Payday loans today remain one of the most expensive forms of credit in the financial system, with some annual percentage rates (APRs) exceeding 660%. Promoted as quick cash for emergencies, they often spiral into high-cost debt traps.

While 20 U.S. states have implemented strict interest caps, many others allow lenders to legally charge fees that compound borrower hardship, especially for low-income communities. This article breaks down the data, laws, and real-world impacts behind America’s priciest payday loans.

Key Takeaways

- APR on payday loans often exceeds 400%, with some lenders crossing the 650% mark.

- $2.4 billion in payday loan fees were drained from borrowers in a single year.

- California, Texas, and Florida account for over 73% of U.S. payday loan fee revenue.

- Most borrowers renew or roll over loans, staying in debt for months or even years.

- Only 20 states and Washington, D.C. cap APRs around 36%, shielding consumers from predatory pricing.

Debt Trap Mechanics: Borrow One, Owe Five

What begins as a short-term fix often spirals into a long-term financial trap. Payday loans are structured to encourage repeat borrowing, where fees compound rapidly and repayment becomes nearly impossible. Here’s a common payday loan sequence:

- Borrow $300 due in 2 weeks.

- Pay a $45 fee, but can’t repay the full amount.

- Roll over the loan and pay another $45.

- After 5 rollovers, the borrower has paid $225, 75% of the original principal, but still owes the full $300.

Many borrowers remain in debt for months or years. The CFPB found some individuals stuck in payday loan cycles for over 1,000 days.

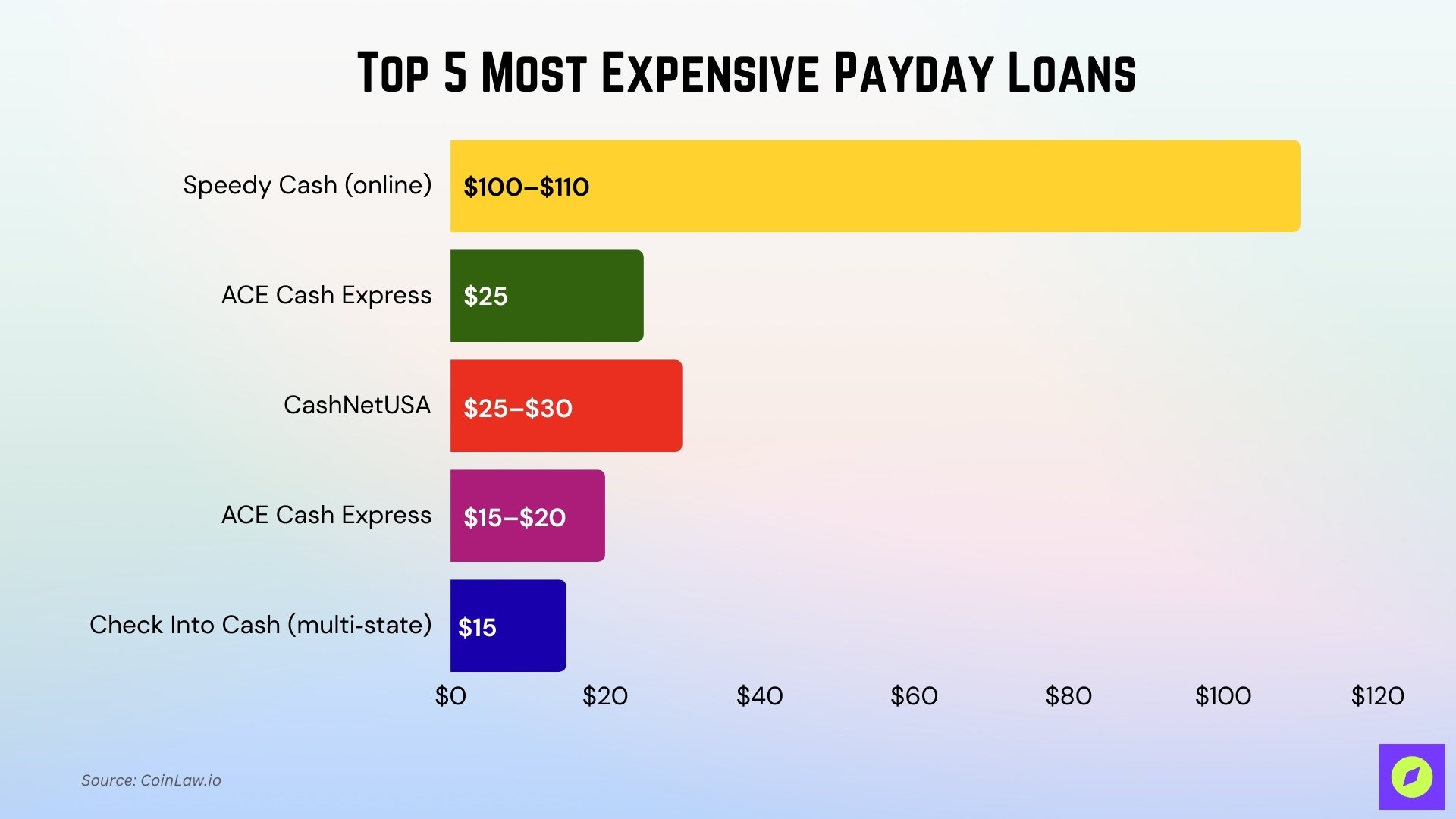

Top 5 Most Expensive Payday Loans

Some payday lenders charge sky-high fees that turn small-dollar loans into multi-hundred-dollar liabilities. This ranking highlights the worst offenders, based on average cost, APR, and borrower risk exposure.

| Rank | Lender | Average Fee per $100 | Estimated APR | Where They Operate | Why It’s Expensive |

| 1 | Speedy Cash (online) | $100–$110 | 651.79% | Online in 29+ states | Extremely high flat fees on short terms, especially online. |

| 2 | ACE Cash Express | $25 | 661.69% | TX, ID, other CSO-permissive states | Credit Access Business (CAB) fees plus interest and doc fees. |

| 3 | CashNetUSA | $25–$30 | 600% | Online in multiple states | Combined high fees, CAB structure, and interest charges. |

| 4 | ACE Cash Express | $15–$20 | 524.11% | Select storefront states (e.g., LA) | Moderate fees but inflated APR due to short terms and extra charges. |

| 5 | Check Into Cash | $15 | 391.07% | Multi-state storefronts | The standard $15 fee becomes expensive due to brief repayment windows. |

1. Speedy Cash (online)

A popular online and storefront lender known for exceptionally high APRs that can begin at several hundred percent. Borrowers often face steep fees for small advance amounts, making it one of the costliest mainstream options.

- Average Fee per $100: $100–$110 (derived from the 651.79% APR in Louisiana examples).

- Estimated APR: 651.79% (based on example fee/payment structure).

- Where They Operate: Nationwide via online services; physical presence in 29 states.

- Why It’s Expensive: High flat fees combined with short repayment terms inflate the APR dramatically, especially in regions without caps.

2. ACE Cash Express

A nationwide storefront and online lender with fee schedules that translate into some of the highest APRs among traditional short-term lenders. Document fees and access charges further escalate the cost.

- Average Fee per $100: $25; common CSO fee in Texas schedules.

- Estimated APR: 661.69% (as seen in Texas 14-day examples).

- Where They Operate: Over 850 locations across 23 states and online.

- Why It’s Expensive: A high flat service fee (CSO) plus interest and documentation fees produce exorbitant effective APRs.

3. CashNetUSA

An online lender offering installment and cash advance loans with varying terms, but fees and interest levels commonly reach triple digits, making it costly for short-term borrowers.

- Average Fee per $100: $25–$30 per $100 borrowed (aligned with a ~600% APR figure).

- Estimated APR: 600% (estimation based on known high APR patterns).

- Where They Operate: Multiple states via online platform; works as a Credit Access Business (CAB) in states like Texas.

- Why It’s Expensive: High transaction fees bundled with interest create extremely costly short-term borrowing scenarios, and the CAB structure adds extra costs.

4. ACE Cash Express (lower-tier fee structure)

In some states, ACE offers lower fee tiers, but even at reduced rates, the APR remains crushingly high due to the short payoff window and combined fees.

- Average Fee per $100: $15–$20 (as seen in Louisiana schedule examples).

- Estimated APR: 524.11% (based on Louisiana fee tables).

- Where They Operate: Select storefront locations where the fee structure differs (e.g., Louisiana).

- Why It’s Expensive: Even modest flat fees plus documentation charges over short periods translate into extremely high APRs.

5. Check Into Cash (multi‑state)

A wide-reaching payday lender known for repetitive short-term loans with standardized fees that translate into high APRs.

- Average Fee per $100: $15 (consistent fee structure across many states).

- Estimated APR: 391.07% (as documented in state-level fee disclosures).

- Where They Operate: Multiple states with storefront locations; operations vary by state regulation.

- Why It’s Expensive: Moderate flat fees create very high APRs due to brief loan terms and frequent rollovers in borrower cycles.

Safer Alternatives to Payday Loans

If you’re facing a financial emergency, these lower-cost, less predatory alternatives can offer short-term relief without the long-term damage:

- Credit Union Payday Alternative Loans (PALs): Capped at 28% APR with longer terms (up to 6 months) and no balloon payments.

- Employer-Based Advances: Platforms like Earnin, DailyPay, and PayActiv allow workers to access a portion of their earned wages early, with no interest.

- Installment Loans from Community Banks: Many local banks and credit unions now offer small-dollar loans with amortized payments and transparent terms.

- Nonprofit & Community Support: Resources like 211.org, Modest Needs, and local churches or assistance networks offer emergency grants, interest-free loans, or bill pay help.

These options reduce dependency on payday lending and provide more sustainable financial recovery paths.

How to Avoid the Trap

Understanding how payday loans work is the first step toward financial protection. With the right strategies, borrowers can sidestep predatory lenders and make smarter credit decisions.

- Calculate the APR, not just the flat fee. A $15 fee on a $100 loan may sound small, but it’s actually a 391% APR.

- Avoid rollover offers. If you can’t repay, rolling over just adds more fees and deeper debt.

- Know your state’s laws. Some states protect borrowers with free “cooling-off” periods, loan frequency limits, and fee refund policies.

- Use free financial counseling from services like NFCC.org or ConsumerFinance.gov.

Conclusion

Payday loans are marketed as fast solutions, but behind the quick cash lies a predatory cost structure that traps vulnerable borrowers in long-term cycles of debt. With fees reaching $110 per $100 borrowed and APRs regularly topping 600%, even a small loan can lead to massive financial strain.

By understanding the true cost, identifying the most expensive lenders, and exploring regulated, affordable alternatives, borrowers can make smarter decisions and avoid the traps these loans are built to set. Nowadays, financial literacy and regulatory awareness are the most powerful tools to protect yourself from the payday loan debt spiral.