In a world where digital transactions are increasingly replacing cash, Mastercard stands as a cornerstone in facilitating secure and seamless payments. With a presence in over 200 countries, Mastercard has consistently driven innovations that connect individuals, businesses, and governments. As we dive into the latest data and trends around Mastercard, this article will explore its financial milestones, market standing, and the impact of its extensive network on the U.S. economy and beyond.

Editor’s Choice: Key Financial Milestones

- Mastercard’s total revenue in 2025 reached $25.1 billion, reflecting a 13.6% increase from the previous year, driven by cross-border growth.

- Net income rose to $11.4 billion in 2025, up 11.8% year-over-year, fueled by strong consumer spending and fintech partnerships.

- Operating margin remained high at 56.2%, reinforcing Mastercard’s efficiency despite rising infrastructure investments.

- Global transactions processed exceeded 121 billion in 2025, showing steady growth in merchant adoption and card usage.

- Total transaction value hit $6.8 trillion in 2025, confirming Mastercard’s role in global digital commerce expansion.

- R&D spending climbed to $1.6 billion in 2025, emphasizing Mastercard’s focus on AI-driven security and tokenization.

- Mastercard’s stock saw a 20.3% year-to-date gain in 2025, outperforming benchmarks amid strong investor confidence and innovation initiatives.

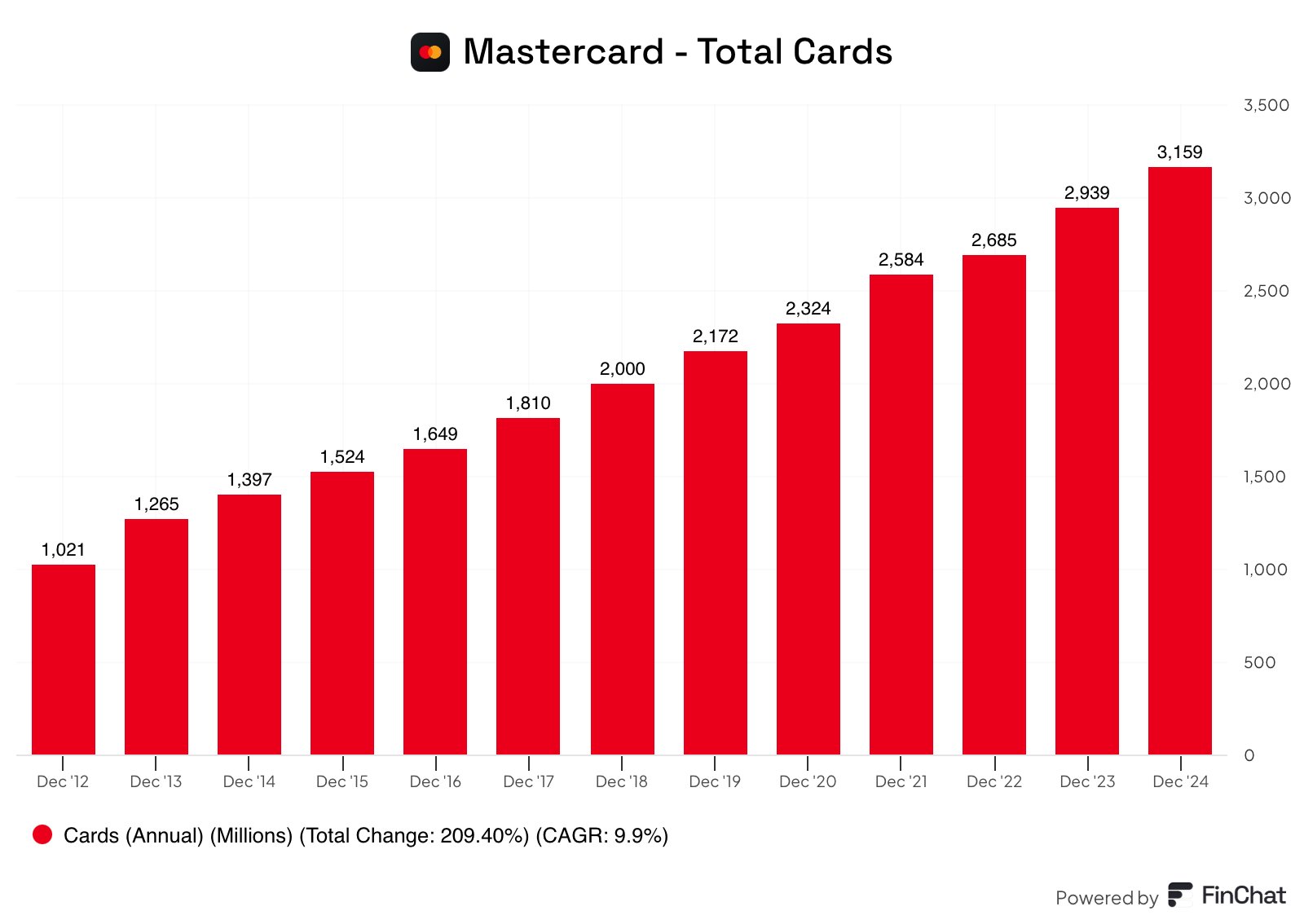

Mastercard Card Growth Highlights

- Mastercard cards grew from 1.02B in 2012 to 3.16B in 2024, marking a 209.4% total increase. This reflects consistent global expansion in card issuance over 12 years.

- The Compound Annual Growth Rate (CAGR) was 9.9%, indicating strong long-term performance. Mastercard maintained steady growth nearly every year without major decline.

- From 2018 to 2024, card volume jumped from 2.00B to 3.16B. That’s a gain of over 1.16 billion cards in just six years.

- The highest annual growth occurred between 2020 and 2021, with an increase from 2.32B to 2.58B. This spike added over 260 million cards in one year.

- Mastercard reached a record high of 3.16B cards in 2024, the highest ever recorded. This continued growth reinforces its dominant global presence in payments.

General Mastercard Statistics

- Total cardholders worldwide surpassed 2.95 billion in 2025, reflecting continued global expansion and financial inclusion efforts.

- Mobile payment transactions rose by 26% in 2025, showing accelerated growth in smartphone-based spending via Mastercard.

- Digital wallet transactions increased by 42% year-over-year in 2025, driven by new partnerships and embedded fintech services.

- Credit card ownership among U.S. adults using Mastercard reached 36.5% in 2025, marking a rise in consumer preference.

- Debit card usage on Mastercard’s network grew by 20.4% in 2025, fueled by adoption across Asia-Pacific and Africa.

- Mastercard held a 36.2% global credit card market share in 2025, maintaining its strong second position behind Visa.

- Average transaction value on Mastercard’s network increased to $56.30 in 2025, influenced by inflation and higher discretionary spending.

Market Share and Competitive Landscape

- Mastercard’s market share in the U.S. credit card market remained strong at 26%, consolidating its position as a leading payment processor.

- Visa and Mastercard collectively dominated 85% of the U.S. credit card market, with Discover and American Express capturing the remaining share.

- In Europe, Mastercard expanded its reach, accounting for 33% of digital transactions, outpacing competitors in digital payment solutions.

- The Asia-Pacific region saw Mastercard’s market share by 29%, largely driven by rising e-commerce trends and digital payment adoption.

- Latin America showed promising growth, with Mastercard capturing 20% of the market share, up from 18% the previous year.

- Mastercard’s global strategy includes partnerships with over 90% of banks worldwide, reinforcing its market position.

- Competitive edge through innovations: Mastercard led in innovations related to cybersecurity and fraud prevention, gaining a trusted reputation among businesses and governments.

Mastercard in the United States

- Total U.S. cardholders using Mastercard hit 267 million in 2025, reflecting steady national growth in digital payment adoption.

- U.S. transactions processed reached over 42.6 billion in 2025, up 12% year-over-year due to higher consumer activity.

- Debit card usage in the U.S. rose by 21.3% in 2025, highlighting the continued preference for contactless and direct-pay options.

- E-commerce made up 43.5% of U.S. Mastercard transactions in 2025, underscoring the shift toward online-first spending.

- Average credit card spending per U.S. cardholder reached $4,390 in 2025, sustained by strong consumer confidence and credit access.

- Retail partnerships with Amazon, Walmart, and others contributed 25.7% of total U.S. Mastercard transactions in 2025, enhancing market penetration.

- Contactless payment usage in the U.S. grew by 29.8% in 2025, driven by demand for speed, security, and tap-to-pay convenience.

Cardholder and Transaction Statistics

- Global Mastercard cardholders surpassed 3.1 billion in 2025, reflecting robust growth in emerging markets and digital card issuance.

- Annual transactions processed by Mastercard exceeded 124 billion in 2025, showcasing the global scale of its payments infrastructure.

- Average spending per transaction rose to $58.20 in 2025, influenced by moderate inflation and increased discretionary spending.

- Contactless payments accounted for 47.6% of all Mastercard U.S. transactions in 2025, up from the prior year’s 42%.

- Total global cardholder spending on Mastercard networks grew by 18.9% in 2025, fueled by travel, entertainment, and digital goods consumption.

- Cross-border transactions surged by 23.4% in 2025, driven by international travel recovery and global e-commerce flows.

- E-commerce spending with Mastercard represented 30% of total cardholder purchases, reflecting a steady preference for online shopping.

Usage and Ownership Trends

- Credit card usage on Mastercard climbed to 45.8% of U.S. adults in 2025, showing a continued preference for Mastercard credit options.

- Debit card ownership rose by 18.1% in 2025, led by Gen Z and underbanked populations adopting mobile-first debit solutions.

- Mobile wallet integration usage jumped by 28.4% year-over-year in 2025, as contactless and tokenized payments became mainstream.

- Contactless card usage reached 59.2% of all Mastercard transactions in North America in 2025, driven by speed and tap-to-pay demand.

- Millennials and Gen Z opened 51.3% of all new Mastercard credit accounts in 2025, cementing youth market dominance.

- Consumer trust in Mastercard’s security features improved by 22.7% in 2025, reinforcing its role in fraud protection and online safety.

- Average monthly spend per global Mastercard user hit $645 in 2025, reflecting inflation and higher digital lifestyle expenditures.

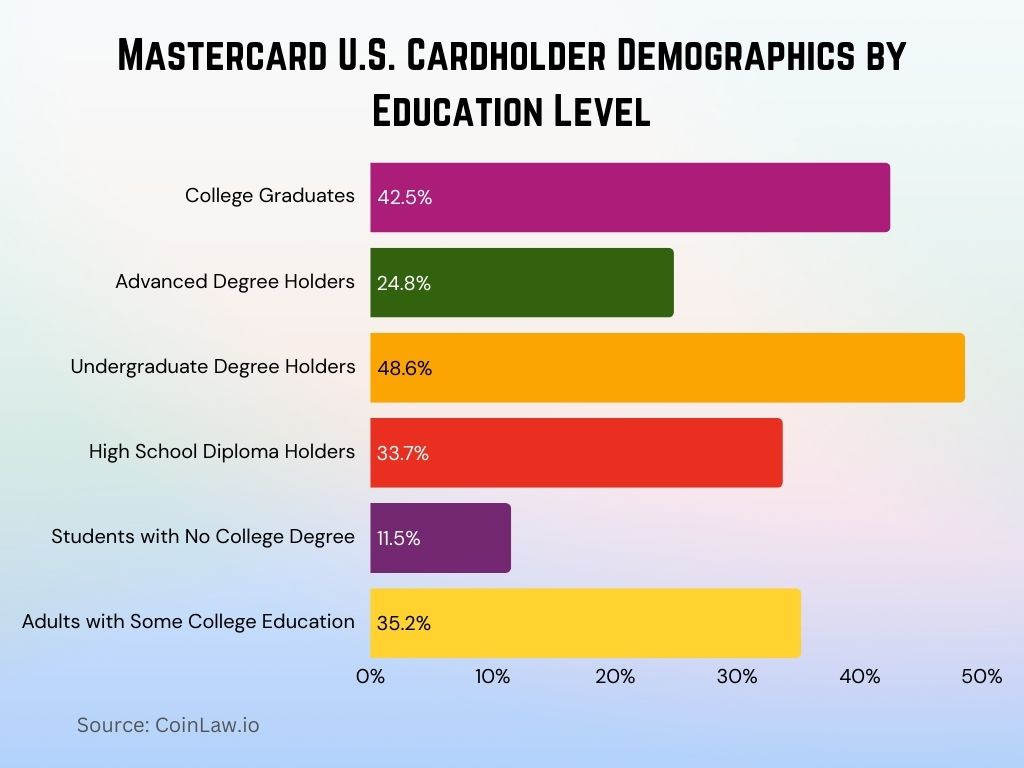

Ownership by Level of Education

- 42.5% of U.S. college graduates use Mastercard as their primary card in 2025, indicating strong brand trust among educated users.

- Advanced degree holders made up 24.8% of Mastercard’s U.S. cardholder base in 2025, highlighting its appeal to high-income segments.

- Undergraduate degree holders represented 48.6% of all U.S. Mastercard debit users in 2025, reflecting broad adoption in the educated middle class.

- High school diploma holders comprised 33.7% of U.S. Mastercard users in 2025, primarily favoring debit for everyday purchases.

- Students without a college degree accounted for 11.5% of new debit Mastercard accounts in 2025, marking an increase of 7.5% year-over-year.

- Adults with some college education chose Mastercard debit for 35.2% of their transactions in 2025, maintaining a strong preference in hybrid-educated groups.

- Graduate students’ spending on Mastercard cards rose by 13.2% in 2025, driven by increased travel, subscriptions, and tech-related purchases.

Ownership by Race

- African American ownership of Mastercard products reached 20.7% in 2025, with continued preference for debit cards.

- Hispanic and Latino consumers made up 23.5% of new U.S. Mastercard cardholders in 2025, driven by inclusion efforts.

- Asian American consumers accounted for 19.2% of total U.S. Mastercard users in 2025, with higher credit card adoption.

- White Americans comprised 40.1% of Mastercard’s U.S. user base in 2025 across all product types.

- Multiracial and other racial groups represented 13.4% of U.S. Mastercard users in 2025, up 2.8% year-over-year.

- Mastercard’s campaigns led to a 19.6% increase in new minority cardholders in 2025.

- Mobile wallet use among African American and Hispanic users grew by 28.1% in 2025.

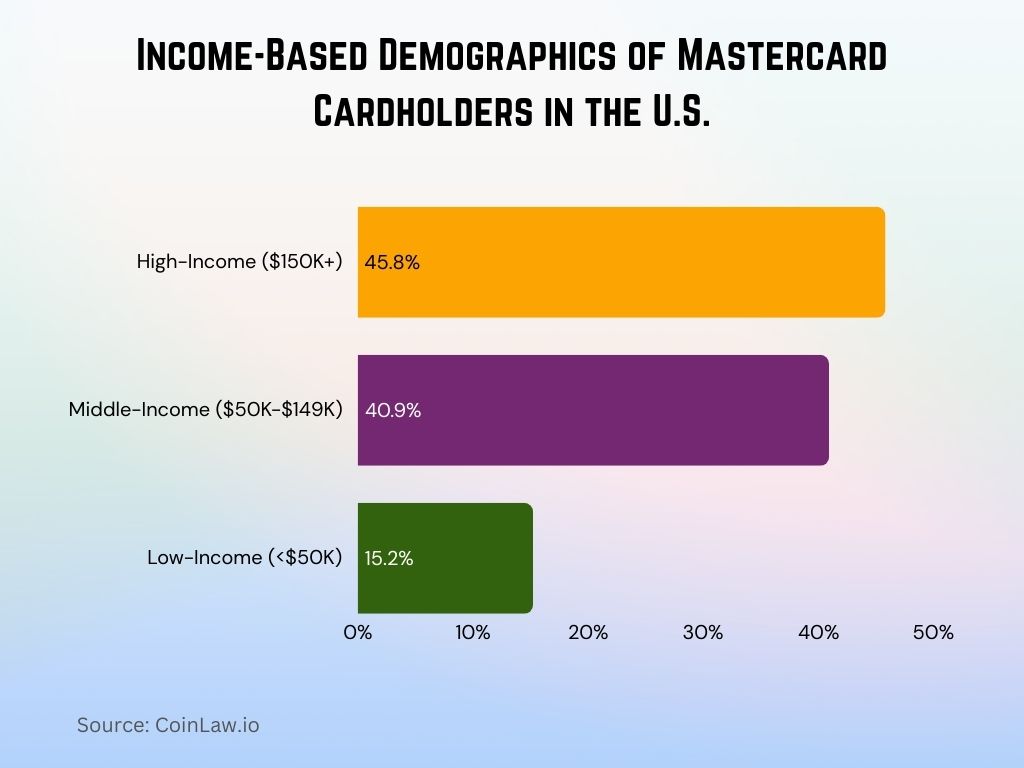

Ownership by Income

- High-income households (over $150,000) make up 45.8% of Mastercard’s U.S. credit cardholders in 2025, showing strong brand retention.

- Middle-income households ($50,000–$149,999) represent 40.9% of Mastercard’s U.S. customer base, maintaining the largest user segment.

- Among low-income households (under $50,000), Mastercard debit card ownership increased by 15.2% in 2025.

- High-income consumers spent an average of $8,630 per year on Mastercard credit in 2025, largely on travel and premium goods.

- Middle-income users averaged $4,150 in annual credit card spending in 2025, with growth in retail and dining.

- Lower-income cardholders used Mastercard debit mainly for groceries and utilities, with spending up 13.4% in 2025.

- 58.1% of high-income households engaged in Mastercard’s rewards programs in 2025, marking the highest participation rate.

Usage by Age

- Young adults (18–24) accounted for 21.6% of new Mastercard debit accounts in 2025, reflecting their digital-first banking preferences.

- Millennials (25–40) made up 36.4% of U.S. Mastercard credit cardholders in 2025, with high spending in travel, retail, and dining.

- Generation X (41–56) represented 24.2% of Mastercard credit usage in 2025, focused on family, healthcare, and home essentials.

- Baby Boomers (57–75) contributed 14.3% of Mastercard’s debit usage in 2025, mostly for groceries and medical costs.

- Generation Z showed a 30.1% year-over-year increase in Mastercard credit card applications in 2025.

- Contactless payments among Generation X users grew by 19.5% in 2025, driven by convenience and mobile tech adoption.

- Senior cardholders (75+) used Mastercard debit cards mainly for recurring essentials, averaging $318 in monthly spending in 2025.

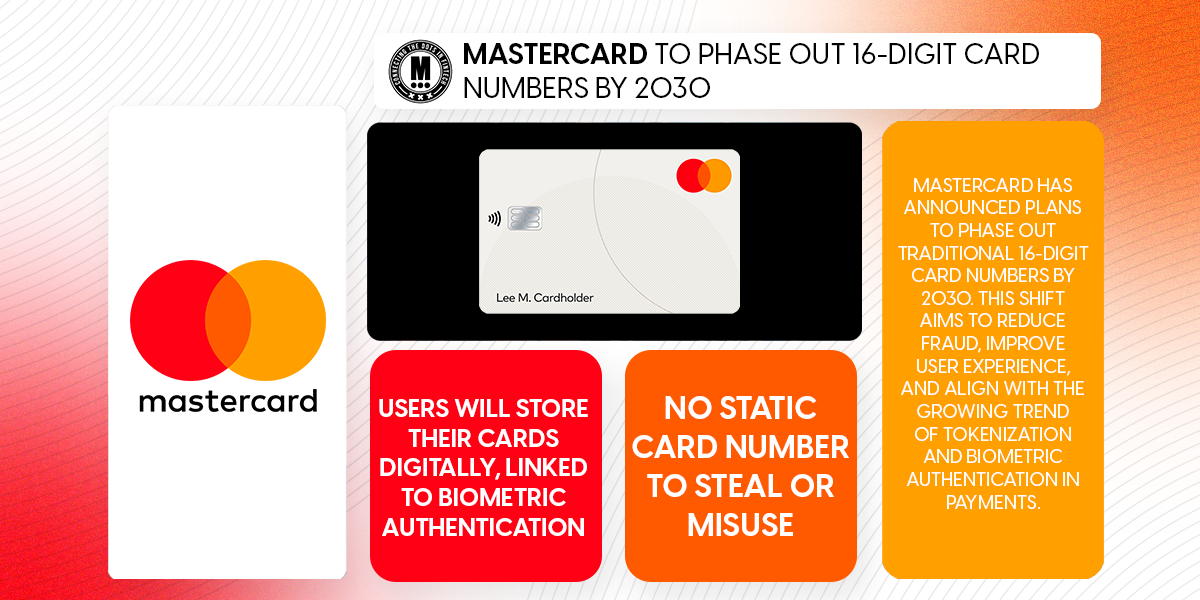

Mastercard to Eliminate 16-Digit Card Numbers by 2030

- Mastercard plans to phase out 16-digit card numbers by 2030. This major move aligns with digital security innovations in the payment industry.

- Users will store cards digitally, connected to biometric authentication like fingerprint or facial recognition. This approach increases both convenience and security.

- There will be no static card number on the physical card. This makes it impossible for fraudsters to steal or misuse card data.

The change supports tokenization and biometric-based payments, which are rapidly growing in adoption. Mastercard is aligning with future-ready, user-first technologies.

Partnerships and Collaborations

- Mastercard and Apple expanded Apple Pay Later in 2025, now covering over 20 countries and driving installment usage up by 31%.

- Amazon’s continued partnership with Mastercard led to a 27.8% increase in Mastercard transactions on the platform in 2025.

- Mastercard’s global integration with Stripe helped capture 13.6% of new business users in 2025 through seamless online payment tools.

- Partnership with Samsung advanced digital ID rollout, securing millions of biometric-linked Mastercard accounts in 2025.

- Mastercard and Microsoft used AI to reduce fraud-related false declines by 17.2% in 2025, enhancing transaction approval accuracy.

- The Plaid collaboration boosted bank account linking, with a 32.5% increase in linked Mastercard accounts in 2025.

- Mastercard and Visa’s shared digital wallet saw rapid adoption, used by over 60 million users globally by mid-2025.

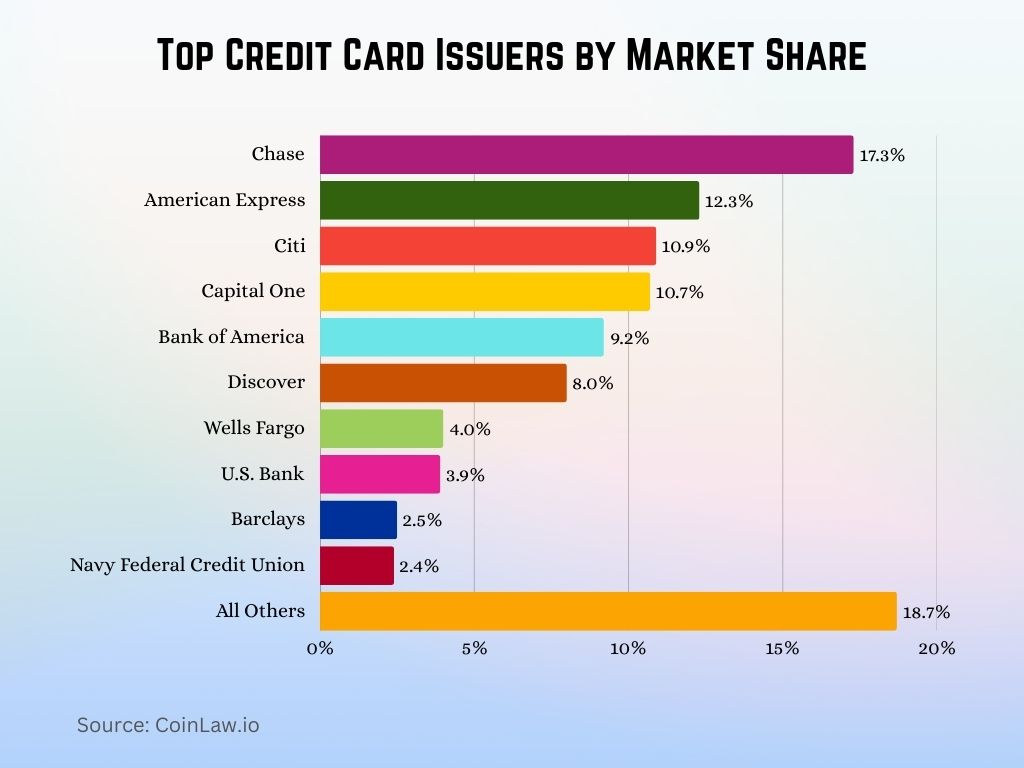

Top Credit Card Issuers by Market Share

- Chase leads the market with a 17.3% share, making it the top credit card issuer in the United States.

- American Express holds the second-largest share at 12.3%, and it is known for its premium card offerings and loyal customer base.

- Citi follows closely with a 10.9% share, maintaining a strong presence in both consumer and business segments.

- Capital One secures a 10.7% market share, driven by popular cashback and travel rewards cards.

- Bank of America commands 9.2% of the market, supported by its extensive banking network and co-branded cards.

- Discover accounts for 8.0%, recognized for no-annual-fee cards and strong customer satisfaction.

- Wells Fargo holds a 4.0% market share, offering a mix of secured and unsecured credit products.

- U.S. Bank captures 3.9%, with a growing portfolio of niche and co-branded cards.

- Barclays has a 2.5% share, mostly through travel and airline partnerships.

- Navy Federal Credit Union represents 2.4%, focusing on members of the military community.

- All other issuers combined make up 18.7%, indicating a highly fragmented market beyond the top players.

Recent Developments

- Mastercard reaffirmed its Net Zero goal for 2040, achieving a 36% reduction in emissions as of 2025 and staying ahead of its 2027 target.

- In 2025, Mastercard’s agreement with the U.S. Treasury expanded to cover additional federal benefit programs, improving digital disbursement efficiency.

- The Fintech Express program added 72 new fintech partners globally in 2025, accelerating access to next-gen payment solutions.

- Sustainability-focused credit cards surpassed 1.5 million issued in 2025, empowering users to track and offset their carbon footprints.

- 88% of new Mastercard cards were issued digitally in 2025, continuing the shift toward plastic-free, digital-first card issuance.

- Mastercard’s Priceless Planet Coalition has planted 7.4 million trees globally as of 2025, advancing its climate restoration goals.

- The partnership with UNICEF reached 2.3 million beneficiaries in 2025 through financial literacy programs in underserved communities.

Conclusion

Mastercard’s influence in the global financial ecosystem is clear, from innovative digital payment solutions to steadfast market growth. With a focus on technological advancements and sustainable practices, Mastercard is not only driving financial connectivity but also positioning itself as a leader in responsible business practices. As Mastercard continues to innovate with AI-powered fraud detection, blockchain, and biometric technology, it stands to reshape how individuals and businesses engage with financial services globally. For cardholders and investors alike, Mastercard’s trajectory in 2025 underscores its resilience, adaptability, and commitment to a secure, inclusive, and sustainable future.