In today’s volatile lending environment, a single loan misstep can quietly drain thousands from your bottom line or cripple your growth trajectory altogether. From hidden prepayment clauses to poorly structured repayment terms, many business owners unknowingly lock themselves into high-cost obligations that limit flexibility and cash flow.

This guide reveals the most financially damaging loan mistakes, real-world cost breakdowns, and exactly how to avoid them before they sabotage your next funding round.

Key Takeaways

- Prepayment penalties can cost $4,000–$9,000, wiping out any savings from early repayment or refinancing.

- Overborrowing by just $40,000 can result in $4,400+ in wasted interest, with no return on that capital.

- A simple mismatch between loan duration and business need can inflate interest costs by $6,000–$9,000.

- Factor rate loans often carry 30%+ effective APRs, disguised as flat repayment deals.

- Submitting multiple hard inquiries for business loans in a short time frame may lower your credit score by 5–15 points.

- Balloon payment structures can lead to $30,000–$50,000 surprise end-of-loan bills, forcing high-cost refinancing or default.

The Do’s and Don’ts That Make or Break Your Business Loan

Getting a business loan approved is only half the battle; what truly matters is how you structure, time, and manage that funding. Avoiding costly mistakes starts with mastering the fundamentals of smart borrowing behavior.

✅ The Do’s

- Compare Multiple Offers: Always get quotes from at least three lenders to secure the best rates and terms.

- Know Your Credit Score: Monitor both personal and business credit; a higher score means lower interest and better approval odds.

- Match Loan Type to Business Need: Use short-term loans for operational gaps and long-term loans for assets with lasting ROI.

- Prepare Full Documentation Ahead of Time: Have tax returns, financials, and cash flow projections ready to show credibility and improve approval speed.

- Read the Entire Loan Agreement: Understand APR, repayment frequency, penalties, and all fees before signing anything.

❌ The Don’ts

- Don’t Borrow More Than You Need: Every extra dollar costs interest; don’t pay for idle capital that doesn’t work for your business.

- Don’t Apply to Multiple Lenders at Once: Too many hard inquiries can lower your credit score and hurt your loan terms.

- Don’t Ignore Repayment Structure: Daily or weekly debits can drain cash flow; know exactly how and when payments are collected.

- Don’t Overlook Prepayment Penalties: These hidden fees can turn refinancing into a losing move.

- Don’t Accept Balloon Payments Lightly: Low monthly payments now may lead to a massive lump-sum crisis later.

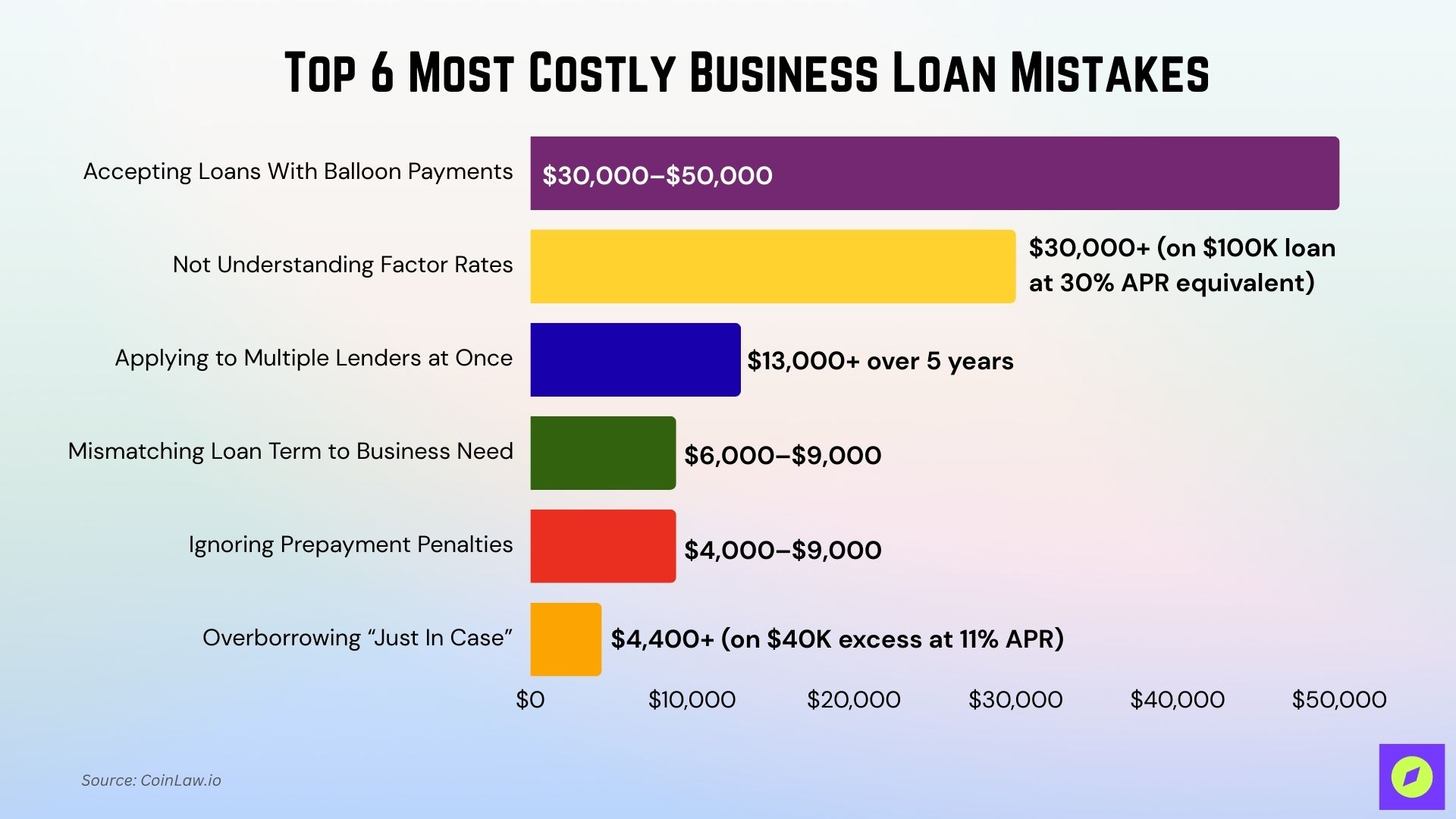

Top 6 Most Costly Business Loan Mistakes

Some business loan mistakes don’t just hurt; they compound over time, draining cash flow, damaging credit, and limiting future borrowing power. These are the most financially dangerous missteps business owners make, complete with real-world cost breakdowns and how to avoid them before they spiral out of control.

| Mistake | Estimated Cost | Why It’s Expensive |

| Accepting Loans With Balloon Payments | $30,000–$50,000 | A huge lump sum at term-end often forces costly refinancing or emergency cash. |

| Not Understanding Factor Rates | $30,000+ (on $100K loan at 30% APR equivalent) | Flat-fee loans hide high interest, draining cash flow with daily/weekly deductions. |

| Applying to Multiple Lenders at Once | $13,000+ over 5 years | A credit score drop raises APR or causes rejection from top-tier lenders. |

| Mismatching Loan Term to Business Need | $6,000–$9,000 | Leads to years of unnecessary repayments for short-term initiatives. |

| Ignoring Prepayment Penalties | $4,000–$9,000 | Cancels out savings from early repayment or refinancing due to hidden penalty clauses. |

| Overborrowing “Just In Case” | $4,400+ (on $40K excess at 11% APR) | Idle capital accrues interest without contributing to revenue or ROI. |

1. Accepting Loans With Final Balloon Payments

Balloon loans come with low monthly payments until the final “balloon” hits. Many businesses aren’t prepared for this lump-sum shock.

- Cost: A $100,000 loan with a $30,000–$50,000 balloon payment at the end.

- Why It’s Expensive: Unless you have guaranteed revenue or cash reserves, these loans can corner you into emergency refinancing. That leads to additional fees, higher rates, or worse, default, which wrecks your credit and borrowing ability.

2. Not Understanding Factor Rates vs. APR

Some lenders offer “easy-to-understand” flat fees through factor rates, but the real cost is anything but simple. A flat repayment hides interest rates that can exceed 30%.

- Cost: $30,000+ (on $100K loan at 30% APR equivalent)

- Why It’s Expensive: Factor rates charge the full borrowing cost upfront, regardless of when you repay. These loans often come with daily ACH debits that drain liquidity, limit flexibility, and increase the risk of overdraft or payroll shortfalls.

3. Applying to Multiple Lenders at Once

Submitting multiple loan applications in a short period can significantly lower your credit score. Lenders see this as a red flag, assuming you’re credit-hungry or high-risk.

- Cost: Credit score drop of 5–15 points = $13,000+ in added interest on a $150K loan over 5 years.

- Why It’s Expensive: A small drop in credit score can push you into a higher APR tier, meaning thousands more in interest over the life of the loan. Worse, you may be rejected by prime lenders and end up with costlier, risk-based options.

4. Mismatching Loan Term to Business Need

Using a 5–7 year loan to fund a short-term project creates long-term debt for something already finished. That means years of paying for something that may no longer generate value.

- Cost: A 7-year loan for a 6-month campaign adds $6,000–$9,000 in unnecessary interest.

- Why It’s Expensive: You’re committing long-term capital to short-lived results. That mismatch locks up your borrowing power, inflates repayment cost, and restricts your ability to pivot financially in the future.

5. Ignoring Prepayment Penalties

Paying off a business loan early may feel smart, but many lenders charge hefty penalties for doing so. Without realizing it, you could erase thousands in expected savings.

- Cost: A 4% penalty on a $100,000 payoff = $4,000 lost.

- Why It’s Expensive: These penalties are designed to protect the lender’s profit, not your bottom line. If you refinance or repay early without reviewing the fine print, you could owe nearly the same as if you stayed locked into your original, higher-interest loan, losing your refinancing advantage entirely.

6. Overborrowing “Just In Case”

Many owners take more than they need to “play it safe,” but unused capital still racks up interest daily. You’ll pay more for money that’s not even working for you.

- Cost: Borrowing $100K instead of $60K at 11% APR = $4,400 in excess interest over 2 years.

- Why It’s Expensive: Extra funds add no value if they sit idle. Instead, they reduce cash flow flexibility, inflate monthly payments, and limit your ability to qualify for future credit due to higher debt-to-income ratios.

How to Avoid These Business Loan Mistakes

Avoiding costly loan mistakes isn’t about being perfect; it’s about being prepared, intentional, and informed. These simple actions can save you thousands in interest, fees, and financial stress down the line.

- Get Prequalified Instead of Applying Blindly: Use soft-credit prequalification tools to explore options without hurting your score.

- Always Compare Total Cost, Not Just the APR: Review the total repayment amount, fees, prepayment terms, and repayment frequency.

- Build a Cash Flow Forecast Before You Borrow: Know when the loan payments will hit, and if your business can sustain them monthly, weekly, or even daily.

- Ask Every Lender About Penalties and Traps: Specifically request details about prepayment penalties, balloon payments, and factor rates.

- Match Loan Structure to Use Case: Short-term needs = lines of credit. Long-term investments = term loans. Don’t mix them.

- Get Professional Help Before Signing: Have a CPA or small business attorney review the agreement, $300–$600 here can prevent $10,000+ in regret.

Final Takeaways

Securing a business loan isn’t just about getting approved; it’s about getting the right loan on the right terms for your cash flow, goals, and long-term stability. A few overlooked clauses or mismatched decisions can quietly cost $5,000 to $50,000 over a loan’s lifetime.

Before signing anything, slow down, read every clause, and ask: “Is this helping or hurting my business six months from now?”

That single question could save you more than any low APR ever will.