As our lives become increasingly digital, online banking has evolved from a convenience to a necessity. From managing accounts on the go to transferring funds with a tap, online banking is now deeply integrated into daily routines. The banking landscape in 2025 shows unprecedented growth and diversity, with millions around the world logging into their bank accounts through mobile apps, web browsers, and wearable devices. But beyond mere usage, shifts in demographics, technology, and security concerns shape the future of digital banking. In this article, we’ll explore the latest statistics that highlight how online banking usage is evolving worldwide and what to expect in the near future.

Editor’s Choice: Key Insights

- The number of online banking users worldwide has reached approximately 3.6 billion in 2025.

- A survey found that 91% of consumers prioritize mobile and online banking access, emphasizing the importance of P2P payments, budgeting tools, and investment services.

- The global digital banking market is projected to reach $107.1 billion by 2030.

- A survey revealed that 77% of banking interactions now occur through digital channels.

- 87% of UK adults use a form of online or remote banking, which is around 47 million people.

- 58% of millennials perform finance-related tasks on a mobile app daily, with 85% engaging weekly.

- 77% of Americans processed banking transactions on smartphones, tablets, or computers.

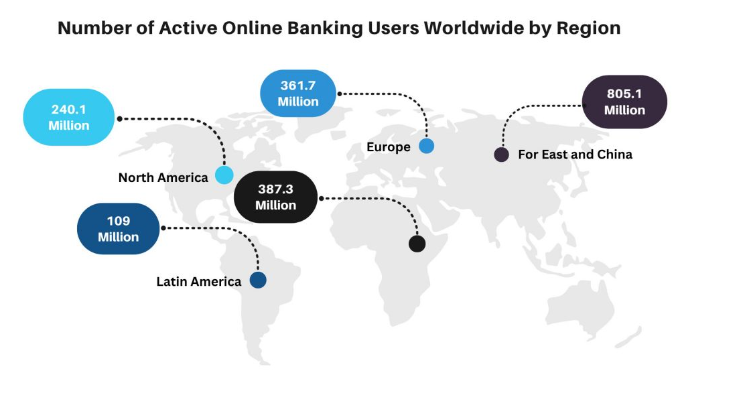

Global Online Banking Usage by Region

- The Far East and China lead the world with 805.1 million active online banking users.

- Middle East & Africa follows with a significant 387.3 million users.

Europe ranks third, with 361.7 million users actively using online banking services. - North America accounts for 240.1 million users.

- Latin America has the lowest count among the regions listed, with 109 million active users.

These figures highlight the growing global adoption of digital banking, especially in Asia and emerging markets.

Global Online Banking Adoption Rates

- North America leads with 85% of users engaged in online banking.

- Europe reports 78% of adults using online banking, with Scandinavian countries exceeding high adoption levels.

- Asia-Pacific sees the fastest rise with 26% growth in users in 2025, led by China, India, and Indonesia.

- Latin America surpasses 150 million users in 2025 thanks to improved digital infrastructure.

- Africa sees a mobile banking surge with a 35% increase due to low branch access and fintech growth.

- China remains dominant with over 940 million users in digital banking as of 2025.

- Australia reaches 72% penetration in online banking, driven by mobile-first platforms.

User Demographics

- Millennials and Gen Z are the most active online banking users, with 78% of 18-34-year-olds using mobile banking as their primary banking method.

- Gen X shows growing adoption, with 63% now relying on online banking for most transactions.

- Baby Boomers are increasingly adopting online banking, reaching a 43% usage rate among users aged 55 and above.

- Women tend to prefer mobile banking apps slightly more than men, with 54% of female users stating they use mobile banking exclusively.

- Rural and suburban areas in the US have seen a 12% rise in online banking usage, spurred by improved internet access.

- High-income households are 25% more likely to use online banking services compared to low-income households.

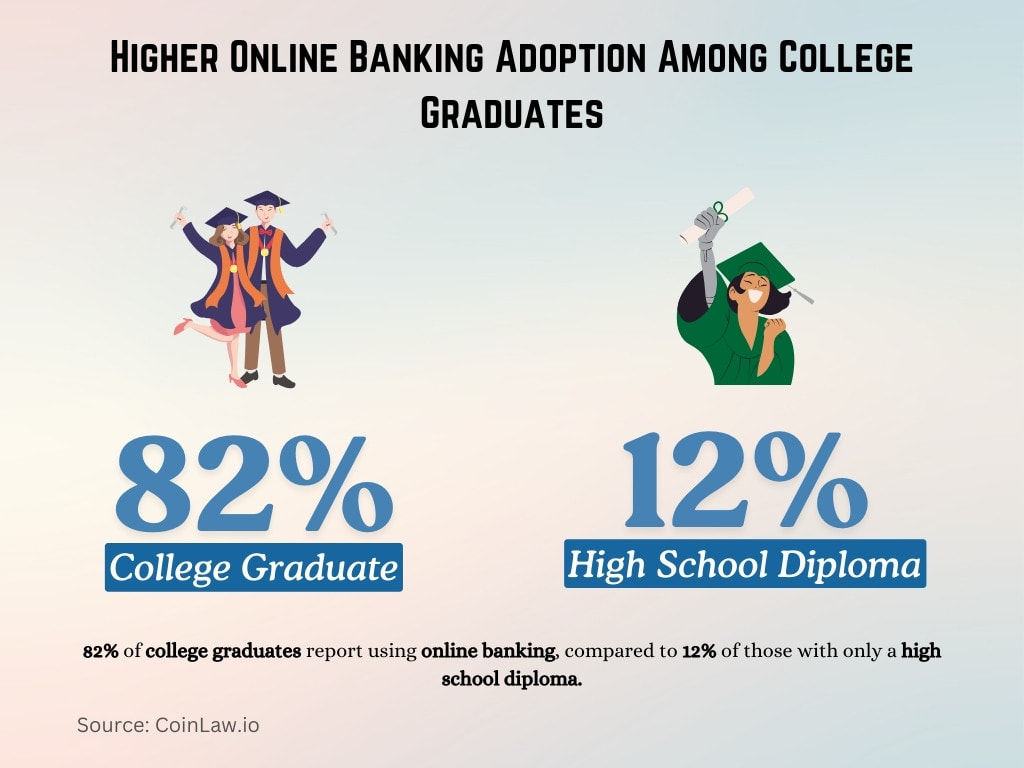

- Education plays a role: 82% of college graduates report using online banking, compared to 12% of those with only a high school diploma.

Neobanks vs. Traditional Banks

- Neobanks in the US now serve 28 million customers in 2025, continuing sharp growth from 2024.

- Chime has reached 16 million users in 2025, showing a 25% year-over-year growth.

- European neobanks like Revolut and N26 now serve 14 million users combined across Europe.

- Traditional banks have responded, with 85% of US banks now offering mobile-first digital services.

- Neobanks maintain a satisfaction rating of 4.7 out of 5 versus 3.8 for traditional banks.

- Neobanks continue to grow at an annual rate above 22%, far outpacing legacy institutions.

- Neobanks are on track to capture 22% of the global market by 2030 if 2025 growth persists.

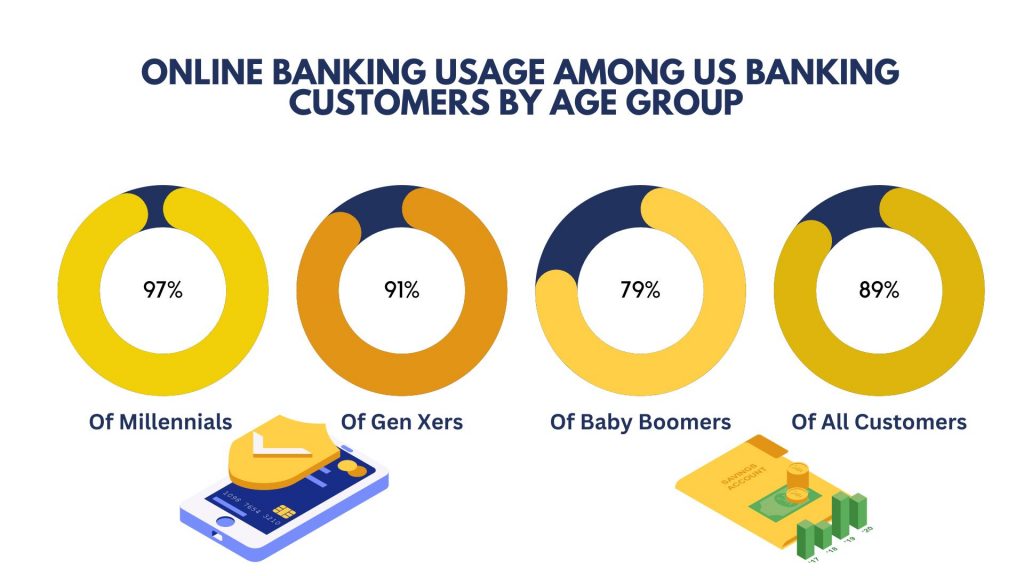

Online Banking Usage by Age Group in the U.S.

- Millennials lead the way, with 97% of them using online banking services.

- 91% of Gen Xers actively use online banking.

- 79% of Baby Boomers engage with online banking platforms.

- Across the board, 89% of all U.S. banking customers use online banking.

Security Concerns and Authentication Advances

- 83% of users remain concerned about data breaches in digital banking.

- Biometric authentication is now used by 77% of mobile users, up from previous years.

- 70% of banks worldwide have adopted multi-factor authentication to improve account security.

- AI-driven fraud detection is preventing over $9.3 billion in fraud losses annually in 2025.

- End-to-end encryption is standard for 94% of digital banks, securing data in transit.

- Device-based authentication is used by 59% of banks, leveraging mobile hardware for ID.

- Phishing attacks still impact 11% of users, driving stronger education initiatives in 2025.

- Tokenization is now implemented by 48% of digital banks to protect sensitive data.

- Behavioral biometrics have cut fraud by 15% for banks deploying this real-time analysis.

- Passwordless login is now available at 52% of banks, led by facial and biometric access.

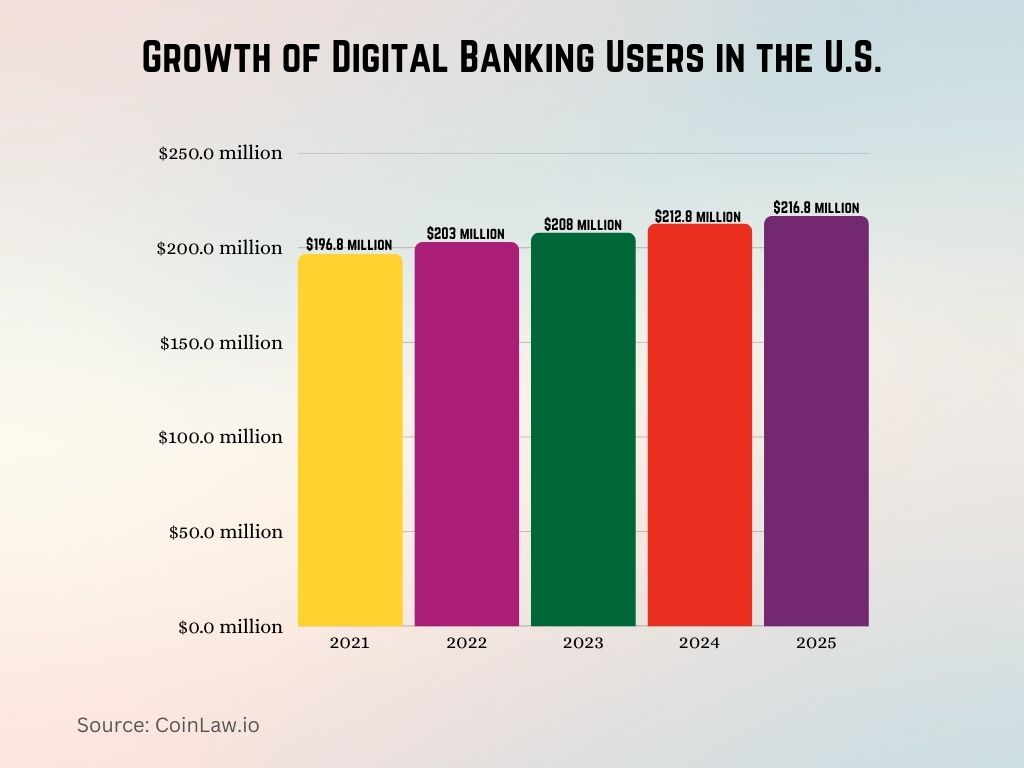

Growth of Digital Banking Users in the U.S.

- In 2021, there were 196.8 million digital banking users in the U.S.

- The number rose to 203.0 million in 2022.

- The year 2023 saw continued growth, reaching 208.0 million users.

- By 2024, the user count will have increased to 212.8 million.

- Projections for 2025 estimate 216.8 million digital banking users.

Banking Fees

- Traditional banks have responded to competition by reducing fees, with average monthly maintenance fees decreasing by 18% since 2022.

- Overdraft fees remain a pain point, with 57% of users stating that high overdraft fees affect their satisfaction with traditional banks.

- Neobanks generally have lower or no monthly fees, making them attractive to younger users; 74% of millennials report choosing a neobank to avoid fees.

- ATM withdrawal fees are declining, with a 7% reduction on average due to partnerships between digital banks and ATM networks.

- In Europe, 41% of online banks now offer fee-free accounts to attract new customers, compared to 32% in 2022.

- Hidden fees are a significant issue, with 38% of users reporting dissatisfaction due to unclear fee structures in traditional banks.

- Low-income customers are nearly twice as likely to choose digital banks due to the fee savings, demonstrating digital banks’ accessibility appeal.

- Transfer fees are also impacted; 66% of online banks provide free or reduced-fee domestic transfers.

- Neobanks report a customer retention rate of 85%, attributed to low fees and simplified account management.

- The average annual fees for online-only banks are around 20% lower than traditional banks, making them increasingly competitive.

Digital Banking Trends

- AI-driven customer service has become more prevalent, with 68% of online banks now using AI to handle common customer inquiries.

- Personalization algorithms help banks tailor offers to individual needs, with 42% of customers reporting they appreciate customized services.

- Biometric security is on the rise, with 73% of digital banking apps using facial recognition or fingerprint authentication.

- Blockchain technology is being tested in 12% of online banking transactions to enhance transparency and reduce fraud.

- Voice-activated banking is gaining traction, with 25% of online banks offering Alexa or Google Assistant integrations.

- Gamification in digital banking, such as savings challenges or spending trackers, has boosted engagement, with 34% of users participating in these features.

- Eco-conscious banking options are gaining popularity; 20% of online banks now offer green accounts that support sustainable initiatives.

- Open banking has led to 37% of users linking their accounts to third-party financial apps, enhancing their financial management.

- Digital loan applications saw a 45% increase, with faster approvals being a key attraction.

- Cryptocurrency offerings are available at 22% of online banks, catering to a growing demand for digital asset management.

Primary Methods to Access a Bank Account

- Mobile apps dominate, with 78% of online banking users preferring apps over other access methods.

- Desktop usage for online banking is declining, now accounting for only 18% of sessions.

- Wearable devices are emerging in the market, with 7% of users checking account balances on smartwatches.

- Browser-based banking is still relevant, especially for business accounts, representing 12% of total access.

- Voice banking services are used by 9% of online banking customers, often through voice assistants.

- Tablet banking is popular among older demographics, with 15% of Baby Boomers preferring tablet-based banking apps.

- Banking notifications via SMS remain widely used, with 45% of users receiving transaction alerts on mobile.

- Smart speaker usage for account inquiries is expected to grow, with 11% of users planning to use this feature by 2025.

- In-app payment options for services like utilities and insurance are accessed by 30% of digital banking users.

- Face ID and Touch ID are used by 84% of mobile banking app users, making security access more seamless.

Top Digital Banks by Total Funding

- Chime leads US neobanks with $4.1 billion in funding, reinforcing its dominance in the market.

- Revolut has secured $2.2 billion in funding, expanding further into crypto, trading, and international banking.

- Monzo raised $1.3 billion in funding to upgrade app intelligence and financial tools.

- Varo Bank holds a federal license and has received $1.05 billion in funding to date.

- N26 has attracted $1.4 billion in funding, continuing its European and global growth.

- Starling Bank has raised $980 million in funding, with a strong focus on SME lending.

- Tinkoff Bank reached $910 million in funding, powering retail and enterprise digital services.

- Current has received $460 million in funding, offering Gen Z perks like early pay access.

- Zopa has grown with $710 million in funding, boosting its loan and savings products.

Technological Innovations in Online Banking

- Artificial Intelligence (AI) in online banking has grown by 45% since 2022, powering features like chatbots, fraud detection, and personalization.

- Blockchain technology is expected to revolutionize banking security, with 18% of banks now using it to enhance transaction transparency.

- Machine learning is widely used in credit scoring, with 30% of banks utilizing ML algorithms to improve loan approval accuracy.

- Voice recognition technology has been adopted by 22% of banks globally, enabling voice-activated banking for enhanced user convenience.

- Augmented Reality (AR) for banking education and tutorials is in the experimental stage but expected to grow, with 5% of banks testing AR apps.

- Robotic Process Automation (RPA) is deployed by 27% of banks, automating repetitive tasks and reducing operational costs.

- Cloud-based banking solutions are adopted by 50% of banks, enhancing scalability and data storage capabilities.

- Quantum computing is being explored by 8% of financial institutions, with the potential to vastly improve data processing speeds.

- Digital twins, or virtual models of banking systems, help in simulations and risk analysis, with 10% of major banks leveraging this tech.

- Predictive analytics assists in anticipating customer needs, with 55% of banks using predictive insights for targeted offers and retention strategies.

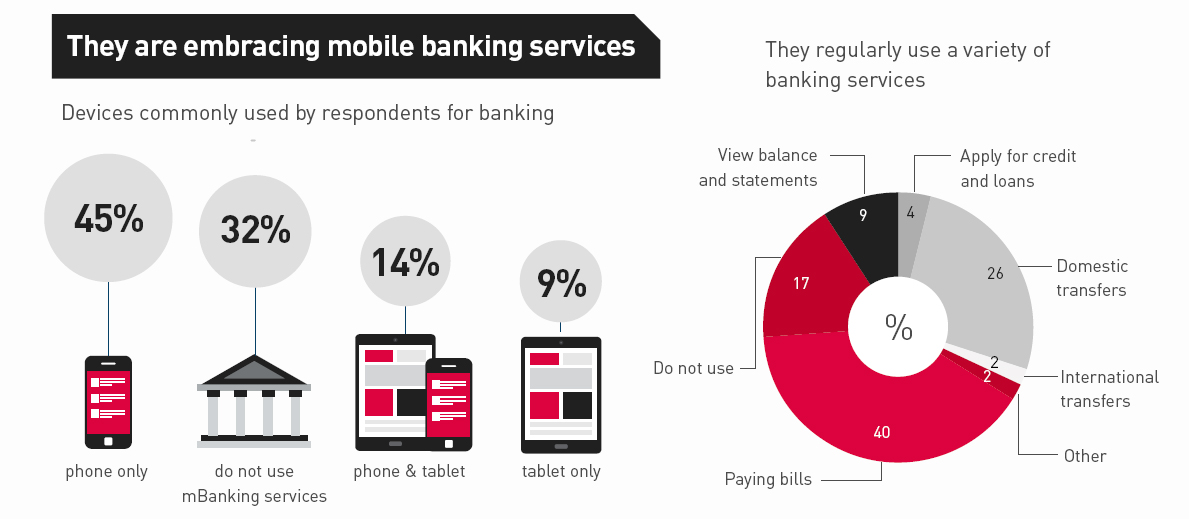

Mobile Banking Trends: Devices & Services in Use

Devices Used for Mobile Banking

- 45% of users rely on phones only for banking activities.

- 14% use both phone and tablet.

- 9% use tablets only.

- 32% of respondents do not use mobile banking services at all.

Most Common Mobile Banking Activities

- 40% of users regularly pay bills via mobile banking.

- 26% make domestic transfers.

- 17% reported that they do not use mobile banking.

- 9% check balances and statements.

- 4% apply for credit and loans.

- 2% perform international transfers, while another 2% use it for other services.

Challenges and Future Opportunities

- Cybersecurity threats remain a primary challenge, with 70% of digital banks investing heavily to protect against rising online attacks.

- Customer retention is challenging for digital banks, with a 12% annual churn rate attributed to competitive switching.

- Regulatory compliance creates operational burdens, especially for neobanks, requiring frequent updates to align with government policies.

- Financial literacy poses an opportunity, as 47% of users express interest in learning more about managing finances via banking apps.

- Emerging markets represent growth potential, with regions like Africa and Southeast Asia seeing 20%+ growth rates in digital banking adoption.

- Environmental concerns provide avenues for green banking; 26% of users would prefer banks offering sustainable investment options.

- Partnerships with tech firms are expanding, with 35% of digital banks collaborating with fintech startups for innovation.

- AI ethics and transparency are emerging issues, as 23% of customers express concerns over AI-driven financial decisions.

- Cross-border payment improvements are a priority, with digital banks working to reduce fees and enhance processing times.

- Customer loyalty programs are being introduced by 19% of neobanks, using rewards to retain customers in a competitive market.

Recent Developments

- A UK study highlights that AI-generated fake news increases the risk of bank runs, as disinformation about deposit safety spreads rapidly through social media.

- The Reserve Bank of India has cautioned lenders about the surge in digital payment frauds and is introducing secure web domain names to combat these fraudulent activities.

- AMP Bank in Australia is launching numerous debit cards to enhance security against fraud and scams, allowing customers to access their card details securely via a mobile app.

- The Bank of Scotland plans to close 22 branches in 2025, reflecting a broader shift towards digital banking as customer preferences evolve.

- New legislation in Australia imposes significant fines on social media companies that fail to remove scam content, aiming to protect consumers from deepfake technology scams.

Conclusion

Online banking has fundamentally transformed how we manage our finances, with 2025 marking a year of notable growth and change. As neobanks gain ground against traditional banks and new technologies redefine security and user experiences, online banking adoption will likely keep rising globally. However, the future presents both challenges and opportunities, from tackling cybersecurity risks to meeting customer demands for innovative features. Ultimately, banks that prioritize digital transformation, user satisfaction, and robust security measures will lead the way in an increasingly digital world of finance.