Litecoin stands out as a reliable, fast, and low‑cost cryptocurrency that’s often called the “silver to Bitcoin’s gold.” It continues to act as both a payment medium and a testing ground for blockchain innovations like MimbleWimble. Its role in merchant adoption and cross‑border transfers highlights its practical value in the real world, particularly where transaction speed matters. Let’s explore its current stats and see what’s making Litecoin relevant today, and perhaps take your curiosity even further.

Editor’s Choice

- Price today ranges between $112–$113 USD, with daily highs near $116.

- Market cap hovers around $8.5 billion.

- Circulating supply is approximately 76.2 million LTC, about 91% of the 84 million max supply.

- 24-hour trading volume sits near $630–640 million.

- Litecoin could see a short-term median target near $37 by late August, though more bullish models place upper bounds closer to $43.

- Recent bullish runs were tied to ETF speculation and a $100M treasury acquisition.

- Short-term trends show price under negative pressure near its 50-day SMA, indicating potential further downside.

Recent Developments

- Wells Fargo gave a mid‑range price target of $37 for LTC on August 27, 2025.

- Market sentiment has turned cautious, as Litecoin hit resistance at its 50‑day simple moving average and began retracing.

- While optimism around crypto ETFs is increasing, some analysts speculate that Litecoin may have a slight regulatory edge due to its historical classification as a commodity by the CFTC. However, no official movement toward a Litecoin spot ETF has been confirmed, and timelines remain uncertain.

- MEI Pharma bought $100 million worth of LTC between late July and early August 2025, boosting market confidence.

- Halving event and ETF chatter combined to lift LTC to a five‑month high earlier this year.

- Relative altcoin performance improved, with LTC labeled among catch-up trades versus Bitcoin.

- Meanwhile, some reports note that LTC remains flat near $114 and hasn’t seen renewed demand post-halving.

Historical Price Trends

- 2025 monthly prices: Jan $128, Feb $128, Mar $83, Apr $83.5, May $87, Jun $86, Jul $106, Aug $113.

- Year-over-year: about doubling since early 2024 levels near $65–70.

- Forecast growth: average 2025 price around $140–143, with December possibly near $151.

- Longer-term outlook sees LTC perhaps reaching $201 in 2025.

- Another forecast offers a wide 2025 price band: $142 to $178.

- Overall trend: significant rebound from mid‑2024 lows (sub‑$70) to current triple‑digit levels.

Litecoin Price Statistics

- Current price is around $112–113.

- Weekly decline of about –1% from $116.89.

- Price history in August: ranged from $106 (Aug 3) to $121 (Aug 5–6).

- Monthly trend: May averaged $87, June $85.98, July $106.22, and August so far at $113.58.

- Forecast range for August 2025: $112.67 to $118.68.

- September projection: average $135.29, high $147.67, low $122.91.

- 2025 average forecast: between $111.38 and $159.79, average of around $143.

Market Capitalization Data

- Market cap is approximately $8.5 billion.

- Reports also show it at around $8.675 billion.

- Fully diluted valuation (FDV) stands near $9.3 billion.

- Volume-to-market cap ratio: about 7–7.5% in 24 hours.

- Trading volumes: between $1 billion earlier this year, now around $630 million daily.

- The 9‑figure FDV suggests that full supply circulation would value LTC near $9.3 billion.

- Ranked #26–27 globally by market capitalization.

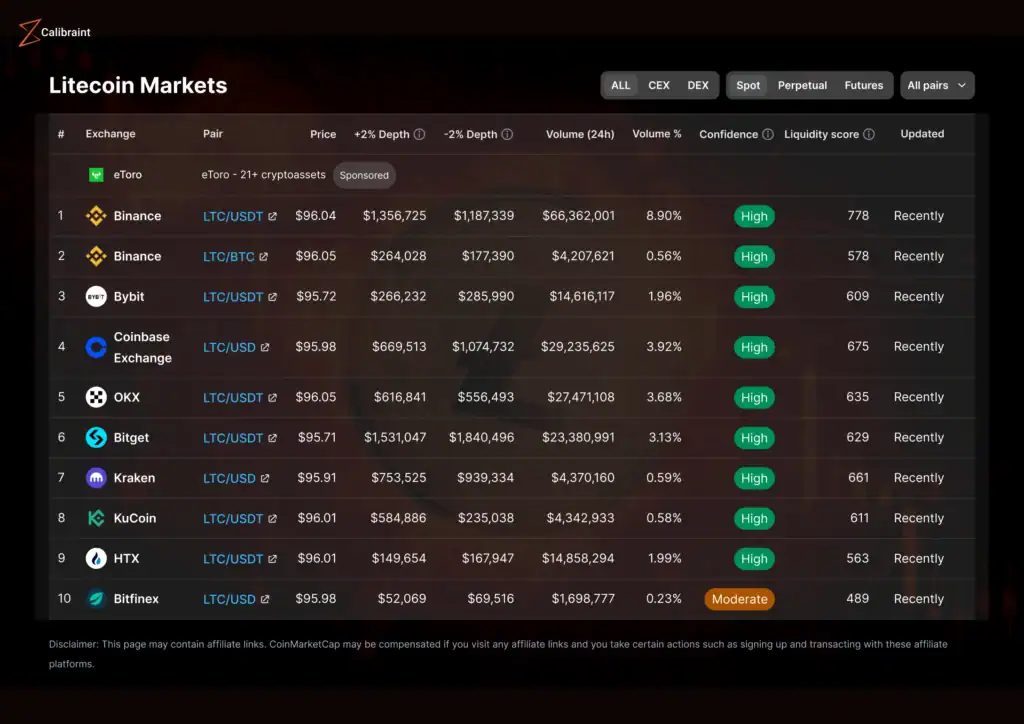

Top Litecoin Markets and Trading Stats

- Binance (LTC/USDT) leads with $66.36 million in 24h volume and a liquidity score of 778, showing 8.90% market share.

- Binance (LTC/BTC) shows a smaller footprint with $4.21 million volume and just 0.56% share, but still maintains high confidence.

- Bybit (LTC/USDT) records $14.62 million in daily volume, 1.96% of the market, and a liquidity score of 609.

- Coinbase Exchange (LTC/USD) ranks high with $29.24 million in trades and 3.92% volume share, backed by a 675 liquidity score.

- OKX (LTC/USDT) processes $27.47 million daily volume, capturing 3.68% market share and scoring 635 on liquidity.

- Bitget (LTC/USDT) contributes $23.38 million to daily activity, representing 3.13% of total LTC trades with a score of 629.

- Kraken (LTC/USD) sees $4.37M in daily volume, 0.59% of market trades, and boasts 661 in liquidity strength.

- KuCoin (LTC/USDT) trades around $4.34 million per day, with a 0.58% market share and 611 liquidity.

- HTX (LTC/USDT) posts $14.86 million volume and 1.99% share, supported by a 563 liquidity score.

- Bitfinex (LTC/USD) rounds out the list with just $1.70M in trades, a 0.23% share, and the only moderate confidence score at 489.

Trading Volume Statistics

- 24‑hour volume ranges between $630 million and $640 million.

- Reports show $639 million, with volume/market cap at 7.51%.

- Earlier data saw a peak at $1.06 billion.

- Volatility: daily volume fluctuates but remains high, commensurate with an active altcoin.

- Trading activity supports liquidity, especially amid ETF speculation and institutional buys.

- Comparisons to past year: volume remains robust even as prices plateau.

- Volume spikes correspond with development events like ETF rumours or treasury purchases.

Circulating and Total Supply

- Circulating supply stands at about 76.23 million LTC, roughly 91% of its 84 million max supply.

- Another source rounds it as 76,234,439 LTC out of 84,000,000.

- Earlier in 2025, the circulating supply was noted at 75.55 million LTC, nearly equivalent to its total supply at the time.

- Maximum supply remains firmly set at 84 million LTC.

- Supply inflation has slowed, as most of LTC is mined and in circulation.

- Supply figures remain consistent across multiple credible trackers, indicating reliable data.

- Litecoin’s supply structure supports scarcity and stable valuation models.

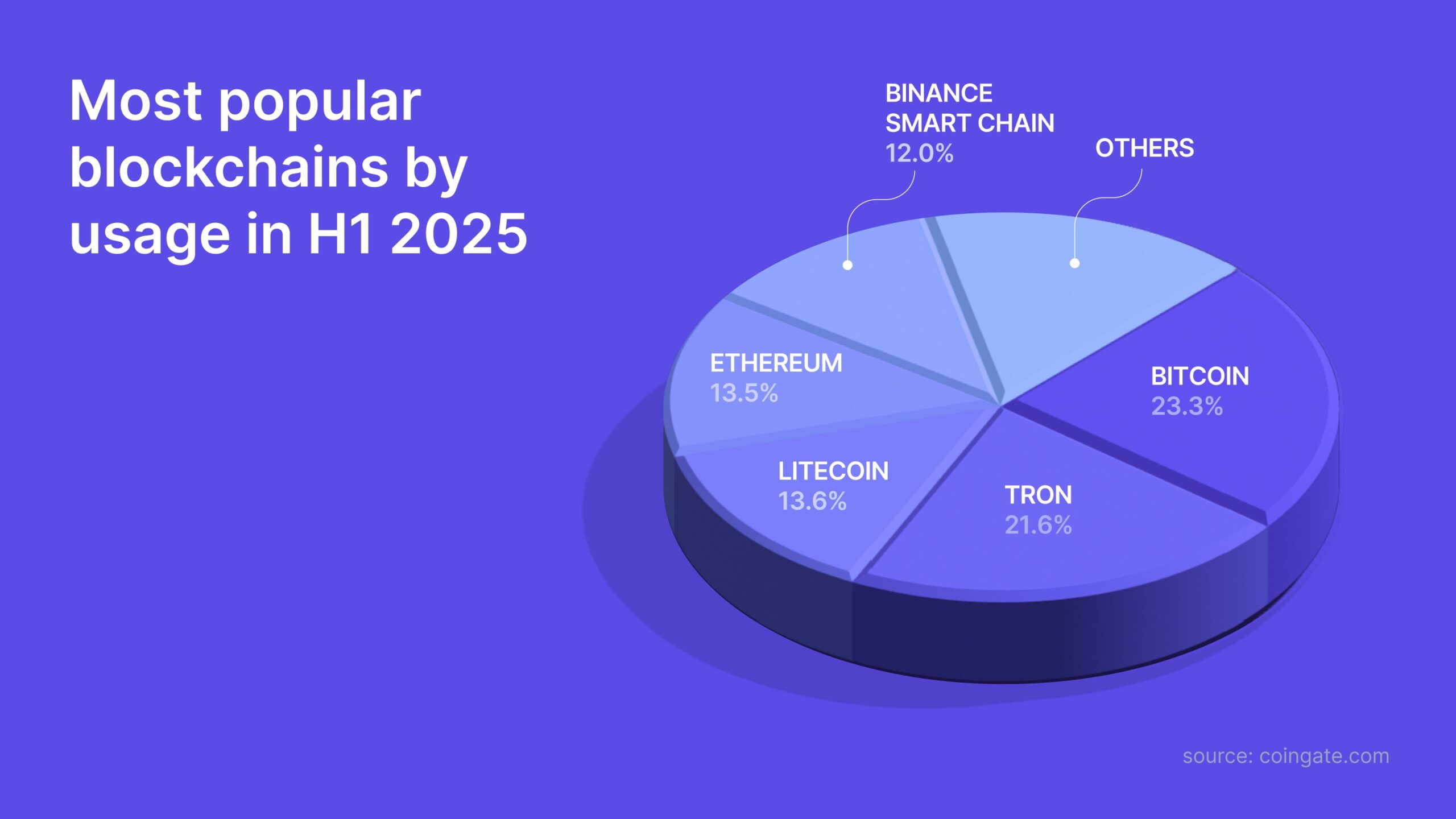

Most Popular Blockchains by Usage

- Bitcoin dominated with 23.3% of total blockchain usage, maintaining its lead across global transactions.

- Tron followed closely with 21.6%, reflecting rising adoption in high-speed and low-fee applications.

- Litecoin accounted for 13.6%, showcasing consistent utility in peer-to-peer payments and transfers.

- Ethereum captured 13.5%, driven by DeFi protocols and smart contract deployments.

- Binance Smart Chain (BSC) held a 12.0% share, favored for its efficiency and ecosystem integration.

- Other blockchains combined made up the remaining 16.0%, covering niche, regional, or emerging networks.

Number of Holders

- As of early January 2025, funded wallets on the Litecoin blockchain dropped to 8.06 million, with 40,000 wallets exiting over a week.

- Data shows 33.79% of holders in profit (25.81M LTC), 8.74% breaking even, and 57.47% at a loss.

- Another report shows over 69% of holders were in profit in mid‑2025, despite price volatility.

- These stats suggest a healthy base of long-term holders.

- The decrease in funded wallets may reflect market volatility rather than long-term exit.

- The mix of profitable and loss-making holders gives insight into potential selling pressure.

- Holder distribution indicates sustained confidence among core users.

On‑Chain Metrics

- Active addresses surged by 15%, rising from around 366,000 to 401,000.

- Daily transaction volume neared $2.8 billion, exceeding 50% of market cap.

- Top 100 wallets control approximately 40% of LTC supply, signaling concentrated holdings.

- The increase in active addresses signals growing on‑chain engagement.

- High transaction volume underscores Litecoin’s real-world transfer activity.

- Spotlights potential centralization risk due to wallet concentration among a few big holders.

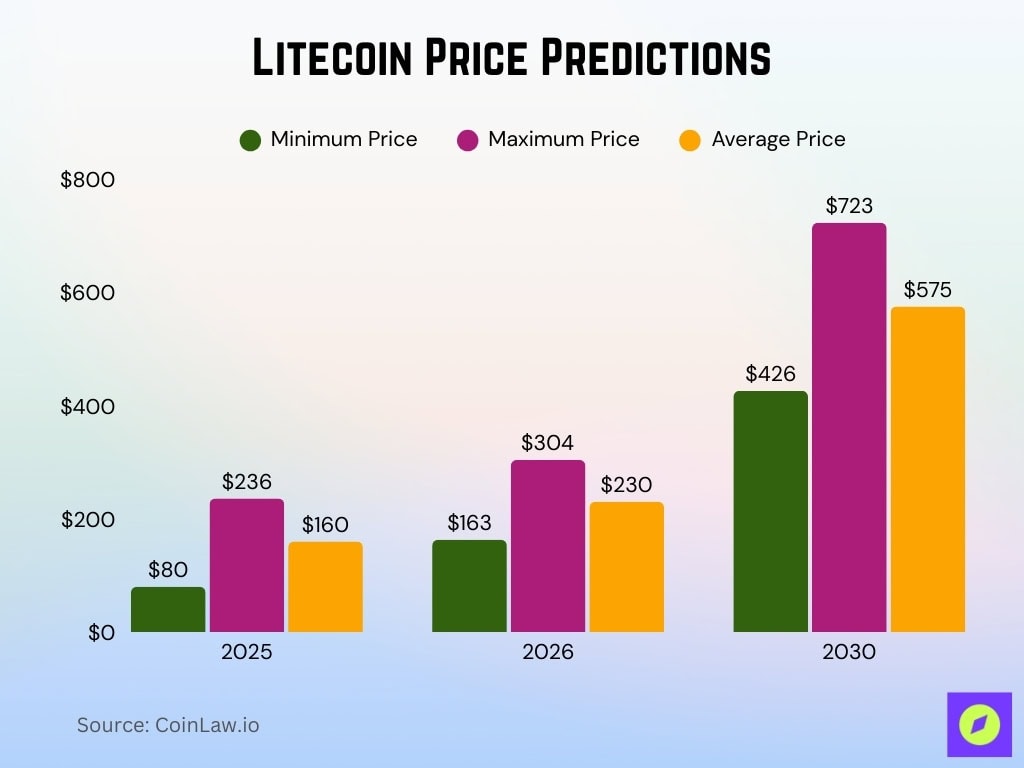

Litecoin Price Predictions Through

- In 2025, Litecoin is forecasted to reach a minimum of $80, a maximum of $236, and an average price of $160.

- For 2026, projections rise to a minimum of $163, a maximum of $304, and an average of $230.

- By 2030, Litecoin could hit a minimum of $426, a maximum of $723, and average around $575.

- Looking ahead to 2040, estimates skyrocket with a minimum price of $1,207, a maximum of $68,750, and an average forecast of $35,000.

Whale and Large Holder Stats

- Whale wallets (holding >10,000 LTC) grew by 4.8% recently.

- Transactions over $100,000 spiked by 22% last month, a clear sign of institutional activity.

- Wallets holding between 100,000 and 1 million LTC increased holdings by 5.6%.

- The rise in large transactions reflects growing whale confidence.

- This accumulation occurred despite over 57% of holders being underwater, emphasizing strategic bullish sentiment.

Transaction Volume and Count

- Transactions in the past 24 hours number approximately 186,338.

- That’s an average of about 7,764 transactions per hour.

- Litecoins sent in 24 hours totaled about 110.3 million LTC, worth $12.33 billion, over 142% of the market cap.

- Average transaction value stands near 591.89 LTC ($66,178), median value around 1.75 LTC ($195.92).

- Median transaction fee is minuscule, about 0.0000097 LTC ($0.0011).

- Litecoin confirms a block every 2 minutes and 24 seconds, with 601 blocks mined in the last 24 hours.

- Reward per block averages 6.25 + 0.01711 LTC, with miner rewards in 24 hrs at 3,756 LTC plus fees.

- Fee makes up just 0.28% of block rewards, and transaction cost remains extremely low.

Daily Active Addresses

- 15% surge, from 366,000 to 401,000 active addresses.

- This uptick reflects increased user engagement and network activity.

- Shows a healthy ecosystem growth at the user interaction level.

Network Hashrate and Security

- Current hashrate stands around 2.90–2.97 PH/s.

- The all-time high was 3.79 PH/s on March 26, 2025.

- Daily average hashrate recently recorded 2.94 PH/s, a +7% rise in 24 hours.

- Mining difficulty is around 98 million, matching the hashrate trends.

- A higher hashrate strengthens network security and makes LTC more robust.

- Slight fluctuations suggest healthy mining competition rather than sudden drops.

Miner Reserves and Activity

- Miner reserves have trended upward over the past year, indicating that large mining pools are accumulating LTC rather than offloading it.

- This accumulation suggests bullish sentiment among miners despite operational costs.

- Thumzup Media’s acquisition of Dogehash Technologies in August 2025 may further consolidate mining infrastructure and stabilize miner reserve behavior.

- Litecoin’s increased hashrate supports this accumulation, indicating miners are confident in long‑term network growth.

- Historical context: reserve levels once plummeted to record lows in late 2024 as miners sold off in response to market pressure.

- The shift from sell-off to accumulation marks a reversal in miner strategy.

- Combined, these trends improve funding resilience and signal reduced short-term selling risk from mining operations.

Exchange Listings and Liquidity

- Litecoin maintains strong listings across virtually all major crypto exchanges, ensuring broad trading access and ease of conversion.

- Binance leads LTC liquidity in 2025, with deep order book depth exceeding $8 million on each side, accounting for 32–36% of global liquidity.

- Other platforms follow in liquidity volume: Bitget with $4.6M, OKX $3.7M; HTX and Crypto.com offer moderate liquidity ($100K–$500K).

- Coinbase and Kraken, U.S.-regulated platforms, each contribute 9% combined to fiat‑to‑crypto liquidity, emphasizing their appeal to institutional and regulated investors.

- The broad range of trading options enhances Litecoin’s price discovery and depth.

- High liquidity supports quick execution and reduces slippage, critical for institutional traders and high-volume moves.

- Despite numerous exchanges, the bulk of trading remains concentrated on a few large platforms.

Technical Indicators

- Litecoin recently tested $133, approaching a resistance zone around $135. A confirmed breakout could lift prices toward $170–220, with further upside to $280 in optimistic scenarios.

- Technical sentiment remains mixed, rally potential exists, but bullish conviction hinges on overcoming resistance.

- Analysts note key technical structures such as ascending channels and open interest spikes linked to institutional inflows.

- Market sentiment indicators, like the Fear & Greed index, hover around neutral, signaling balanced trader psychology.

- Forecasts for August 2025 place LTC price between $112.67 (low) and $118.68 (high), with an average around $114–115.

- For September, projections rise to an average of $135.29, ranging from $122.91 to $147.67.

- These technical profiles suggest that momentum could pick up if resistance zones are breached.

Litecoin vs Bitcoin Statistics

- Litecoin confirms blocks every 2.5 minutes, four times faster than Bitcoin’s average 10-minute block time, catering to quicker transactions.

- LTC uses the Scrypt hashing algorithm, unlike Bitcoin’s SHA‑256, historically aimed at ASIC resistance and mining diversity.

- Litecoin’s cap of 84 million coins is four times larger than Bitcoin’s 21 million, affecting perceived scarcity and distribution dynamics.

- Bitcoin is widely viewed as “digital gold” for its store-of-value strength, while Litecoin remains “digital silver,” focusing on payments and speed.

- LTC’s faster confirmation and lower fees make it more attractive for smaller, real-world transactions, though less desirable as a long-term store of value compared with BTC.

- Litecoin is merge‑mined with Dogecoin and supports optional privacy features like MWEB; Bitcoin lacks these out of the box.

- Despite these operational advantages, Litecoin still trails Bitcoin in network security, adoption, and institutional recognition.

Ecosystem Growth and Milestones

- The Litecoin Foundation introduced LitVM, a zero‑knowledge, EVM-compatible Layer‑2 chain enabling smart contracts and cross-chain transfers with Bitcoin and Cardano.

- In May 2025, a key privacy bug in the MWEB (MimbleWimble Extension Block) was patched, improving stealth features and wallet recovery for older addresses.

- Version 0.21.4, deployed in March 2025, included critical security patches addressing denial‑of‑service, memory exhaustion, and block propagation vulnerabilities.

- These upgrades reinforce LTC’s commitment to security, scalability, and privacy.

- Institutional interest is growing: MEI Pharma’s $100M purchase of LTC earlier in the year and ETF speculation point to broader ecosystem traction.

Community and Developer Activity

- Litecoin founder Charlie Lee joined the advisory board of Luxxfolio in June 2025, signaling deeper engagement in crypto infrastructure and governance.

- The Developer Report tracks code contributions across crypto, though specific monthly activity numbers for LTC aren’t broken out publicly, overall ecosystem contributions remain robust.

- The continued maintenance of MWEB, LitVM enhancements, and ongoing upgrades reflect active developer support.

- Community discourse echoes optimism, with retail traders anticipating future breakouts and milestone achievements.

- Such decentralized engagement strengthens adoption potential and on-chain resilience.

Conclusion

Litecoin today occupies a unique position, built for speed, privacy, and real-world utility, while maintaining vigilance in security and infrastructure. From upward‑trending miner reserves and developer-backed Layer‑2 expansion to institutional inflows and deep exchange liquidity, Litecoin remains resilient and evolving.

As ETF decisions loom, institutional sentiment could either ignite renewed rallies or test LTC’s structural support. Whether viewed as digital silver for payments or a hybrid DeFi enabler, Litecoin’s trajectory still offers meaningful insights for both U.S. audiences and global observers, inviting deeper exploration into its evolving ecosystem.