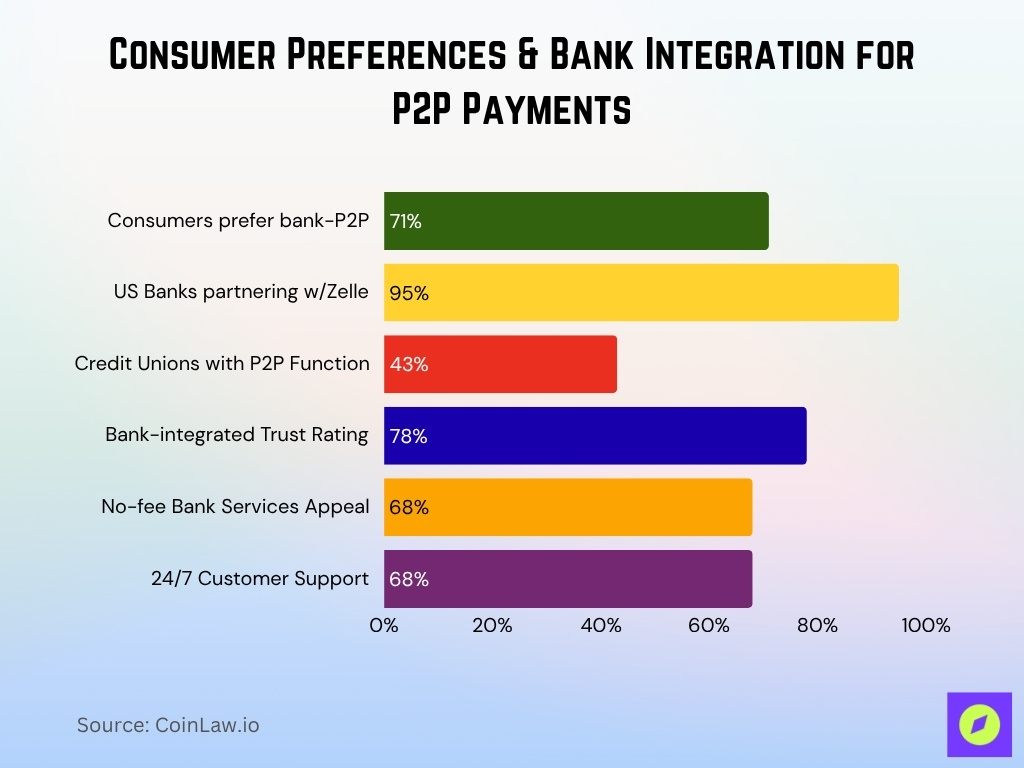

Consumers Demand P2P From Banks

- 71% of consumers in 2025 prefer banks to offer integrated P2P payment solutions for ease and security.

- 95% of US banks now partner with platforms like Zelle to provide seamless P2P services in 2025.

- Over 43% of credit unions introduced mobile apps with P2P payment functionalities in 2025, leading to broader inclusion.

- Bank-integrated P2P apps reported a 78% trust rating in 2025, outpacing standalone platforms.

- Lack of fees in bank-provided services appealed to 68% of users in 2025, encouraging wider adoption.

- 68% of users say 24/7 customer support through banks boosts confidence in resolving payment issues in 2025.

- Integration of loyalty rewards and cashback via bank apps increased user engagement by 15% year-over-year in 2025.

Fraud Casts Shadow on P2P

- P2P payment fraud caused losses exceeding $4.4 billion globally in 2025, rising 22% YoY.

- Phishing scams accounted for 18% of all P2P fraud cases in 2025, highlighting persistent vulnerabilities.

- Synthetic identity fraud surged by over 100% since 2022, making it one of the fastest-growing fraud types in 2025.

- Unauthorized account access due to weak passwords led to 30% of major fraud incidents in 2025, with account takeover rising sharply.

- 36% of users in 2025 expressed concerns about the safety of their P2P transactions, despite enhanced protections.

- Platforms are spending over $600 million annually educating users on fraud prevention in 2025, increasing awareness.

- Collaboration with law enforcement has helped recover over $1.7 billion in stolen funds in 2025, boosting user trust.

Recent Developments

- In 2025, Zelle launched a dedicated business payment feature, enabling small businesses to claim custom handles and expanding its reach to over 7 million businesses.

- PayPal initiated integration with AI chat-based payment platforms, preparing to launch payments via messaging apps and ChatGPT in 2026.

- Venmo introduced a cash back rewards program in 2025, offering up to 5% cash back on debit card purchases and crypto cashback options for users.

- Revolut added multi-currency P2P transfers in 2025, supporting seamless payments for frequent travelers.

- Cash App expanded into the UK in 2025, recording a 19% increase in user base within three months.

Frequently Asked Questions (FAQs)

UPI in India processes over 8 billion transactions monthly in 2025.

About 81% of U.S. consumers used a P2P payment app at least once in 2025.

The average transaction value per user reached $1,746 in 2025.

Conclusion

Peer-to-peer payment apps are not just about convenience; they are at the forefront of reshaping how we interact with money. Seamless integration with banks, advancements in AI-powered fraud prevention, and innovative security features make these platforms indispensable in our daily lives. However, challenges like rising fraud cases underscore the need for vigilance and continual innovation. The future of P2P payments is bright, fueled by technological innovation, user demand, and a commitment to global financial inclusivity.