Loan defaults influence both individual borrowers and entire financial systems. Rising delinquency rates and tightening economic conditions have renewed attention on how different types of loans perform. Real‑world impacts already appear, for instance, lenders are flagging elevated default rates on personal and student loans, while banks brace for potential rises in charge-offs. This article breaks down the latest statistics to show where defaults are rising and why.

Editor’s Choice

- The delinquency rate on all loans at U.S. commercial banks stood at 1.47% in Q3 2025, down slightly from 1.59% in Q4 2024.

- In Q2 2025, 3.37% of U.S. personal loan accounts were 60+ days past due.

- As of mid‑2025, roughly 9.4% of aggregate U.S. student loan debt was 90+ days delinquent or in default.

- The U.S. non‑mortgage consumer debt pool stood at $4.60 trillion in March 2025.

- The default rate for U.S. senior‑secured and unitranche private credit loans dropped to 1.76% in Q2 2025.

- Meanwhile, overall U.S. consumer credit increased at an annual rate of 2.7% in Q3 2025.

- Global speculative‑grade corporate default rates are expected to fall from about 4% to about 2.5% over the next year.

Recent Developments

- The 2025 Q3 delinquency rate for all loans at U.S. commercial banks was 1.47%, stable compared with Q2 but modestly lower than late 2024 levels.

- In the United States, non‑mortgage debt now amounts to $4.60 trillion, a component of total consumer debt in 2025.

- For personal loans, the 60‑plus‑days delinquency rate in Q2 2025 was 3.37%, marginally below Q2 2024.

- The average personal loan balance per borrower reached $11,676 in Q2 2025.

- The share of consumer credit in revolving and nonrevolving lines rose in Q3 2025.

- Private credit default rates fell to 1.76% in Q2 2025, down from 2.42% in Q1 2025.

- Global speculative‑grade corporate default rates remain elevated but are projected to decline toward 2.5%.

- Mortgage delinquency saw a mild uptick in early 2025, affecting 30‑ and 60‑day buckets.

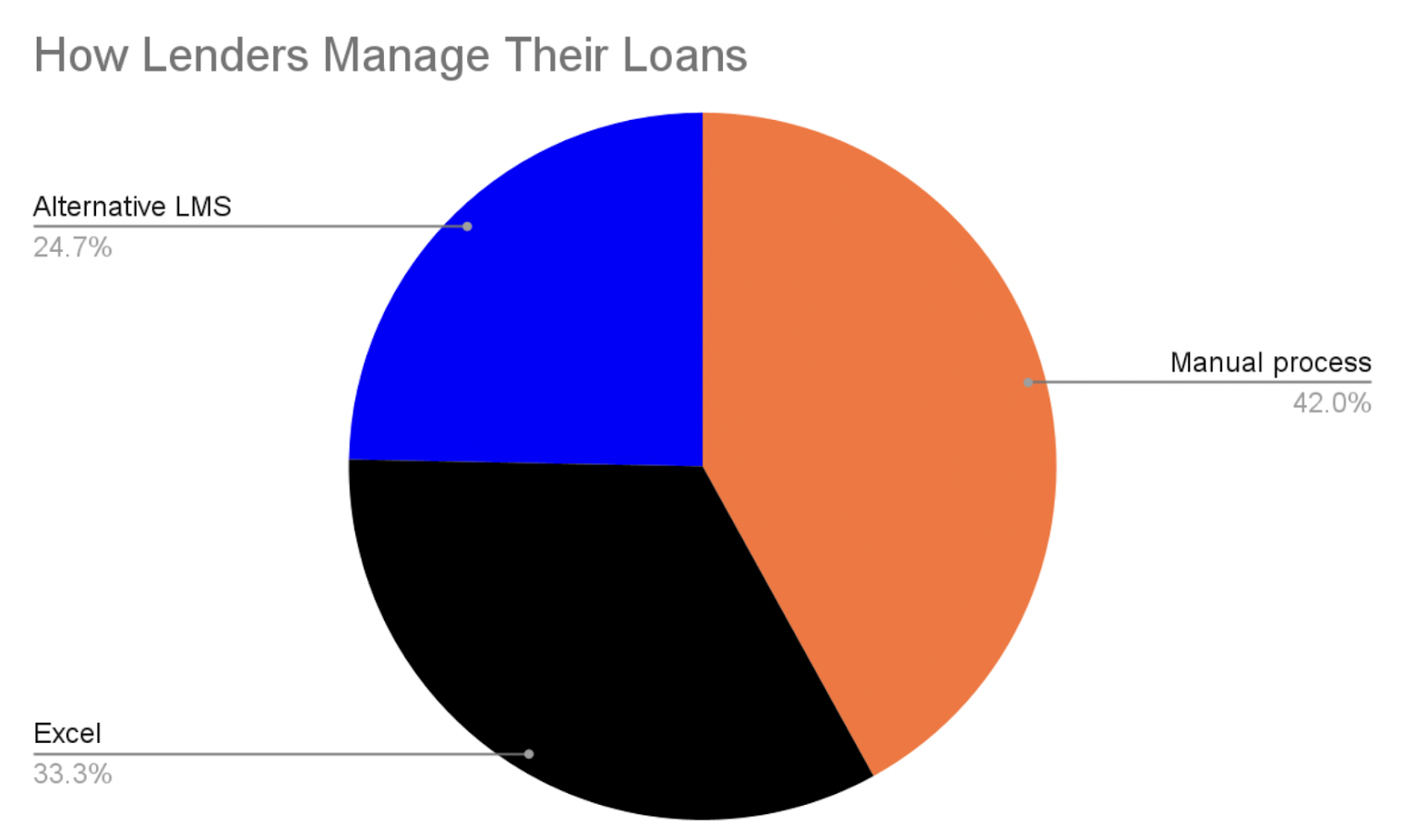

How Lenders Manage Their Loans

- 42.0% of lenders still rely on manual processes to manage their loan portfolios.

- 33.3% of lenders use Excel spreadsheets as their primary loan management tool.

- Only 24.7% of lenders have adopted alternative loan management systems (LMS) for automation and tracking.

Overview of Loan Default Statistics

- Overall delinquency across all loans at commercial banks was 1.47% in Q3 2025.

- As of March 2025, U.S. non‑mortgage consumer debt reached $4.60 trillion, about 26% of total consumer debt.

- Auto loans and leases account for 36.2% of non‑mortgage debt, student loans 28.6%, and credit cards 24%.

- The delinquency rate for U.S. personal loans was 3.37% in Q2 2025.

- The average personal loan borrower owed $11,676.

- Private credit default rate measured 1.76% in Q2 2025.

- Consumer credit overall rose at a 2.7% annual rate in Q3 2025.

- Mortgage debt reached about $13.09 trillion in 2025.

- Mortgage delinquency varies by loan type, with short-term delinquency rising in Q3 2025.

Global & Regional Default Trends

- Overall global default rates in 2025 remain slightly above historical averages, though stable in many regions.

- Emerging‑market corporates show default expectations of 0.9% for investment‑grade and 2.4% for high-yield.

- European speculative‑grade corporate default rates are projected to decline from 4.7% to about 4.25%.

- Sector‑specific volatility persists, affecting high‑yield segments.

- In South Asia, loans overdue 90+ days climbed to 3.6% in 2025, up from 3.3% a year earlier.

- Public‑debt burdens in emerging economies sustain elevated risk.

- Global credit conditions are projected to improve moderately in 2025–2026.

- High interest rates and economic uncertainty keep vulnerable sectors under pressure.

- Cross‑border lenders face uneven recovery across regions.

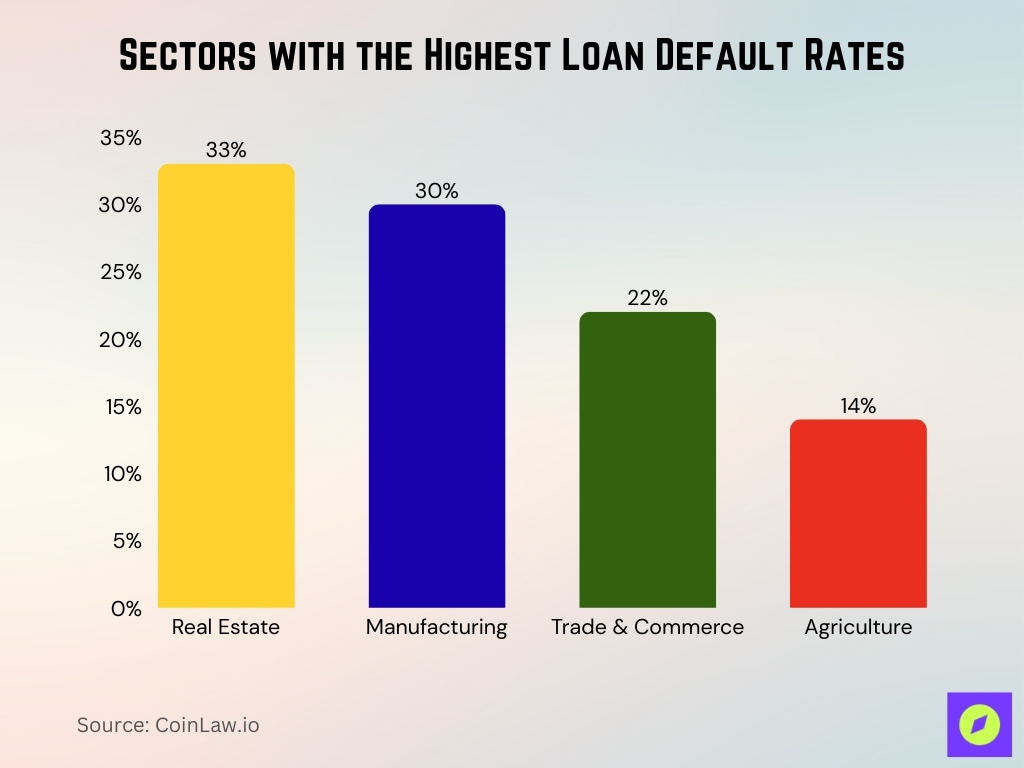

Sectors with the Highest Loan Default Rates

- Real estate accounts for the largest share of loan defaults at 33%.

- Manufacturing follows closely with a default rate of 30%.

- Trade and commerce contribute to 22% of total loan defaults.

- Agriculture shows the lowest sectoral default rate at 14%

Loan Default Rates by Type of Loan

- Personal loans: delinquency at 3.37% in Q2 2025.

- Average personal‑loan balance: $11,676.

- Private credit: default rate 1.76% in Q2 2025.

- Mortgages: 30‑day delinquency 2.12%, 60‑day 0.76%, 90‑day 1.11% in Q3 2025.

- FHA and VA loans showed larger quarter‑over‑quarter variability.

- Student loans: 9.4% delinquent or in default.

Historical Trends in Loan Defaults

- Post‑pandemic, loan delinquencies rose as payment pauses expired.

- Delinquency fell from 1.59% in Q4 2024 to 1.47% in Q3 2025.

- Auto loan delinquency has increased by over 50% since 2010.

- Private‑credit defaults peaked at 2.67% in Q4 2024, then declined.

- Global speculative‑grade defaults expected to fall in 2025–2026.

- Mortgage delinquency shifted, with serious delinquency remaining relatively low.

- Regional consumer credit showed rising overdue loans in areas such as South Asia.

- Long-term economic cycles shape delinquency patterns across loan types.

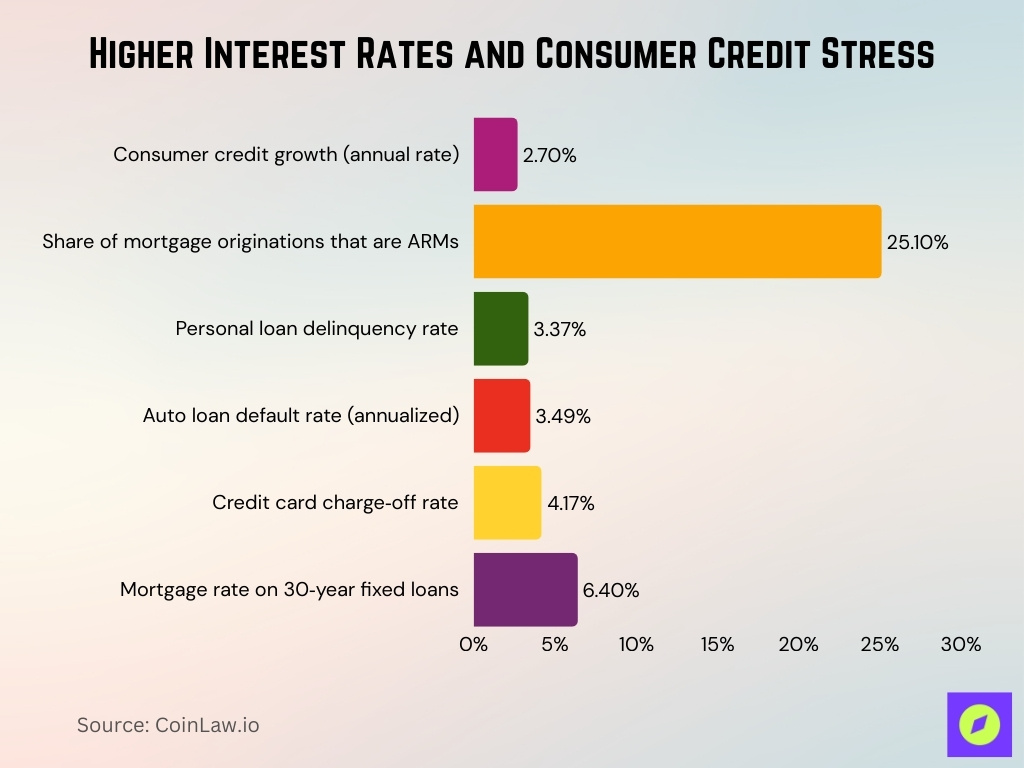

Impact of Interest Rates on Loan Defaults

- Consumer credit grew at an annual rate of 2.7% in Q3 2025.

- Adjustable-rate mortgages (ARMs) rose to 25.1% of total mortgage originations in early 2025.

- Personal loan delinquency rate held steady at 3.37% as of Q2 2025.

- Auto loan default rates surged to an annualized 3.49% in early 2025.

- Credit card charge-offs reached 4.17% in Q3 2025, near multi-year highs.

- Variable-rate debt affordability declined as mortgage rates climbed to around 6.4% on 30-year fixed loans.

Loan Default Rates by Borrower Demographics

- Average U.S. consumer debt was $104,755 in mid‑2025.

- Non‑mortgage delinquency reached 1.51% in March 2025.

- Delinquency rose across nearly all credit‑score tiers.

- Subprime representation in credit‑card originations fell to 16.4% by 2025.

- Younger borrowers saw significant increases in debt loads.

- Student loan delinquency at 9.4% heavily affects younger adults.

- Borrower stress spans both lower‑ and higher‑credit tiers.

Loan Default Rates by Credit Score

- Personal loan delinquency rate remained steady at 3.37% in mid-2025.

- Auto loan delinquencies increased by over 50% since 2010, reaching their highest levels in 2025.

- Mortgage balances over 30 days delinquent rose to 3.68% in Q2 2025, surpassing pre-pandemic levels.

- Credit card delinquency rates were near 3.0% nationally in Q3 2025 but over 20% in the lowest-income ZIP codes.

- Subprime auto loan delinquencies hit around 6.43%, matching record highs in 2025.

- The average new car loan interest rate was about 9%, with subprime rates between 18-20% in 2025.

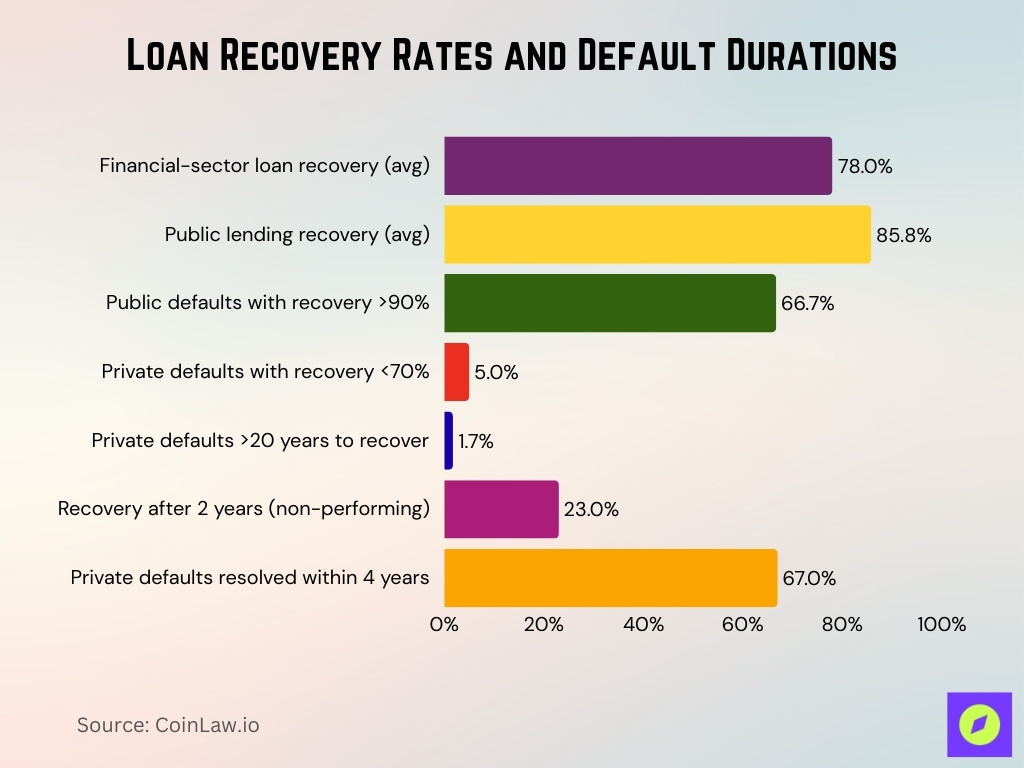

Recovery Rates After Loan Default

- Financial-sector loans recovered an average of 78% on bank defaults worldwide.

- Public-lending recoveries averaged 85.8% with an overall default rate of 2.61%.

- Two-thirds (66.7%) of public defaults achieved recoveries above 90% in recent cycles.

- Fewer than 5% of private defaults resulted in extreme losses below 70% recovery.

- 1.7% of private defaults took longer than 20 years to fully recover.

- Non-performing loans showed a 23% average recovery after 2 years in default.

- 67% of private counterpart defaults were resolved within four years.

- Private-sector loan recovery averaged 72.9% from 1994 to 2024 across 1,801 defaulted contracts.

- Half of defaults are resolved within five years, with a median time of 2-3 years.

Default Rates in Public vs. Private Lending

- Private‑credit default rate dropped to 1.76% in Q2 2025.

- Default rate previously peaked at 2.67% in Q4 2024.

- Federal student loans reached 9.4% delinquency or default.

- Private student‑loan default rates remained lower at about 1.61%.

- Mortgage delinquency remains historically low overall.

- Institutional lending shows better risk performance.

- Divergence between private‑credit and consumer‑loan performance widened in 2025.

Causes of Loan Defaults

- Total US debt reached $37.64 trillion in FY2025, up $2.17 trillion year-over-year.

- Net interest costs projected to hit $973 billion in 2025, more than doubling to $2.2 trillion by 2034.

- Average new car payment rose to $749/month in Q2 2025, up 1.9% from 2024 amid higher vehicle prices.

- Auto loan monthly payments increased nearly 30% from 2020 to 2023 due to elevated prices and rates.

- Older student loan delinquencies reached 18% in Q2 2025 following the end of payment pauses.

- Unsecured credit applications surged 14.2% in Q2 2025, with BNPL arrears at 2.45%.

- Auto loan delinquencies hit 5.0% for 90+ days past due in Q2 2025, up 12.6% year-over-year.

- Subprime auto delinquencies spiked to 6.56% in early 2025, the highest since 1994.

- Tighter underwriting reduced subprime credit card originations to 16.4% from 23.3% in 2022.

Loan Terms and Their Effect on Default Rates

- Six-year auto loans had 2-year cumulative default rates 67% higher than five-year loans.

- Seven-year loans showed 3.34 times higher default rates than five-year terms over 24 months.

- Loans six years or longer exceeded 8% default rates, double the 4% for shorter-term loans.

- Balloon-payment loans faced elevated LGD risks due to maturity refinancing failures.

- Covenant-heavy loans had lower 19.0% default rates (2008-to-date) versus cov-lite peers.

- Flexible repayment terms like BNPL showed <2% delinquency, below 3.5% consumer debt average.

- Longer-term borrowers self-selected into higher risk, with endogeneity inflating default estimates by 60-234%.

Influence of Collateral on Loan Default Rates

- Secured loans had delinquency rates around 2.72% in Q3 2025, lower than unsecured loans.

- Collateralized private loans exhibited an average default risk of 2.9% in recent data.

- Public lending recovery rates averaged about 85.8% in 2025.

- Unsecured credit consistently shows higher default rates, often exceeding 6% annual delinquency.

- Secured corporate loans demonstrated significantly lower loss given default (LGD) compared to unsecured bonds.

- Weak legal enforcement reduces collateral recovery effectiveness, lowering expected recoveries by up to 20%.

- Emerging-market financial sector loans reported recovery rates of around 79.1% in 2025.

Payment Methods and Default Statistics

- Consumer loan delinquency at commercial banks stood at 2.72% in Q3 2025.

- Auto-debit payments reduced permanent charge-offs by 13-19 percentage points on credit cards.

- P2P loan platforms recorded average default rates of 17.3%, far exceeding traditional loans’ 2.78%.

- Adjustable mortgages experienced payment shocks leading to elevated default risks upon rate resets.

- Digital payment infrastructure boosted non-performing loan recovery rates significantly in advanced regions.

- Credit card delinquency rate reached 2.87% in Q2 2025, with charge-offs at 4.04%.

- Variable-installment P2P loans showed default rates exceeding 10% on some platforms.

Loan Default Prediction Models and Accuracy

- Gradient Boosting achieved an accuracy of 0.8887 and a recall of 0.8021 in loan default prediction.

- XGBoost delivered an ROC AUC of 0.9714 on bank loan default datasets.

- Random Forest reached 91.86% accuracy in predicting loan outcomes on Lending Club data.

- LightGBM posted AUC > 0.86 and up to 99.8% accuracy in P2P lending defaults.

- Ensemble models attained 98% accuracy, outperforming single models like logistic regression.

- Time-series neural networks surpassed legacy models in mortgage default detection accuracy.

- P2P models with behavioral factors hit 90% accuracy and AUC near 0.91.

- Credit score alone underperformed ensembles by 10-20% in predictive accuracy.

Effects of Loan Defaults on Banking Profitability

- Net charge-off ratio rose to 0.70% in 2024, the highest since Q2 2013.

- Credit card, C&I, and multifamily CRE loans drove the annual charge-off increase.

- Net interest income grew 4% industry-wide in early 2025 amid solid economic conditions.

- Banking ROA reached 1.27% in Q3 2025, up 13 basis points quarter-over-quarter.

- Consumer loan charge-off rate hit 2.89% in Q3 2025, above pre-pandemic averages.

- Net interest margin stood at 3.34% in Q4 2024, stabilizing after prior declines.

- Philippine banks saw net interest income grow 11% in 2025, leading regional peers.

Government and Institutional Interventions in Defaults

- Public lending achieved an average of 85.8% recovery rates from 1994-2024 across defaulted contracts.

- MDBs reported private lending recovery rates of 72.2%, exceeding global benchmarks.

- Machine-learning models detected early default risks, improving prediction accuracy by 10-20%.

- Digital payment systems boosted non-performing loan recovery rates in high-development regions.

- Regulatory capital requirements maintained banks’ CET1 ratios above 10.9% post-stress tests.

- Loan-modification programs reduced re-default rates to 25-30% within 6 months.

- Stress-testing showed large banks absorbing $550 billion in losses while staying above capital minimums.

- EBA stress tests covered 68 EU banks in 2025, enhancing system-wide readiness.

Frequently Asked Questions (FAQs)

The delinquency rate on all loans stood at 1.47% in Q3 2025.

Outstanding student loan debt stood at $1.65 trillion in Q3 2025.

The delinquency rate on credit card loans was 3.05% in Q2 2025.

Consumer credit increased at a 2.7% annual rate in Q3 2025.

Conclusion

Loan default remains a complex challenge, but one that financial institutions, regulators, and lenders can manage wisely by combining solid underwriting, appropriate loan terms, and advanced risk‑prediction technology. Collateralization, structured loan terms, and stable payment methods reduce default risk; meanwhile, modern machine‑learning models help detect high‑risk borrowers early. Although defaults and charge-offs continue to pressure bank profitability, recovery rates, especially in collateralized or institutional lending, remain substantial. As lenders and regulators adapt, we may see more resilient credit systems that balance access with risk. The data paints a nuanced picture; defaults are a persistent risk, but mitigation and recovery mechanisms are improving across sectors.