The cryptocurrency revolution has disrupted traditional finance, but it hasn’t been equal-opportunity. A gender divide persists between people in crypto adoption, touching on ownership rates, investment motivations, and participation in leadership. In the U.S., tech-savvy men often lead the charge, while women encounter barriers ranging from lower financial literacy to cultural exclusion. Real-world examples include the growing number of women-led crypto startups gaining traction and educational platforms aimed at onboarding more female investors. These shifts suggest a changing tide, but there’s still ground to cover. This article explores the gender dynamics in crypto adoption, offering detailed data and insights.

Editor’s Choice

- Women represent only 26% of global cryptocurrency investors.

- Surveys indicate that a significant number of women, up to 60% in some cases, have reported experiences of bias or exclusion in crypto-related communities, although this varies by context and study.

- Men are three times more likely than women to own NFTs.

- Crypto ownership among women grew 16% year-over-year globally.

- Only 6% of crypto CEOs are women, while 94% are male.

- Women receive just 10% of crypto startup funding.

- 63% of Americans express low confidence in crypto’s safety and reliability.

Recent Developments

- As of 2025, women account for 26% of global crypto investors.

- Crypto ownership by women in Africa rose by 20% in the past year.

- 84% of surveyed women increased their crypto holdings in 2024.

- 500 women gathered at Bitcoin 2025’s Women’s Brunch to promote female leadership.

- The Unstoppable WoW3 initiative aims to onboard 6 million African women into Web3 by 2030.

- Global search interest for “women in crypto” grew by 40% year-over-year.

- NFT platforms are increasingly highlighting female creators and collectors.

- Educational platforms such as Crypto Chicks and SheFi have expanded by 150% in member count over the past two years.

- Female-led crypto events are drawing record attendance across the U.S. and Europe.

- Women-centric blockchain incubators launched in Asia and South America in 2025.

Global Gender Gap in Cryptocurrency Ownership

- Globally, 74% of cryptocurrency investors are men, leaving 26% women.

- In the U.S., 19% of men own crypto compared to 8% of women.

- The gender gap in crypto ownership is widest in North America and Europe.

- In Asia, women represent approximately 31% of crypto holders.

- African women are showing the fastest growth in crypto adoption.

- Gender disparity is often linked to differences in income, education, and access to technology.

- Surveys show that women are more likely to hold crypto indirectly, such as through financial advisors.

- Female crypto ownership is higher among Millennials and Gen Z.

- Women in emerging markets report higher interest in using crypto for remittances.

- Studies suggest that countries with strong fintech infrastructure, financial literacy initiatives, and mobile-first ecosystems tend to have higher rates of female crypto ownership.

Crypto Adoption Rates by Gender

- Estimates vary, but one report notes that approximately 32.6% of surveyed women globally reported holding crypto assets, compared to over 50% of men; figures differ depending on sample and geography.

- Men are more likely to make multiple crypto purchases per month.

- Women tend to hold assets longer, while men are more active traders.

- Among U.S. investors, 64% of male crypto holders are under 40; for women, it’s 70%.

- Men are 2x more likely to diversify into altcoins beyond Bitcoin and Ethereum.

- Women prefer mainstream cryptocurrencies and stablecoins for perceived safety.

- Social media plays a stronger role in influencing male adoption patterns.

- Among beginner investors, women cite ease of use and platform reputation as top concerns.

- Men report higher exposure to DeFi tools than women.

- Women adopt crypto at higher rates when introduced via financial education programs.

Regional Differences in Gender Adoption

- In the U.S., women make up about 18% of crypto holders.

- Reports from African crypto platforms suggest that women made up a rising share, approaching 45%, of new crypto adopters in Nigeria in recent years, though comprehensive national data is limited.

- Industry data from Indian exchanges show that women’s crypto activity has increased, with some platforms reporting a 15% year-over-year rise in investment, especially among women aged 25–40.

- Latin American women increasingly use crypto for cross-border transactions.

- Female crypto communities are growing rapidly in the Philippines and Vietnam.

- European women cite regulatory clarity as a major factor in adoption.

- Crypto gender parity is closer in African and Southeast Asian countries than in Western nations.

- Middle Eastern adoption by women remains low due to cultural restrictions.

- Urban areas show narrower gender gaps than rural regions globally.

- Female-led crypto education hubs are influencing higher adoption in Latin America.

Crypto Market Sentiment Expectations

- 83% of current crypto owners believe the market will increase in 2025, showing strong optimism among active investors.

- Only 13% of current owners expect the market to stay the same, and just 3% anticipate a decline.

- Among non-owners, only 56% expect the market to increase, while 31% think it will stay the same, and 13% predict a decline.

- Looking at all informed adults, 67% foresee a market increase, 24% believe it will remain stable, and 9% expect a decline.

- The data suggests a notable optimism gap between current owners and non-owners regarding the future of cryptocurrency.

Age and Gender Demographics in Crypto

- Gen Z women show the highest growth rate in crypto participation.

- Millennial women hold the largest share of female crypto investors.

- Gen X women show slower adoption but higher average holdings.

- Boomers remain underrepresented in crypto regardless of gender.

- Among Gen Z, women prefer NFTs and social tokens over traditional coins.

- Millennial men dominate active trading volumes in crypto markets.

- Gen Z women often learn about crypto via TikTok and YouTube influencers.

- Women aged 25–34 are the fastest-growing demographic in Web3 platforms.

- Baby Boomer men are 3x more likely than Boomer women to own any digital asset.

- Older women express higher trust in regulated crypto exchanges versus decentralized options.

Financial Literacy and Knowledge Gap by Gender

- 60% of women cite lack of crypto knowledge as a barrier to entry.

- Women score lower than men on crypto-related financial literacy quizzes.

- 52% of women say they don’t feel confident making crypto investment decisions.

- Financial literacy training increases crypto participation among women by up to 30%.

- Men are twice as likely to feel “very confident” managing crypto assets.

- Several women-focused crypto education initiatives, such as SheFi and Crypto Chicks, report growth of 100–150% in user participation over the past two years, signaling increased interest and reach.

- Women respond more positively to community-based learning versus solo tutorials.

- Female financial influencers play a key role in closing the knowledge gap.

- Educational content tailored to women has higher engagement rates than general tutorials.

- Schools and universities are beginning to include crypto literacy in women-focused finance courses.

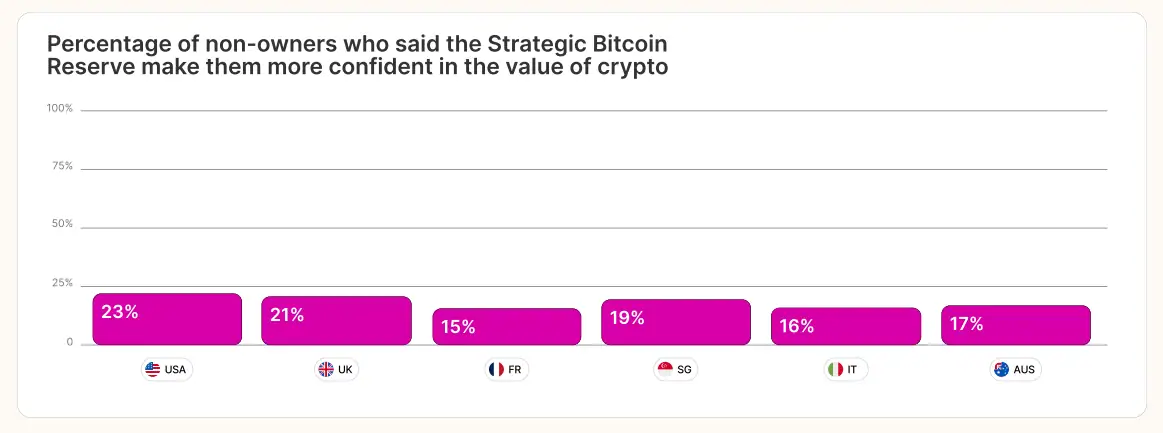

Non-Owners Gaining Crypto Confidence from Strategic Bitcoin Reserve

- 23% of non-owners in the USA say the Strategic Bitcoin Reserve makes them more confident in the value of cryptocurrency.

- In the UK, 21% of non-owners report increased confidence due to the Reserve.

- Only 15% of French non-owners feel more confident in crypto, the lowest among the countries surveyed.

- 19% of non-owners in Singapore say the Reserve boosts their trust in cryptocurrency’s value.

- In Italy, 16% of non-owners say their confidence in crypto increases because of the Reserve.

- 17% of Australian non-owners report feeling more confident in crypto due to the Reserve’s presence.

- Overall, the data shows a modest but meaningful impact of the Strategic Bitcoin Reserve on crypto sentiment among non-investors, particularly in the US and UK.

Investment Amounts: Men vs. Women

- Globally, 74% of cryptocurrency investors are men, leaving 26% women.

- A study estimates that 32.6% of women invest in crypto, compared to a notably higher rate among men.

- In the U.S., households headed by men tend to allocate a larger share of their portfolios to crypto than those headed by women.

- Among women investors, Bitcoin remains the top choice for approximately 76% of them.

- 84% of women in one study say they have increased their crypto investments over the last year.

- Research shows men are more likely to consider crypto among the top-five investment tools, as opposed to women.

- While detailed transaction data is scarce, research suggests women investors tend to invest smaller amounts per trade and adopt longer-term strategies compared to men, who are more frequent traders.

Motivations for Crypto Adoption by Gender

- 52% of women agree that crypto can help them attain financial independence.

- 40% of women report investing in crypto to gain that independence.

- 28% are drawn by high return potential, and around 20% invest to learn or explore the market.

- In addition, younger men are often motivated by risk appetite and speculation, while women emphasize autonomy and learning.

- Growth in female investors is partly driven by the appeal of a decentralized, gatekeeper-free environment.

- Social and peer learning influence women’s decisions; many cite community support as a motivation.

- Men’s motivations skew more toward portfolio performance, diversification, and novelty.

Barriers to Entry for Women in Crypto

- 60% of women report experiencing discrimination or discomfort in crypto spaces.

- 22.9% hesitate to engage due to insufficient understanding or experience.

- Women often feel underestimated or not taken seriously in discussions about crypto.

- Lack of knowledge remains the biggest barrier to crypto investment across genders.

- Women report greater concern about investment security and low income as a barrier, compared to men.

- Limited financial literacy and technological confidence deter many women.

- The dominance of men in crypto communities fosters imposter syndrome and exclusion.

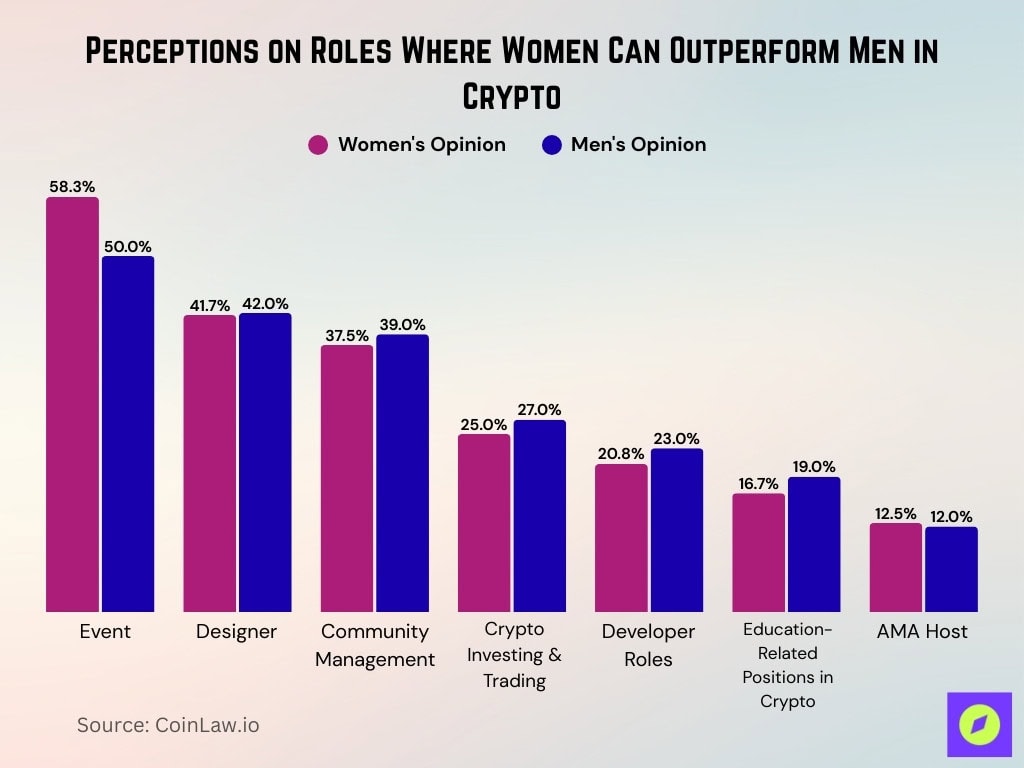

Perceptions on Roles Where Women Can Outperform Men in Crypto

- 58.3% of women and 50% of men believe women can outperform in event roles within the crypto industry.

- 41.7% of women and 42% of men see women excelling as designers in the crypto space.

- In community management, 37.5% of women and 39% of men agree that women can lead effectively.

- For crypto investing and trading, 25% of women and 27% of men think women can outperform men.

- 20.8% of women and 23% of men see potential in women leading developer roles.

- When it comes to education-related positions, 16.7% of women and 19% of men believe women have the edge.

- As AMA (Ask Me Anything) hosts, 12.5% of women and 12% of men say women may do better.

- An additional 4.2% of women noted another unspecified role where women may outperform men.

This data reveals a shared optimism between genders about women’s strengths in various crypto roles, especially in events, design, and community leadership.

Gender Representation in Crypto Professions

- Women make up less than 30% of the crypto workforce in 2025.

- Leadership roles are even more male-dominated, often below that threshold.

- A notable rise in women-led crypto startups and projects exists, but they remain a minority.

- Educational inequalities exacerbate the pipeline gap, especially for STEM education.

- Role models are scarce; this lack of representation impacts recruitment and retention.

- Women in crypto leadership are gaining visibility through platforms like Female Founders on the Block.

Gender and Risk Appetite in Crypto Investment

- Crypto investors tend to be young, male, and more risk-tolerant.

- Barriers among women include concerns about security, education, and income, which reduce risk appetite.

- Men are more discouraged by market volatility and poor ROI, women by low income and perceived insecurity.

- Women’s greater hesitation stems from lower confidence in both financial and technical domains.

- However, women who do enter the space often engage consistently and intentionally, indicating steady confidence growth.

- Overall, women invest strategically (e.g., focusing on Bitcoin), and men are more likely to engage broadly.

Trends in Gender Parity Over Time

- Women’s crypto investment rose 16% year-over-year globally.

- Female investor growth is fastest in Asia and Africa.

- Workforce representation hasn’t kept pace, remains below 30% as of mid-2025.

- More crypto communities and media now highlight female influencers and leaders.

- Educational efforts and female-focused platforms are increasing access and visibility.

- Still, barriers like literacy and discrimination persist; progress is gradual.

Initiatives Promoting Female Participation in Crypto

- Several platforms, such as Female Founders on the Block and Crypto.Chicks, support women-led crypto initiatives.

- Communities like EVE Wealth and Bad Bitch Empire offer mentoring and education.

- Universities and NGOs are working to combat gender bias in tech and digital finance education.

- Female role models are increasingly featured in mainstream crypto media, a visibility boost.

- Some projects aim to offer beginner-friendly content to lower entry barriers.

- Inclusion efforts remain piecemeal; broader institutional commitment is needed.

- Continued expansion of these initiatives promises to narrow the gender gap over time.

Awareness vs. Ownership: Gender Analysis

- In the U.S., nearly 60% of women say they lack awareness of crypto, versus 37% of men.

- Only 8% of women own crypto, compared to almost 20% of men.

- Although most adults have heard of crypto, only 35% say they know something about it, while 60% say they’ve heard of it but don’t know much.

- Crypto familiarity among men aged 18–49 is 59%, but only 24% among women the same age.

- Confusion rises with age, among Millennials it’s 51%, Gen X 60%, Boomers 70%.

- Over 60% of Americans have little to no confidence in crypto’s safety or reliability.

- Among those not interested in crypto, 72% see it as very risky, versus 42% of existing owners.

Influence of Education and Income on Adoption by Gender

- Crypto ownership is higher among college graduates (19%), upper-income Americans (19%), and conservatives (18%).

- Among non-owners, fewer than one-third of women reach high financial literacy, compared to about half of men.

- Even among Bitcoin owners, women report lower understanding and more “don’t know” responses than men.

- Age, gender, income, occupation, and education significantly influence crypto adoption.

- Higher education and income levels correlate with greater understanding and willingness to take perceived risks in crypto.

- Younger, educated women, especially those earning more, are more likely to adopt crypto.

Perceptions and Trust in Crypto by Gender

- Around 63% of Americans lack confidence in crypto’s safety or reliability, and only 5% are very or extremely confident.

- Adoption increases when trust in institutions like the civil service rises, while distrust in political or financial institutions can suppress adoption.

- Women show lower crypto literacy, which may tie into lower trust or confidence, although direct gender-based trust data remain limited.

- Public trust perceptions influence whether people, especially women, view crypto as accessible or intimidating.

- Women often require more validation before investing, reflecting broader trust and risk dynamics.

Cultural Attitudes and Gender Imbalance in Crypto

- Women in crypto face technical gatekeeping, a lack of representation, limited funding access, and societal bias.

- In 2023, women held 26% of crypto jobs, but only 6% of leadership roles, with 94% of CEOs being male.

- Female professionals in the blockchain sector earn significantly less, up to 46% less, than their male counterparts, particularly in executive roles, though newer startups show more equity.

- Cultural norms still position crypto as a male domain, reinforcing exclusion.

- Visibility is rising, such as the Top 50 Women in Web3 & AI lists that highlight female leaders.

- Events like Bitcoin 2025’s Women’s Brunch hosted 500 women to support leadership and networking.

- Initiatives like Unstoppable WoW3 invest in education and Web3 mentorship to counter gender bias.

Women’s Role in Crypto Startups and Leadership

- Female-led startups in the crypto space remain few; just 13% are run by women.

- Women receive only about 10% of funding for crypto startups and earn 46% less than men in similar roles.

- Only 6% of crypto leadership roles are held by women, with 94% of CEOs being male.

- Platforms highlight role models to bring visibility, such as women in Web3 features.

- The Bitcoin 2025 Women’s Brunch gathered 500 women to empower leadership and networking.

- The Unstoppable WoW3 initiative includes a $10M grant and aims to educate six million African women about Web3.

- In the broader tech sector, women hold only 11% of executive roles and 15% of C-suite seats.

Gender Distribution in NFT and DeFi Sectors

- Men are three times as likely as women to collect NFTs.

- NFT collection by hobby or investment includes 15% of men, and only 4% of women.

- Women gain visibility through NFTs, offering creative platforms and funding via inclusive digital art.

- Female creators use NFTs to promote gender equality and build equity.

- DeFi usage shows similar gender imbalances, though precise figures vary.

- Lower female DeFi acceptance and usage rates persist compared to men.

- Research into NFT pricing shows measurable gender-based bias in market valuations.

Future Projections for Gender Balance in Crypto

- Women’s crypto investment grew 16% year-over-year, especially in Asia and Africa.

- As women’s educational attainment and earnings rise, female crypto adoption is likely to follow.

- Continued emphasis on education, mentoring, and inclusive programs may advance gender parity.

- Emerging recognition of women’s leadership signals cultural shifts ahead.

- Inclusive platforms like NFTs and Web3 give women new visibility and ownership tools.

- As financial literacy gaps narrow, women’s crypto confidence and asset-holding may catch up.

- The trend suggests gradual but steady improvement, with gender gaps likely shrinking over the next few years.

Societal Impact of Closing the Gender Gap in Crypto

- More gender-diverse crypto participation could enhance financial inclusion, especially for women globally.

- Greater female involvement brings varied perspectives, improving product design and access.

- Equitable leadership shapes more inclusive governance and community standards.

- Financial empowerment via crypto can reduce economic inequality for women.

- Women’s economic participation strengthens macroeconomic resilience.

- Gender-balanced engagement helps normalize digital finance adoption across households.

- Closing the gap supports socially fair access to emerging financial systems.

Conclusion

The crypto landscape is evolving, and the gender gap is narrowing, albeit slowly. Awareness still lags among women, and adoption trails by both knowledge and confidence. Cultural norms, funding gaps, and leadership imbalances persist. Yet, growth is real, women-led initiatives, NFTs as creative platforms, and expanding educational efforts are broadening access. As education levels rise and more inclusive policies emerge, gender parity in crypto seems increasingly achievable. This snapshot isn’t just about numbers; it’s about opening finance and innovation to everyone and the stronger, fairer future that follows.