The global movement of millionaires is reaching new heights, with many individuals relocating worldwide. For example, a tech entrepreneur leaving one country and taking capital to a new hub can reshape local real estate, while a family relocating for favorable tax conditions can influence education and service demand in the destination. Across private banking and investment migration sectors, this trend is already affecting where capital and talent flow. Let’s dive into the data and explore how this is playing out in real terms.

Editor’s Choice

- A projected 142,000 millionaires will relocate globally in 2025, up from around 134,000 in 2024.

- The Henley & Partners “Country Wealth Flows 2025” report estimates the United Arab Emirates (UAE) will attract 9,800 net new millionaires in 2025.

- The same report projects about $63 billion in investable wealth flowing into the UAE in 2025.

- The United Kingdom is forecast to have a net loss of approximately 16,500 millionaires in 2025.

- The trend of wealth mobility is increasingly driven by tax policy, lifestyle factors, and global business conditions.

- While mobility is increasing, critics note these shifts still represent less than 1% of the total millionaire populations.

- Hubs in the Middle East and emerging markets are now growing fastest as destinations for wealthy migrants.

Recent Developments

- In 2025, the worldwide count of millionaires relocating is projected to hit 142,000, setting a new record.

- That contrasts with roughly 134,000 relocations in 2024, suggesting an increase of around 6%, 7%.

- The UAE’s net gain of 9,800 millionaires in 2025 marks one of the largest single‑country increases globally.

- The UAE is expected to receive about $63 billion in investable assets from incoming millionaires this year.

- Less than 0.2% of global millionaires migrate each year.

- The trend is prompting more jurisdictions to review visa, residency, and tax policies aimed at attracting affluent newcomers.

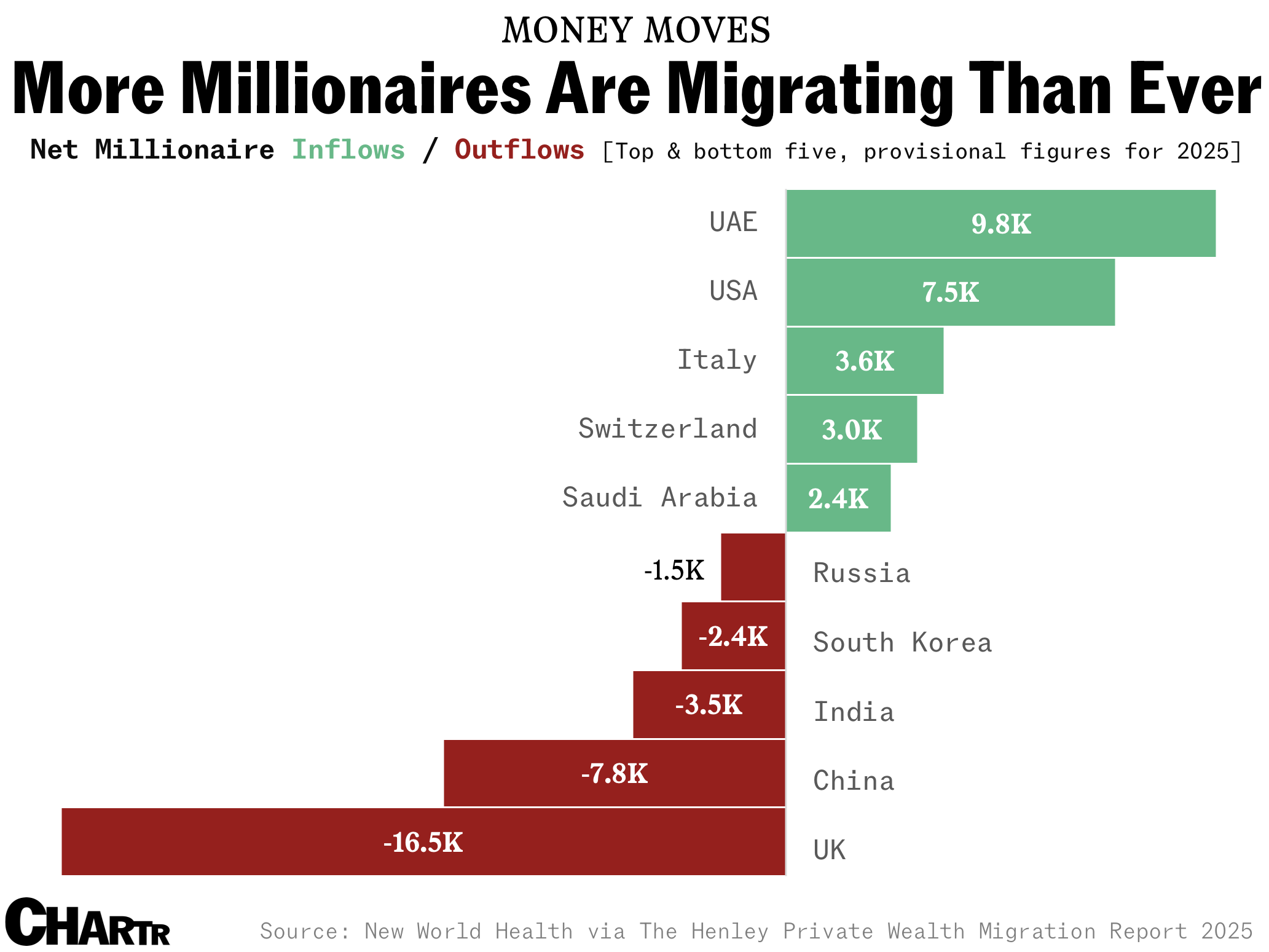

Net Millionaire Inflows and Outflows

- UAE recorded the largest net inflow with 9.8K new millionaires.

- USA followed with a strong inflow of 7.5K high-net-worth individuals.

- Italy attracted 3.6K millionaires, reflecting rising appeal among wealthy migrants.

- Switzerland posted an inflow of 3.0K, driven by stability and tax advantages.

- Saudi Arabia saw a positive gain of 2.4K millionaire arrivals.

- South Korea experienced a small net outflow of 1.5K millionaires.

- Russia lost 2.4K millionaires as geopolitical risks increased departures.

- India recorded a net outflow of 3.5K, continuing its multi-year trend.

- China saw a significant outflow of 7.8K millionaires leaving the country.

- UK faced the largest loss with a net outflow of 16.5K, driven by tax and political uncertainty.

Global Millionaire Migration Overview

- Global millionaires’ relocation is set to reach 142,000 in 2025.

- In comparison, the total number of millionaires worldwide is tens of millions, so migration remains a small fraction of the overall figure.

- Estimated investment wealth moving into destination countries in 2025 includes the $63 billion into the UAE.

- Migration tends to concentrate among individuals with liquid investable wealth, not all millionaires in the broad sense.

- Wealth movement flows are increasingly being tracked as a metric of global business climate and tax competitiveness.

Fastest Growing Millionaire Hubs

- Montenegro achieved approximately 124% growth in its millionaire population between 2014 and 2024.

- The UAE saw roughly 98% growth in millionaires over the same decade.

- In the US, cities like Scottsdale (Arizona) observed millionaire growth of ~102% and Austin (Texas) ~110% from 2013‑2023.

- The tech hubs Shenzhen and Hangzhou in China recorded growth of over ~140% in certain wealth metrics over the past decade.

- The UAE added approximately 13,000 new dollar‑millionaires in 2024, about one in every 30 adults.

- Such hubs benefit from infrastructure, tax regimes, and policies designed to attract high‑net‑worth residents.

- Emerging destinations in Eastern Europe and the Middle East are shortening the advantage gap with traditional Western hubs.

Top Wealth Migration Destinations

- UAE leads the world with a massive inflow of 9,800 millionaires.

- U.S. attracts 7,500 wealthy individuals, remaining a dominant destination.

- Italy brings in 3,600 millionaires due to lifestyle, investment, and tax incentives.

- Switzerland gains 3,000 newcomers seeking stability and financial security.

- Saudi Arabia records 2,400 high-net-worth arrivals driven by economic reforms.

- Singapore welcomes 1,600 millionaires, reflecting its strong position as a financial hub.

- Portugal continues its appeal with 1,400 new millionaire migrants.

- Greece attracts 1,200 wealthy individuals, boosted by residency and tax programs.

- Canada sees an inflow of 1,000 millionaires, maintaining steady demand.

- Australia also gains 1,000 millionaire migrants seeking safety and quality of life.

Major Drivers of Millionaire Migration

- In 2025, 142,000 millionaires are projected to relocate globally.

- Residence or citizenship-by-investment programs globally facilitate migration for over 50,000 individuals annually.

- Political stability ranks as a top factor, with millionaires favoring countries with predictable legal regimes.

- 15% of relocating millionaires are entrepreneurs creating new business opportunities in destination countries.

- Quality-of-life factors like healthcare and education influence over 40% of wealthy migrants’ destination choice.

Tax Policy and Migration Push Factors

- A 2025 study shows super-rich individuals have a moderate sensitivity to tax changes influencing migration decisions.

- The UAE attracted about 6,700 new millionaire residents in 2025 with a zero personal income tax policy.

- Capital gains and inheritance tax rates up to 40% in the UK drive wealthy individuals to relocate abroad.

- Massachusetts saw a 38.6% increase in millionaire residents despite introducing a new surtax, showing that tax is not the only factor.

- Over 53% of UK millionaires would consider relocating if a wealth tax is imposed, reflecting tax-driven migration risks.

- Around 4,000 UK company directors left for countries like the UAE and Italy after the 2025 tax reform, a 40% departure increase from prior years.

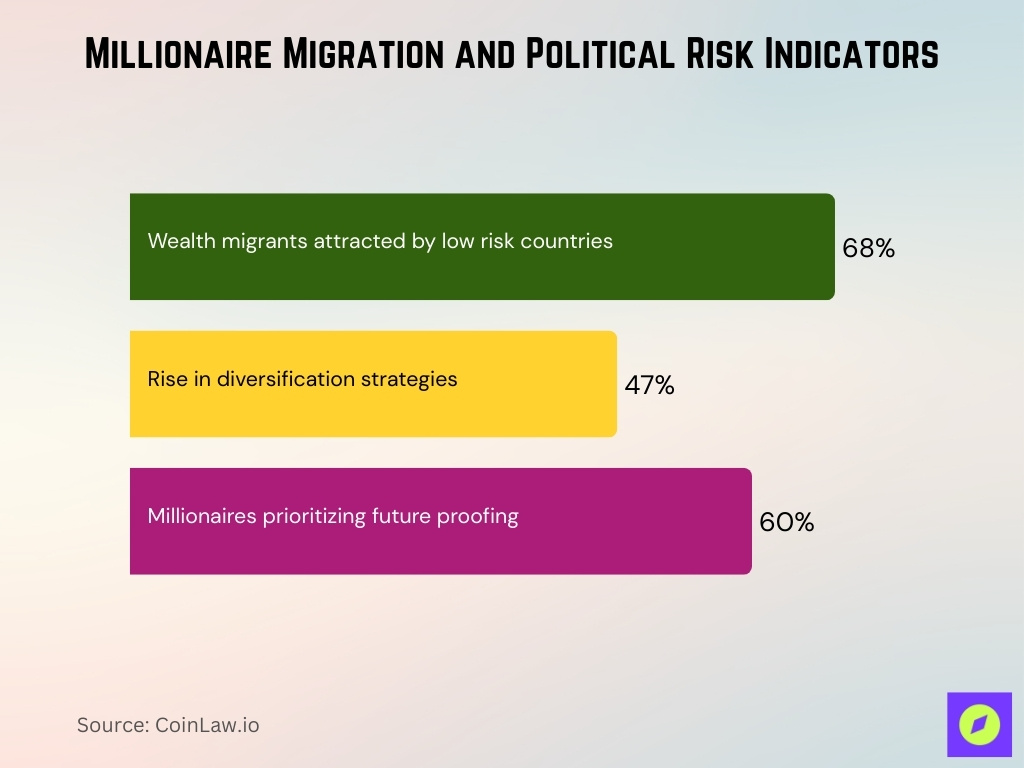

Political Stability and Migration Trends

- Countries with low political risk attract 68% more wealth migrants than unstable ones.

- Global geopolitical tensions increased millionaire migration diversification strategies by 47% in 2025.

- Millionaires increasingly relocate proactively, with 60% considering future-proofing their wealth in location decisions.

- The UAE’s stable governance contributed to attracting over 20,000 millionaires between 2023 and 2025.

- Millionaire migration numbers reached a historic high of 142,000 in 2025, reflecting geopolitical instability factors.

- Destinations combining political stability, low bureaucracy, and clear visa pathways rank in the top 5 for wealth inflows.

- Wealth migration patterns act as early warnings of economic or political stress in affected nations.

Popular Residence and Citizenship Programs

- The 2025 Henley & Partners report analyzed 40 investment-migration programs, including 14 citizenship and 26 residence programs.

- Malta ranked first in the 2025 Global Citizenship Program Index with a score of 76/100, its 10th consecutive year at the top.

- Greece topped the 2025 Global Residence Program Index for the first time, scoring 73/100, surpassing Portugal.

- The UAE and the Maldives received perfect 10/10 tax scores in the Residence-by-Investment index.

- Around 30% of high-net-worth individuals use investment migration programs for relocation.

- IMF research highlights risks such as disproportionate capital inflows and real estate price inflation linked to these programs.

- Smaller states, like Malta, leverage programs for EU access, while Gulf states emphasize tax-free regimes.

- Portugal’s Golden Visa backlog is extending processing times, pushing decisions as late as 2030.

- The total number of millionaires expected to relocate using programs reached over 142,000 globally in 2025.

Lifestyle and Quality of Life Motivations

- 68% of millionaires cite lifestyle factors like climate and safety as key migration motivations.

- Jurisdictions with world-class education attract over 40% of migrating wealthy families.

- Quality-of-life rankings influence 53% of millionaire residency decisions globally.

- 60% of migrating millionaires seek a balance of lifestyle and business opportunities.

- Access to elite healthcare and international schools motivates 45% of millionaire relocations.

- Millionaires with secured tax and business stability prioritize lifestyle improvements by 55%.

- Cities with high congestion prompt a 22% increase in millionaires relocating to lower-density areas.

- Luxury real estate markets grew by 12% in millionaire-favored cities in 2025.

Investment Migration: Golden Visa Trends

- The global investment migration market size was about $30 billion in 2025, growing at 12% annually.

- Real estate investment linked to migration programs often requires minimum purchases of €250,000 to over €2 million, depending on location.

- Entry costs for Golden Visa programs range from $500k property investments to over $2 million for business investments.

- Due diligence processes remain a concern, with some programs criticized for insufficient checks, risking tax planning abuse.

- Malta’s updated citizenship model emphasizes innovators, founders, and cultural leaders over pure capital investment.

- Fastest-growing source markets for Golden Visa migration include the United States, India, and Russia.

- Regulatory scrutiny and housing market pushback are increasing in some high-inflow Golden Visa countries.

Economic Benefits for Destination Countries

- Wealthy migrants create local jobs by establishing family offices and relocating headquarters, boosting private banking and legal sectors.

- Millionaires invest in high-value property, increasing property tax revenues and stimulating luxury construction markets.

- New arrivals bring “debt-free capital,” injecting funds directly into local economies without public borrowing.

- RCBI programs boost local entrepreneurship, with up to 25% of luxury tourism growth linked to migrant spending.

Frequently Asked Questions (FAQs)

Approximately 142,000 millionaires are projected to relocate internationally in 2025.

Migrating millionaires represent about 0.2% of the global millionaire population in 2025.

Americans account for over 30% of all investment‑migration programme applications processed so far in 2025.

Conclusion

The global landscape of affluent mobility is shifting visibly, and with it, the geography of wealth is evolving. From the rapid rise of investment‑migration programs to the bold redistribution of millionaires toward jurisdictions offering tax flexibility, global mobility, and quality of life, this trend is reshaping economies and policies. While destination countries stand to gain through investment, jobs, and global branding, sending nations face the challenge of retaining capital, talent, and economic dynamism. For stakeholders, from policymakers to wealth‑advisors, understanding the mechanisms, implications and data behind millionaire migration is no longer optional.