While many hedge funds still tread near the classic “2 and 20” model, a rare and elite class demands far steeper fees and keeps attracting capital. These ultra-premium funds combine restrictive terms, enormous scale, and secretive strategies in exchange for the promise of outsized net returns. We dig into what fuels these high costs, who is charging them, and whether paying the premium still makes sense today.

Key Takeaways

- Top-tier hedge funds command 35%–50% performance fees, often alongside 2–5% management charges.

- Minimum investments frequently start at $10 million–$50 million, with long lock-ups and strict redemption gates.

- Renaissance Technologies’ Medallion Fund remains the costliest hedge fund ever created, though it is closed to outside investors.

- Despite high costs, funds like Citadel, Millennium, and D. E. Shaw attract billions due to consistent, data-driven alpha.

What Makes a Hedge Fund Truly Expensive

Being “expensive” in hedge fund terms goes beyond just high fees; it’s about exclusivity, restrictions, and cost layers that compound investor friction:

- Above-market management fees often exceed 2–3% annually.

- Performance fees are soaring beyond the traditional 20%, reaching 40–50% in rare cases.

- Lock-ups and redemption gates that tie capital for years.

- Operational pass-throughs, such as technology, compliance, and data analytics, are charged directly to investors.

- Limited access, many elite funds are closed, private, or invite-only.

Together, these mechanics make total investor costs dramatically higher than standard benchmarks.

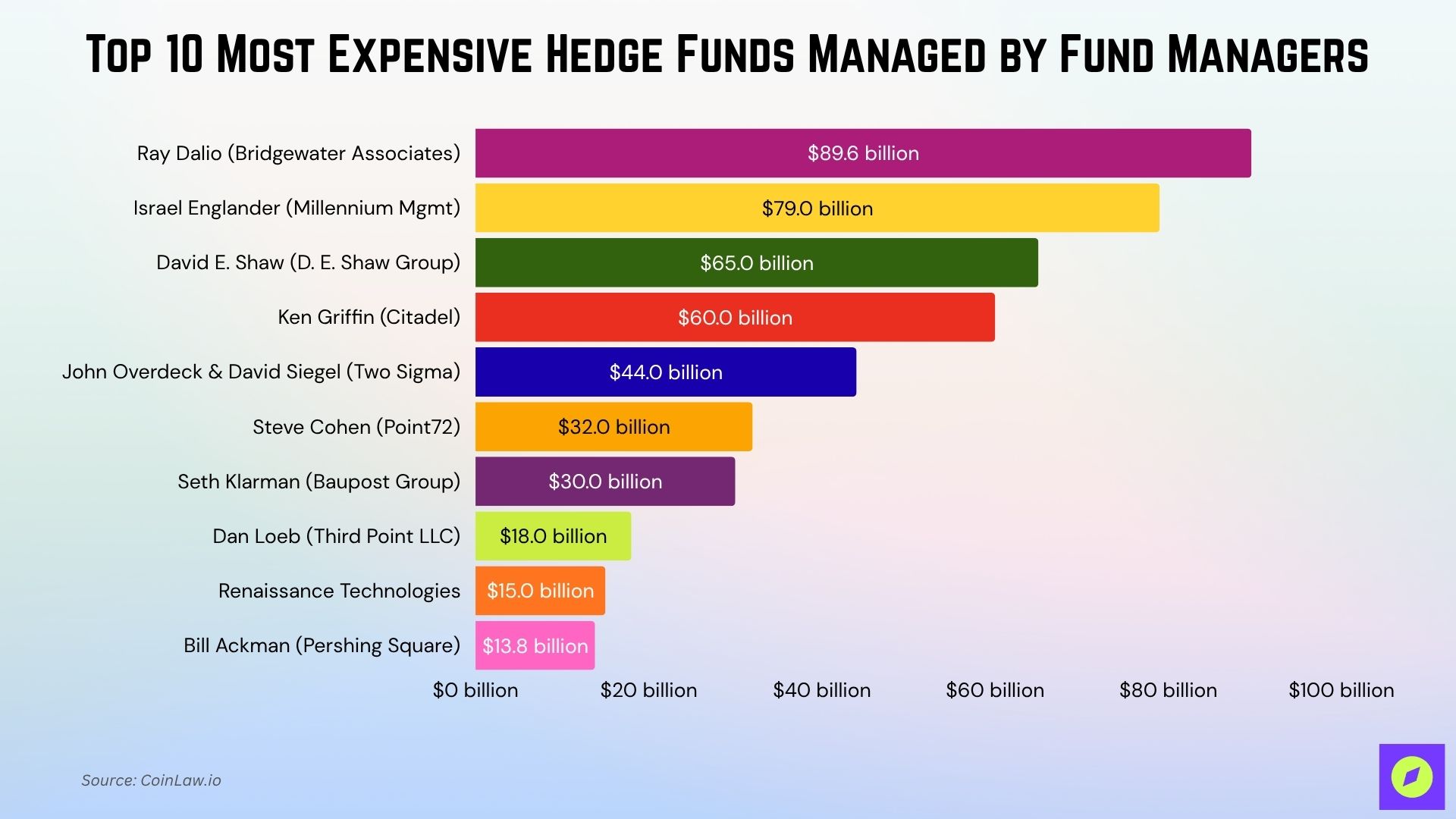

Top 10 Most Expensive Hedge Funds

These hedge funds don’t just charge premium fees; they represent the pinnacle of exclusivity, scale, and strategy in the investment world. From quant giants to macro titans, each commands billions while setting the bar for what ultra-high-net-worth investors will pay for access.

| Fund Name | Manager | AUM | Fee Structure (Est.) | Why It’s Expensive |

| Pure Alpha II | Ray Dalio (Bridgewater Associates) | $89.6 billion | 2% Mgmt + 20% Perf | Institutional macro strategy, legacy brand trust |

| Millennium International | Israel Englander (Millennium Mgmt) | $79 billion | 2.5% Mgmt + 25% Perf | Pod model structure with capital allocation efficiency |

| Composite Fund | David E. Shaw (D. E. Shaw Group) | $65 billion | 3% Mgmt + 30% Perf | Quantitative modeling, low volatility performance |

| Wellington Fund | Ken Griffin (Citadel) | $60 billion | 3% Mgmt + 30% Perf | Multistrategy execution and speed infrastructure |

| Compass Fund | John Overdeck & David Siegel (Two Sigma) | $44 billion | 2.75% Mgmt + 28% Perf | Advanced AI/ML‑driven trading systems |

| Point72 Capital | Steve Cohen (Point72) | $32 billion | 2% Mgmt + 30% Perf | Hybrid long/short with private equity exposure |

| Baupost Group Fund | Seth Klarman (Baupost Group) | $30 billion | 2% Mgmt + 20% Perf | Deep value and distressed investments |

| Third Point Ultra | Dan Loeb (Third Point LLC) | $18 billion | 2.25% Mgmt + 25% Perf | Event‑driven activism and deep research |

| Medallion Fund | Renaissance Technologies | $15 billion | 5% Mgmt + 44% Perf | Legendary quant edge, closed to outsiders |

| Pershing Square Holdings | Bill Ackman (Pershing Square) | $13.8 billion | 1.5% Mgmt + 16% Perf | Concentrated activist bets via a listed structure |

1. Ray Dalio (Bridgewater Associates)

A pioneer of macro investing, Dalio’s philosophies about risk parity and economic cycles have influenced generations of fund managers. His Pure Alpha strategy seeks positive returns across market conditions by balancing exposures globally.

- Fund Name: Pure Alpha II

- AUM: $89.6 billion

- Fee Structure (Est.): 2% management + 20% performance

- Why It’s Expensive: It commands premium pricing for its macro insights, extensive research infrastructure, and brand prestige as a foundational macro house

2. Israel Englander (Millennium Management)

Englander steered Millennium into becoming one of the most prolific multi‑strategy funds, employing hundreds of “pods” that each manage distinct bets under central risk oversight. Its adaptability allows rapid reallocation to trending strategies.

- Fund Name: Millennium International

- AUM: $79 billion

- Fee Structure (Est.): 2.5% management + 25% performance

- Why It’s Expensive: The pod structure demands tight oversight, robust infrastructure, and substantial capital for risk controls

3. David E. Shaw (D. E. Shaw Group)

Shaw’s firm is one of the most secretive quant shops, blending finance, mathematics, and computing in proprietary models that few outsiders fully understand. It maintains a highly technical edge across multiple asset classes.

- Fund Name: Composite Fund

- AUM: $65 billion

- Fee Structure (Est.): 3% management + 30% performance

- Why It’s Expensive: The cost reflects deep investment in research, technology, and the rare talent needed to sustain a quant advantage

4. Ken Griffin (Citadel)

Griffin built Citadel into a powerhouse through aggressive execution and capital deployment across credit, equities, and systematic strategies. His firm is known for punishing execution standards and rapid adaptation to market shifts.

- Fund Name: Wellington Fund

- AUM: $60 billion

- Fee Structure (Est.): 3% management + 30% performance

- Why It’s Expensive: The fund underwrites top-tier infrastructure, fast trading systems, and elite talent, all built for scale

5. John Overdeck & David Siegel (Two Sigma)

Overdeck and Siegel’s Two Sigma is a trailblazer in algorithmic and machine‑learning investing, continuously incorporating new data sources and AI techniques into trading models. They emphasize scalability and probabilistic forecasting.

- Fund Name: Compass Fund

- AUM: $44 billion

- Fee Structure (Est.): 2.75% management + 28% performance

- Why It’s Expensive: High fees support cutting-edge AI/ML development, data acquisition, and model upkeep

6. Steve Cohen (Point72 / formerly SAC)

Cohen’s legacy as a stock-picking legend carries weight in his new vehicle, where concentrated equity bets combine with discretionary macro and private deals. His teams pursue high-conviction ideas, often with deep fundamental research.

- Fund Name: Point72 Capital

- AUM: $32 billion

- Fee Structure (Est.): 2% management + 30% performance

- Why It’s Expensive: It demands high-quality research, deal sourcing, and operational flexibility to support concentrated bets

7. Seth Klarman (Baupost‑style / value investing)

Klarman is a value investor’s investor, focusing on distressed opportunities, deep-value securities, and asymmetric risk-reward plays. His approach is patient, defensive, and deeply analytical.

- Fund Name: Baupost Group Fund

- AUM: $30 billion

- Fee Structure (Est.): 2% management + 20% performance

- Why It’s Expensive: The premium supports thorough due diligence, legal structuring, and active credit / distressed strategy deployment

8. Dan Loeb (Third Point)

Loeb is best known as an activist investor, taking concentrated stakes and pushing for corporate change. His funds often combine event-driven, merger arbitrage, and tactical equity strategies.

- Fund Name: Third Point Ultra

- AUM: $18 billion

- Fee Structure (Est.): 2.25% management + 25% performance

- Why It’s Expensive: The cost covers intensive research, proxy battles, and activist campaign execution

9. Medallion (Renaissance Technologies)

Though closed to most external investors, Medallion remains legendary in quant circles, known for relentless iteration, ultra-short timescales, and secrecy. Its returns are among the few that regularly beat its high fees.

- Fund Name: Medallion Fund

- AUM: $15 billion

- Fee Structure (Est.): 5% management + 44% performance

- Why It’s Expensive: It demands the highest continued investment in data, signals, infrastructure, and rare quant talent

10. Bill Ackman (Pershing Square Holdings)

Ackman’s fund is structured as a public vehicle, but operates with activist conviction in concentrated equity positions. He emphasizes transparency and accountability, even in a high-fee context.

- Fund Name: Pershing Square Holdings

- AUM: $13.8 billion

- Fee Structure (Est.): 1.5% management + 16% performance

- Why It’s Expensive: The premium reflects activist campaign costs, deep research, and public‑vehicle infrastructure

What’s Next? (The High‑Fee Hedge Fund Landscape)

The hedge fund fee model is evolving as investors push for transparency and value, while firms defend high pricing through innovation and specialization. In this shifting landscape, only the most adaptable and high-performing managers will justify their premium price tags.

- Fee compression intensifies & structural pressure grows: Many firms are already experimenting with fee concessions, such as implementing “cash hurdle” models (where performance fees apply only above a risk-free benchmark) or introducing new share classes with lower fees.

- Pass‑through cost models become more common: Over 80 percent of multi‑manager hedge funds now embed pass-through expense models, meaning investors bear direct infrastructure, data, and personnel costs, making true cost transparency a must.

- Regulation, scrutiny, and the family office shift: Some hedge fund principals are converting to family offices to escape external pressure, reporting mandates, and investor expectations.

- Alpha gets harder; replication and alternatives advance: As quant and systematic strategies saturate, more investors will lean on hedge fund replication, liquid alternatives, or hybrid models that deliver parts of the return profile at lower cost.

- Technology & AI will alter cost dynamics: Funds that can automate operations, risk, data pipelines, and strategy testing via AI will have a competitive edge. The ability to scale innovation may help justify premium pricing only if performance sustains.

How Investors Should Navigate the High‑Fee Landscape

Allocating to expensive hedge funds requires more than capital; it demands selectivity, risk awareness, and sharp cost-benefit analysis. With alternatives expanding and fee structures shifting, strategic due diligence is essential to avoid overpaying for underperformance.

- Demand full transparency: Insist on line-by-line expense reporting (tech, data, personnel) beyond headline fees.

- Stress-test net returns: Model downside and volatility scenarios, not just average returns.

- Prefer performance‑based structures with hurdles: These help ensure the manager only earns when value exceeds risk premiums.

- Diversify fee tiers: Mix premium, mid-tier, and “cheap beta + smart beta” exposures to balance cost vs upside.

- Don’t chase names blindly: Even among elite funds, access might be closed, and past performance is no guarantee.

- Watch for secular shifts: Be ready to tilt allocations if more funds move to family office status, lower fees, or new vehicles.

Frequently Asked Questions (FAQs)

They have charged $1.8 trillion in fees cumulatively from 1969 to December 2024.

The minimum was $375 million.

Fees have captured about 49 % of gross investment gains over time.

On average, pass‑through costs amount to 6.5 % of AUM, with some reaching the high teens.

Conclusion

In the rarefied world of ultra-premium hedge funds, high fees are not a bug; they’re a feature. These funds promise alpha, exclusivity, and elite infrastructure, but the price of entry is steep and often opaque. For some investors, especially institutions and family offices, the prestige and potential outperformance justify the cost. For others, the fee drag may erode long-term value, especially in an era where low-cost alternatives are gaining traction.

Ultimately, navigating this space requires more than capital; it demands clarity, discipline, and a deep understanding of what you’re really paying for.