MyEtherWallet (often called MEW) remains among Ethereum’s most enduring and trusted wallet interfaces. It continues to serve millions of users who demand noncustodial access to Ethereum, DeFi, and NFT ecosystems. Its influence spans from individual retail users to developers building dApps. For instance, a decentralized project might recommend using MEW to onboard new users to staking, while an NFT marketplace may support MEW for wallet connection during trading. Below you’ll find key metrics and trends on MEW’s reach, usage, and evolving position in the crypto wallet landscape.

Editor’s Choice

- It supports Ethereum and more than 2,000 ERC‑20 tokens.

- In 2024, Ethereum averaged about 1,164,911 transactions per day, up ~11.8% year‑on‑year.

- The global crypto wallet market is projected to grow to $18.96 billion in 2025.

- The Ethereum wallet segment is forecast to expand at ~14.2% CAGR through 2033.

- Browser‑based wallet security audits revealed 116 vulnerabilities across 96 wallets, many in popular extensions.

- MyEtherWallet is identified as one of the top competitors in the crypto wallet space among 600+ firms.

Recent Developments

- In the past year, MEW launched enhanced gas-fee estimation to reduce failed transactions.

- MEW added direct cross‑chain token swaps, allowing ERC‑20 bridges to other chains.

- It rolled out a revamped mobile app interface with biometric login support.

- MEW strengthened internal auditing and now publishes quarterly security reviews.

- The team expanded into educational content, video tutorials, guides, and blog posts.

- MEW announced partnerships with several DeFi aggregators to offer one-click access.

- They extended support for L2 solutions to reduce gas overhead, e.g., Optimism, Arbitrum.

- MEW improved ENS integration, letting users manage ENS domains through its interface.

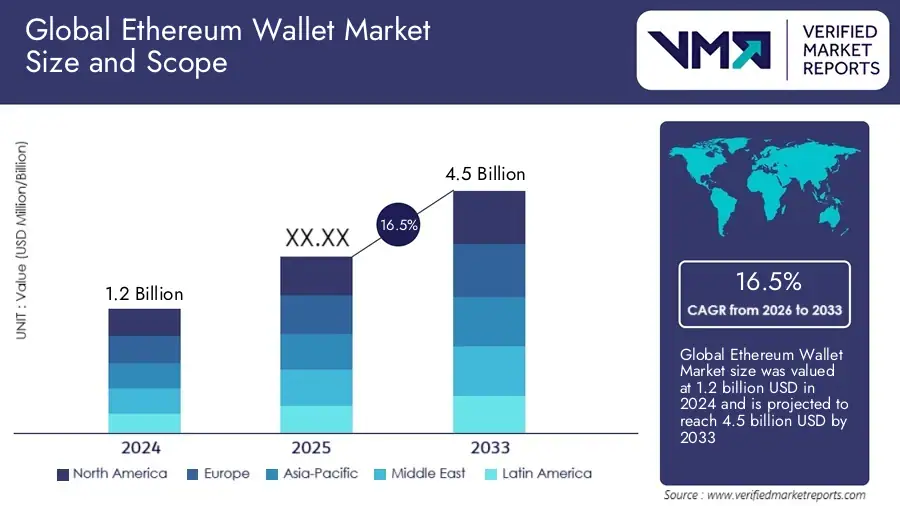

Global Ethereum Wallet Market Growth Highlights

- The Global Ethereum Wallet Market was valued at $1.2 billion in 2024.

- It is projected to reach $4.5 billion by 2033, reflecting rapid expansion.

- The market is expected to grow at a compound annual growth rate (CAGR) of 16.5% from 2026 to 2033.

- North America, Europe, and the Asia-Pacific dominate the market, followed by the Middle East and Latin America.

- Rising DeFi, NFT, and staking activity is driving demand for Ethereum wallets worldwide.

- Verified Market Reports identifies increasing non-custodial wallet adoption as a key factor behind this growth.

User Base and Adoption Statistics

- MEW claims “millions of users” in its marketing copy, though exact numbers aren’t publicly disclosed.

- In competitor analysis, it shows up in the top wallet usage lists across Ethereum users.

- Ethereum’s cumulative unique addresses recently surpassed 336 million.

- Daily active addresses on Ethereum in late 2025 averaged ~570,000+.

- Over 2024, Ethereum daily transactions averaged approximately 1,164,911.

- Globally, the number of crypto users is projected to reach 861 million in 2025.

- In the U.S., nearly 100 million people are expected to be crypto users in 2025.

- MEW retains popularity among Ethereum-native users who prefer noncustodial control rather than exchange wallets.

Global Reach and Regional Popularity

- North America leads in crypto wallet adoption and remains a strong region for MEW growth.

- Europe and Asia are key growth markets for Ethereum wallets, given rising DeFi use.

- Latin America saw cryptocurrency user growth of 117% from 2023 to 2024.

- In 2024, 2025, Latin America accounted for ~9% of global crypto value flows.

- MEW’s noncustodial model appeals in regions with limited trust in exchanges.

- MEW supports multiple languages, aiding adoption in non-English speaking markets.

- Regional wallet hacking incidents historically motivate stronger security adoption in markets like Southeast Asia.

- MEW remains comparatively less known in developing markets compared to mobile-only wallets.

Ethereum Price Forecast Highlights

- In 2025, ETH could rise to between $2,560 and $5,555, driven by increased staking and broader Web3 integration.

- In 2026, analysts expect a potential surge to $5,555–$10,000, fueled by institutional adoption and DeFi expansion.

- By 2027, Ethereum could reach around $7,500, assuming steady network upgrades and Layer-2 scaling success.

- In 2028, ETH is forecasted to hit $10,000, marking a key milestone as Ethereum strengthens its dominance in smart contract platforms.

- By 2029, ETH could climb to $11,000, aligning with growth in tokenized assets and enterprise blockchain use.

- In 2030, Ethereum’s price may reach $12,000, supported by mass integration in decentralized finance and real-world applications.

- Long-term forecasts predict that ETH could reach $15,000 by 2035 and potentially $20,000 by 2040, as Ethereum continues to lead the smart contract and DeFi ecosystems.

Wallet Creation and Usage Trends

- Globally, 198 million wallets in 2025 have interacted with at least one dApp, about 24% of all wallets.

- Wallets used for yield farming rose 37% year-over-year in 2025.

- The average DeFi wallet supports 5.4 tokens and interacts with 2.3 chains in 2025.

- NFT‑linked wallets grew 33% YoY in 2025.

- Social recovery wallets, trust‑based backup, grew 44% in 2025.

- Browser extension wallets remain the primary interface for many users, being the most targeted attack vector in 2025, with 42% of attacks.

- The odds of randomly generating an already active Ethereum address are so extraordinarily low that it’s effectively zero, MEW has explained the astronomical address space.

- MEW maintains a token registry that dynamically updates, which helps new tokens to be recognized without manual configuration.

- The trend of cross-chain bridges being integrated into wallet creation flows is increasing, encouraging users to manage assets across multiple networks from the outset.

MyEtherWallet Transaction Volumes

- In 2024, Ethereum averaged 1,164,911 transactions per day, an 11.8% increase from 2023.

- The Ethereum mainnet currently records ~1.55 million daily transactions.

- On Etherscan, the total 24h Ethereum transactions recently exceeded 1,576,776.

- Swaps executed through MEW’s interface, token trades, are rising, in line with overall DEX volume expansions.

- Network congestion episodes lead to spikes in MEW usage, particularly during major NFT drops or DeFi events.

- MEW’s integrated bridge traffic contributes indirectly to cross-chain transaction volume, though separate from Ethereum’s core volume.

- MEW-enabled staking and unstaking transactions also form a subset of its transaction mix, especially after Ethereum’s transition to PoS.

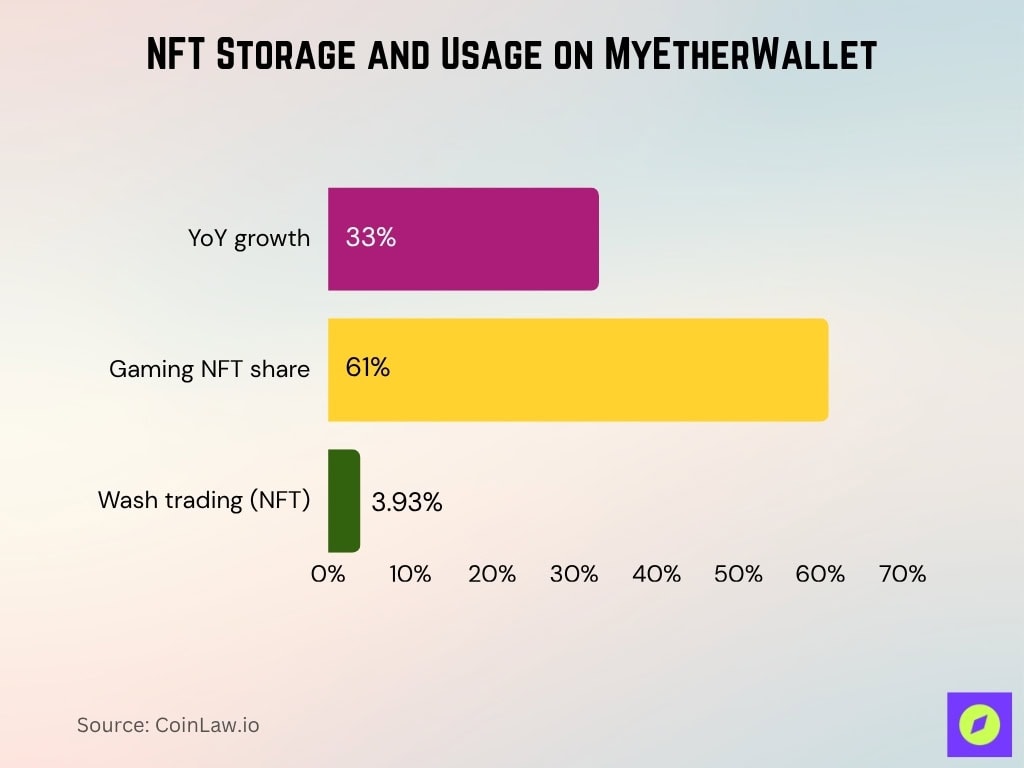

NFT Storage and Usage on MyEtherWallet

- NFT‑linked wallets globally hit 294 million in 2025, up 33% YoY.

- A majority of NFT interactions, 61%, are tied to gaming NFTs in 2025.

- Wash trading in NFT markets is a known issue; approximately 3.93% of addresses may engage in suspicious patterns.

- MEW allows users to view and store ERC‑721 and ERC‑1155 tokens.

- MEW’s interface integrates with popular NFT market APIs to fetch metadata.

- Cross‑chain NFT bridges, e.g., from Ethereum to sidechains, are increasingly accessible from MEW.

- MEW includes previews and links to OpenSea or equivalent marketplaces for direct viewing.

- NFT portfolios within MEW can be organized by collection or rarity.

- MEW users sometimes encounter failed metadata fetches during peak congestion.

Integration with DeFi and DApps

- In 2025, 48% of all wallets globally have interacted with at least one dApp.

- MEW supports direct swap integrations, via aggregators, to allow one‑click access to liquidity pools.

- MEW’s cross‑chain bridges enable users to access DeFi on multiple networks from a single interface.

- The wallet’s enhanced gas optimizers reduce slippage in DeFi trades for users.

- MEW participates in partner programs with lending protocols to embed “borrow/repay” flows.

- Users can use MEW to approve token allowances, a critical step in many DeFi actions.

- The wallet supports ENS and allows users to manage names within dApp flows.

- MEW also enables viewing and interacting with contract calls, if the ABI is known, within its interface.

Incident and Security Breach Statistics

- In 2025, phishing attacks caused $1.1 billion+ in wallet‑related thefts globally.

- Wallets with multi-factor authentication (MFA) show ~62% lower compromise rates.

- Browser extension wallets made up 42% of known attack vectors in 2025.

- MEW has not publicly disclosed a major systemic breach in recent years.

- Many reported losses stem from user error, seed phrase leaks rather than protocol flaws.

- MEW’s bug bounty and audit programs have identified dozens of minor vulnerabilities over time.

- The broader Ethereum network has seen contract‑level attacks and exploits, e.g., frontrunning, reentrancy.

- Security incident coverage often leads to surges in app downloads as users switch wallets.

- MEW’s transparency and educational guides help restore trust after event reports.

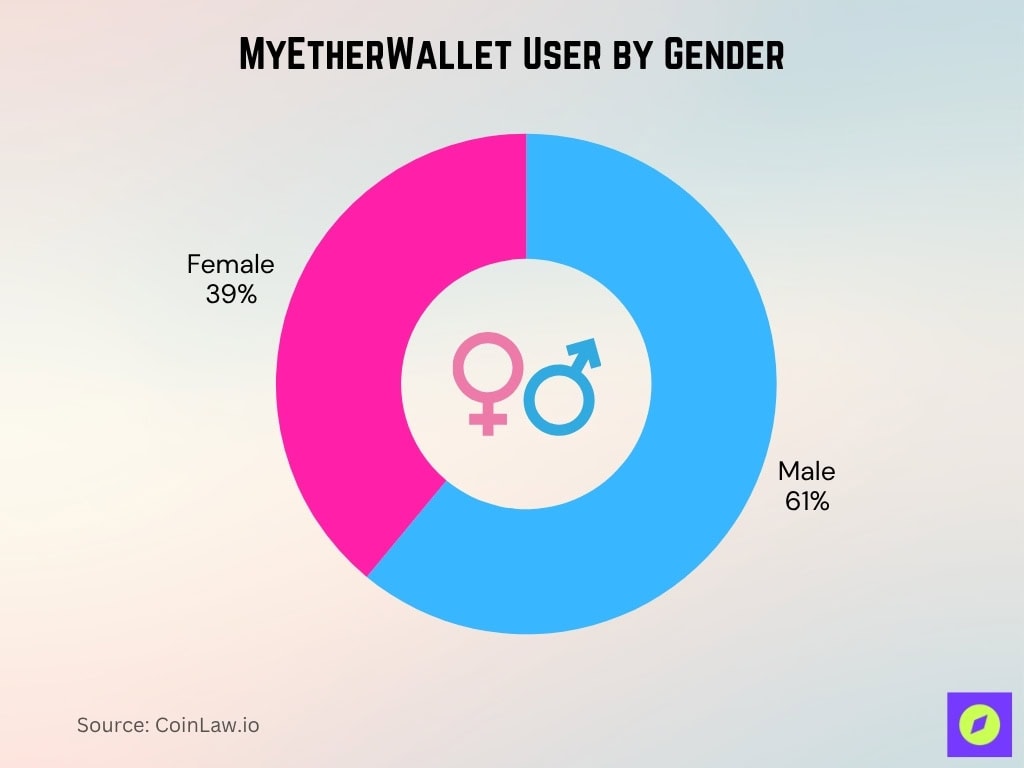

User Demographics and Profiles

- Among crypto owners, ~61% are male and ~39% female.

- Globally, in 2024, about 560 million people own cryptocurrency, representing ~6.8% of the global population.

- The largest age group is 25–34 years old, accounting for ~34% of crypto owners.

- In the U.S., ~15.56% of adults were crypto owners, as of 2023.

- Among crypto users, 59% prefer noncustodial wallets in 2025, versus custodial.

- The average user now holds ~2.7 wallets in 2025.

- Institutional/enterprise wallets have increased multi-signature deployments by 47% YoY.

- 52% of institutional wallets interact with smart contracts monthly, indicating active DeFi use.

- MEW’s user base likely skews toward technically savvy individuals who value self‑custody, given its feature set and noncustodial model.

- Because MEW integrates with dApps and DeFi, many of its users are active participants, not passive holders.

Hardware Wallet Compatibility

- The global hardware wallet market is estimated at $348.4 million in 2025, growing at ~23.5% CAGR.

- In 2025, 69.1% of the hardware wallet market share is attributed to hot wallet types, i.e., software + hardware hybrids.

- MEW supports major hardware wallets like Ledger and Trezor through integration.

- Use of hardware wallets offers offline key security, reducing vulnerability to software exploits.

- More users connect hardware wallets to MEW to sign transactions securely.

- Hardware wallet adoption among MEW users is growing, particularly for long-term holdings.

- Market expansion in hardware wallets suggests increasing demand for secure custody options.

MyEtherWallet Mobile App Usage

- The MEW Wallet app is available on both Android and iOS.

- In 2025, mobile wallets, hot wallets account for 78% of all crypto wallet usage, highlighting the mobile-first trend.

- Among hot wallets, mobile app usage is growing faster than browser extension usage.

- The mobile app supports core wallet features, sending, receiving, swapping tokens, and interacting with dApps.

- MEW’s mobile app also supports biometric login, fingerprint or face recognition, for added security.

- Users report that the mobile interface of MEW matches much of the functionality of its desktop/web version.

- Peak download periods for MEW’s mobile app often correspond to high‑interest crypto events or NFT drops.

- The mobile app usage helps MEW reach users in regions where desktop access is limited, e.g., parts of Asia, Latin America.

- While MEW does not publicly disclose monthly active users, MAU, for its app, industry benchmarks suggest top Ethereum wallets manage millions to tens of millions of MAUs.

- Because mobile use is dominant in many markets, MEW’s success increasingly depends on app stability, updates, and mobile UX.

Browser Extension Usage Statistics

- Browser extension wallets still hold a core user base, especially among power users and DeFi traders.

- In 2025, browser extensions make up only ~9% of hot wallet usage, indicating a shift toward mobile and app‑based wallets.

- Extension wallets remain a prime target for attacks. In 2025, ~42% of known wallet attack vectors target browser extensions.

- Many users prefer extensions for easier dApp connectivity in desktop browser settings.

- Extensions generally offer faster switching between networks and token views for experienced users.

- The usage of extensions tends to spike during desktop‑native NFT minting or trading events.

- Some users adopt “hybrid” habits, mobile for quick use, extension for deeper tasks.

- Extension errors or compatibility issues, e.g., with browser updates, still cause friction and drop‑offs.

- Security audits of wallet extensions are frequent; vulnerabilities in extensions can undermine user confidence.

- The shift to L2, Layer‑2, usage encourages extension wallets to support multiple chains with better switching flows.

MyEtherWallet vs Other Ethereum Wallets

- MEW is often compared with wallets like Coinbase Wallet, MetaMask, Trust Wallet, etc.

- MetaMask extension had over 21 million monthly active users.

- Coinbase Wallet offers both custodial and non-custodial features, competing directly in usability.

- Trust Wallet is mobile‑native and supports many blockchains beyond Ethereum.

- MEW’s strength lies in its deep Ethereum/DeFi/NFT specialization and open‑source client‑side architecture.

- Some users find MEW’s UI steeper to learn compared to simpler wallets like Trust Wallet.

- Because MEW is noncustodial, it does not control user funds, unlike exchange wallets.

- In comparison, MEW is praised for security and control, while challengers may win on convenience or multi‑chain breadth.

- MEW’s position among the ~626 active wallet competitors remains strong due to its Ethereum focus.

Revenue and Business Metrics

- The global crypto wallet market is projected to grow from $14.39 billion in 2024 to about $18.96 billion in 2025.

- That implies a compound annual growth rate, CAGR, around 31.7%.

- North America accounted for ~30.9% of overall wallet revenue in 2024.

- The “hot wallet” segment dominates, making up ~56% of wallet revenue share.

- MEW, as a free, open‑source interface, likely generates income via partnerships, integrations, swap fees, and token listing services.

- MEW has not publicly disclosed major fundraising events to date.

- A portion of MEW’s ecosystem revenue likely comes from referral fees from bridges, DEXes, or DeFi protocols.

- As wallet usage grows, ancillary revenue streams, e.g,. education, analytics, and premium features may emerge.

- The expanding market size suggests greater monetization opportunities for wallets with strong adoption.

Frequently Asked Questions (FAQs)

~ 571,652 unique addresses per day.

~ 68.6% of all wallets.

626 active competitors.

Increased by ~ 65%.

Conclusion

MyEtherWallet remains a key player in the Ethereum wallet ecosystem, backed by rising mobile use, deep integration with DeFi/NFT, and a user base that values control and security. The statistics today point to accelerating wallet adoption, shifting usage toward mobile interfaces, and mounting pressure for secure interfaces and advanced features. As competition intensifies, MEW’s continued success depends on balancing usability, security, and innovation. Dive into the full article to see the complete data, trends, and forecasts that define MyEtherWallet’s journey.