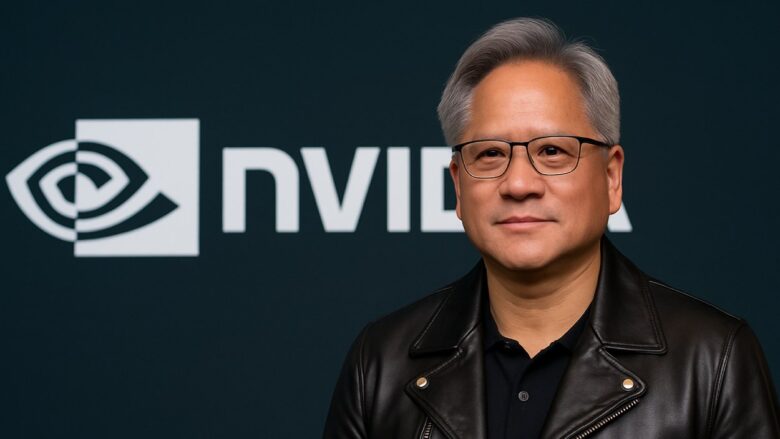

SCS Capital Management has slightly reduced its position in Nvidia, even as the chipmaker posts blockbuster earnings and remains a dominant force in AI.

Key Takeaways

- SCS Capital Management cut its Nvidia stake by 3,092 shares, as disclosed in a February 12, 2026, filing.

- The move follows similar reductions by other firms but comes despite Nvidia’s Q3 revenue jumping 62 percent year over year.

- Institutional ownership remains strong, with firms like Boston Common Asset Management, Vanguard, and BlackRock maintaining or increasing their stakes.

- Nvidia’s market cap now stands at $4.61 trillion, cementing its position as a leader in AI and semiconductors.

What Happened?

SCS Capital Management LLC, overseen by fund manager Antony J. Abbiati, filed with regulators that it has sold off 3,092 shares of Nvidia Corporation (NVDA). No formal reason was given for the reduction, and the firm did not issue a public statement. This adjustment is part of a broader trend among institutional investors that have recently repositioned their holdings in Nvidia. Yet, the company’s robust earnings and AI dominance continue to attract long-term interest from major financial players.

Institutional Moves Reflect Mixed Sentiment

Nvidia remains a magnet for large-scale investment, but recent filings reveal a mix of actions. SCS Capital’s recent reduction mirrors similar trimming by other firms, including Suncoast Equity Management and SKY Mountain Capital Management Inc. However, other asset managers are still buying.

Boston Common Asset Management LLC increased its Nvidia holdings by 3.9 percent in Q3, acquiring an additional 15,884 shares and bringing its total to 418,132. The tech giant now makes up 2.2 percent of the firm’s entire portfolio, ranking as its second-largest position.

Meanwhile, some of the largest institutional holders continue to reinforce their positions:

- Vanguard, BlackRock, and State Street remain among the top holders.

- State Street Corp increased its Nvidia shares by 1.0 percent in Q2, totaling 978 million shares.

- Geode Capital Management LLC lifted its position by 1.5 percent.

- Norges Bank entered with a new stake reportedly worth over $51.3 billion.

- Legal and General Group Plc bought an additional 2.6 million shares recently, bringing their total investment to over $28.2 billion.

- Charles Schwab Investment Management Inc. held 155.7 million shares as of Q2.

These actions suggest that while some funds are locking in gains or rebalancing, long-term conviction remains high among heavyweight investors.

Market Context: Why the Trim Now?

SCS Capital did not provide a reason for the stake reduction, which is common for institutional portfolio updates. Such adjustments are often attributed to routine rebalancing, risk management, or profit-taking after major stock rallies.

Technical indicators may also be a factor. Analysts have pointed to a “death cross” formation in 2025, which signaled a potential bearish trend. However, Nvidia’s fundamentals remain strong, especially after its Q3 2026 earnings report revealed $57 billion in revenue, marking a 62 percent year-over-year increase.

While analysts have flagged the stock’s high valuation and geopolitical supply chain risks, Nvidia’s core strategy around AI chips and data center expansion has helped it maintain momentum in the tech sector.

CoinLaw’s Takeaway

In my experience tracking institutional trends, these kinds of trims are less about doubt and more about discipline. SCS Capital likely saw an opportunity to lock in profits after Nvidia’s meteoric rise. But the big picture tells a more bullish story. The fact that Boston Common and giants like Vanguard and Norges Bank are adding or holding strong is the real signal here. Nvidia is no longer just a chipmaker. It’s becoming the backbone of AI infrastructure, and smart money knows it.