A deepening rift in the Artificial Superintelligence (ASI) Alliance has erupted into controversy after blockchain analysts flagged suspicious token movements by Ocean Protocol.

Key Takeaways

- Ocean Protocol is suspected of swapping and redistributing $191 million worth of FET tokens, raising transparency concerns.

- Fetch.AI accused Ocean of misconduct, calling the actions a “rug pull” if done by a standalone project.

- The controversy follows Ocean Protocol’s abrupt exit from the ASI Alliance on October 9 without addressing the token transfers.

- Bubblemaps data shows most of the tokens ended up on exchanges, hinting at possible liquidation.

What Happened?

Ocean Protocol allegedly moved hundreds of millions of dollars in FET tokens to exchanges after its quiet exit from the ASI Alliance. The tokens were initially obtained through a large swap from OCEAN tokens that were supposed to support community initiatives. The movements have triggered accusations from alliance partner Fetch.AI, intensifying doubts about the alliance’s future.

Did Ocean Protocol dump $100M+ in community tokens?

— Bubblemaps (@bubblemaps) October 21, 2025

Fetch AI is openly accusing them of misconduct

Here’s what the data shows 🧵 pic.twitter.com/G4eYlr1wLH

Ocean Swaps $191M in Tokens Then Leaves ASI

On July 1, on-chain data revealed that a multisig wallet linked to Ocean Protocol converted 661 million OCEAN tokens into 286 million FET, valued at around $191 million at the time. These OCEAN tokens were meant for “community incentives” and “data mining”, yet were instead moved in large amounts to exchanges.

Ocean Protocol transferred 90 million FET to OTC provider GSR Markets, then split the remaining 196 million FET across 30 newly created wallets. Between late August and mid-October, nearly 270 million FET tokens were funneled to Binance or GSR, according to analytics platform Bubblemaps.

These patterns are typically linked to token liquidation, though Bubblemaps clarified it cannot definitively prove the tokens were sold.

Ocean’s Silent Exit From the Alliance

On October 9, Ocean Protocol announced its withdrawal from the ASI Alliance, formed earlier in March 2024 alongside Fetch.AI and SingularityNET. The alliance had aimed to unify the three projects under a single token, FET, through the merger of their token supplies.

Ocean’s announcement made no mention of the FET token transfers, nor did it clarify the status of the community allocation funds. This lack of transparency has unsettled both investors and alliance partners.

In the aftermath, Ocean stated that OCEAN would be de-pegged and relisted on exchanges, further signaling a return to independence.

Accusations and Denials

The CEO of Fetch.AI, Humayun Sheikh, responded strongly, accusing Ocean Protocol of misconduct. He said, “This would be a rug pull if done by any standalone project,” implying a serious breach of trust in the crypto space.

Ocean Protocol’s co-founder Bruce Pon rejected the allegations, calling them “unfounded and baseless rumors.” He also stated that the team is preparing a formal response and that legal proceedings are underway.

So far, the Ocean team has not directly addressed the on-chain data or confirmed whether the tokens were sold.

Market Reaction Sends Mixed Signals

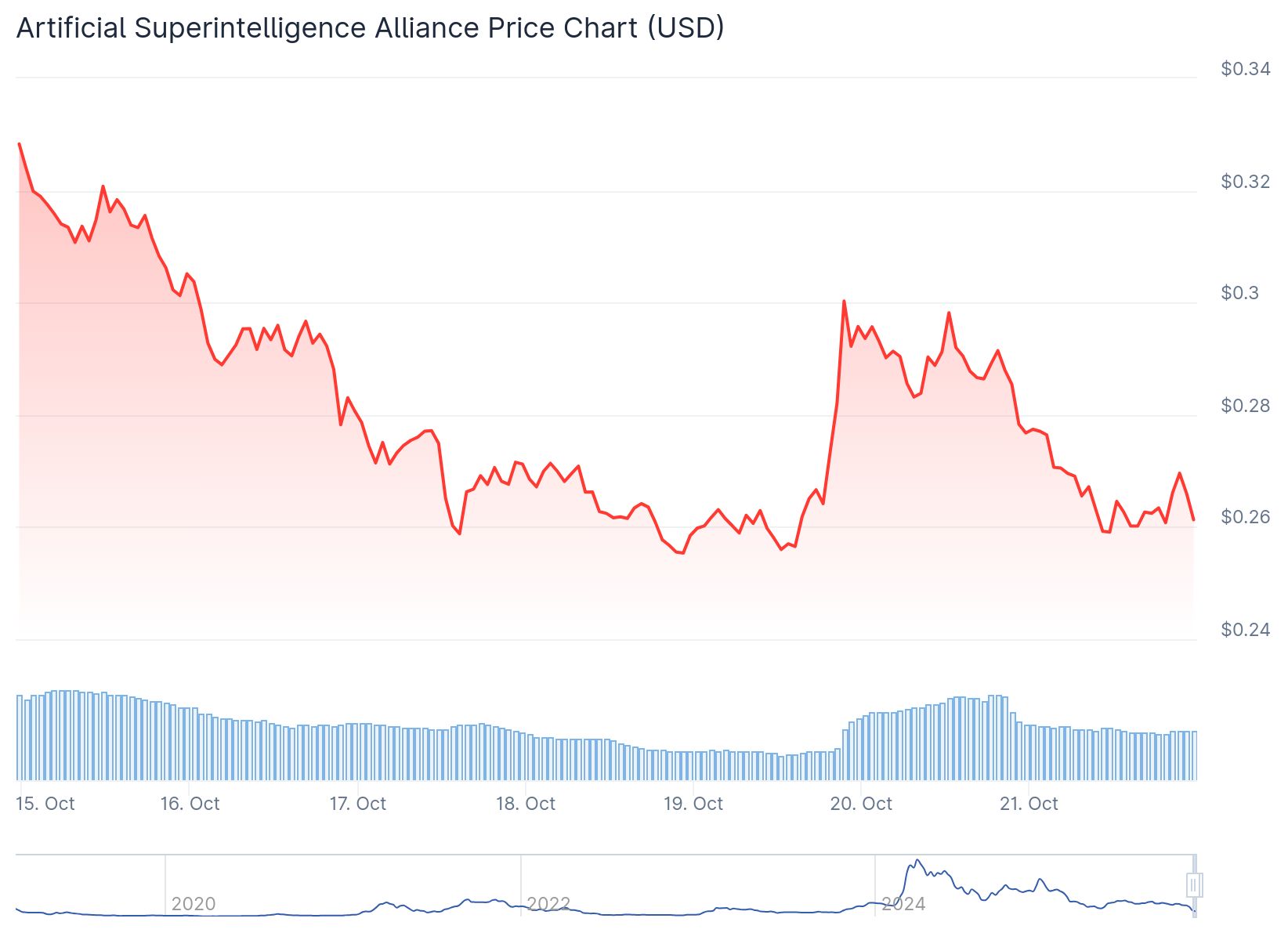

The controversy has had a clear impact on token prices. Between October 9 and 21, Fetch.AI’s FET token plunged over 52%, dropping from $0.55 to $0.27, according to CoinGecko.

Meanwhile, OCEAN’s price rose from $0.25 to $0.30 during the same period. Technical indicators like the Relative Strength Index (RSI) now sit around 55, suggesting a recovery from oversold levels.

The contrasting price action reflects a shift in investor sentiment, with some seeing Ocean’s departure and potential relisting as a stabilizing move, even as scrutiny over the token transfers continues.

CoinLaw’s Takeaway

This situation feels like a textbook case of why transparency and governance matter so much in Web3. In my experience covering crypto partnerships, it’s often the token treasury management that sparks the biggest trust issues. If Ocean really intended to use those funds for community growth, they should have communicated every step clearly. Now, with accusations flying and market trust shaken, this alliance looks more fractured than united. Let’s hope this pushes more projects toward open, accountable frameworks.